UAE morning meeting notes Market Statistics

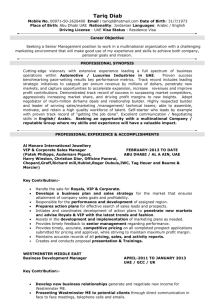

advertisement

UAE morning meeting notes

UAE morning meeting notes

26th May 2009

Market Statistics

DFM top 5 traded by value on:

Equity investment analysis

On the U.A.E. stock markets

MAC CAPITAL ADVISORS CONTACTS

RESEARCH

Head: Research

Ian Munro

Email: ian@maccapitaladvisors.com

Tel: +971 4 409 7140

Head: Sales

Nour Al Zoubi

Email: nour@mac-sharaf.com

Tel: +971 4 4097110

Head: Institutional Sales

Ron Garcha

Email: ron@mac-sharaf.com

Tel: +971 4 4097121

Senior Equity Sales

Amjad Bakir

Email: amjad@mac-sharaf.com

Tel: +971 4 4097117

Senior Equity Sales

Samer M. Hammad

Email: samer@mac-sharaf.com

Tel: +971 4 409 7119

•

•

25-May-09

Value

Close

Prior

Ch

(mln)

(AED)

(AED)

Mkt Cap

EMAAR

333.7

2.88

2.95

-2.37

ARTC

181.6

2.60

2.68

-2.99

847

DFM

99.0

1.37

1.42

-3.52

2,984

DIC

41.6

1.19

1.20

-0.83

1,187

AIRARABIA

30.0

0.98

0.97

1.03

1,245

(%)

(US$ mln)

4,777

Source: DFM, Bloomberg

ADX top 5 traded by value on:

Equity Investment Analyst – Technical

Shiv Prakash

Email: sp@maccapitaladvisors.com

Tel: +971 4 409 7141

SALES

Stock

Stock

25-May-09

Value

Close

Prior

(mln)

(AED)

(AED)

Ch

Mkt Cap

(%)

(US$ mln)

DANA

56.4

1.07

1.09

-1.84

1,748

ALDAR

39.0

3.90

3.93

-0.76

2,738

SOROUH

21.0

2.86

2.85

0.35

1,947

TAQA

14.8

1.79

1.83

-2.19

3,034

RAKPROP

14.0

0.63

0.64

-1.56

343

Source: ADX, Bloomberg

NASDAQ Dubai top traded by value on:

Stock

DPW

25-May-09

Value

Close

Prior

('000)

(AED)

(AED)

1850.2

0.360

0.390

Ch

(%)

-7.69

Mkt Cap

(US$ mln)

5,976

Source: Bloomberg

Inside this issue:

•

•

UAE Market Update

Corporate News

•

Directors’ Dealings

•

Regional Market Update

MAC Daily Trading Ideas

Buy DFM stock- Volumes traded on the DFM have improved in recent days, driven in part by foreign

investors changing their stance to overweight DFM listed company’s. DFM stock trades at a 32% P/E

discount to its 4 year average. The exchange generates high levels of free cash flow, has a 30% share

of GCC stock volumes traded and is likely to grow earnings exponentially as long term oil prices and

GCC economic growth improves. Look to accumulate on market weakness today for short term traders,

long term investors can accumulate on any prevailing market weakness during the traditionally lower

volume Summer months. 12 month price target AED 1.83.

Buy Qatar X Pert Certificates (NASDAQ Dubai)- Qatar has strong macroeconomic fundamentals,

driven by significant gas reserves, foreign assets and a large pipeline of property investments. The

country aims to supply 30% of the world’s LNG needs by 2012. We believe this scenario would be a

large driver of fiscal/corporate earnings in Qatar, with surplus funds flowing into property,

infrastructure and overseas investments. Investors can buy DBXQA certificates on the NASDAQ Dubai,

which represent a weighted portfolio of 12 Qatar listed companies. Trading at 14%< price issue.

May 26, 2009

-1-

UAE morning meeting notes

UAE Market Update

AE Market Update

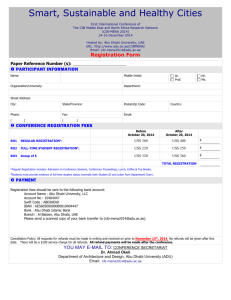

The DFMGI declined 25 points to close at 1,709. The total traded value decreased 13.0% to AED 790 mln.

AED mln

Index

DFM traded values (column) v DFMGI (line) 2009

1400

1,700

1200

1000

800

1,600

600

400

200

0

26-Apr-09

1,500

03-May-09

10-May-09

17-May-09

22-May-09

The ADI declined 3 points to close at 2,622. The total traded value decreased 48.6% to AED 211 mln.

AED mln

ADX traded values (column) v ADI (line) 2009

800

Index

2,700

600

2,600

400

2,500

200

0

26-Apr-09

2,400

03-May-09

10-May-09

17-May-09

22-May-09

Total value traded on the NASDAQ Dubai exchange was 1.91m USD. DP World is the largest company on

the NASDAQ Dubai and comprises the majority of volumes traded.

May 26, 2009

-2-

UAE morning meeting notes

Corporate News

Abu Dhabi Finance offers mortgages for Sorouh's projects

Abu Dhabi Finance and Sorouh Real Estate have announced an exclusive new mortgage product for

customers at four of the developer's projects. For a limited period, property owners at Sky Tower, Sun

Tower, Tala Tower and Golf Gardens will be able to apply for a specially-developed mortgage which includes

discounted interest rates starting at 7.24% along with no application or processing fees.

NBAD inaugurates Abu Dhabi National Islamic Finance (ADNIF)

H.E. Nasser Ahmed Khalifa AlSowaidi, Chairman of National Bank of Abu Dhabi (NBAD), officially

inaugurated Abu Dhabi National Islamic Finance (ADNIF) which would be the Islamic finance and banking

arm of NBAD. Islamic Banking and financial services would be provided through the Islamic Banking division

of NBAD and Abu Dhabi National Islamic Finance (ADNIF) complementing each other under brand ADNIF.

ADNIF has projected its investment portfolio to grow to AED 3.2b by the year-end.

Aldar sees under supply in affordable housing

John Bullough, chief executive of Aldar Properties said that there's an over supply in high-end real estate

segment and an under supply in the affordable housing segment. He added that Aldar is focusing on

working with the government on projects and is reviewing a number of their existing projects to create

more affordable housing and move away from the high-end (property) focus.

flydubai gets green light for take off

A new era for budget air travel within the region took a big step closer to realization when flydubai, received

its Air Operators Certificate (AOC) from the General Civil Aviation Authority (GCAA). flydubai is Dubai's first

low-cost airline. Ghaith Al Ghaith, CEO of flydubai said that the award of the operator's certificate is the

green light for flydubai to start its commercial operations.

Adnoc invites bids for 4 Shah sour gas packages

Abu Dhabi National Oil Co. (Adnoc) and ConocoPhillips (COP) have invited bids for four contracts on the

estimated US$ 10b Shah sour gas field development, which is set to help Abu Dhabi meet rising gas

demand. Adnoc's chief executive said that the contracts are part of plans to award energy deals worth

between US$ 35b-50b in 2009 and 2010.

Taqa buys back another 5.17m shares

Abu Dhabi National Energy Co. (Taqa) bought back 5,175,023 shares. The latest buyback brings the total to

121,893,587 shares that Taqa has bought back since it received the approval of the Securities and

Commodities Authority in February 2009.

Taqa to expand power plant in Morocco

The Office National de L’Electricite (ONE) of Morocco and Taqa has signed a strategic partnership to extend

the capacity of the Jorf Lasfar Energy Company (JLEC) by two new units of at least 350 MW each. JLEC will

build, own, and operate the new units 5 and 6 under a 30-year power purchase agreement.

Salwan leases 5,600 Al Khail Gate units

Salwan LLC, a subsidiary of Dubai Properties Group (DPG), announced that it has commenced leasing of

5,600 units at phase-II of the Al Khail Gate community. Saeed Bushalat, CEO of Salwan, said that within a

May 26, 2009

-3-

UAE morning meeting notes

year, their portfolio has grown to 18,000 units and they are planning to bring an additional 8,000 properties

for leasing by this year-end.

Global takes NBQ to court for US$ 250m

Global Investment House has moved court against National Bank of Umm Al Quwain (NBQ) seeking

recovery of a deposit the former placed with NBQ. Global stated in a document that NBQ has failed to

refund a deposit worth US$ 250m (AED 917m), which it says it placed with the bank as an advance on a

transaction between the two.

UAE TRA chief outlines strategy for future revenue streams

Mohammed Al Ghanim, Director General of the UAE Telecommunications Regulatory Authority (TRA), said

that if additional revenue streams are to be opened up with mobile phone penetration approaching

saturation levels, regional operators should further develop multimedia, mobile commerce and capitalize on

advertising revenue. TV broadcasts to mobile handsets and fixed line services such as video on demand

were potential development areas. Al Ghanim added that fixed and mobile voice and data services maybe

major revenue segments, but the key to future growth is next generation of broadband as well as

integrating the parallel stream of wire-line and wireless technologies.

Plan for 100% ownership

Abu Dhabi is considering allowing 100% foreign ownership of some projects in the emirate. Nasser Ahmed

Al Suwaidi, the chairman of the Department of Economic Development, said that they are strongly inclined

to grant 100% ownership to foreigners in new and old industries as well as other projects. The percentage

might be less in other sectors according to the emirate's needs. Ownership covers projects and not land.

However, no final decision to this effect had been made in Abu Dhabi and the new company law was being

reconsidered.

Abu Dhabi aims to attract 2.3m hotel guests by 2012

The Abu Dhabi government aims to attract 2.3m hotel guests by 2012 as the emirate aims to build up its

tourism sector in a bid to diversify its economy. Sultan bin Tahnoon al Nahyan said that they plan to sustain

last year's performance when Abu Dhabi received 1.5m hotel guests. He added that for 2010 Abu Dhabi

aims to achieve a 10% rise in hotel guests and a 15% increase in both 2011 and 2012.

Islamic Bonds worth US$ 27.5b to be issued in 2009, says Ernst & Young

Although Islamic investment funds face bigger risks this year due to the global economic crisis, new issues

of Islamic bonds, or sukuks, are likely to rise by 56% from last year, according to financial services firm

Ernst & Young. Worldwide sukuk issuance slowed last year as spreads widened, with issuances of US$ 15.5b

in 2008 down sharply from the US$ 47.1b in sukuks issued in 2007. Shariah-compliant investment assets

grew nearly three-fold to US$ 736b in 2008 from US$ 267b in the previous year. The average Islamic fixedincome fund return dropped from 3% in 2007 to 1% in 2008 and in the first quarter this year.

May 26, 2009

-4-

UAE morning meeting notes

Directors’ Dealings

There are many reasons why a director will sell shares (eg. to buy a new car, a new house, etc.).

However, a director who buys shares is doing so because he believes in the company and that

the share price is cheap

Directors’ dealings:

DFM directors’ dealings yesterday

There were no directors’ dealings on DFM yesterday

ADX directors’ dealings yesterday

Insider sold METHAQ (Methaq Takaful Insurance) 240,173 shares at price of 5.17,

estimated average value AED 1,241,694.

Insider bought DANA (Dana Gas) 600,000 shares at price of 1.06-1.07, estimated

average value AED 639,000.

NASDAQ Dubai directors’ dealings yesterday

There were no directors’ dealings on NASDAQ Dubai yesterday

Company Share buy-backs:

DFM Company Share buy-backs yesterday

There were no share buy-backs on DFM yesterday

ADX Company Share buy-backs yesterday

Bought TAQA (AD National Energy) 4,000,000 shares at price of 1.77-1.80, estimated

average value AED 7,140,000.

NASDAQ Dubai Company Share buy-backs yesterday

There were no share buy-backs on NASDAQ Dubai yesterday

Outstanding Company Share buy-backs:

DFM outstanding Company Share buy-backs

Aramex (ARMX)

Gulf Navigations Holdings (GULFNAV)

ADX outstanding Company Share buy-backs

First Gulf Bank (FGB)

AD National Energy (TAQA)

NASDAQ Dubai outstanding Company Share buy-backs

Depa Limited (DEPA)

May 26, 2009

-5-

UAE morning meeting notes

Regional Market Update

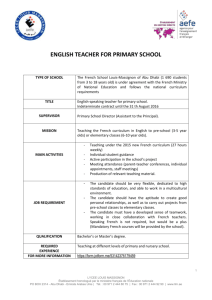

GCC - MARKET SNAPSHOT

MAJOR GAINERS AND LOSERS

Source: Bloomberg, Gulfbase

Index

DFM

ADX

NDI

TASI

BSE

KSE

MSM

DSM

Close

1709.8

2622.5

1437.9

5914.2

1630.0

7884.7

5551.6

6743.0

Daily

-1.4%

-0.1%

0.1%

-2.3%

-0.1%

0.3%

0.1%

-0.6%

WTD

6.5%

3.8%

11.1%

5.1%

2.1%

4.3%

8.2%

20.3%

MTD

6.5%

3.8%

11.1%

5.1%

2.1%

4.3%

8.2%

20.3%

YTD

4.5%

9.7%

15.2%

23.1%

-9.7%

1.3%

2.0%

-2.1%

Kuwait Stock Exchange

Stock

NCCI.KSE

ALAMAN

PCEM

SANAM

COAST

Close

Ch

(KWD)

(%)

110.00

10.00

114.00

9.61

570.00

9.61

146.00

7.35

104.00

7.21

Stock

TIJARA

JAZEERA

ABRAJ

GLOBAL

IKARUS

Close

Ch

(KWD)

(%)

70.00

-6.66

300.00

-6.25

80.00

-5.88

128.00

-5.88

108.00

-5.26

Bahrain Stock Exchange

30%

Y T D P e rf o rm a nc e o f G C C m a rk e t s

Stock

22%

ITHMR*

ABC*

DUTYF

14%

6%

Close

Ch

(QAR)

(%)

0.26

4.08

0.60

1.69

0.85

1.19

Stock

GFH*

CINEMA

ESTERAD

Close

Ch

(QAR)

(%)

1.04

-3.70

0.86

-3.37

0.35

-1.42

Close

Ch

(QAR)

(%)

1.10

-12.00

0.44

-2.00

0.62

-1.28

0.65

-1.22

Close

Ch

(QAR)

(%)

31.20

-4.87

17.00

-3.95

10.50

-3.66

27.90

-3.12

35.00

-3.04

Close

Ch

* Prices in US$

-2%

DFM ADX NDI TASI BSE KSE MSM DSM

-10%

-18%

Muscat Stock Exchange

Stock

OMPS

MTMI

NAPI

OIFC

NSCI

Close

Ch

(QAR)

(%)

0.99

11.42

0.15

10.37

0.28

8.26

0.25

7.82

0.10

7.77

Stock

OSCI

VOES

GECS

RNSS

Doha Stock Exchange

Stock

QISI

ZHCD

QIMD

AKHI

QATI

Close

Ch

(QAR)

(%)

32.50

7.26

46.50

3.33

40.30

3.33

32.50

1.88

54.00

1.50

Stock

QSHS

DBIS

QGMD

AHCS

UDCD

Tadawul Stock Exchange

Stock

May 26, 2009

Close

Ch

(SAR)

(%)

SFICO

TAACO

DARALARKAN

SRMG

59.00

9.76

29.60

3.13

26.80

3.07

32.90

2.49

SAGRINSURANCE

51.00

2.20

-6-

Stock

SALAMA

GUCIC

TRADEUNION

SIIC

AL-AHLIA

(SAR)

(%)

63.00

-10.00

26.10

-10.00

23.50

-9.96

52.00

-9.95

52.25

-9.91

UAE morning meeting notes

8.77

MAC CAPITAL ADVISORS LIMITED- DISCLAIMER

Potential Conflicts

1. MAC Capital Advisors Limited (“MAC”) and/or its affiliate(s) hold or own or control 1% or more of the issued share capital of this company. 2. The issuer holds or owns or

controls a material amount of the issued share capital of MAC. 3. MAC and/or its affiliate(s) are or may regularly be doing proprietary trading in equity securities of this company.

4. MAC and/or its affiliate(s) have been lead manager or co-lead manager in a public offering of the issuer’s financial instruments during the last twelve months. 5. MAC and/or its

affiliate(s) are a market maker in the issuer’s financial instruments. 6. MAC and/or its affiliate(s) are a liquidity provider for the issuer to provide liquidity in such instruments. 7.

MAC and/or its affiliate(s) act as a corporate broker or as a sponsor or a sponsor specialist (in accordance with the local regulations) to this company. 8. MAC and/or its

affiliate(s) and the issuer have agreed that MAC will produce and disseminate investment research on the said issuer as a service to the issuer. 9. MAC and/or its affiliate(s) have

received compensation from this company for the provision of investment banking or financial advisory services within the previous twelve months. 10. MAC and/or its affiliate(s)

may expect to receive or intend to seek compensation for investment banking services from this company in the next three months. 11. The author of or an individual who

assisted in the preparation of this report (or a close relative), or a person who although not involved in the preparation of the report had or could reasonably be expected to have

access to the substance of the report prior to its dissemination has a direct ownership position in securities issued by this company. 12. An employee of MAC and/or its affiliate(s)

serves on the board of directors of this company.

Rating Ratio MAC Q2 2009

Rating breakdown

Overweight

Equalweight

Underweight

Not Rated/Under Review/Accept Offer

Total

A

B

C

75%

0%

25%

0%

100%

0%

0%

0%

100%

100%

0%

0%

0%

100%

100%

Source: MAC

A: % of all research recommendations

B: % of research recommendations for this sector

C: % of issuers to which Investment Banking Services are supplied

Recommendation Structure:

All stock prices are stated as of the market close on the previous day. Our recommendations are based on absolute upside (if positive) or downside (if negative) potential, which

we define as being equal to Fair Value minus Current Price. Unless otherwise specified, our recommendations are set with a 12-month horizon. Initial investment research is

from January 2008. MAC’s rating system consists of three recommendations: OVERWEIGHT, EQUALWEIGHT and UNDERWEIGHT. For an OVERWEIGHT rating, the

minimum expected upside is 10% over 12 months. For an EQUALWEIGHT rating the expected upside is less than 10%. An UNDERWEIGHT rating is applied when there is

expected downside on the stock.

Analyst Certification

Any opinions, projections, forecasts or estimates in this report are those of the author only, who has acted with a high degree of expertise. They reflect only current views of the

author and are subject to change without notice. MAC has no obligation to update, modify or amend this publication or to otherwise notify a reader or recipient of this publication

in the event that any matter, opinion, projection, forecast or estimate contained herein, changes or subsequently becomes inaccurate, or if research on the subject company is

withdrawn. The analysis, opinions, projections, forecasts and estimates expressed in this report were in no way affected or influenced by the issuer. The author of this publication

benefits financially from the overall success of MAC and not from the specific recommendations or views that have been expressed in this research report. The analyst has

distinguished between opinion and fact where necessary.

Regulatory Status

MAC is an independent research company registered in St. Lucia. It has two affiliates in UAE, MAC Capital Limited which is regulated by the Dubai Financial Services Authority,

and MAC Sharaf Securities (UAE) LLC which is regulated by the Securities and Commodities Authority.

For further information relating to research recommendation and conflict of interest management please refer to www.maccapitaladvisors.com

Legal Information

The information contained in this publication was obtained from various sources believed to be reliable, but has not been independently verified by MAC.

The investments referred to in this publication may not be suitable for all recipients. Recipients are urged to base their investment decisions upon their own appropriate

investigations that they deem necessary. Any loss or other consequence arising from the use of the material contained in this publication shall be the sole and exclusive

responsibility of the investor and MAC accepts no liability for any such loss or consequence. In the event of any doubt about any investment, recipients should contact their own

investment, legal and/or tax advisers to seek advice regarding the appropriateness of investing. Some of the investments mentioned in this publication may not be readily liquid

investments. Consequently it may be difficult to sell or realize such investments. The past is not necessarily a guide to future performance of an investment. The value of

investments and the income derived from them may fall as well as rise and investors may not get back the amount invested. Some investments discussed in this publication may

have a high level of volatility. High volatility investments may experience sudden and large falls in their value which may cause losses. International investing includes risks

related to political and economic uncertainties of foreign countries, as well as currency risk.

To the extent permitted by applicable law, no liability whatsoever is accepted for any direct or consequential loss, damages, costs, prejudices arising from the use of this

publication or its contents.

MAC, and its affiliates, acts in various capacities including brokerage, research and investment banking. MAC, and its affiliates have put in place Chinese Wall procedures in

order to avoid any conflict of interests or dissemination of confidential and privileged information.

United Arab Emirates: This document is intended to be communicated in UAE. Where distributed in or from the DIFC, it is only intended for professional investors who qualify as

Clients within the DIFC.

Other countries: Laws and regulations of other countries may also restrict the distribution of this report. Persons in possession of this document should inform themselves about

possible legal restrictions and observe them accordingly.

May 26, 2009

-7-