Confidentiality Agreement

mp

le

The undersigned reader acknowledges that the information provided by

_________________________ in this business plan is confidential; therefore, reader agrees

not to disclose it without the express written permission of _________________________.

It is acknowledged by reader that information to be furnished in this business plan is in all

respects confidential in nature, other than information which is in the public domain through

other means and that any disclosure or use of same by reader, may cause serious harm or

damage to _________________________.

Sa

Upon request, this document is to be immediately returned to _________________________.

___________________

Signature

ro

___________________

Name (typed or printed)

nP

___________________

Date

Bu

sin

ess

Pla

This is a business plan. It does not imply an offering of securities.

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com

Table of Contents

Executive Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.1

Objectives . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.2

Mission . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.3

Keys to Success . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1

1

1

2

2.0

Company Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.1

Company Ownership . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.2

Start-up Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2.3

Company Locations and Facilities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

2

2

3

4

3.0

Products and Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.1

Service Description . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.2

Competitive Comparison . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.3

Sales Literature . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.4

Technology . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.5

Future Services . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4

5

5

6

6

6

4.0

Market Analysis Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.1

Target Market Segment Strategy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.2

Market Needs . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.2.1 Market Trends . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.2.2 Market Growth . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.3

Service Business Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.3.1 Business Participants . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7

7

7

7

8

8

8

5.0

Strategy and Implementation Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.1

Competitive Edge . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.1.1 Marketing Strategy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.1.2 Pricing Strategy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.1.3 Promotion Strategy . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.2

Sales Forecast . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8

9

9

9

9

10

6.0

Management Summary . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

6.1

Personnel Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

6.2

Management Team . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

7.0

Financial Plan . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.1

Important Assumptions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.2

Key Financial Indicators . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.3

Break-even Analysis . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.4

Projected Profit and Loss . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.5

Projected Cash Flow . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.6

Projected Balance Sheet . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.7

Business Ratios . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Bu

sin

ess

Pla

nP

ro

Sa

mp

le

1.0

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com

13

13

13

14

15

16

18

18

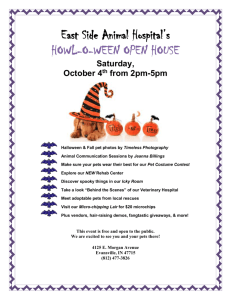

Noah's Arf

1.0 Executive Summary

mp

le

Noah's Arf is a full-service animal care facility dedicated to consistently providing high

customer satisfaction by rendering excellent service, quality pet care, and furnishing a fun,

clean, enjoyable atmosphere at an acceptable price. We will maintain a friendly creative work

environment which respects diversity, ideas, and hard work.

Sa

The timing is right for starting this new venture. Animals are playing a larger role in our lives,

and working people are choosing to provide them with a good life. Loving families with active

pets and an active conscience are in search of better lives for their pets and peace of mind for

themselves, causing busy animal lovers to flock to an ever-growing number of animal day care

facilities across the nation. For customer convenience, in addition to day care, Noah's Arf will

include overnight care, in-home care, wash your own, pet grooming, animal behavior, pet

portraits, gift and pet specialty products, 24 hour service, and special requests, all at one

facility.

nP

ro

Kris Price, owner, has worked at a high paced, customer service oriented profession at a

growing company for twenty-three years. She has earned the respect of her colleagues

through hard work and dedication. Her daughter is a graduate from veterinarian technical

college and will join the staff in the fall of 2001. Kris cares for pets of friends often, and at any

given time there have been one or more animals living in her home. From business colleagues

to friends surveyed, Kris has what it takes to make this venture extremely successful. She will

count on her reputation to exceed expectations while continuously establishing an active client

base.

1.1 Objectives

ess

Sales of $194,595 in FY2002.

Gross margin higher than 50% on pet products.

Full capacity by year end 2002.

Expansion of services by 2003.

sin

1.

2.

3.

4.

Pla

To achieve our objectives, Noah's Arf is seeking $100,000. This loan will be paid back from the

cash flow of the business within seven years, collateralized by the assets of the company,

backed by personal integrity, experience and a contractual guarantee from the owner. Startup costs will be used to purchase fixed assets of $65,000. The remainder will be used for

supplies, advertising, and cash on hand.

1.2 Mission

Bu

To provide excellent animal care in a pet friendly atmosphere while ensuring our customers,

both pet and owner, receive excellent service in a playful safe environment.

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com Page 1

Noah's Arf

1.3 Keys to Success

le

The keys to success in our business are:

Sa

mp

• Superior Customer Service: 24 hour high-quality care and service.

• Environment: provide a clean, upscale, odor free, enjoyable environment conducive

to giving professional trusting service.

• Convenience: offering clients a wide range of services in one environment.

• Location: provide an easily accessible location for customer convenience.

• Reputation: credibility, integrity, and 100% dedication from 23+ years employment at

current workplace.

2.0 Company Summary

nP

Overnight care.

Day care.

In-home care.

Wash your own pet.

Pet grooming.

Animal behavior classes.

Pet portraits.

Gift shop.

Special events.

Special requests.

24 hour service.

Pla

•

•

•

•

•

•

•

•

•

•

•

ro

Noah's Arf is a new company that will provide high-level animal care and customer service in

the following categories:

ess

What will set Noah's Arf apart from the competition is our commitment to provide these

services in one convenient location that is not limited to dogs and cats.

2.1 Company Ownership

Bu

sin

Noah's Arf will be created as a Oregon Limited Liability Company (LLC) based in Multnomah

County, privately owned by its principal operator.

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com Page 2

Noah's Arf

2.2 Start-up Summary

mp

le

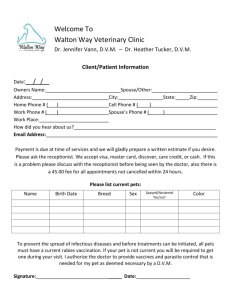

Total start-up requirements (including legal costs, logo design, stationery and related

expenses) comes to $170,000. The start-up costs are to be financed partially by the direct

owner investment of $70,000 and financing in the amount of $100,000. The details are

included in the following table and chart.

Table: Start-up

Start-up

Long-term Assets

Total Assets

Total Requirements

Funding

ess

Investment

Investor 1

Investor 2

Other

Total Investment

ro

$2,500

$500

$27,000

$39,000

$4,000

$0

$43,000

Pla

Start-up Assets Needed

Cash Balance on Starting Date

Start-up Inventory

Other Current Assets

Total Current Assets

$2,000

$500

$4,000

$5,000

$3,000

$7,500

$2,000

nP

Start-up Expenses

Legal and Accounting

Office Supplies (stationery, etc)

Collateral Materials (brochures, cards, etc.)

Consultants/Permits

Insurance

Rent/Lease

Space design/contractor

Sales and Marketing (advertising, direct

mail, etc)

Expensed equipment

Other

Total Start-up Expenses

sin

Current Liabilities

Accounts Payable

Current Borrowing

Other Current Liabilities

Current Liabilities

$100,000

$143,000

$170,000

$70,000

$0

$70,000

$0

$0

$0

$0

Long-term Liabilities

Total Liabilities

$100,000

$100,000

Loss at Start-up

Total Capital

Total Capital and Liabilities

($27,000)

$43,000

$143,000

Bu

Sa

Requirements

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com Page 3

Noah's Arf

le

Start-up

mp

$160,000

$140,000

$120,000

$100,000

Sa

$80,000

$60,000

$40,000

$0

Assets

Investment

Loans

nP

Expenses

ro

$20,000

2.3 Company Locations and Facilities

Pla

This facility will be established in an upscale, growing area in Northwest Portland described as

the Pearl District. We will service the growing condominium area, the West Hills area, while

capturing the Beaverton area for those customers coming into the Downtown Portland and

airport areas. The facility is zoned EXD, which will allow day and overnight care.

ess

3.0 Products and Services

sin

Noah's Arf wants to set itself apart from other animal service facilities that may offer only one

or two types of services. While talking to several pet owners, I have come to realize they

desire the services I am proposing, but are frustrated because they must go to several

different businesses. The focus of Noah's Arf is day care and overnight care. However, the

services we provide will be above and beyond what our competition can offer.

Our business atmosphere will be clean, friendly and upscale where customers will be

comfortable leaving their pets. We will offer a personal touch, such as birthday cards and a

daily report card for each pet that is registered with Noah's Arf.

Bu

Our business will offer 24 hour service, a unique concept in this type of industry.

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com Page 4

Noah's Arf

3.1 Service Description

le

Noah's Arf will be considered an upscale, full-service animal care facility. We will offer a wide

range of services, not limited to dogs or cats. Services are as follows:

3.2 Competitive Comparison

nP

ro

Sa

mp

• Overnight Care: Leave your pet for as long as necessary for 24 hour care and

attention. 26 large dog runs and eight kitty condos.

• Day Care: Provide 3,000 sq. ft. for a fun, safe atmosphere for pets to spend the day

exercising and enjoying the company of other pets.

• In-home Animal Care: Staff will go to homes to feed, walk, play, and check on pets

as often as requested. Mail will be picked up and plants watered if requested.

• Wash Your Own Pet: Provide four tubs, brushes, environmentally safe shampoo,

dryers and aprons for clients who bring their pets in to wash.

• Pet Grooming: Provide on-site professional pet grooming services.

• Animal Behavior Courses: Provide certified animal training courses for the beginner,

intermediate, and advanced.

• Pet Portraits: On-site portrait opportunities.

• Gift Shop: Provide specialty pet-related gifts and products.

• Special Events: Coordinate pet birthday parties or any other special occasions on-site

or at a location of choice.

• Special Requests: Provide service for pets with special needs including administering

medication, assisting with recovery from surgery, handicaps, etc.

• Pet taxi.

Pla

The competition comes in several forms. There are several organizations that offer one or two

services at their location.

Day care is a new business, offered currently only to dogs. There are eight dog day care

facilities in the Portland area:

ess

Urban Fauna in Northwest.

Lucky Dog Day Care in Tigard.

Happy Go Lucky Dog Training and Playcare in N. E. Portland.

Day Care for Doggy in N. E. Portland.

Doggone Fun! in Tualatin/Sherwood.

Kountry Kanine in Gresham.

No Bonz About It N. E. in Portland.

See Spot Play in S. E. Portland.

sin

•

•

•

•

•

•

•

•

None of these facilities offer 24 hour care making it inconvenient for clients to pick up their pet

by a specified time.

Bu

Noah's Arf will service all domestic animals within reason. We will not be limited to dogs only.

There are seven wash your own dog facilities in the Portland area:

•

•

•

•

•

•

Beauty For the Beast in N. E. Portland.

Rub-A-Dub Dog Wash in S. E. Portland.

The Dog Wash in Beaverton.

Bowsers Bath in Tigard.

Connie's U Wash Dog Wash.

Aqua Dog in Beaverton.

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com Page 5

Noah's Arf

• Pups & Cups in N. E. Portland.

mp

le

There are 73 grooming and boarding combined facilities and 18 dog training and obedience

combined facilities in the Portland area. Noah's Arf offers complete and total services at one

location. One-stop high-quality pet care for customer convenience.

3.3 Sales Literature

Sa

This business will begin with a general corporate brochure establishing offered services. This

brochure will be developed as part of the start-up expenses and distributed to large

businesses, restaurants, local veterinarians, pet stores, real estate agencies, fire departments,

The Humane Society, and the Washington Park Zoo. There will be a direct mailing to registered

pet owners and a website created.

ro

Literature and mailing for the initial market forums will be very important, with the need to

establish a high-quality look and feel in order to create a trusting sense of professionalism.

nP

3.4 Technology

3.5 Future Services

Pla

Noah's Arf will maintain the latest Windows and Internet capabilities including complete email

capabilities on the Internet to work directly with clients for reservations, purchasing products

online, asking questions, providing information, etc., as well as a Web page will provide

information and maximum exposure of available services.

ONE YEAR GROWTH PLAN

ess

• Veterinarian technician on staff to administer vaccinations on specified days and tend

to any unforeseen emergencies.

• Internet access to watch your pet online.

• Monthly newsletter.

• Weekly play hour.

• Espresso and juice bar.

sin

THREE YEAR

Expand the number of overnight kennels by 10.

Mobil pet wash--will go to pet owners home to wash their pets.

Sell and distribute gifts and products online.

Add an exercise pool.

Combine facility with a local veterinarian.

Bu

•

•

•

•

•

FIVE YEAR

• Expand the number of overnight kennels by 10.

• Franchise.

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com Page 6

Noah's Arf

4.0 Market Analysis Summary

mp

le

Noah's Arf will focus on dual-income, traveling professional families with hectic schedules.

Those trying to strike a balance between the demands of their careers, personal lives and their

pets. Our most important group of customers are those who do not have as much time as they

desire to invest in their pets and are willing to seek additional help regardless of costs.

Two years ago, doggie day care did not exist in Portland. Today, there are eight such centers

complete with entrance requirements and waiting lists.

Sa

4.1 Target Market Segment Strategy

ro

We will not be successful waiting for the customer to come to us. Instead, we must focus on

the specific market segments whose needs match our offerings. Focusing on targeted

segments is the key to our future.

nP

Therefore, our focus and marketing message will be the services offered. We will develop our

message, communicate it, and fulfill our commitment to excellence.

4.2 Market Needs

4.2.1 Market Trends

Pla

Our target customers are pet owners, not restricted to only one pet per household. They are

working professionals that need reliable, trusting and convenient pet care available to them to

keep up with the demands of their hectic schedules. There is a need for one-stop convenience.

ess

Today's trend consists of professionals having their families later in life or deciding not to have

children at all. Pet owners are increasingly treating their pets as they would their children. Pets

aren't just part of the family anymore. In some cases they are the family. They are willing to

invest dollars to have them cared for in an environment that would mirror their home

surroundings.

sin

Another important workplace trend is working longer hours and more days. There is also the

traveling professional. Professionals are looking for help to care for their pets in a loving

playful daycare. There is a need to have pets cared for over long periods of time while their

owners are away on business trips. Downtown and condominium living has also become very

popular for professionals. This creates the need to provide a daily exercise and a playful

environment for their pets.

Bu

In 1998, the amount of money Americans spend on dog food totaled $5.9 billion. America's

hottest new publication is "The Bark," a monthly publication for dog owners. Portland has their

own publication, "Dog Nose News." Hotel chains are encouraging pet owners to bring their pets

to stay in their hotels.

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com Page 7

Noah's Arf

4.2.2 Market Growth

mp

le

The benefits of sharing our lives with our pets offers owners affection, companionship and

security. For busy families, professionals and single pet owners, Noah's Arf offers a peace of

mind alternative to leaving their pets home alone. Over 350,000 Portland Metro households

have dogs, according to the "Dog Nose News." The nations 58 million pet owners spent an

estimated 22.7 billion on their pets in 1999 according to the Pet Industry Joint Advisory

Council.

Sa

A 1998 American Animal Hospital Association survey of pet owners who took their animals to a

vet, found that nearly one-third said they spend more time with their pets than with their

friends. Animals are playing a larger role in our lives and working people are choosing to

provide them with a good life, according to the director of community programs at the San

Francisco Society for the Prevention of Cruelty to Animals.

ro

Pet owners can be confident that their pets are in the best of hands at Noah's Arf. Pets can

socialize with buddies, revel in attention from expert care givers, and enjoy play activities.

nP

4.3 Service Business Analysis

The animal care service industry consists of many small individual facilities. Noah's Arf

direction is to establish itself as a full-service, 24 hour facility, creating customer convenience.

Pla

4.3.1 Business Participants

ess

The animal care industry is made up of many small participants that are function-specific.

These businesses offer one or two services. There are no businesses that offer full care,

including day care, overnight care and in-home care for 24 hours a day. Current facilities have

limited hours, causing a great inconvenience for the customer. Noah's Arf will change these

trends and offer "one stop convenience" for all their pet needs.

5.0 Strategy and Implementation Summary

Emphasize Customer Service

sin

Noah's Arf will differentiate themselves from other animal care facilities. We will establish our

business offering as a clear and viable alternative for our target market.

Build a Relationship-Oriented Business

Bu

Build long-term relationships with clients, not just an occasional visit. Let them become

dependent on Noah's Arf to help out in many situations. Make them understand the value of

the relationship.

Focus on Target Markets

We need to focus our offerings on the busy professionals, who want to save time to enjoy

convenience, multiple services, and total satisfaction of services.

Differentiate and Fulfill the Promise

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com Page 8

Noah's Arf

le

We can't just market and sell service and products, we must actually deliver as well. We need

to make sure we have the knowledge-intensive business and service-intensive business we

claim to have.

mp

5.1 Competitive Edge

Sa

Noah's Arf starts with a critical competitive edge: There is no competitor that can claim several

multiple services, 24 hour care, and customer convenience at one location.

5.1.1 Marketing Strategy

ro

Our marketing strategy is a simple one: satisfied customers are our best marketing tool. When

a customer leaves our business with a happy pet knowing that it has had a fulfilled day, our

name and service will stand on its own. We have talked with many friends, and associates who

are excited about our plans and are anxious to use our services.

nP

In addition, we will distribute advertising brochures to large businesses for bulletin boards,

(Nike, Adidas, Columbia Sportswear, Fred Meyer, Epson, Intel, Planar, etc.) offering a 10%

discount for a limited time to build a client base.

5.1.2 Pricing Strategy

Pla

Local TV news shows (AM Northwest, Good Day Oregon) will be contacted to feature our

business as a new service to the community. Direct mail will be sent to registered pet owners

in the Portland Metro area. Brochures will be distributed to hotels, restaurants, condominiums,

pet stores, coffee shops, Washington Park Zoo, local veterinarians, etc. Create a Noah's Arf

Web Page. Advertise in the Oregonian, Willamette Weekly, Portland Tribune, and Dog Nose

News newspapers.

ess

Noah's Arf will be priced at the upper edge of what the market will bear, competing with

similar types of services in the area.

sin

5.1.3 Promotion Strategy

We will host a open house with a business card drawing for one free service. We will offer

discounts after a specified number of visits for the first six months to establish a client base.

Bu

Example:

•

•

•

•

•

•

•

•

10 wash your own = one free day visit gift certificate.

10 day care visits = one free overnight visit gift certificate.

10 overnight visits = one free wash your own gift certificate.

20 visits = $10.00 discount.

Three referrals = one free day care visit gift certificate.

Monthly business card drawing = one free visit.

Create specified packages = one day, one night, one wash for a special discount price.

Multiple pets from the same family = family discount rate.

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com Page 9

Noah's Arf

le

• Use promotional items such as frisbees, collars, coffee mugs, etc. with Noah's Arf logo

imprinted.

5.2 Sales Forecast

mp

The following table and charts present the sales forecast for Noah's Arf.

Sales Forecast

Sales

Overnight Care

Day Care

In Home Care

Wash Your Own

Grooming

Retail

Obedience

Small Animal Care/cats

Special requests, misc.

Other

Total Sales

2002

$3,300

$2,425

$205

$370

$280

$5,300

$275

$1,025

$155

$0

$13,335

nP

Pla

Direct Cost of Sales

Overnight Care

Day Care

In Home Care

Wash Your Own

Grooming

Retail

Obedience

Small Animal Care/cats

Special requests, misc.

Other

Subtotal Direct Cost of Sales

2003

$103,334

$111,360

$11,090

$19,800

$8,880

$12,720

$6,790

$31,482

$1,920

$0

$307,376

2004

$113,668

$133,600

$13,310

$23,760

$10,660

$15,260

$8,150

$34,630

$2,300

$0

$355,338

2003

$4,000

$3,000

$250

$440

$340

$6,360

$330

$1,200

$190

$895

$17,005

2004

$4,400

$3,300

$300

$530

$410

$7,630

$400

$1,400

$230

$1,070

$19,670

ro

2002

$93,940

$146,050

$9,240

$15,900

$7,000

$10,600

$5,460

$28,620

$1,600

$0

$318,410

Sa

Table: Sales Forecast

Sales Monthly

Overnight Care

ess

$35,000

$30,000

Day Care

$25,000

In Home Care

Wash Your Own

$20,000

sin

Grooming

$15,000

Retail

Obedience

$10,000

Small Animal Care/cats

Bu

$5,000

Special requests, misc.

Other

$0

Jan Feb Mar Apr May Jun

Jul Aug Sep Oct Nov Dec

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 10

Noah's Arf

le

Sales by Year

$300,000

mp

Overnight Care

Day Care

$250,000

In Home Care

$200,000

Wash Your Own

Grooming

Sa

$150,000

$100,000

$0

6.0 Management Summary

2003

Obedience

Small Animal Care/cats

Special requests, misc.

Other

2004

nP

2002

ro

$50,000

Retail

Pla

Noah's Arf will be organized and managed in a creative, innovative fashion to generate very

high levels of customer satisfaction. We will create a working climate conducive to a high

degree of personal development and satisfaction for employees.

A policy manual will be developed and implemented. Job descriptions will be developed to

identify necessary competencies and skill sets. Team oriented professionals with common

goals will be hired.

ess

We will conduct weekly staff meetings to discuss ideas, suggestions, and operations. An annual

motivational seminar will be held and we will develop an employee recognition program. As the

business grows, the company will offer an employee benefit package to include health and

vacation benefits for everyone.

sin

6.1 Personnel Plan

The personnel plan will be as follows:

Bu

• One manager to oversee and fill-in for all areas.

• Two front desk reception to greet customers, receive payments for services/products,

set appointments, answer phones, check-in pets, distribute wash your own supplies

and maintain files of clients with data entry.

• Four playground supervisors will feed and water pets, keep area clean, walk and

exercise, collect pets at check-out time. Two will be on staff full time and two will work

part time.

Contract Employees:

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 11

Noah's Arf

• One pet groomer.

• One behavioral trainer.

Table: Personnel

Personnel Plan

Production Personnel

Playground supervisor

Playground supervisor

Playground supervisor part time

Playground supervisor part time

Playground supervisor

Playground Supervisor

Groomer

Pet taxi/in-home care/dog walker

Subtotal

Other Personnel

Other

Other

Subtotal

Total People

Total Payroll

$0

$0

$0

$0

$0

$0

$0

$0

$0

$36,000

$16,560

$0

$52,560

$36,000

$17,760

$6,912

$60,672

$36,000

$18,240

$7,104

$61,344

$0

$0

$0

$0

$0

6

$86,760

11

$163,440

11

$167,520

Sa

2004

$16,320

$12,240

$6,144

$3,072

$16,320

$12,240

$24,000

$15,840

$106,176

ro

Pla

General and Administrative Personnel

Manager

Reception 1

Reception 2

Subtotal

2003

$15,840

$11,880

$5,952

$2,976

$15,840

$11,880

$23,040

$15,360

$102,768

nP

Sales and Marketing Personnel

Other

Other

Subtotal

2002

$14,720

$11,200

$5,520

$2,760

$0

$0

$0

$0

$34,200

mp

le

In the first year, assumptions are that there will be only one receptionist, four playground

supervisors, and the manager will serve as part time receptionist and night personal until the

business can build. The groomer and trainer will work on contract. In the second year, a

second receptionist, two playground supervisors and a groomer will be added to the payroll.

ess

6.2 Management Team

Kris Price: Owner and Operations Manager

Nike, Inc. - 1979 to present:

sin

***Owner resume has been omitted for confidentiality.***

Classes and Seminars:

Bu

***Owner resume has been omitted for confidentiality.***

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 12

Noah's Arf

7.0 Financial Plan

le

The following is Noah's Arf's financial plan.

mp

7.1 Important Assumptions

Table: General Assumptions

General Assumptions

2002

1

0.00%

9.00%

25.00%

0.00%

2003

2

0.00%

9.00%

25.00%

0.00%

2004

3

0.00%

9.00%

25.00%

0.00%

$163,440

$258,992

$17,625

$167,520

$277,641

$20,222

ro

Plan Month

Current Interest Rate

Long-term Interest Rate

Tax Rate

Other

Calculated Totals

Payroll Expense

New Accounts Payable

Inventory Purchase

Sa

The following table summarizes key financial assumptions, including payment for services in

cash or credit card. We assume fast-growth and large demands in this new specialized service.

7.2 Key Financial Indicators

nP

$86,760

$210,723

$12,235

Pla

The benchmark comparison chart highlights our ambitious plan. We feel this is a new fast

growing service offered to the community. The opportunity to expand services is endless.

Benchmarks

ess

1.2

1.0

0.8

0.6

2002

0.2

2003

0.0

2004

Bu

sin

0.4

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 13

Noah's Arf

7.3 Break-even Analysis

mp

le

For our break-even analysis, we assume running costs of approximately $13,800 per month,

which includes our full payroll, rent, and utilities, and an estimation of other running costs.

Break-even Analysis

$15,000

Sa

$10,000

$5,000

$0

($5,000)

ro

($10,000)

($15,000)

$0

$6,000

$12,000

$18,000

$24,000

$30,000

nP

Monthly break-even point

Pla

Break-even point = where line intersects with 0

Table: Break-even Analysis

18,400

$18,400

Assumptions:

Average Per-Unit Revenue

Average Per-Unit Variable Cost

Estimated Monthly Fixed Cost

$1.00

$0.25

$13,800

Bu

sin

ess

Break-even Analysis:

Monthly Units Break-even

Monthly Revenue Break-even

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 14

Noah's Arf

7.4 Projected Profit and Loss

le

Month-by-month assumptions for profit and loss are included in the appendices.

mp

Table: Profit and Loss

Pro Forma Profit and Loss

Sales

Direct Costs of Goods

Production Payroll

Other

2003

$307,376

$17,005

$102,768

$0

-----------$119,773

$187,603

61.03%

2004

$355,338

$19,670

$106,176

$0

-----------$125,846

$229,492

64.58%

$0

$2,700

$0

$600

-----------$3,300

1.04%

$0

$5,500

$0

$1,000

-----------$6,500

2.11%

$0

$7,000

$0

$1,000

-----------$8,000

2.25%

$52,560

$0

$12,000

$1,200

$14,400

$12,000

$6,000

$38,500

$10,411

$0

-----------$147,071

46.19%

$60,672

$0

$12,000

$1,500

$15,000

$13,000

$7,000

$3,600

$19,613

$0

-----------$132,385

43.07%

$61,344

$0

$12,000

$1,700

$15,500

$14,000

$8,000

$3,800

$20,102

$0

-----------$136,446

38.40%

$0

$3,000

-----------$3,000

0.94%

-----------$153,371

$117,504

$8,210

$27,323

$81,970

25.74%

TRUE

$0

$4,000

-----------$4,000

1.30%

-----------$142,885

$44,718

$6,630

$9,522

$28,566

9.29%

TRUE

$0

$5,000

-----------$5,000

1.41%

-----------$149,446

$80,046

$5,050

$18,749

$56,247

15.83%

TRUE

Pla

nP

Total Sales and Marketing Expenses

Sales and Marketing %

General and Administrative Expenses:

General and Administrative Payroll

Sales and Marketing and Other Expenses

Depreciation

vehicle maintence

Utilities

Insurance

Taxes

Rent

Payroll Taxes

Other General and Administrative Expenses

ro

Sa

Cost of Goods Sold

Gross Margin

Gross Margin %

Operating Expenses:

Sales and Marketing Expenses:

Sales and Marketing Payroll

Advertising/Promotion

Travel

Miscellaneous

2002

$318,410

$13,335

$34,200

$0

-----------$47,535

$270,875

85.07%

ess

Total General and Administrative Expenses

General and Administrative %

Other Expenses:

Other Payroll

Contract/Consultants

Total Other Expenses

Other %

Bu

sin

Total Operating Expenses

Profit Before Interest and Taxes

Interest Expense

Taxes Incurred

Net Profit

Net Profit/Sales

Include Negative Taxes

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 15

Noah's Arf

7.5 Projected Cash Flow

le

The following chart and table show the project cash flow for Noah's Arf.

mp

Cash

$140,000

$120,000

$100,000

Sa

$80,000

$60,000

$40,000

Net Cash Flow

Cash Balance

ro

$20,000

$0

($20,000)

Jul Aug Sep Oct Nov Dec

Bu

sin

ess

Pla

nP

Jan Feb Mar Apr May Jun

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 16

Noah's Arf

Table: Cash Flow

2002

Cash Received

Cash from Operations:

Cash Sales

Cash from Receivables

Subtotal Cash from Operations

$318,410

$0

$318,410

Additional Cash Received

Non Operating (Other) Income

Sales Tax, VAT, HST/GST Received

New Current Borrowing

New Other Liabilities (interest-free)

New Long-term Liabilities

Sales of Other Current Assets

Sales of Long-term Assets

New Investment Received

Subtotal Cash Received

$0

$0

$0

$0

$0

$0

$0

$0

$318,410

$0

$0

$0

$0

$0

$0

$0

$0

$307,376

$0

$0

$0

$0

$0

$0

$0

$0

$355,338

2002

2003

2004

$12,617

$199,923

$212,540

$8,438

$262,569

$271,007

$10,002

$276,302

$286,304

$0

$0

$0

$0

$17,556

$0

$0

$0

$230,096

$0

$0

$0

$0

$17,556

$0

$0

$0

$288,563

$0

$0

$0

$0

$17,556

$0

$0

$0

$303,860

$88,314

$127,314

$18,813

$146,127

$51,478

$197,605

Sa

mp

$355,338

$0

$355,338

Bu

sin

ess

Pla

nP

Additional Cash Spent

Non Operating (Other) Expense

Sales Tax, VAT, HST/GST Paid Out

Principal Repayment of Current Borrowing

Other Liabilities Principal Repayment

Long-term Liabilities Principal Repayment

Purchase Other Current Assets

Purchase Long-term Assets

Dividends

Subtotal Cash Spent

2004

$307,376

$0

$307,376

ro

Expenditures

Expenditures from Operations:

Cash Spending

Payment of Accounts Payable

Subtotal Spent on Operations

Net Cash Flow

Cash Balance

2003

le

Pro Forma Cash Flow

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 17

Noah's Arf

7.6 Projected Balance Sheet

Table: Balance Sheet

Pro Forma Balance Sheet

Long-term Liabilities

Total Liabilities

Sa

$100,000

$24,000

$76,000

$225,647

2004

$197,605

$4,071

$0

$201,677

$100,000

$36,000

$64,000

$265,677

2002

$10,799

$0

$0

$10,799

2003

$7,222

$0

$0

$7,222

2004

$8,561

$0

$0

$8,561

$82,444

$93,243

$64,888

$72,110

$47,332

$55,893

$70,000

($27,000)

$81,970

$124,970

$218,214

$124,970

$70,000

$54,970

$28,566

$153,537

$225,647

$153,537

$70,000

$83,537

$56,247

$209,783

$265,677

$209,783

ess

7.7 Business Ratios

$100,000

$12,000

$88,000

$218,214

Pla

Paid-in Capital

Retained Earnings

Earnings

Total Capital

Total Liabilities and Capital

Net Worth

2003

$146,127

$3,520

$0

$149,647

nP

Liabilities and Capital

Accounts Payable

Current Borrowing

Other Current Liabilities

Subtotal Current Liabilities

2002

$127,314

$2,900

$0

$130,214

ro

Assets

Current Assets

Cash

Inventory

Other Current Assets

Total Current Assets

Long-term Assets

Long-term Assets

Accumulated Depreciation

Total Long-term Assets

Total Assets

mp

le

The Projected Balance Sheet is quite solid. We do not project any real trouble meeting our

debt obligations--as long as we can achieve our specific objectives.

Bu

sin

The table follows with our main business ratios. We intend to improve gross margins and

inventory turnover. Industry profile ratios based on the Standard Industrial Classification (SIC)

code 0752, Animal Specialty Services, nec., are shown for comparison.

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 18

Noah's Arf

Table: Ratios

Ratio Analysis

ess

Activity Ratios

Accounts Receivable Turnover

Collection Days

Inventory Turnover

Accounts Payable Turnover

Payment Days

Total Asset Turnover

sin

Debt Ratios

Debt to Net Worth

Current Liab. to Liab.

Liquidity Ratios

Net Working Capital

Interest Coverage

Additional Ratios

Assets to Sales

Current Debt/Total Assets

Acid Test

Sales/Net Worth

Dividend Payout

Bu

0.00%

1.33%

0.00%

59.67%

40.33%

100.00%

0.00%

1.56%

0.00%

66.32%

33.68%

100.00%

0.00%

1.53%

0.00%

75.91%

24.09%

100.00%

15.80%

8.20%

31.90%

55.90%

44.10%

100.00%

3.20%

28.76%

31.96%

68.04%

3.22%

17.82%

21.04%

78.96%

32.70%

19.90%

52.60%

47.40%

100.00%

85.07%

59.33%

0.85%

36.90%

100.00%

61.03%

51.74%

1.79%

14.55%

100.00%

64.58%

48.76%

1.97%

22.53%

100.00%

42.50%

26.40%

0.50%

2.40%

12.06

11.79

42.73%

87.46%

50.09%

20.72

20.23

31.96%

24.81%

16.88%

23.56

23.08

21.04%

35.75%

28.23%

2.19

1.48

52.60%

4.50%

9.40%

2002

$53,068

2003

$27,943

2004

$32,303

Industry

$0

0.00%

2002

25.74%

65.59%

2003

9.29%

18.61%

2004

15.83%

26.81%

n.a

n.a

0.00

0

4.74

19.51

15

1.46

0.00

0

5.30

35.86

13

1.36

0.00

0

5.18

32.43

10

1.34

n.a

n.a

n.a

n.a

n.a

n.a

0.75

0.12

0.47

0.10

0.27

0.15

n.a

n.a

$119,414

14.31

$142,425

6.74

$193,115

15.85

n.a

n.a

0.69

5%

11.79

2.55

0.00

0.73

3%

20.23

2.00

0.00

0.75

3%

23.08

1.69

0.00

n.a

n.a

n.a

n.a

n.a

ro

nP

Pla

Main Ratios

Current

Quick

Total Debt to Total Assets

Pre-tax Return on Net Worth

Pre-tax Return on Assets

Additional Ratios

Net Profit Margin

Return on Equity

Industry Profile

-2.90%

4.95%

37.78%

42.73%

57.27%

Percent of Sales

Sales

Gross Margin

Selling, General & Administrative Expenses

Advertising Expenses

Profit Before Interest and Taxes

Business Vitality Profile

Sales per Employee

Survival Rate

2004

15.60%

Sa

Current Liabilities

Long-term Liabilities

Total Liabilities

Net Worth

2003

-3.47%

le

Percent of Total Assets

Accounts Receivable

Inventory

Other Current Assets

Total Current Assets

Long-term Assets

Total Assets

2002

0.00%

mp

Sales Growth

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.comPage 19

Appendix

Appendix Table: Personnel

Personnel Plan

Production Personnel

Playground supervisor

Playground supervisor

Playground supervisor part time

Playground supervisor part time

Playground supervisor

Playground Supervisor

Groomer

Pet taxi/in-home care/dog walker

Subtotal

Sales and Marketing Personnel

Other

Other

Subtotal

General and Administrative Personnel

Manager

Reception 1

Reception 2

Subtotal

Other Personnel

Other

Other

Subtotal

Total People

Total Payroll

Jan

$640

$640

$240

$120

$0

$0

$0

$0

$1,640

Feb

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

Mar

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

Apr

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

May

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

Jun

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

Jul

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$3,000

$720

$0

$3,720

$3,000

$1,440

$0

$4,440

$3,000

$1,440

$0

$4,440

$3,000

$1,440

$0

$4,440

$3,000

$1,440

$0

$4,440

$3,000

$1,440

$0

$4,440

$0

$0

$0

$0

$0

P

s

6

$7,400

6

$7,400

6

$5,360

u

B

n

i

s

s

e

6

$7,400

n

la

6

$7,400

e

l

p

Aug

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

Sep

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

Oct

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

Nov

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

Dec

$1,280

$960

$480

$240

$0

$0

$0

$0

$2,960

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$0

$3,000

$1,440

$0

$4,440

$3,000

$1,440

$0

$4,440

$3,000

$1,440

$0

$4,440

$3,000

$1,440

$0

$4,440

$3,000

$1,440

$0

$4,440

$3,000

$1,440

$0

$4,440

$0

$0

$0

$0

$0

$0

$0

6

$7,400

6

$7,400

6

$7,400

6

$7,400

6

$7,400

6

$7,400

6

$7,400

r

P

S

o

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com

m

a

Page 1

Appendix

Appendix Table: General Assumptions

General Assumptions

Plan Month

Current Interest Rate

Long-term Interest Rate

Tax Rate

Other

Calculated Totals

Payroll Expense

New Accounts Payable

Inventory Purchase

u

B

Jan

1

0.00%

9.00%

25.00%

0.00%

Feb

2

0.00%

9.00%

25.00%

0.00%

Mar

3

0.00%

9.00%

25.00%

0.00%

Apr

4

0.00%

9.00%

25.00%

0.00%

May

5

0.00%

9.00%

25.00%

0.00%

Jun

6

0.00%

9.00%

25.00%

0.00%

Jul

7

0.00%

9.00%

25.00%

0.00%

Aug

8

0.00%

9.00%

25.00%

0.00%

$5,360

$7,941

$0

$7,400

$14,191

$0

$7,400

$14,680

$0

$7,400

$15,297

$0

$7,400

$16,846

$970

$7,400

$17,640

$1,225

$7,400

$19,843

$1,765

$7,400

$20,332

$1,595

n

i

s

s

e

P

s

n

la

r

P

S

o

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com

e

l

p

Sep

9

0.00%

9.00%

25.00%

0.00%

Oct

10

0.00%

9.00%

25.00%

0.00%

Nov

11

0.00%

9.00%

25.00%

0.00%

Dec

12

0.00%

9.00%

25.00%

0.00%

$7,400

$20,509

$1,375

$7,400

$21,380

$2,155

$7,400

$22,604

$3,150

$7,400

$19,460

$0

m

a

Page 2

Appendix

Appendix Table: Profit and Loss

Pro Forma Profit and Loss

Sales

Direct Costs of Goods

Production Payroll

Other

Cost of Goods Sold

Gross Margin

Gross Margin %

Operating Expenses:

Sales and Marketing Expenses:

Sales and Marketing Payroll

Advertising/Promotion

Travel

Miscellaneous

Total Sales and Marketing Expenses

Sales and Marketing %

General and Administrative Expenses:

General and Administrative Payroll

Sales and Marketing and Other Expenses

Depreciation

vehicle maintence

Utilities

Insurance

Taxes

Rent

Payroll Taxes

Other General and Administrative Expenses

12%

Total General and Administrative Expenses

General and Administrative %

Other Expenses:

Other Payroll

Contract/Consultants

Total Other Expenses

Other %

Total Operating Expenses

Profit Before Interest and Taxes

Interest Expense

Taxes Incurred

Net Profit

Net Profit/Sales

Include Negative Taxes

u

B

n

i

s

Jan

$2,800

$235

$1,640

Feb

$13,420

$510

$2,960

Mar

$15,760

$640

$2,960

-----------$1,875

$925

33.04%

-----------$3,470

$9,950

74.14%

$0

$500

$0

$50

-----------$550

19.64%

$3,720

$0

$1,000

$100

$1,200

$1,000

$500

$643

$0

-----------$8,163

291.54%

s

e

$0

$250

-----------$250

8.93%

-----------$8,963

($8,038)

$750

($2,197)

($6,591)

-235.40%

-----------$3,600

$12,160

77.16%

Apr

$18,750

$855

$2,960

$0

-----------$3,815

$14,935

79.65%

May

$21,845

$910

$2,960

$0

-----------$3,870

$17,975

82.28%

Jun

$24,495

$1,015

$2,960

$0

-----------$3,975

$20,520

83.77%

Jul

$32,415

$1,265

$2,960

$0

-----------$4,225

$28,190

86.97%

$0

$200

$0

$50

-----------$250

1.86%

$0

$200

$0

$50

-----------$250

1.59%

$0

$200

$0

$50

-----------$250

1.33%

$0

$200

$0

$50

-----------$250

1.14%

$0

$200

$0

$50

-----------$250

1.02%

$0

$200

$0

$50

-----------$250

0.77%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

94.10%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

80.13%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

67.35%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

57.81%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

51.55%

$0

$250

-----------$250

1.86%

-----------$13,128

($3,178)

$738

($979)

($2,937)

-21.89%

$0

$250

-----------$250

1.59%

-----------$13,128

($968)

$726

($424)

($1,271)

-8.06%

$0

$250

-----------$250

1.33%

-----------$13,128

$1,807

$714

$273

$820

4.37%

$0

$250

-----------$250

1.14%

-----------$13,128

$4,847

$702

$1,036

$3,109

14.23%

$0

$250

-----------$250

1.02%

-----------$13,128

$7,392

$690

$1,675

$5,026

20.52%

P

s

n

la

r

P

e

l

p

Aug

$35,415

$1,375

$2,960

$0

-----------$4,335

$31,080

87.76%

Sep

$37,115

$1,375

$2,960

$0

-----------$4,335

$32,780

88.32%

Oct

$38,165

$1,635

$2,960

$0

-----------$4,595

$33,570

87.96%

Nov

$40,165

$2,140

$2,960

$0

-----------$5,100

$35,065

87.30%

Dec

$38,065

$1,380

$2,960

$0

-----------$4,340

$33,725

88.60%

$0

$200

$0

$50

-----------$250

0.71%

$0

$200

$0

$50

-----------$250

0.67%

$0

$200

$0

$50

-----------$250

0.66%

$0

$200

$0

$50

-----------$250

0.62%

$0

$200

$0

$50

-----------$250

0.66%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

38.96%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

35.66%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

34.02%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

33.09%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

31.44%

$4,440

$0

$1,000

$100

$1,200

$1,000

$500

$3,500

$888

$0

-----------$12,628

33.17%

$0

$250

-----------$250

0.77%

-----------$13,128

$15,062

$678

$3,596

$10,788

33.28%

$0

$250

-----------$250

0.71%

-----------$13,128

$17,952

$666

$4,321

$12,964

36.61%

$0

$250

-----------$250

0.67%

-----------$13,128

$19,652

$654

$4,749

$14,248

38.39%

$0

$250

-----------$250

0.66%

-----------$13,128

$20,442

$642

$4,950

$14,850

38.91%

$0

$250

-----------$250

0.62%

-----------$13,128

$21,937

$630

$5,327

$15,980

39.79%

$0

$250

-----------$250

0.66%

-----------$13,128

$20,597

$618

$4,995

$14,984

39.36%

S

o

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com

m

a

Page 3

Appendix

Appendix Table: Cash Flow

Pro Forma Cash Flow

Cash Received

Cash from Operations:

Cash Sales

Cash from Receivables

Subtotal Cash from Operations

Additional Cash Received

Non Operating (Other) Income

Sales Tax, VAT, HST/GST Received

New Current Borrowing

New Other Liabilities (interest-free)

New Long-term Liabilities

Sales of Other Current Assets

Sales of Long-term Assets

New Investment Received

Subtotal Cash Received

0.00%

Jan

Feb

Mar

Apr

May

Jun

Jul

$2,800

$0

$2,800

$13,420

$0

$13,420

$15,760

$0

$15,760

$18,750

$0

$18,750

$21,845

$0

$21,845

$24,495

$0

$24,495

$32,415

$0

$32,415

$0

$0

$0

$0

$0

$0

$0

$0

$2,800

$0

$0

$0

$0

$0

$0

$0

$0

$13,420

$0

$0

$0

$0

$0

$0

$0

$0

$15,760

$0

$0

$0

$0

$0

$0

$0

$0

$18,750

$0

$0

$0

$0

$0

$0

$0

$0

$21,845

$0

$0

$0

$0

$0

$0

$0

$0

$24,495

$0

$0

$0

$0

$0

$0

$0

$0

$32,415

May

Jun

r

P

Aug

e

l

p

Sep

m

a

Oct

Nov

Dec

$35,415

$0

$35,415

$37,115

$0

$37,115

$38,165

$0

$38,165

$40,165

$0

$40,165

$38,065

$0

$38,065

$0

$0

$0

$0

$0

$0

$0

$0

$35,415

$0

$0

$0

$0

$0

$0

$0

$0

$37,115

$0

$0

$0

$0

$0

$0

$0

$0

$38,165

$0

$0

$0

$0

$0

$0

$0

$0

$40,165

$0

$0

$0

$0

$0

$0

$0

$0

$38,065

Jul

Aug

Sep

Oct

Nov

Dec

S

o

Expenditures

Expenditures from Operations:

Cash Spending

Payment of Accounts Payable

Subtotal Spent on Operations

Jan

Feb

Mar

Apr

$215

$6,068

$6,283

$656

$10,358

$11,014

$710

$14,207

$14,918

$779

$14,701

$15,480

$951

$15,348

$16,299

$1,039

$16,872

$17,911

$1,284

$17,713

$18,997

$1,338

$19,860

$21,198

$1,358

$20,338

$21,696

$1,455

$20,538

$21,993

$1,591

$21,421

$23,012

$1,241

$22,499

$23,741

Additional Cash Spent

Non Operating (Other) Expense

Sales Tax, VAT, HST/GST Paid Out

Principal Repayment of Current Borrowing

Other Liabilities Principal Repayment

Long-term Liabilities Principal Repayment

Purchase Other Current Assets

Purchase Long-term Assets

Dividends

Subtotal Cash Spent

$0

$0

$0

$0

$0

$0

$0

$0

$6,283

$0

$0

$0

$0

$1,596

$0

$0

$0

$12,610

$0

$0

$0

$0

$1,596

$0

$0

$0

$16,514

$0

$0

$0

$0

$1,596

$0

$0

$0

$17,076

$0

$0

$0

$0

$1,596

$0

$0

$0

$17,895

$0

$0

$0

$0

$1,596

$0

$0

$0

$19,507

$0

$0

$0

$0

$1,596

$0

$0

$0

$20,593

$0

$0

$0

$0

$1,596

$0

$0

$0

$22,794

$0

$0

$0

$0

$1,596

$0

$0

$0

$23,292

$0

$0

$0

$0

$1,596

$0

$0

$0

$23,589

$0

$0

$0

$0

$1,596

$0

$0

$0

$24,608

$0

$0

$0

$0

$1,596

$0

$0

$0

$25,337

$810

$36,327

($754)

$35,573

$1,674

$37,248

$3,950

$41,198

$4,988

$46,186

$11,822

$58,008

$12,621

$70,629

$13,823

$84,452

$14,576

$99,028

$15,557

$114,585

$12,728

$127,314

Net Cash Flow

Cash Balance

s

e

($3,483)

$35,517

u

B

n

i

s

P

s

n

la

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com

Page 4

Appendix

Appendix Table: Balance Sheet

Pro Forma Balance Sheet

Assets

Current Assets

Cash

Inventory

Other Current Assets

Total Current Assets

Long-term Assets

Long-term Assets

Accumulated Depreciation

Total Long-term Assets

Total Assets

Starting Balances

$39,000

$4,000

$0

$43,000

Jan

$35,517

$3,765

$0

$39,282

Feb

$36,327

$3,255

$0

$39,582

Mar

$35,573

$2,615

$0

$38,188

Apr

$37,248

$1,760

$0

$39,008

May

$41,198

$1,820

$0

$43,018

Jun

$46,186

$2,030

$0

$48,216

$100,000

$0

$100,000

$143,000

$100,000

$1,000

$99,000

$138,282

$100,000

$2,000

$98,000

$137,582

$100,000

$3,000

$97,000

$135,188

$100,000

$4,000

$96,000

$135,008

$100,000

$5,000

$95,000

$138,018

$100,000

$6,000

$94,000

$142,216

$0

$0

$0

$0

Jan

$1,873

$0

$0

$1,873

Feb

$5,706

$0

$0

$5,706

Mar

$6,179

$0

$0

$6,179

Apr

$6,775

$0

$0

$6,775

May

$8,272

$0

$0

$8,272

Jun

$9,040

$0

$0

$9,040

Long-term Liabilities

Total Liabilities

$100,000

$100,000

$100,000

$101,873

$98,404

$104,110

$96,808

$102,987

$95,212

$101,987

$93,616

$101,888

$92,020

$101,060

Paid-in Capital

Retained Earnings

Earnings

Total Capital

Total Liabilities and Capital

Net Worth

$70,000

($27,000)

$0

$43,000

$143,000

$43,000

$70,000

($27,000)

($6,591)

$36,409

$138,282

$36,409

$70,000

($27,000)

($9,528)

$33,472

$137,582

$33,472

$70,000

($27,000)

($10,799)

$32,201

$135,188

$32,201

$70,000

($27,000)

($9,979)

$33,021

$135,008

$33,021

$70,000

($27,000)

($6,870)

$36,130

$138,018

$36,130

$70,000

($27,000)

($1,844)

$41,156

$142,216

$41,156

Liabilities and Capital

Accounts Payable

Current Borrowing

Other Current Liabilities

Subtotal Current Liabilities

u

B

n

i

s

s

e

P

s

n

la

r

P

Jul

$58,008

$2,530

$0

$60,538

Aug

$70,629

$2,750

$0

$73,379

S

o

Sep

$84,452

$2,750

$0

$87,202

m

a

e

l

p

Oct

$99,028

$3,270

$0

$102,298

Nov

$114,585

$4,280

$0

$118,865

Dec

$127,314

$2,900

$0

$130,214

$100,000

$10,000

$90,000

$192,298

$100,000

$11,000

$89,000

$207,865

$100,000

$12,000

$88,000

$218,214

$100,000

$7,000

$93,000

$153,538

$100,000

$8,000

$92,000

$165,379

$100,000

$9,000

$91,000

$178,202

Jul

$11,170

$0

$0

$11,170

Aug

$11,643

$0

$0

$11,643

Sep

$11,813

$0

$0

$11,813

Oct

$12,656

$0

$0

$12,656

Nov

$13,839

$0

$0

$13,839

Dec

$10,799

$0

$0

$10,799

$90,424

$101,594

$88,828

$100,471

$87,232

$99,045

$85,636

$98,292

$84,040

$97,879

$82,444

$93,243

$70,000

($27,000)

$8,944

$51,944

$153,538

$51,944

$70,000

($27,000)

$21,908

$64,908

$165,379

$64,908

$70,000

($27,000)

$36,157

$79,157

$178,202

$79,157

$70,000

($27,000)

$51,006

$94,006

$192,298

$94,006

$70,000

($27,000)

$66,986

$109,986

$207,865

$109,986

$70,000

($27,000)

$81,970

$124,970

$218,214

$124,970

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com

Page 5

Appendix

Appendix Table: Sales Forecast

Sales Forecast

Sales

Overnight Care

Day Care

In Home Care

Wash Your Own

Grooming

Retail

Obedience

Small Animal Care/cats

Special requests, misc.

Other

Total Sales

Jan

$840

$1,150

$120

Direct Cost of Sales

Overnight Care

Day Care

In Home Care

Wash Your Own

Grooming

Retail

Obedience

Small Animal Care/cats

Special requests, misc.

Other

Subtotal Direct Cost of Sales

u

B

$0

$150

$0

$540

$0

$0

$2,800

Feb

$2,800

$6,900

$360

$900

$0

$250

$0

$2,160

$50

$0

$13,420

Mar

$4,200

$6,900

$360

$900

$400

$400

$390

$2,160

$50

$0

$15,760

Apr

$6,300

$6,900

$600

$1,200

$500

$600

$390

$2,160

$100

$0

$18,750

May

$6,300

$9,200

$1,200

$1,200

$500

$600

$585

$2,160

$100

$0

$21,845

Jun

$6,300

$11,500

$1,200

$1,200

$600

$800

$585

$2,160

$150

$0

$24,495

Jan

$50

$75

$10

$0

$0

$75

$0

$25

$0

$0

$235

Feb

$100

$150

$10

$25

$20

$125

$25

$50

$5

$0

$510

Mar

$150

$150

$10

$25

$25

$200

$25

$50

$5

$0

$640

Apr

$200

$150

$15

$30

$25

$300

$25

$100

$10

$0

$855

May

$200

$200

$20

$30

$25

$300

$25

$100

$10

$0

$910

Jun

$200

$200

$20

$30

$25

$400

$25

$100

$15

$0

$1,015

n

i

s

s

e

P

s

n

la

r

P

Jul

$11,200

$13,800

$1,200

$1,200

$600

$800

$585

$2,880

$150

$0

$32,415

Aug

$11,200

$16,100

$1,200

$1,500

$750

$1,000

$585

$2,880

$200

$0

$35,415

Sep

$11,200

$18,400

$600

$1,500

$750

$1,000

$585

$2,880

$200

$0

$37,115

Jul

$400

$250

$20

$30

$25

$400

$25

$100

$15

$0

$1,265

Aug

$400

$250

$20

$35

$25

$500

$25

$100

$20

$0

$1,375

Sep

$400

$250

$20

$35

$25

$500

$25

$100

$20

$0

$1,375

S

o

Copyright © Palo Alto Software, Inc. 1995-2008 All rights reserved. Not for resale, reproduction, publication, or distribution. www.paloalto.com

m

a

e

l

p

Oct

$11,200

$18,400

$600

$1,800

$1,000

$1,500

$585

$2,880

$200

$0

$38,165

Nov

$11,200

$18,400

$1,200

$2,100

$1,000

$2,500

$585

$2,880

$300

$0

$40,165

Dec

$11,200

$18,400

$600

$2,400

$900

$1,000

$585

$2,880

$100

$0

$38,065

Oct

$400

$250

$20

$40

$30

$750

$25

$100

$20

$0

$1,635

Nov

$400

$250

$20

$40

$30

$1,250

$25

$100

$25

$0

$2,140

Dec

$400

$250

$20

$50

$25

$500

$25

$100

$10

$0

$1,380

Page 6