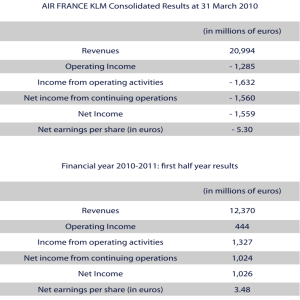

in air transport gives us performance and social

advertisement