Sheldon A. Kimber - Haas School of Business

advertisement

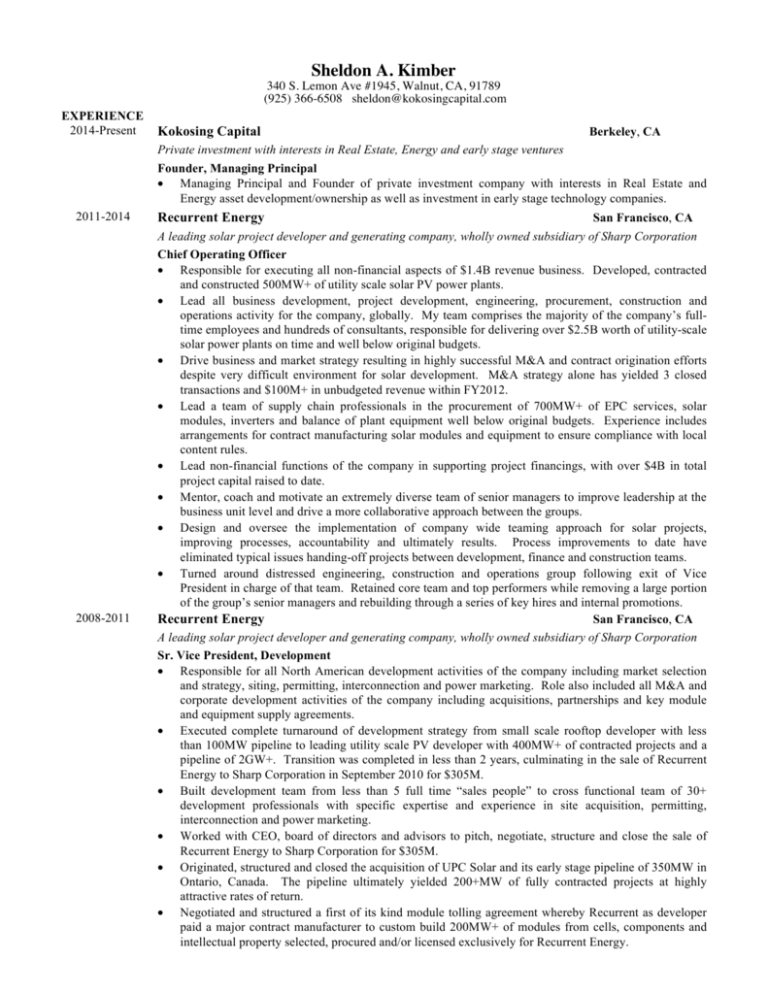

Sheldon A. Kimber 340 S. Lemon Ave #1945, Walnut, CA, 91789 (925) 366-6508 sheldon@kokosingcapital.com EXPERIENCE 2014-Present Kokosing Capital 2011-2014 Recurrent Energy 2008-2011 Berkeley, CA Private investment with interests in Real Estate, Energy and early stage ventures Founder, Managing Principal • Managing Principal and Founder of private investment company with interests in Real Estate and Energy asset development/ownership as well as investment in early stage technology companies. San Francisco, CA A leading solar project developer and generating company, wholly owned subsidiary of Sharp Corporation Chief Operating Officer • Responsible for executing all non-financial aspects of $1.4B revenue business. Developed, contracted and constructed 500MW+ of utility scale solar PV power plants. • Lead all business development, project development, engineering, procurement, construction and operations activity for the company, globally. My team comprises the majority of the company’s fulltime employees and hundreds of consultants, responsible for delivering over $2.5B worth of utility-scale solar power plants on time and well below original budgets. • Drive business and market strategy resulting in highly successful M&A and contract origination efforts despite very difficult environment for solar development. M&A strategy alone has yielded 3 closed transactions and $100M+ in unbudgeted revenue within FY2012. • Lead a team of supply chain professionals in the procurement of 700MW+ of EPC services, solar modules, inverters and balance of plant equipment well below original budgets. Experience includes arrangements for contract manufacturing solar modules and equipment to ensure compliance with local content rules. • Lead non-financial functions of the company in supporting project financings, with over $4B in total project capital raised to date. • Mentor, coach and motivate an extremely diverse team of senior managers to improve leadership at the business unit level and drive a more collaborative approach between the groups. • Design and oversee the implementation of company wide teaming approach for solar projects, improving processes, accountability and ultimately results. Process improvements to date have eliminated typical issues handing-off projects between development, finance and construction teams. • Turned around distressed engineering, construction and operations group following exit of Vice President in charge of that team. Retained core team and top performers while removing a large portion of the group’s senior managers and rebuilding through a series of key hires and internal promotions. Recurrent Energy San Francisco, CA A leading solar project developer and generating company, wholly owned subsidiary of Sharp Corporation Sr. Vice President, Development • Responsible for all North American development activities of the company including market selection and strategy, siting, permitting, interconnection and power marketing. Role also included all M&A and corporate development activities of the company including acquisitions, partnerships and key module and equipment supply agreements. • Executed complete turnaround of development strategy from small scale rooftop developer with less than 100MW pipeline to leading utility scale PV developer with 400MW+ of contracted projects and a pipeline of 2GW+. Transition was completed in less than 2 years, culminating in the sale of Recurrent Energy to Sharp Corporation in September 2010 for $305M. • Built development team from less than 5 full time “sales people” to cross functional team of 30+ development professionals with specific expertise and experience in site acquisition, permitting, interconnection and power marketing. • Worked with CEO, board of directors and advisors to pitch, negotiate, structure and close the sale of Recurrent Energy to Sharp Corporation for $305M. • Originated, structured and closed the acquisition of UPC Solar and its early stage pipeline of 350MW in Ontario, Canada. The pipeline ultimately yielded 200+MW of fully contracted projects at highly attractive rates of return. • Negotiated and structured a first of its kind module tolling agreement whereby Recurrent as developer paid a major contract manufacturer to custom build 200MW+ of modules from cells, components and intellectual property selected, procured and/or licensed exclusively for Recurrent Energy. 2007-2008 Summer 2006 Recurrent Energy San Francisco, CA A leading solar project developer and generating company, private equity backed start-up Vice President, Finance • Joined company shortly after founding as one of first non-founding employees. Responsible for all financial matters of the company including project finance, corporate finance, tax and accounting, facilities and human resources. • Worked with CEO to pitch, structure and close $75M private equity round from Hudson Clean Energy Partners. • Extensive board level exposure. Worked closely on planning, business development, financing and other strategic initiatives with principals from Recurrent’s private equity and venture capital investors. • Sourced, negotiated and closed $200M solar PV tax equity facility with Morgan Stanley • Led financial planning and budgeting for the company including formulation of business and financial plan for private equity “B-round” at the corporate level • Led risk management and pricing function for the company, defining the hurdle rate and capital budgeting process for the capital committee. Standardized and implemented quality controls for all model templates and assumptions used by project developers. • Led all structuring of PPA contracts and key module, EPC and other supply agreements for the company. Goldman, Sachs & Co. San Francisco, CA Global investment banking, securities and investment management firm Summer Associate – Investment Banking Division • Participated in raid-defense and the initial sale process for a large timber company; including preparation, diligence and marketing. • Prepared financial models, fairness committee presentations, board materials and client presentations. 2001 – 2005 Calpine Corporation San Jose, CA Developer and owner of 90+ power generation facilities in North America Corporate Finance Manager Financial Analysis and Structuring • Structured and negotiated $300M power purchase contract and subsequent financing for the Deer Park Energy Center. This transaction was a highly structured, non-recourse financing achieved by way of a commodity prepayment. • Led financial analysis and assisted in structuring the IPO of the Calpine Power Income Fund (A Canadian trust, similar to a REIT). This transaction was a spin-off of Calpine’s power-generating assets in Canada, valued at over CAN $700M. • Led financial and risk analysis for $803M securitization of California Department of Water Resources contract. Assisted with pricing and closing the associated 144A bond offering. • Conducted due diligence, financial analysis, structuring and negotiations on project and structured financings. Reported directly to the Deputy CFO. • Drove analysis and diligence of over $1.5B in closed transactions including a CAN$150M secondary offering of public equity, a $100M lease on a California cogeneration plant, an $88M sale of interest in Auburndale Power Partners and an $83M securitization of a power purchase agreement. Leadership and Project Management • Led transaction involving internal, investment banking, and consulting personnel, including structuring, analysis and closing of a $300M power purchase contract and subsequent financing. • Managed the due diligence process and teams of internal, investment banking and consulting personnel. This included due diligence for a CAN$700M IPO and a $100M lease restructuring. 1999 - 2001 Accenture San Francisco, CA Global management consulting and technology services company Strategy Consultant • Developed and presented valuation analyses of M&A, asset divestiture and generation planning strategies in the utility industry. Primary clients were Ameren, Cinergy, and TXU. • Designed complex dispatch model to simulate generation assets in Midwest power markets. • Researched new generation technologies and the strategic implications of power deregulation. EDUCATION 2005 - 2007 University of California at Berkeley – Haas School of Business Masters of Business Administration, May 2007 • Co-Founder of the Berkeley Energy and Resources Collaborative • Non-Profit Board Fellow 1996 - 1999 Kenyon College Bachelor of Arts degree in Economics, Departmental Honors, May 2000 • Kenyon College Honors Scholarship • Completed honors program in Economics with High Honors ADDITIONAL Board Membership Sunfunder, Inc – Board Member Folsom Labs, Inc – Advisor and Lead Seed Round Investor Berkeley Energy and Resources Collaborative (BERC) – Co-Founder and Former Advisory Board Member Habitat for Humanity Greater San Francisco – Former Board Member Teaching and Lecturing Professional Faculty Member at UC Berkeley, Haas School of Business • Currently teach Project Finance in the full-time MBA program • Topics covered include key elements of power project finance and development Speaking, Publishing and Awards Frequent panelist and speaker at energy finance and renewable industry events and conferences • Platts Energy Awards 2013 – Rising Star Award • SF Business Times 2013 – 40 Under 40 • Key speaking engagements include: Solar Power International, Intersolar, Renewable Energy Finance Forum, and Canadian Solar Industries Association Annual Conference. • Guest writer and blogger on energy related topics