Folie 1 - Vienna Economic Forum

advertisement

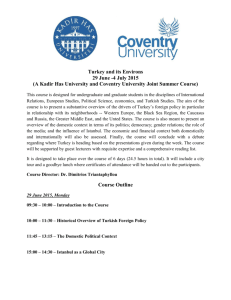

Discussion Materials Macroeconomic Overview of Turkey June 2012 Macroeconomic Overview of Turkey ...A Promising Macroeconomic Outlook... Growing GDP & GDP per Capita Consistently Increasing Population USD bn USD 1,000 900 80.0 12,000 70.0 800 10,000 700 m people 14,000 60.0 50.0 600 8,000 40.0 500 6,000 400 300 4,000 30.0 20.0 200 2,000 100 0 0 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 GDP Actual 10.0 0.0 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 2014 GDP / Capita Forecast Actual Forecast Source: Turkish Treasury, Economist Intelligence Unit (EIU) Slide 2 Macroeconomic Overview of Turkey ...With Significant Growth Potential... Strong Recovery in Real GDP Growth (%) Ranking Among the Fastest Growing Economies in the World (2011, G20 Countries) 12.0% 10.0% 9.4% 8.9% 8.4% 8.0% 6.8% 6.9% 6.2% 6.0% 5.3% 5.0% 4.7% 4.0% 8.5% 4.0% 3.1% 2.0% 1.1% 0.0% -2.0% -4.0% -3.4% -4.7% -6.0% -5.7% -8.0% 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 China Turkey India Saudi Arabia Indonesia Mexico Korea South Africa Germany G20 Brazil Canada Australia USA France EU UK Italy Japan -1.0% Earthquake in Turkey Financial Crisis Forecast 9.5% 8.5% 7.3% 6.8% 6.5% 3.9% 3.6% 3.1% 3.0% 2.8% 2.7% 2.5% 2.2% 1.7% 1.7% 1.5% 0.8% 0.4% -0.7% 1.0% 3.0% 5.0% 7.0% 9.0% Source: OECD & IMF, Press Release Source: Turkish Treasury, Economist Intelligence Unit (EIU) Slide 3 Macroeconomic Overview of Turkey ...On the Back of a Strong Banking System... Significant Improvement in Inflation Rate (%) 69.9% 68.8% Strong Banking & Financial Sector CAR (Tier 1 Cap. to Risk Weig. Assets) - G20 69.3% 39.1% 29.7% 18.4% 9.3% 7.7% 9.7% 8.4% 10.1% 10.3% 6.5% 6.4% 7.2% 5.5% Turkey - Q311 Indonesia - Q411 Mexico - Q311 Canada - Q211 UK - 2010 Argentina - 2010 USA - Q311 Brazil - Q311 Germany - Q311 South Africa - Q211 Russia - Q311 Austria - Q311 Rep. of Korea - Q311 France - 2010 Japan - Q111 China - 2010 Australia - Q311 Italy - Q211 India - Q111 14.9% 14.7% 14.1% 13.5% 13.2% 13.1% 12.9% 12.9% 12.5% 12.0% 11.7% 11.6% 11.4% 10.8% 10.7% 10.1% 10.0% 9.4% 9.3% 0.0% 2.0% 4.0% 6.0% Source: IMF, Financial Soundness Indicators 8.0% 10.0% 12.0% 14.0% 16.0% Non-Performing Loans to Total Gross Loans 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 Earthquake in Turkey Financial Crisis Forecast Source: Turkish Treasury, Economist Intelligence Unit (EIU) Ukraine - Q411 Romania - Q311 Greece - Q311 Hungary - Q411 Bosnia & Herz. - Q411 Italy - Q211 Russia - Q311 Portugal - Q311 Bulgaria - Q411 Czech Rep. - Q311 Spain - Q211 UK - 2010 USA - Q311 Denmark - Q311 Brazil - Q311 Turkey - Q311 Austria - Q311 Japan - Q111 India - Q111 Mexico - Q411 Australia - Q411 China - 2010 Canada - Q211 14.70% 14.20% 13.40% 13.30% 11.80% 11.0% 7.20% 6.90% 6.40% 5.50% 5.30% 4.0% 3.8% 3.50% 3.5% 3.1% 2.7% 2.4% 2.2% 2.1% 2.0% 1.1% 0.8% 0.0% 2.0% 4.0% 6.0% 8.0% 10.0% 12.0% 14.0% 16.0% Slide 4 Macroeconomic Overview of Turkey ...Supported by Stable Economic Fundamentals... Central Government Budget Balance (as % of GDP) [-] Gross Public Debt to GDP Ratio (%) 14 12 90% 11.9 70% 10 (-) % 80% 11.2 8.8 60% 8 50% 5.5 5.4 6 40% 3.6 4 1.6 1.5 2 30% 2.8 1.8 0.5 20% 10% 0% 0 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Source: Turkish Treasury, Ministry of Finance 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 Source: Turkish Treasury, Ministry of Finance Selected Countries - Government Budget Balance (as % of GDP): Selected Countries – Public Debt to GDP (%) Austria: -3.6% Austria: 72% Czech Rep.: -3% Germany: 81% France: -4% Italy: 120% Germany: -2.3% Belgium: 98% Italy: -3% France: 85% Poland: -7% UK: 77% Spain: -7% Greece: 165% Turkey: -2.8% Turkey: 42% Slide 5 Macroeconomic Overview of Turkey ...Driving FDI and M&A Volume... Foreign Direct Investment “FDI” (USD bn) M&A Deal Volume and Number of Deals 35.0 22.0 300 20.2 30.0 18.2 241 16.8 13.0 11.5 10.0 8.4 8.9 USD bn 25.0 203 160 20.0 200 172 150 15.0 31.0 101 10.0 3.4 0.9 0.8 1.0 1.1 1.8 2.8 19.0 19.3 100 17.2 16.2 15.0 5.0 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 2009 2010 2011 2012 2013 0 2005 2006 2007 Completed Deals Financial Crisis 50 5.2 0.0 Earthquake in Turkey 250 Forecast 2008 2009 2010 2011 Number of Deals Source: Deloite, Annual Turkish M&A Review Slide 6 Positioning in the Turkish Market The Number 1 Investment Bank in Turkey Mergermarket league tables Mergermarket Turkey M&A League Table (2009 – 2012 YTD) Rank House M&A League Table in Turkey Value (EUR M) Number of Deals 1 Raiffeisen Investment 6,497 16 2 JPM organ 6,341 8 3 Goldman Sachs 4,692 7 4 M organ Stanley 4,453 3 5 BBVA 4,200 1 6 Bank of America M errill Lynch 4,069 8 7 Credit Suisse 2,322 5 8 EFG Istanbul Equities 1,998 6 9 UBS Investment Bank 1,701 2 10 HSBC 1,680 6 11 JP M organ Cazenove 1,490 1 12 BNP Paribas 1,352 4 13 Deutsche Bank 1,171 1 14 Is Investment 1,050 19 15 Societe Generale 1,020 1 16 Standard Unlu 1,016 20 17 Rothschild 835 3 18 Rabobank 770 1 19 3 Seas Capital Partners 512 30 20 Citigroup 457 3 • Sale of Meram Elektrik Dağıtım A.Ş. (Meram) to Cengiz as well as the privatization of Meram have not been included in Mergermarket’s 2009 league tables due to internal league table regulations, e.g. privatization of Meram has been announced in 2008 and therefore only appears in their 2008 league tables • Acquisition of Samsun Port by Ceynak not included in the rankings of Mergermarket due to internal regulations of Mergermarket … Raiffeisen Investment managed to use its expertise in becoming the leading financial advisor in the Turkish market... Slide 7