S.I. No. 266 of 2015 European Union

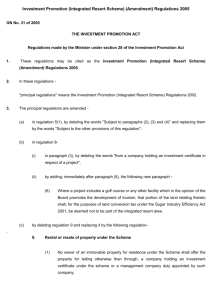

advertisement