The Social Organization of Secrecy and Deception

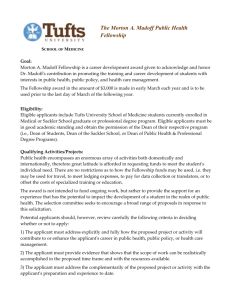

advertisement