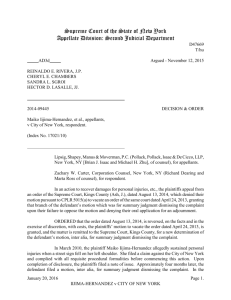

Appeal Brief

advertisement