2010 closing report - 3 Seas Capital Partners

advertisement

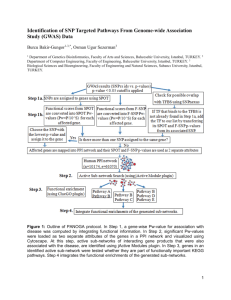

2010 CLOSING REPORT “If there is any one secret of success, it lies in the ability to get the other person’s point of view and see things from that person’s angle as well as from your own.” Henry Ford Institutional Completed Transactions IMAP Articles Thinking Global, Acting Global We have gained new and important experiences in 2010, a vibrant year in which our country staged a great performance in handling the global crisis successfully, and was recognized globally with an 8.9% growth. As a company, we further enhanced our market leadership and entered new markets. In the business world, which has always been breezy, hectic and variant throughout the history, there is now a continuous motion and noticeable activity, especially since the 90’s, when national economies started being more sensitive to global movements. The countries, companies, professionals and their ecosystems are facing significant ups and downs within this intricate scenario. Therefore, there is no doubt that we have to think more dynamically, more analytically and in a larger scale in this fast paced business environment affecting broader geographies. Since the day we established 3 Seas Capital Partners, we always considered and prioritized this important reality of our age. We thought and acted globally. We never fell behind the global standards in our services, with the immense opportunities and support provided by our IMAP 2 partners in 30 different countries, where we have been the exclusive member for Turkey since 2006. Our company became the market leader in Turkey based on the number of completed transactions in 2008, 2009 and 2010. We completed over 40 successful M&A transactions in the last five years with a total volume of over 3.5 billion USD by adding new services every year. We are very proud of this success. At this point I would like to share an important development with you. The high level of our completed transactions in the last years in terms of both number and volume have been appreciated and recognized by all IMAP partners. Moreover; our performance, dynamism, visionary approach and professionalism within IMAP provided us with an important and reputable position among all IMAP partners. Consequently, I have been elected as the Chairman of the Board of Directors of IMAP in the General Assembly meeting held in Paris in October 2010 with unanimous support and approval of all the members of the board and the partners. I will hereafter be in charge of the global collaborative activities of all IMAP members in international markets as well as the management of IMAP. Beyond being a source of personal pride, I believe that this duty is a very important opportunity for our country and will add significant value to Turkey’s M&A market and our business community as IMAP, with thousands of successful transactions to its credit, offers substantial know-how and experience as well as a global relationship network. I strongly believe that this opportunity will allow us to offer significant value added services to our clients. In addition to achieving a well-respected position among IMAP partners we took two other important steps in 2010 to carry 3 Seas Capital Partners forward in order to become a global company. First of these is a step in our international growth. We acquired 50% shares of Intelligent Way, one of the leading corporate finance companies in Egypt, with the goal of expanding 3 Seas Capital Partners in the African and Middle Eastern markets. I-Way, under the management of Mr. Khaled El Ghannam, was renamed as 3 Seas Capital Partners Egypt as a result of this partnership. Khaled El Ghannam previously worked in prominent companies such as Arthur Andersen, Deloitte & Touche and ExxonMobil and undersigned a transaction volume of over one billion USD at Bayt El Khebra, where he had been a managing partner. Our second step in carrying 3 Seas Capital Partners forward was the joining of Mehmet Akseki and Ibrahim Arinc as partners. Mehmet Akseki, an experienced investment banker who previously held senior management positions in financial institutions in England and Turkey, has close relationships with private equity funds and has a broad professional know-how. Furthermore, I believe he will add significant value to our company and our clients with his wide and strong relationship network in the financial circles in the UK and around the world. I also believe İbrahim Arınç, who had been successfully contributing his significant professional experience that he gained in the USA and Turkey into our efforts for the last four years as a Vice President and a Director at 3 Seas Capital Partners, will continue his successful endeavors as an equity partner. We are again the leader in 2010 Being the market leader in terms of the number of completed M&A transactions in 2008 and 2009 with nine and eight transactions, respectively, 3 Seas Capital Partners managed to sustain its market leadership in 2010 with 11 completed transactions. Details of these transactions are presented in the “Completed Transactions” section of our Closing Report. We have gained new and important experiences in 2010, a vibrant year in which our country staged a great performance in handling the global crisis successfully, and was recognized globally with an 8.9% growth. As a company, we further enhanced our market leadership and entered new markets. Besides the IMAP process, which illustrated again the importance of thinking and acting globally in today’s business world, having a good team is one of the “sine qua non” components of doing successful business for me. I firmly believe that the 3 Seas Capital Partners team, which is one of the most dynamic and highest caliber teams in our industry, will become stronger with our new equity partners and consolidate our sector leadership. In light of these developments, I would like to mention again that as a team, we are ready to cater to all domestic and global corporate needs and requirements in the area of M&A with an enhanced dynamism and professionalism in 2011 and I also wish our respectful stakeholders a successful and a prosperous year. Sincerely, Şevket Başev 3 3 Seas Capital Partners, operating mainly in the area of mergers and acquisitions (M&A), is Turkey’s leading corporate finance house. 4 Corporate Presentation 3 Seas Capital Partners is Turkey’s leading corporate finance house in terms of completed M&A transactions in 2008, 2009 and 2010. With a wide local and international corporate network combined with substantial know-how and experience, the company serves its clients with highest possible standards. Providing a highly competent service range, with the value proposition of “personal” level of care and integration, 3 Seas Capital Partners offers reliable, effective, and sustainable solutions. 3 Seas Capital Partners is the partner of IMAP, which is an exclusive global organization of leading independent M&A advisory firms. IMAP is composed of 40 prominent M&A focused financial institutions, in 30 different countries with 50 offices. Since its foundation, 3 Seas Capital Partners has completed over 40 successful M&A transactions valued over 3.5 billion USD. M&A Projects As the market leader in Turkey based on the number of completed transactions in 2008, 2009 and 2010, 3 Seas Capital Partners provides buy-side or sell-side strategic and financial advisory services according to the unique nature of each transaction. M&A transactions, which require a long and disciplined process, necessitate a closer client-advisor relationship compared to other financial services due to the sensitive and secretive nature of the issue. 3 Seas Capital Partners maintains the corporate and trade secrets of its clients during and after the completion of the M&A 5 3 Seas Capital Partners provides world-class services with its wide international network. process, where absolute loyalty and confidentiality is essential. 3 Seas Capital Partners’ principle of “establishing cooperation with the client as a real partner” is a standard conduct in all of its M&A advisory services as well as the rest of the company’s operations. 3 Seas Capital Partners maintains constant dialogue with its clients to get them oriented to the M&A process with the main stages listed below. This continuous dialogue, while ensuring a healthy and effective flow in the M&A processes, also allows our clients to fully and correctly understand the process. 6 • Data analysis • Preparation of the company valuation report and all the relevant documentation • Candidate research (search and identification of suitable candidates) • Contacting the candidates • Negotiations • Completion of the letter of intent/memorandum of understanding and due diligence processes • The transfer of shares The detailed list of completed transactions on the following pages is the most significant evidence of 3 Seas Capital Partners’ unparalleled expertise in M&A transactions. Financing Solutions 3 Seas Capital Partners, according to the needs and the variable market conditions, offers the following to its clients: • Project financing • Acquisition finance • Debt restructuring 3 Seas Capital Partners provides these services through its constant corporate cooperation with leading global investment funds, as well as domestic and international banks. 2010 Mergers and Acquisitions (M&A) Ranking of Corporate Finance Institutions Operating in Turkey Having reached the market leader position with nine and eight completed transactions in 2008 and 2009 respectively, 3 Seas Capital Partners is once again the market leader in 2010 with 11 completed transactions. Rank Company Total Transaction Size (million USD) Number of Transactions 1 3 Seas Capital Partners 582* 11 2 Standard Unlu Securities 397 10 3 Raiffeisen Investment AG (RIAG) 2,353 6 4 IS Investment Securities 415 6 5 PDF Corporate Finance 17 4 6 EFG İstanbul Securities SA 860 3 7 Ventura Partners 106 2 8 HSBC Bank plc 85 2 9 PwC 17 2 10 SG 753 1 11 Morgan Stanley 312 1 12 Nomura Holdings Inc 312 1 13 Banco Millennium BCP Investimento, S.A. 85 1 14 Goldman Sachs 83 1 15 Rothschild 82 1 16 Global M&A 74 1 17 Banco Portugues de Investimento SA 63 1 18 Sardis Capital Ltd 10 1 19 Deloitte 8 1 20 Credit Suisse 0 1 21 Pragma Corporate Finance 0 1 * Undisclosed deals are not included in the total transaction volume. Mergermarket league table 2010 completed deals. 7 3 Seas Capital Partners corporate finance team is comprised of an executive team with extensive experience, and professionals with degrees from leading universities of the world. 8 Partners Şevket Başev / CEO Şevket Başev is one of the founding partners and the CEO of 3 Seas Capital Partners. Başev has significant long term experience in competition law, investment law and advisory, mergers and acquisitions, contract negotiations, corporate finance and financial structuring. Graduating from American Collegiate Institute in İzmir in 1993, Başev holds a B.A. in Political and Administrative Sciences from Economy and Finance Department of Marmara University, İstanbul and M.Sc. in European Union Studies from Galatasaray University, İstanbul. Başev also made post graduate studies on International Economic Law in Pantheon-Sorbonne University, Paris. Başev was chosen as one of the top 15 Emerging European Investment Bankers by the Euromoney Magazine in 2004, and recently elected as the Chairman of IMAP in November 2010. Emre Erginler / Managing Partner Emre Erginler is one of the founding partners of 3 Seas Capital Partners. Aside from a solid long term experience in private equity funds, mergers and acquisitions, venture capital and corporate finance; Mr. Erginler also worked as an industrialist, in his early career. He has also served as a member on the Board of Directors of different companies. Graduating from Österreichisches St. Georgs-Kolleg İstanbul, Erginler took his BA degree in Mechanical Engineering in Syracuse University, USA in 1994 and completed MBA in Rice University, USA in 1996. Completing many M&A transactions in the areas of automotive, logistics, industry, financial services, telecommunications and energy in 3 Seas Capital Partners; Erginler had served in the European Council of IMAP. 9 Tarık Şarlıgil / Managing Partner Tarık Şarlıgil is one of the founding partners of 3 Seas Capital Partners. He has vast, long term experience in mergers and acquisitions, venture capital, corporate finance, project and tender management. Graduating from Robert College in 1995, he received his undergraduate degree in Food Engineering from İstanbul Technical University in 1999. In 2000, he completed the MBA program of Sabancı University. Completing many M&A transactions in the areas of food, retail, internet, service, FMCG, real estate and logistics, in 3 Seas Capital Partners; Tarık Şarlıgil is active on the FMCG, Food, Services, Retail and Internet committees of IMAP. İbrahim Arınç / Managing Partner Having joined 3 Seas Capital Partners in 2007, İbrahim Arınç has over a decade of professional experience in mergers and acquisitions, corporate finance, public offerings, convertible securities, strategic partnerships and corporate and debt restructuring areas. Upon his graduation from Tarsus American School in 1994, Arınç received his Bachelor of Science (Hons.) degree in Business Administration with a double major in and Finance and Economics from Babson College, USA, in 1998. Arınç completed his graduate studies at Boston College, USA and earned a M.Sc. degree in Finance in 2003. Since 1998, İbrahim Arınç has held various positions with New York and İstanbul based securities firms and international investment banks, completing over 30 M&A transactions for strategic as well as financial clients. Arınç’s transaction expertise covers a wide spectrum of sectors including; media and entertainment, telecommunications, Internet, retail, consumer goods, food, healthcare and entertainment. 10 Mehmet Akseki / Managing Partner Mehmet Akseki, graduated from İzmir Özel Türk Fen Lisesi and Yıldız Technical University Faculty of Architecture prior to obtaining his MBA in Koç University, İstanbul, Turkey and his M.Sc degree in Finance from London Business School. Akseki joined 3 Seas Capital Partners in 2010 as a Managing Partner. Since 1998, Mehmet Akseki held several corporate finance advisory roles in İstanbul and London based securities firms and global investment banks, working on cross-border M&A transactions for corporate and financial investors across different geographies. In his career, Akseki acted as an advisor in several mid to large size M&A transactions in media, telecommunications, energy, consumer products and infrastructure sectors. Khaled El Ghannam / Chairman, 3 Seas Capital Partners Egypt Khaled El Ghannam is the Chairman of 3 Seas Capital Partners Egypt. Mr. El Ghannam has wide experience in M&A, due diligence, audit, and tax consultancy. Following his graduation from university in 1978 he joined the Egypt office of one of the largest international audit, tax and financial advisory services firms where he became a partner in 1992 and subsequently established the corporate finance and financial transactions division in 1998. Since 2003, the companies where Mr. El Ghannam has been a Managing Partner have carried out many restructurings and turnarounds that included financial debt settlements, debt and equity financings, advisory, valuation and M&A assignments for domestic and multinational companies. 11 11 M&A projects in 2010 and ranked first among all the financial institutions in Turkey in number of completed transactions. 3 Seas Capital Partners completed 12 Completed Transactions in 2010 Groupe Cheque Déjeuner - Multinet Wenice Kids - Eurasia Capital Partners One of the top three payment voucher firms in the world, France based Groupe Cheque Dejeuner has acquired Multinet Kurumsal Hizmetler A.Ş., one of the leading Turkish firms in the payment vouchers and meal cards business for a sum of 90 million USD. The leading kids’ apparel brand Wenice Kids has formed an alliance with The Netherlands based WNC Kids Holding, a joint venture representing the consortium led by Eurasia Capital Partners, a Turkey based private equity fund and also and including Netherlands Development Finance Company (FMO) and the regional investment fund Balkan Accession Fund (BAF). Under the terms of this alliance, WNC Kids Holding has acquired a 50% stake in Wenice Kids. 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to Groupe Cheque Dejeuner throughout the process. Groupe Cheque Dejeuner Established in 1964 to serve as a voucher service provider for both private and public institutions, Groupe Cheque Dejeuner has evolved into one of the top three payment voucher firms globally. The firm operates in 12 countries with its 48 subsidiaries and 1955 personnel. In 2009, Groupe Cheque Dejeuner has achieved a transaction volume of over 4 billion EUR with its 26.8 million clients. Multinet Founded in 1999, Multinet was the first in its sector to employ smart card technology services. The firm provides smart cards covering food, fuel, accommodation and transportation expenditures for its retail and corporate clients. Multinet has also formed “Multicar” to provide fleet rental services which has expanded to a 1,300 vehicle fleet. Multinet generated revenues of 250 million EUR in 2010. 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to Wenice Kids shareholders throughout the process. Wenice Kids Wenice Kids was established in 1998 by Kuşam Tekstil which had started its children’s clothing production in 1993. Wenice Kids quickly became one of the world’s leading brands in children’s clothing with its pioneering approach to kids fashion and retailing. Wenice Kids currently operates 378 stores in 63 countries with over 1100 points of sale and aims to expand its presence to 90 countries, securing its place as one of the top 10 children’s clothing brands by the year 2012. Eurasia Capital Partners Eurasia Capital Partners, a Turkey focused private equity fund has made its first investment in Wenice Kids. İstanbul Venture Capital Initiative (iVCi) - an advisor to the European Investment Fund (EIF), Netherlands Development Finance Company (FMO), International Finance Corporation (IFC) - a World Bank organization, European Bank for Reconstruction and Development (EBRD) and Axxess Capital are among the investors of Eurasia Capital Partners. 13 Invus - Airties Invus, a U.S. base private equity firm, has invested in Turkey’s leading wireless network equipments manufacturer Airties as a minority shareholder. 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to Invus Group and partners throughout the process. Invus Group Established in 1985, Invus manages over 4 billion USD of funds with its offices in New York, London Paris and Hong Kong. Invus aims to focus on web-based technology firms which offer high growth opportunities. Some of the past investments made by Invus include Weight Watchers, Keebler, Harry’s, Avantec, Grow.net and Odontoprev. AirTies AirTies was founded in 2004 by an executive and technical team, originally from the Silicon Valley, with the vision of becoming the market leader in the EMEA market. AirTies develops and markets products that wirelessly connect electronic devices to each other, the internet and people. The firm also has operations in Greece, Russia and Ukraine with a domestic retail market share of 60%. AirTies is the leading supplier for many service providers including Türk Telekom. 14 Turkon / MNG - Energo-PRO Energo-Pro, the Czech Republic based energy company, has acquired Hamzalı, Resadiye and Kaskatı hydroelectric power plants with a total generation capacity of 81 MW, from the leading Turkish groups, Turkon Holding and MNG Holding for a sum of 380 million USD. 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to Turkon Holding and MNG Holding shareholders throughout the process. Turkon Holding Turkon Holding is a prominent Turkish maritime transport company and a part of the Kaşif Kalkavan Group, one of the most established players in Turkey’s maritime business. Led by Mr. Nevzat Kalkavan, Turkon Holding has one of the country’s most modern fleets and conducts container transportation on the U.S., Europe, and Eastern Mediterranean routes. Turkon has offices and agencies in all ports of Turkey as well as several important maritime centers of the world. MNG Holding MNG Holding is one of the leading groups of Turkey with activities in various sectors. The Holding is involved in tourism, energy, domestic and international air transportation, domestic cargo transportation, aircraft maintenance and repairs, finance and media sectors. Energo - Pro One of the largest energy firms of Central and Eastern Europe, the Czech Republic based Energo-Pro is active in renewable energy resources and hydroelectric power plant operations. Kar-en - Energo-PRO Energo-Pro,the Czech Republic based energy company, has acquired Kar-En Karadeniz Elektrik Üretim ve Ticaret A.Ş., a joint venture by the leading Turkish groups Turkon and MNG Holdings, including “Aralık” hydroelectric power plant, for a sum of 26 million USD. 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to Turkon Holding and MNG Holding shareholders throughout the process. Turkon Holding Turkon Holding is a prominent Turkish maritime transport company and a part of the Kaşif Kalkavan Group, one of the most established players in Turkey’s maritime business. Led by Mr. Nevzat Kalkavan, Turkon Holding has one of the country’s most modern fleets and conducts container transportation on the U.S., Europe, and Eastern Mediterranean routes. Turkon has offices and agencies in all ports of Turkey as well as several important maritime centers of the world. MNG Holding MNG Holding is one of the leading groups of Turkey with activities in various sectors. The Holding is involved in tourism, energy, domestic and international air transportation, domestic cargo transportation, aircraft maintenance and repairs, finance and media sectors. Energo - Pro One of the largest energy firms of Central and Eastern Europe, the Czech Republic based Energo-Pro is active in renewable energy resources and hydroelectric power plant operations. Duru Grup - Hunca Duru Grup, headquartered in Antalya divested its 50% shares in Hunca Kozmetik Sanayi A.Ş. to Tuncer Hunca and Jozy Holdings LLP. 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to Duru Grup’s shareholders throughout the process. Duru Grup Established in 1973, Antalya headquartered Duru Grup has six companies operating in the sales and distribution of food, cleaning and other utility supplies and personal care products in Mediterranean, Aegean and Marmara Regions. Duru Grup being one of the leading groups in the distribution and wholesale of food products to hotels, restaurants and cafeterias operates with a staff of 500 and 300 vehicles. Hunca Founded in 1957, Hunca Kozmetik is one of Turkey’s leading personal care products company, which owns more than 1,400 products, including “Madigan”, Turkey’s first local men perfume brand. In 1997, the company established the largest personal care products of Balkans and the Middle East in Tekirdağ, Turkey. Hunca Kozmetik owns many brands like SHE, CALDION, Jagler and SHE COLORS. 15 Hakkasan - İstanbul Doors The House Apart - Kerten Hakkasan İstanbul, one of the world’s top restaurants and a subsidiary of Turkish Conglomerate Unitim has been acquired by İstanbul Doors Group, the Turkey based bar and restaurant management company. 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to Unitim Holding shareholders throughout the process. Kerten Private Equity, Ireland based private equity firm, has bought a 50% shares in The House Apart, one of Turkey’s emerging names in accommodation & hospitality services. Unitim Holding Established in 1997, Unitim Holding is the representative and master franchisee of the world’s leading fashion brands in Ukraine, Moldova, Azerbaijan, Kazakhstan, Romania, Georgia and Russia as well as Turkey and operates many stores in these countries. Operational in retail and textile sectors, Unitim Holding is also the master franchisee of global brands such as Polo Ralph Lauren and Accessorize in Turkey. The House Apart Established in 2007 by the founders of The House Café —an enterprise founded in 2002 and since then expanded to 11 different locations— The House Apart operates with the “A Home Away from Home” concept. The House Apart operates in Cihangir, Galata, Tünel and Teşvikiye neighborhoods of İstanbul with 5 buildings and 40 units. Recently, the firm has opened new boutique hotels in Galatasaray, Nişantaşı and Ortaköy under the “The House Otel” brand name. İstanbul Doors Group İstanbul Doors Group, founded in 1993, incorporates several prominent İstanbul based restaurants like Da Mario, Vogue, Wan-na, Anjelique, A’jia, Private Room, Kichnette and Zuma. The Group is the first institutional restaurant operator and many of its restaurants have made it to “the Best” lists in various culinary and gusto magazines. 16 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to The House Apart shareholders throughout the process. Kerten Private Equity The Ireland based Kerten Private Equity operates in 4 different countries with its offices in Dubai, İstanbul, Bucharest, and Warsaw. Established in 2006, Kerten currently has made investments into Fota, Kamot and Kisan/SKS of Poland and Logos Investments s.r.l. of Romania. Mynet - Trendyol.com The shareholders of Mynet A.S., the leading Turkish Internet portal, have made a minority investment into DSM Grup Danışmanlık İletişim ve Satış Tic. A.Ş, the proprietor of Trendyol.com online shopping website. 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to Mynet shareholders throughout the process. Mynet Turkey’s first web portal Mynet, with over 6 million registered users, 1.2 billion pages viewed monthly and 15 million visitors, is the leading Turkish web portal. Apart from its news, video, movie, finance and gaming services, Mynet provides numerous subcategories for different interest groups. The firm owns the top e-mail service in Turkey as well as the largest website for women, Ivillage. Tiger Global Private Equity Fund has acquired a minority stake in Mynet in February 2006 in a transaction advised by 3 Seas Capital Partners. Trendyol.com The online shopping service provider Trendyol A.Ş. was established in 2010 by DSM Grup Danışmanlık İletişim ve Satış Tic. A.Ş. The firm quickly became one of the leaders of its field with its exclusive “private shopping” concept. Trendyol offers its customers a variety of distinguished brands at special discounts. Membership to the site is limited and by invitation only. Taha Tatlıcı - Galerist Taha Tatlıcı, a diversified investor who predominantly focuses on education and real estate sectors, have established a partnership with Galerist, one of the leading galleries of contemporary art. 3 Seas Capital Partners acted as the exclusive financial and strategic advisor to Taha Tatlıcı throughout the process. Taha Tatlıcı One of the leading businessmen of Turkey, Taha Tatlıcı has interests in a variety of sectors including education and real estate. Galerist Established in 2000 by Murat Pilevneli, Galerist Eser Sergileme Sanat Etkinlikleri Müzayede Düzenleme Film Prodüksiyon San. ve Tic. Ltd. Şti pioneered the progress of contemporary art in Turkey. Galerist has helped showcase the artwork of Turkish modern artists in various international art galleries from Basel to FIAC. Galerist also owns numerous works of Turkish contemporary artists including Hüseyin Çağlayan, Elif Uras, Mustafa Hulusi and Haluk Akakçe. Medyaguru - Mynet Medyaguru, one of the leading internet advertising companies in Turkey had been acquired by Turkey’s leading portal Mynet. 3 Seas Capital Partners has acted as the exclusive financial and strategic advisor to the partners of Medyaguru throughout the process. Mynet Turkey’s first web portal Mynet, with over 6 million registered users, 1.2 billion pages viewed monthly and 15 million visitors, is the leading Turkish web portal. Apart from its news, video, movie, finance and gaming services, Mynet provides numerous subcategories for different interest groups. The firm owns the top e-mail service in Turkey as well as the largest global website for women, Ivillage. Medyaguru Established in 2005, Medyaguru is one of the pioneers in Turkey in the area of internet advertising. Providing alternative advertisement options for the efficient use of the internet for the brands and services according to their budget and the target audience criteria; Medyaguru has a team of experts in brand advisory, project development and banner designs. 17 Completed Transactions Based on Sectors INDUSTRY Bossa - Akkardan Akkardan, the Turkish automotive parts manufacturer, acquired 50.12% of Bossa, one of the most established group companies of Sabanci Holding, based on a total value of 152.5 million USD. Farplas - Öncü Numarine - Abraaj Capital Abraaj Capital, one of the largest private equity firms in the Middle East, has acquired 50% of the shares of Numarine, one of Turkey’s leading motor yacht manufacturers. Farplas, one of the leading Turkish plastic injection producers for automotive OEM producers acquired 100% shareholding in Oncu Dayanikli Tuketim Mallari A.S., the leading supplier of ABS based products to commercial vehicle producers in Turkey. 18 FarInvest - Mata FarInvest, a Turkey based investment company which invests mainly in the automotive industry, has acquired 51% of Mata Otomotiv; producer of automotive spare parts and wooden interiors. Turkuaz - Henkel Europe based Henkel, one of the largest, global chemicals companies, has signed a joint venture agreement with Turkuaz a leading distributor in Kazakhstan. LOGISTICS AND INFRASTRUCTURE Fina Turkon Holding Fina Holding acquired the remaining 50% shares owned by Turkon Holding in Fina Turkon Holding, the owner of Kumport Liman İşletmesi A.Ş.. Fina Holding became the sole owner of Fina Limancılık Lojistik Holding A.Ş. (formerly known as Fina Turkon Holding) after the transaction, where 3 Seas Capital Partners acted as the exclusive financial and strategic advisor. Turkon Fina Denizcilik Türkerler - Derince Turkon Holding acquired the remaining the 50% shares owned by Fina Holding in Turkon Fina Denizcilik A.Ş.. Turkon Holding became the sole owner of Turkon Fina Denizcilik A.Ş. after the transaction, where 3 Seas Capital Partners acted as the exclusive financial and strategic advisor. Türkerler Grubu, a leading Turkish group active in construction, energy, tourism, real estate and textiles industries, has won the privatization tender of Derince Port, held by the Privatization Administration of Turkey, for 192.5 million USD. Fina / Turkon - Kumport İSBİ - Doba Panda - K-Line Kumport Liman Hizmetleri Lojistik Sanayi ve Ticaret A.Ş., one of Turkey’s leading container ports, was acquired by Fina Holding A.Ş. and Turkon Konteyner Taşımacılık ve Denizcilik A.Ş. for 255 million USD. ISBI, Turkey’s leading free trade zone & logistics center management company has acquired majority shareholding in Doba Investments Ltd., which is the founder and operator of Famagusta Free Zone in Cyprus. 3 Seas Capital Partners has advised the shareholders of Panda Denizcilik in their joint venture agreement with Japan based Kawasaki Kisen Kaisha Line (“K Line”), one of the largest global transportation companies, operating as K-Line Turkey. 19 REAL ESTATE The House Apart - Kerten Hakkasan - İstanbul Doors Port Göcek - Doğuş Holding Kerten Private Equity, Ireland based private equity firm, has acquired 50% of shares in The House Apart, one of Turkey’s emerging names in accommodation & hospitality services. Hakkasan İstanbul, one of the world’s top restaurants and a subsidiary of Turkish conglomerate Unitim Holding has been acquired by the Turkey based bar and restaurant management company İstanbul Doors Group. Dogus Holding, one of Turkey’s largest conglomerates, has agreed to acquire Anadolu Turizm Yatırımları A.Ş., the operator of Port Gocek Marina, from Turkon Holding, one of the most established groups in Turkey. Marmaris Select Maris - Doğuş Holding Dogus Holding, one of Turkey’s largest conglomerates, has acquired Kartal Otel Marmaris Turizm İsletmeciligi A.Ş., the company which owns and operates Marmaris Select Maris Hotel from Turkon Holding, one of the most established groups in Turkey. 20 Kendir Keten - Boğaziçi / Mak-Yol Kendir Keten Sanayi T.A.Ş. was acquired by Mak-Yol İnşaat Sanayi Turizm ve Ticaret A.Ş. and Boğaziçi Yatırımları A.Ş. Yeniköy Turizm - Carlton Yeniköy Turizm, İstanbul based real estate investment company, has won the tender for Carlton Hotel property in Yeniköy, İstanbul for an amount of 70 million TL. The tender was held by Savings Deposit Insurance Fund of Turkey. REAL ESTATE Boğaziçi - Sait Halim Paşa Boğaziçi Turizm Yatırım Ltd., an İstanbul based tourism investment company, acquired Yeniköy Turizm Yatırım Ltd., the İstanbul based real estate Investment Company, which owns the operating rights for Sait Halim Pasa Mansion located on in Yeniköy, on the Bosphorus. HEALTHCARE Çam Tourism Investments A group of private Turkish investors have acquired Çam Tourism Investments Ltd, a company holding certain real estate properties in Cyprus. 3 Seas Capital Partners has acted as the exclusive financial and strategic advisor to the group of private Turkish investors on the acquisition. Marfin Investment - Şafak Hastaneleri Hygeia Diagnostic & Therapeutic Center of Athens SA, an Athens based healthcare group, owned by Marfin Investment Group, Greece based investment holding company, has acquired 50% of İstanbul based Şafak Healthcare Group which owns four hospitals in İstanbul. CONSUMER PRODUCTS AND SERVICES Duru Toplu Tüketim - Güney 2M Dağıtım Güney 2M, the largest Turkish distributor and wholesaler of food and food related products to the hotel, restaurant and cafeteria businesses, has acquired 80% share of Duru G2M, a joint venture set up by and between Güney 2M and Duru Toplu Tüketim, an Antalya, Turkey based distributor and wholesaler. Sandras Su - Coca Cola Coca Cola İçecek, the listed Turkish bottler and distributor of non-alcoholic beverages, has acquired certain assets, rights and licenses of Sandras Su Gıda Turizm Taşımacılık İnşaat A.Ş., the Turkeybased company engaged in water bottling business, from Turkon Holding, one of the most established groups in Turkey. Duru Grup - Hunca Duru Grup, headquartered in Antalya, has transferred its 50% shares in Hunca Kozmetik Sanayi A.Ş. to Tuncer Hunca and Jozy Holdings LLP. 21 RETAIL Taha Tatlıcı - Galerist Taha Tatlıcı, a diversified private investor who predominantly focuses on education and real estate sectors, has established a partnership with Galerist, one of the leading galleries of contemporary art. Tommy Hilfiger Wenice Kids - Eurasia Capital Partners Turkey’s leading kids’ apparel brand Wenice Kids has formed a partnership with The Netherlands based WNC Kids Holding, a joint venture representing the consortium of Netherlands Development Finance Company (FMO) and the regional investment fund Balkan Accession Fund (BAF), under the leadership of Eurasia Capital Partners, a Turkey based private equity fund. Under the terms of this alliance, WNC Kids Holding has acquired a 50% stake in Wenice Kids. Unitim Holding, which has been the owner of the exclusive franchising and distribution rights of fashion brand Tommy Hilfiger in Turkey and several CIS countries since 1998, has transferred all Tommy Hilfiger stores operating in Turkey along with the exclusive franchising and distribution rights of the brand to Tommy Hilfiger Marka Dagitim ve Ticaret A.Ş., the Turkey based retail firm and an affiliate of Tommy Hilfiger Europe BV. 22 Camper - Coflusa Sau Coflusa Group, the Spanish retail group, has agreed to acquire majority shareholding in the Unitim Holding subsidiary that operates 15 Camper stores in Turkey from Unitim Holding through an asset sale transaction. Harvey Nichols - Demsa Maxi - Migros Demsa İç ve Dış Ticaret A.Ş., the Turkey based retail firm, has agreed to acquire Harvey Nichols İstanbul, the İstanbul franchise of the UK based luxury department store from UnitimHolding. Certain assets belonging to İstanbul based Maxi Supermarkets; the supermarket chain belonging to Hamoğlu Group, has been acquired by Migros, one of the leading retail groups in Turkey. MEDIA AND ENTERTAINMENT Mynet - Trendyol.com The shareholders of Mynet A.Ş., the leading Turkish Internet portal, have made a minority investment into DSM Grup Danışmanlık İletişim ve Satış Tic. A.Ş., the proprietor of Trendyol.com online shopping website. Medyaguru - Mynet Medyaguru, one of the leading Internet advertising companies in Turkey has been acquired by Turkey’s leading Internet portal Mynet. Tiger / Mynet - Yonja Tiger Global, a New York based private equity fund, and Mynet, the leading Turkish Internet portal, acquired 50% of San Francisco based Yonja LLC, owner of www. yonja.com, the international community and friendship site. Lift - Kampüs Mynet - Beyazperde Lift - Tiger Lift Medya, the leading indoor advertising company in Turkey, has acquired Kampüs together with its subsidiary Okul, the leading indoor advertising companies active in universities and high schools. Mynet, the number one Turkish Internet portal, has acquired the leading cinema Web site, beyazperde.com. The Tiger Global Private Investment Partners, a New York based private equity fund, acquired minority interest in Lift Medya, one of the leading indoor advertising companies in Turkey. 23 MEDIA AND ENTERTAINMENT TELECOMMUNICATIONS Mynet - Tiger Fintur Holding - Azercell The Tiger Global Private Investment Partners, a New York based private equity fund, acquired minority interest in Mynet, the number one Turkish Internet portal. In March 2008, Azerbaijan Information and Communication Technologies Ministry privatized the remaining 35.7% shares of Azercell, which is the largest GSM operator in Azerbaijan with more than 3 million subscribers. Fintur Holding, a joint venture between TeliaSonera and Turkcell, acquired the remaining 35.7% shares of Azercell TeliaSonera - MCT TeliaSonera, the leading telecommunications company in the Nordic and Baltic region, has acquired 100% of the shares in MCT, a US based company with majority controlling shareholdings in three Central Asian GSM operators in Uzbekistan and Tajikistan and a small minority interest in the leading GSM operator in Afghanistan, for an enterprise value of approximately 300 million USD. FINANCIAL SERVICES Groupe Cheque Déjeuner - Multinet One of the top three meal and payment voucher firms in the world, France based Groupe Cheque Dejeuner has acquired Multinet Kurumsal Hizmetler A.Ş., one of the leading Turkish firms in payment vouchers and meal cards business for a sum of 90 million USD. 24 Fleetcorp In March 2009, The International Investor (TII), a leading Middle Eastern investment group, has agreed to acquire the remaining 25% stake in Fleetcorp Turkey (previously known as Docar), one of the leading Turkish operational fleet leasing companies, from its founding shareholders. TII had previously acquired the 75% shareholding of Docar in 2005 from the founding shareholders. TII has became the sole owner of the company after the transaction. Eko Finans - Bancroft Bancroft, a private equity firm that has been active exclusively in the region of Central and Eastern Europe since 1989, acquired minority interest in Eko Finans Factoring, which is a factoring services provider in Turkey with 15 branch offices countrywide, focusing on small to mid-sized enterprises. FINANCIAL SERVICES TECHNOLOGY Docar - TII Docar - Renty Invus - Airties The International Investor (TII), a leading Middle Eastern Investment Group acquired 75% shareholding in Docar, one of the leading operational fleet leasing companies in Turkey. Docar, one of the leading Turkish operational fleet leasing companies acquired 100% shareholding in Desas Ticari Araçlar Kiralama Servis ve Tic. A.Ş., the leading commercial vehicle leasing company in Turkey, operating under the “Renty” brand. A U.S. base private equity firm Invus has invested in Turkey’s leading wireless network equipments manufacturer Airties as a minority shareholder. ENERGY Turkon / MNG - Energo-PRO Kar-en - Energo-PRO The Czech Republic based Energy Company Energo-Pro has acquired Hamzalı, Resadiye and Kaskatı hydroelectric power plants with a total generation capacity of 81 MW, from the leading Turkish groups, Turkon Holding and MNG Holding for a sum of 380 million USD. The Czech Republic based energy company Energo-Pro has acquired Kar-En Karadeniz Elektrik Üretim ve Ticaret A.Ş., a joint venture by the leading Turkish groups Turkon and MNG Holdings, including Aralık hydroelectric power plant, with with a generation capacity of 13 MW, for a sum of 26 million USD. 25 IMAP is an exclusive global organization of leading independent mergers and acquisitions advisory firms. 28 30 countries, 50 offices, more than 400 senior executives IMAP: M&A Services Worldwide Formed in1973, IMAP is the most established and experienced M&A partnership in the world. This year we spare more pages for IMAP, of which we’ve been the exclusive partner in Turkey since 2006. The main reason for this is that; as our founding partner and CEO, Şevket Başev has been elected as the Chairman of IMAP and we now have first hand access to more opportunities that we can offer to our clients in the global arena. In light of the information provided in the following pages, we believe that the performance of IMAP firms in the global markets and their completed transactions will inspire us all. IMAP is an exclusive global partnership of leading independent mergers and acquisitions advisory firms. Formed in 1973, IMAP is the world’s most established and experienced M&A partnership. IMAP is shifting towards a more integrated operating structure through systematic business practices that support the ability to serve its clients. Today, IMAP operates as a global operation with a professional staff and a large team of committed global transaction advisors. For almost 40 years of service, IMAP colleagues have worked together to successfully complete thousands of transactions. Currently, IMAP is comprised of 40 firms located in 30 countries. These firms are represented by more than 400 experienced advisors and analysts who share common values and principles, reinforced by rigorous standards and qualifications to ensure maximum service quality and best results. IMAP’s corporate headquarters is located in Sarasota, Florida, USA. 29 Board of Directors Şevket Başev, Turkey Jose Sauma, Costa Rica Michel Champsaur, France Michael Drury, USA Scott Eisenberg, USA Mark Esbeck, USA Chairman Director Director Director Financial Director President & CEO Karl Fesenmeyer, Germany Eduardo Morcillo, China Steven Dresner, USA Søren Nørbjerg, Denmark Istvan Preda, Hungary Antonio Zecchino, Italy Former Chairman General Secretary Director Director Director Director IMAP Board of Directors is comprised of leading international investment banking and corporate finance professionals who are also the shareholders of IMAP. Şevket Başev, founding partner and CEO of 3 Seas Capital Partners has-been elected as the Chairman of the Board of Directors at the general assembly meeting in November 2010. IMAP Board members are listed above. 30 Global Financial Ranking 2010 w Number of Deals IMAP Deal Value (million USD) Rank Financial Advisor 1 KPMG 291 7,819.6 2 PricewaterhouseCoopers 267 4,703.9 Deloitte 241 4,483.5 IMAP Ernst & Young LLP 186 184 1,812.6 4,334.7 3 4 5 6 Morgan Stanley 163 9,510.1 6 Lazard 163 5,892.0 6 Rothschild 163 5,174.2 9 Houlihan Lokey 142 4,530.8 10 Credit Suisse 133 6,133.9 11 Goldman Sachs & Co 126 4,967.7 12 UBS 118 5,706.4 13 Nomura 109 5,258.4 14 BDO International 108 1,049.8 15 JP Morgan 101 3,282.3 16 Deutsche Bank AG 96 5,070.6 16 M&A International 96 1,235.8 18 Mizuho Financial Group 95 2,819.9 18 Bank of America Merrill Lynch 95 5,082.5 20 Sumitomo Mitsui Finl Grp Inc 93 2,500.1 1st 1st 4th 4th 5th in Eastern Europe For values up to 500 million USD in Nordic Region For values up to 500 million USD in the entire world For values up to 200 million USD in EMEA region For values up to 100 million USD in the USA For values up to 100 million USD * Transactions up to 200 million USD in value are included. Industry Groups In accordance with their sector expertise, global experience and relationship network, IMAP firms established “Industrial Groups” to provide their clients with the most convenient solutions for their needs within M&A activities. These groups are focused on Industrials, Healthcare, Energy & Power, Real Estate, Retail, Financials, Technology, Telecommunications, Government & Agencies, Media and Entertainment, Consumer Products and Services, Materials, Chemicals, Packaging & Construction Goods, Food & Beverage and Consumer Staples. Facts and Figures Over its 37-year history, IMAP has seen a steady increase in the number of successful transactions completed each year. This past decade has been marked by especially strong growth and IMAP successfully completed more than 2,000 transactions in the last 10 years. IMAP completed a remarkable 179 transactions in 2009, the most difficult year in the history of global M&A market, and 184 transactions in 2010. IMAP consistently ranked at the top of the Thomson Reuters League Tables for completed M&A transactions around the world. IMAP ranked fourth in the world in 2010 for the completed transactions valued under 200 million USD and first in Eastern Europe and Nordic Countries for the completed transactions valued up to 500 million USD. 31 Transaction Volume & Value Year Number of Transactions Total Value of Transactions (million USD) Average Value per Transaction (million USD) 2000 182 3,151.0 17.3 2001 199 2,096.0 10.5 2002 217 4,425.0 20.4 2003 210 3,470.0 16.5 2004 190 5,803.0 30.5 2005 220 4,079.0 18.5 2006 218 6,341.0 29.1 2007 254 9,946.0 39.2 2008 252 13,024.0 51.7 2009 179 6,159.3 34.4 2010 186 11,130.4 59.8 2010 Transactions by Region Region Number of Transactions Asia Average Value of Transaction (million USD) 11 552.3 50.2 121 2,434.7 20.1 Latin America 12 4,908.1 409.0 US & Canada 42 3,155.9 75.1 EMEA What sets IMAP apart from other leading M&A advisory networks is the way in which the IMAP colleagues collaborate globally in order to meet client needs and provide them a suitable environment to do their business at the right time, under right circumstances and in the most suitable regions. IMAP partners are experienced M&A professionals who share their intimate knowledge of local markets with each other. The differences in local dynamics and competitive situations in various markets 32 Value of Transactions (million USD) are presented to the clients with accurate analysis undertaken by the IMAP partners. The global competitiveness of companies depends on their ability to receive the same scale of global advisory services. IMAP partners, with their global cooperation, allow their clients to receive high-quality of services without high costs. IMAP colleagues stay linked via IMAP’s exclusive Global Collaboration Centre (GCC). Through the GCC, advisors constantly share: • • • • • Business Opportunities Transactions & Mandates Buyer and Seller Researches Sector Expertise Effective and Direct Relationships and Communication Channels When an IMAP partner begins a project, he or she first determines the priority needs of the project depending on the project features, market and the industry. This partner (“the Project Leader”) chooses the suitable team members from the partners within the related industry group by considering their experience and operations in targeted markets. Therefore, the Project Leader establishes a team that exactly matches the needs of the specific project. IMAP advisors and analysts from around the world routinely come together at regional and international meetings for sharing their knowledge, experience and ideas. The last symposium of 2010 was held in Paris on 21 October 2010 In the meeting where 35 IMAP members joined from all around the world, global collaboration issues, mainly in evaluation and optimization of cross-border cooperation and specific information sharing about industries, trends, forecasts of the global business environment has been discussed. Besides the IMAP partners, executives of private equity groups, corporate development officers, global M&A attorneys and M&A transaction advisors from more than 30 countries attended the symposium. The following speakers joined the symposium’s main panel: Gonzague de Blignieres, Co-president of Barclays Private Equity Europe; Scott Berman, Managing Director and Senior Transaction Advisor of Morgan Joseph (IMAP New York); Pierre Bosset, Head of Research for HSBC Securities; and Carlos Méndez-Peñate, a shareholder with AkermanSenterfitt, one of the world’s leading law firms. The first meeting of IMAP in 2011 will be held in New York and the second in Spain. 33 3 Seas Capital Partners Egypt is Up and Running Becoming Turkey’s leader corporate finance firm, 3 Seas Capital Partners took an important step in the fourth quarter of 2010. Our company established a partnership by acquiring 50% shares of Intelligent Way, a leading corporate finance company in Egypt, with the aim of global expansion. Our office in Egypt will bring together the regional influence and the wide network connections of Mr. Khaled El Ghannam, with the experience of 3 Seas Capital Partners. The company will be named 3 Seas Capital Partners as in 34 Turkey and we believe that we will become the leader corporate finance company in the region very shortly. With this first step in expanding 3 Seas Capital Partners in the Middle East and Africa, we will be able to provide M&A services not only to regional companies but also to Turkish and foreign companies, which desire to enhance their investments in the Middle East and Africa. The reason for choosing Intelligent Way as the Egypt partner is the company’s wide network and local experience as well as the close relations of Mr. Khaled El Ghannam with the business community in Egypt. About 3 Seas Capital Partners Egypt Our young and dynamic Egypt office, which will be called 3 Seas Capital Partners Egypt, has been established in 2003 by Khaled El Ghannam, one of the founding partners of Bayt El Khebra, the most well known and successful corporate finance company of Egypt. Bayt El Khebra had completed many successful transactions and projects since 2008 with annual revenue of approximately 10 million USD. After 2008, the company went through a transformation We expect to become the leader corporate finance company in the region very shortly. period with the strategy of focusing on M&A transactions, and was named Intelligent Way. Focused on M&A, Intelligent Way has a well established structure to provide its clients with high quality services with high command over the business environment and investment opportunities in Egypt coupled with experience in the M&A process. Our office provides a full range of services in M&A process with a dynamic team of seven members who are the leading corporate finance professionals in Egypt through their experience in Bayt El Khebra Group and Intelligent Way. We believe that Egypt will become the center of attention in the Middle East and Africa in the upcoming period with its business environment, which will recover very soon, and the investment opportunities carrying high potential in many sectors and areas. 3 Seas Capital Partners is ready to provide its expertise for the Turkish and global investors who desire to seize the opportunities that Egypt offers. We hope this acquisition will contribute and add value to Turkish businessmen and companies operating in Egypt as well as our domestic business environment. 35 Corporate Events Since the establishment of 3 Seas Capital Partners, we strived to share our exclusive know-how and experience with the business community in Turkey that reached beyond our clients, in order to increase awareness and spread the M&A culture. This year, we enhanced our corporate activities to a broader audience and targeted the occupational and industrial business organizations and NGOs that represent our business world in different areas. Within this 36 frame, in 2010 we started visiting different regions of Anatolia in corporate events organized with the cooperation of respected associations, local chambers of commerce, local chambers of industry and shared our knowledge in M&A through seminars and meetings. During these visits, we presented the ways to enhance the attending companies’ businesses and opportunities ahead for improvement and growth. Our visits in 2010 started with the Association of Aegean Businessmen and Industrialists (ESIAD) and continued with Kayseri Chamber of Industry (KAYSO). In 2011, we desire to continue these visits to many other cities in Anatolia and contribute to the growth and development of M&A culture in our business community. ESIAD Meeting The first meeting was in cooperation with the Association of Aegean Businessmen and Industrialists and took place in the headquarters The presentations of our Founding Partner and CEO, Şevket Başev and our Managing Partner İbrahim Arınç are appreciated by the attendants. of their Association with the attendance of respectful business people who mainly operate in the Aegean Region. The subject of our meeting was “The Trends and M&A in the New World Economy”. We emphasized the investment opportunities in the emerging market countries and showed examples of M&A activities that took place in low risk countries like USA, England and Germany. KAYSO Meeting In the symposium we held in the central Anatolian city of Kayseri in cooperation with Kayseri Chamber of Industry, our subjects were “Working Principles and Investment Criteria of the Private Equity Funds” and “The Role of the Private Equity Funds in the New World Economy and Their Increasing Effectiveness in Emerging Market Countries”. During the meeting which we held with the attendance of KAYSO Members and the businessmen of Kayseri, we presented examples of the increasing M&A activities and investment criteria of private equity funds which show an increasing trend in Turkey. Our Meetings Will Continue in 2011 3 Seas Capital Partners plans to continue its corporate events in 2011 with the aim of increasing awareness of the M&A culture in Turkey. In line with the invitations received from respected business people and associations, partners and experts of 3 Seas Capital Partners would be happy to attend corporate events across Anatolia. 37 M&A World 2010 Bekir Yıldırım / Research Analyst In 2010, Energy and Power was the most active industry with an M&A volume of 492 billion USD, constituting 20.6% of global transactions. According to Thomson Reuters, the global M&A market experienced its strongest year since 2008 and reached a volume of 2.4 trillion USD in 2010. Following a 40% decrease in transaction volume in 2009 due to the global crisis, the increase of 22.9% in 2010 signals that the market is poised to reach its precrisis levels in the near term. The most noteworthy developments in 2010 M&A world were significant increases in large cap deals and the share of emerging market countries in global M&A, constituting 33% of global transaction volume in 2010. 38 Significant increase in large cap deals The difficulties at global investment banks such as Lehman Brothers, Merrill Lynch and AIG and the problems experienced by other major investment banks during the global crisis had a significant negative impact on large cap deals. Financing problems experienced during the financial crisis led to a substantial decrease in large cap deal volume in 2009. Aggressive monetary expansion policies pursued by the United States and its European counterparts and global government support to distressed banks helped increase large cap deal volumes in 2010. Compared to 138 large cap deals completed in 2009, 2010 has been a year of recovery with 213 deals. Albeit being lower than the 2008 record of 235 large cap deals, these transactions have helped boost global M&A volume considerably. Large cap deals with an aggregate size of over 700 billion USD account for almost 30% of global M&A volume and are of particular importance due to their positive knock-on effects on mid and small cap deals. The largest deal of 2010 was the 27.3 billion USD asset sale based merger of BeNeLux based GDF Suez Energy International and UK based International Power Plc, which also affected Turkish assets including İzgaz natural gas distribution. Followed by the sale of 52% stake in Alcon Inc., the medical unit of Nestle, to Novartis for 25.8 billion USD and sale of Cadbury to Kraft Foods for 23 billion USD which rounded out the top three major transactions in 2010. Additionally, sale of 24.9% stake in Garanti Bankası to Banco Bilbao for 6 billion USD constituted the largest transaction in Turkey in 2010 and was also one of the 30 largest transactions worldwide. Emerging market countries deal volume has reached 806.3 billion USD Despite the financial turmoil, emerging market countries such as China, Brazil and India had attracted global attention with their significant growth rates and their 24% share in global M&A transactions in 2009. In 2010, emerging market countries became significant players in the market further increasing their share in global M&A transactions to 33% in 2010. M&A transactions in developed countries increased slightly over their 2009 levels due to the absence of growth expectations and shrinking domestic economies. Emerging market countries, on the other hand, have become a major market for global M&A transactions with a volume of 806.3 billion USD. Additionally, emerging market countries delivered an outstanding performance in IPOs in 2010. Their share in global IPO transactions reached 269.4 billion USD representing 50% of all IPOs worldwide. Emerging market countries, particularly China, Brazil and India, are expected to increase their share in M&A and IPO transactions with their high growth rates and increasing energy, raw material and financing needs. Sectors with the Largest Transaction Volumes in 2010 (million USD) 102 75 127 492 141 166 349 174 176 195 231 Energy & Power Real Estate Financials High Technology Materials Consumer Staples Industrials Media & Entertainment Telecommunications Consumer Product & Healthcare Services Source: Thomson Reuters Energy and power sector was the most active Energy and power was the most 39 Announced Global Mergers and Acquistions Quarterly (billion USD) 1600 1400 1418 1200 1000 972 896 800 895 879 800 669 600 521 400 591 476 443 471 Q1 Q2 Q3 519 563 635 547 200 0 Q1 Q2 Q3 Q4 Q1 2007 Q2 Q3 2008 Q4 Q4 2009 Source: Thomson Reuters active industry in 2010 with a volume of 492 billion USD, constituting 20.6% of global M&A transactions. International companies such as GDF Suez, BP, Gazprom, Repsol, EnBW and E.ON completed multibillion dollar M&A transactions while Turkey stepped forward with the privatization of electricity and natural gas distribution assets in 12 regions valued at 13.5 billion USD. As Adam Smith’s theorem states, natural resources are limited but human needs are not. Therefore, energy and power will continue to be one of the most sought after sectors both in the M&A market and the global agenda, due 40 to limited availability of such energy resources. However, the increase in transaction volumes in 2010 is not yet a signal of sector wide recovery. Financial institutions, particularly the banks which have experienced large capital losses, are expected to consolidate in order to strengthen their capital structures. Similar to the financial services industry, the real estate sector seems to have come to an end of its descent. Following a dramatic decrease of 46% in 2009, real estate sector reached a transaction volume of 166 billion USD in 2010. However, like the financial services sector, the real Q1 Q2 Q3 2010 Q4 estate sector is still far from its peak as high growth rates in western economies are essential for the recovery of the real estate sector. rating agencies, underlining the improvement in Turkish economy, which was reflected in the Turkish M&A market as well. The significant increase in the Turkish M&A market Following contractions in 2008 and the first three quarters of 2009, Turkish economy started to recover in the fourth quarter of 2009 and sustained its growth in all four quarters of 2010 reaching an annual growth rate of 8.9%. The economic recovery was followed by credit rating upgrades from international According to our analysis based on selected sector reports and announced transactions, the Turkish M&A market achieved 500% growth in 2010. The total volume of M&A transactions reached 30 billion USD including the estimated value of undisclosed transaction and privatizations, accounted for approximately 50% of all transaction volume. Transactions excluding privatizations have increased considerably as well, tripling 2009 figures. In total, 243 transactions were completed in 2010. Also in 2010, a notable shift in the Turkish M&A market was observed with domestic investors increasing their share in both the number of deals and transaction volumes. We believe the Turkish M&A market, which has started its recovery in the last quarter of 2009, has not reached its full potential yet. The Turkish M&A market is poised to reach new highs with increased domestic and international interest and the expected credit rating upgrades by international rating agencies in 2011. 2010 Number of M&A Transactions by Region 13,568 2,044 11,195 1,062 9,725 Source: Thomson Reuters 41 Branding ensures stable and predictable future cash flows, reducing financial risks and boosting enterprise value. 42 Company Valuation Methods and Brand Value Çağlar Uğurlu / Senior Analyst A brand is the aggregate of all marks that are utilized to distinguish a company’s goods and services from its competitors’ goods and services on the market. Today’s economic environment requires not only competitive production capabilities, but also creation of brands, which has been gaining importance in the recent years. The value of a thriving brand lies in its ability to address psychological needs of its consumers in addition to functional ones This additional value is essential for the creation of a strong brand creating the subjective perception that the product is superior to its counterparts. Such objective perceptions are crucial in the creation of a successful brand. Only for such brands, the consumer may be willing to pay a premium. Another significant benefit of a strong brand is the customer loyalty it instills, which enables the company to secure steady, sustainable and profitable sales in the long term. In other words, branding aims to improve sales volumes, prices and frequency of purchases over the long term. Brand equity is the aggregate of all values that consumers identify the brand with and differentiate it from other brands and, in a sense, is the result of all marketing activities and brand related investments. From a financial point of view, the value of a brand can be estimated as the sum of all economic benefits that the brand generates for its owner. This is also equivalent to the net present value of all future financial returns generated by the brand. The aggregate present value of all long term financial benefits secured by a branded product over a nonbranded one reveals the brand value. 43 Brand Equity and Enterprise Value (EV) Discounted Cash Flow (DCF) and Comparables Analysis (CA) are the two major valuation methods utilized by international investment banks. These widely accepted methods also form the basis for the brand equity valuation methods. should produce similar products and/or services. However, the number of companies with similar outputs and similar characteristics can be limited. Additionally, financial details of M&A transactions are not always announced; hence, narrowing the CA method’s applicability. Financial ratios of comparable publicly traded companies or M&A transactions realized in the same sector are examined and compared within the scope of the CA method. In order to be suitable peers for the CA method, prospective companies In the CA method, EV is generally expressed as a multiple of certain financial measures such as revenues, EBITDA or book value. Likewise, brand valuation within the CA method is based on comparisons and analyses of financial figures 44 and ratios. EBITDA margins of public companies that own strong brands tend to be than their peers. In the meantime, the EV/EBITDA ratios (EBITDA multiples) of such firms also tend to be higher, illustrating investors’ strong appetite for investing in companies with prominent brands. Higher multiples attached to companies with stronger brands indicate that the EVs of these companies include the value of their brands and an isolated brand valuation is not possible with CA. Another issue is that, by definition, brand is a unique notion and its Brand equity is the aggregate of all values consumers identify the brand with and differentiate it from other brands. comparability is questionable. Although the outcomes of the CA method provides apt intuitions about the brand equity and the EV of a company, accuracy of these outcomes are debatable. DCF, the most widely accepted and utilized valuation method, has its roots on the time value of money. Within the DCF framework, the value of a company is equal to the aggregate of the present values of all projected future cash flows generated by that company. Similarly, the value of a brand can also be calculated by taking into account the projected future cash flows generated solely by the contributions of it. In other words, the value of a brand is equal to the present value of the sum of the differences between all future cash flows generated by the sales of a product with and without that brand. In contrast to an unbranded product, consumers typically prefer to purchase a branded product, even at a higher price, more frequently and in higher volumes. Moreover, branding can be utilized to build customer loyalty, which consequently trims down the volatility in sales volumes and profitability therefore reducing financial risks. Increased predictability, reliability and stability of future cash flow projections decrease discount rates used to calculate the present values, thus, increasing the EV of the company. The sum of all these added values represents the total value of a brand. Despite the fact that the DCF method produces more meaningful and dependable outcomes compared to CA method, like any valuation method, it is built on assumptions and forecasts which inherently contain uncertainties. 45 3 Seas Capital Partners Turkey İnşirah Sokak No: 18 34342 Bebek - İstanbul/Turkey Telephone: +90 (212) 257 70 00 Fax: +90 (212) 257 70 05 3 Seas Capital Partners Egypt 1, El Obour Buildings, Salah Salem Road Nasr City, Cairo, Egypt Telephone: (+202) 226 18333 Fax: (+202) 226 19913 582 leading M&A house in Turkey the in the World.