franchise territories: a community standard

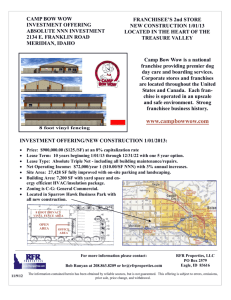

advertisement