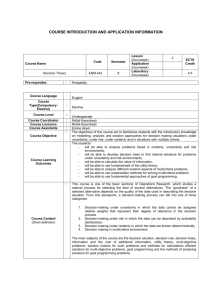

Competitive Firm and the Theory of Input Demand under Price

advertisement

Competitive Firm and the Theory of Input Demand under Price Uncertainty

Author(s): Raveendra N. Batra and Aman Ullah

Source: The Journal of Political Economy, Vol. 82, No. 3 (May - Jun., 1974), pp. 537-548

Published by: The University of Chicago Press

Stable URL: http://www.jstor.org/stable/1829844

Accessed: 20/07/2009 18:14

Your use of the JSTOR archive indicates your acceptance of JSTOR's Terms and Conditions of Use, available at

http://www.jstor.org/page/info/about/policies/terms.jsp. JSTOR's Terms and Conditions of Use provides, in part, that unless

you have obtained prior permission, you may not download an entire issue of a journal or multiple copies of articles, and you

may use content in the JSTOR archive only for your personal, non-commercial use.

Please contact the publisher regarding any further use of this work. Publisher contact information may be obtained at

http://www.jstor.org/action/showPublisher?publisherCode=ucpress.

Each copy of any part of a JSTOR transmission must contain the same copyright notice that appears on the screen or printed

page of such transmission.

JSTOR is a not-for-profit organization founded in 1995 to build trusted digital archives for scholarship. We work with the

scholarly community to preserve their work and the materials they rely upon, and to build a common research platform that

promotes the discovery and use of these resources. For more information about JSTOR, please contact support@jstor.org.

The University of Chicago Press is collaborating with JSTOR to digitize, preserve and extend access to The

Journal of Political Economy.

http://www.jstor.org

Competitive Firm and the Theory of Input

Demand under Price Uncertainty

Raveendra N. Batra and Aman UI1ah

SouthernMethodistUniversity

In this paper, we examine the behavior of the competitive firm faced

with making input-hiring decisions under conditions of price uncertainty.

Unlike Sandmo and Baron, among others, we show categorically that a

marginal increase in uncertainty stimulates a decline in the firm's output,

provided the absolute risk aversion is decreasing. Furthermore, the

implications of a change in expected price remain unchanged, but those

of a change in input price need not be the same as in the certainty case.

Specifically, the input demand function is downward sloping only if the

production function is well behaved.

The purpose of this paper is to develop systematically the theory of input

demand for a competitive firm facing price uncertainty. For the sake of

simplicity, we postulate a two-input model and exa mine the implications

of uncertainty for the firm's output and input demand under the

assumption that the competitive firm, facing given input prices, seeks to

maximize the expected utility from profits. Earlier contributors to the

theory of the firm have either approached the question from the side of

product markets,1 or, in examining the firm's behavior from the side of

factor markets, they have assumed that the firm seeks to maximize

expected profits and is thus risk neutral.2 The focus of this paper is on the

We are indebted to J. Hadar and W. Russell for useful discussions on the subject

matter of this paper.

1 See, for example, McCall 1967; Horowitz 1970, chap. 12; Sandmo 1971; and

Leland 1972.

2 See, for example, Smith 1960; Tisdell 1968, chap. 3; and Rothenberg and Smith

1971. One exception is that of Horowitz, who uses the expected utility approach to

analyze the implications for the firm's decision making of uncertainty in the production

function (not in the product price) in terms of a long-run model allowing for variability

in the use of both capital and labor. Apart from the fact that Horowitz is concerned with

different questions, his analysis is incomplete because he does not get involved in the

comparative-statics properties of his model. It may be mentioned in passing that in

another chapter, Horowitz anticipates some of the results derived recently by Sandmo

(1971), especially the results concerning the output level of the risk evader and the

implications of a change in fixed costs.

537

538

JOURNAL OF POLITICAL ECONOMY

expected utility approach, which permits a more general formulation of

the firm's attitude toward risk.

For the main tools of analysis, we draw upon the recent seminal work

by Sandmo (1971), who has examined under price uncertainty the

behavior of the competitive firm from the side of the product market.

However, in contrast to Sandmo's results which are obtained from a

short-run model of the firm where the capital stock is given, our results

are derived from a long-run model where all factors of production are

variable.3 Furthermore, Sandmo (1971) is unable to derive categorical

effects of a marginal increase in uncertainty whereas we show that an

increase in uncertainty leads to a decline in the firm's output, provided

absolute risk aversion is decreasing.

I.

Assumptions

and the Basic Model

Unless otherwise specified, the following assumptions will be maintained

throughout the paper.

1. The firm is a price taker in the probabilistic sense. That is to say,

the firm is not large enough to influence its subjective probability

distribution about the sales price, which is assumed to be a random variable. Furthermore, the prices of the two inputs, capital and labor, are

given to the firm.

2. The decisions concerning the volume of output and hence the

utilization of inputs must be made prior to the knowledge of the market

price.

3. The firm seeks to maximize expected utility from profits, and its

attitude toward risk can be described by a von Neumann-Morgenstern

utility function, which among other things requires that the firm's

decisions are made by one individual.4

Let U stand for utility and ir for profits. Then the firm's utility function

is given by

U=

U(rc)

(1)

where U'(ic) > 0 and U"(ir) ,' 0, depending on whether the firm is

risk averse, risk neutral, or a risk preferrer.5 Let q = output, K = capital,

3 Actually, the short-run results of Sandmo can be derived as special cases of our results.

This assumption is central to much of the recent work in the theory of the firm under

uncertainty (see, for example, McCall 1967, 1971; Sandmo 1971; and Leland 1972).

Acceptance of this utility function implies acceptance of the axioms underlying the

existence of the von Neumann-Morgenstern utility function. For a lucid analysis of

these axioms, see De Groot (1970) and Horowitz (1970, chap. 12).

5 Arrow (1965) has shown that if the utility function is to satisfy the von NeumannMorgenstern axioms, it must be bounded from above. This means that as Xrapproaches

infinity, the utility function must become concave, so that at least in the range close to

the upper bound of the utility function, U"(7r) < 0. This also suggests that for the firm

to be risk neutral [U"(7r) = 0] or a risk preferrer [U"(7r) > 0], i should be restricted

to a finite value.

4

539

COMPETITIVE FIRM

and L = labor. Then the production function of the firm is given by

q=f(K,L).

(2)

The only assumption that we make about the production function is

that fK and fL, the marginal products of capital and labor, respectively,

are positive and that the isoquants are convex to the origin, so that

- fULL

2fKfLIKL

> 0, which, it may be noted, does not

ffKK

necessarily imply that fij > 0 (i = L, K).6 The firm's total cost of

production is given by wL + rK, so that its profit is given by

it=pq-wL-rK

(3)

where p is product price, which is assumed to be a random variable with

density function f (p) and mean E (p) = i. We assume that p is nonnegative.

In view of (2) and (3), the expected utility from profit is furnished by

E{U[pf (K, L) - wL

-

rK]},

(4)

where E is the expectations operator. The firm chooses input quantities

so as to maximize expected utility from profits. The first-order conditions

for the maximum are

8E(U) = E[U'(7c)(PIfL- w)] = 0

aL

(5)

BE(U) = E[U'(it)(pIK - r)] = 0.

OK

(6)

and

The second-order conditions for the maximum are given by

=

2(U)

w)

Al

=

E[U"(7r) (pfL

A2

=

E[U"(7r)(pfK -r)

a2E(U)

aK~l)=

-

)

< 0,

(7)

+ PfKKU'(7E)] < 0,

(8)

+ PILLU'(7t)]

and

a2E(U) .2E(U)

aL2

aK2

aE(U)

_

]2

aL (K9

> 0;

(9*

or

A1A2 -B2

D>

(9)

where

B-

a2 E(U)

aL aK

-

E[U"(r)(pfK

-

r)(PfL

-

w)

+ PfKLU'(7t)]-

6 See, for example, Hadar (1970, chap. 3, pp. 26-27) on this

point.

(10)

540

JOURNAL OF POLITICAL ECONOMY

Before we proceed further with our analysis, it is necessary first to

briefly examine the second-order conditions for the attainment of maximum expected utility. In the certainty case, utility maximization requires

-i

that fij < 0 and ILLfKK

L > 0 (i = L, K), which means that the

production function is strictly concave.' We will now show that if the

firm is risk averse, strict concavity of the production function is sufficient

but not necessary to ensure expected utility maximization.

Expanding (9*) by using (7), (8), and (10), we obtain

D = {E(U"a2)E(U"b 2)

-

[E(U"ab)]2}

+ {E(p U') [fKKE(U"a 2)

+

where a

=

+

fLLE(U"b 2)

{[E(pU)] 2(fLLIKK -IKL)}

pIL- w, b = pfK- r, and U'

-

2IKLE(U"ab)]}

(11)

U'(ir).8 From the first-

order conditions given by (5) and (6), sincefL and fK are nonrandom

and since w and r are given,

W

fLE[U&(7)p]

r

fKE[U&(Q)P]

(12)

= fL

fK

Using this in a and b, we get

a = (pfL - w) =

bA

= fL

(PfK

r),

(13)

so that a2 = b2fL /fK2. Using this, the first term in (11) reduces to zero,

and D becomes D = -E[U"b IK] (2fL fKfKL -fL fKK

KI LL) +

- IKL).

For second-order conditions to be satisfied,

[E(pU')]2(ILLIKK

Al and A2 from (7) and (8) should be each negative, whereas D should

be positive. If the firm is risk averse, then U"(i) < 0, in which case,

Al and A2 may be negative even iffKK andILL are positive. This immediately suggests that the production function need not be strictly

concave for (7) and (8) to be satisfied. This also holds true for (9), because

D may be positive even if (ILL IKK - IKL) < 0, provided, of course, that

isoquants are convex to the origin so that (2LIfKfKL

-f ffKK

> 0. Thus, if the firm is risk averse, the concavity of the prof2fLL)

duction function is no longer necessary for the firm to be at the optimum.

However, concavity is sufficient because it implies fij < 0 as well as

convexity of the isoquants toward the origin.

If the firm is risk neutral, then concavity is both necessary and

sufficient for (7), (8), and (9) to be satisfied, because here U"(i) = 0.

However, if the firm is a risk preferrer, so that U"(n) > 0, then the

concavity of the production function becomes a necessary but not a

sufficient condition for the firm to be at the optimum.

7 See, for instance, Henderson and Quandt 1971, pp. 61-69.

8

Whenever the equation is too long, we will write U' for U'(7r).

COMPETITIVE FIRM

541

Suppose the firm is risk averse. Then the convexity of the isoquants

toward the origin along with (12) imply that, even with uncertainty about

the product price, the firm minimizes the unit cost of production for

whatever output it chooses to produce. As with the certainty case, the

marginal rate of substitution between the factors equals the factor price

ratio at the optimum, even when the price is seen by the firm as a random

variable. This is very interesting, because in the following section we show

that the risk-averse firm produces an output at which the expected value

of the marginal product of each factor exceeds the given input price. In

other words, the firm produces an output at which expected price exceeds

marginal cost, but the level of output is one where the average cost is

minimum.

II.

Optimal Input Demand and Output under Uncertainty

In this section, we will show that under price uncertainty, the riskaverse competitive firm hires smaller quantities of inputs and thus produces

lower output than in the case where p is known with certainty. The problem may be formulated in terms of this question: What are the optimal

input demand and output under uncertainty as compared with the case

where the product price is known with certainty to be equal to the mean

of the probability distribution?

The first-order conditions (5) and (6) can be rewritten as

E [U'(n)pfL] = E [U'(7t)w]

(5*)

and

E[U'(Qt)pfK]

E[U '(i)r].

=

(6*)

Subtracting E[U'(lr)ufL] from both sides of (5*), we obtain

E[U '(n)fL(p - ia)] = E[U'Qr) (w

-

fL)]-

(14)

Applying the expectations operator to both sides of the profit equation (3)

yields E(Zr) = E(p)q - wL - rK or E(7r) - ,q = -(wL + rK). Substituting the expressionfor - (wL + rK) in (3) then furnishes ir = E(Zc) +

(p - It)q. If the utility function is strictly concave, so that U"(7r) < 0,

then U'(ic) < U'[E(7t)] for p ? jy, or by multiplying through by

(p - ,)fL, U'(7c)fL(p - it) < U'[E(7r)]fL(p - yi) for all p. Taking

expectations on both sides and noting that U'[E(m)] is a given number

and thatfL is nonrandom, we obtain

E[U'(t)fL(p

-

y)] < 0.

Using this result in (14) implies that E[U'(t) (w

-

(15)

IfL)]

<

0, and since

marginal utility is always positive, w < yfL. Similarly, we can show that

r < HIK.

542

JOURNAL OF POLITICAL ECONOMY

In other words, under uncertainty equilibrium, the expected marginal

value productivity of each factor exceeds its price, or, what is the same

thing, E(p) exceeds marginal cost. By contrast, the certainty equilibrium

is defined by the equality between marginal value productivity of each

factor with its price. Furthermore, under certainty conditions, fij < 0

is necessary to satisfy the second-order conditions for utility maximization.

Thus, iffij < 0, it is clear that under uncertainty, the optimal quantity

demanded of each input is lower than the certainty case. It then follows

that the optimal output produced under uncertainty will also be lower

than the certainty output.

Until now, our analysis has been concerned with the implications for

optimal input demand and output of what Sandmo calls the overall

impact of uncertainty. We will now consider the effects of a marginal

increase in uncertainty by defining the increased variability of the

density function of the price in terms of a "mean preserving spread."9

Let us define p* as p* = yp + 0 where 0 and y are the shift parameters

which initially equal zero and unity, respectively. Then the mean

preserving spread type of shift in the density function ofp* leaves the mean

E(p*) unchanged,

that is, dE(p*) -dE(yp

+ 0) = yudy + dO = 0, or

-u

d-

(16)

dy

Using p* instead of p,

7r = (py + 0)f(K,

i

and the first-order conditions are replaced by

L) - wL

rK;

-

E{U'(it)[(py

+ O)fL

w]} = 0,

-

and E{U'(7t)[(py +

r]} = 0. Differentiating these conditions

totally with respect to y, and using (16), we obtain

O)fK -

A

OL

ay

ay

and

Bi

OK

B

aL

OK

+ A2-=

ay

ay

(17)

H,

(18)

H2

where A1, A2, and B1 have been defined before, and where

-H1

= E[qU"(7r)(pfL

-

w)(p

-H2

= E[qU"(7r)(pfK

-

r)(p

-

p)] + E[U'(t)fL(P

-j)]

(19)

and

-

I)]

+ E[U'(7r)fK(p-

e)],

(20)

9 Defining a change in uncertainty in terms of a change in the probability distribution

while keeping its mean constant is quite common with economic theorists nowadays (see,

for example, Sandmo 1970, 1971, 1972; Rothenberg and Smith 1970; and Rothschild

and Stiglitz 1970, 1971).

543

COMPETITIVE FIRM

remembering that initially y

simultaneously, noting that H,

AL

1 and 0 = 0. Solving (17) and (18)

H2fL/fK, and using (9), we obtain

- B1]

H2[(A2IL/fK)

H2E[U'(7r)p](fLIKK

byYD

(21

-KfKL)

DfK

and

AK

ay

H2(A,

-

H2E[U '()p](I

BjfL/fK)

D

ILL

-fLfKL)

(22)

DfK

The signs of aL/ay and aK/ay depend on the signs of H2 andfKL, given

the fact that fij < 0, and, from (9), D is positive. Now the sign of H2

from (20) depends on the signs of (i) E [U'(ir) (p - yu)],which has already

been shown to be negative under risk aversion, and (ii) E[U"(7r) (pfK r) (p - i)]. In the next section, we show that under the hypotheses of

decreasing absolute risk aversion, E[U"(7r)(pfK- r)] is positive. Thus

E[U"(7t) (pIK- r) (p

= E{U"(7) (pfK

=

E [U"(i) (1K

-

)]

r)[P

-

+ (

-

] + E[U"(72)(PIK- r)](

i-

)

(23)

where E{U"(7r)[(pfKr)2fK]} < 0 if firms are risk averse and, as

shown before, (rifK) < ji. Therefore, with E[U"(pfKr)] positive

under decreasing absolute risk aversion, (23) is clearly negative. All this

discussion suggests that the right-hand side of (20) is negative, so that

"2

>

0.

Once H2 is demonstrated to be positive, then for OL/Dyto be negative,

it is clear that (IL KK - IKIKL) is negative. Similarly, for aK/ay < 0,

< 0. Given that fij < 0, then a sufficient condition

(IK ILL - ILKL)

for the marginal impact of uncertainty to be in line with the overall

impact is that fKL > 0, which, of course, is satisfied for several wellknown production functions.'0 However, if (ILIKK - IKIKL)

and

are positive becausefKL < 0, then the marginal impact

(IKILL - fLAL)

of uncertainty will be opposite to the overall impact.

However, although the marginal and overall effects of uncertainty on

the firm's input utilization may not be the same, it still turns out that the

marginal and overall impacts of uncertainty for the firm's output run

in the same direction. Differentiating the production function given by (2)

with respect to y and using (21) and (22), we obtain (aq/ay) = fL(ULIay)+

fK(aKIDy) = {(2LIfKfKL

It

fKK -fKIfLL)E[U(7r)p]H2}/DIK.

-fL

1o A production function is said to be "well behaved"

iffij < 0 andfEL

our results necessarily hold for well-behaved production functions.

>

0. Thus,

544

JOURNAL OF POLITICAL ECONOMY

can be easilyseen that with convexisoquantsand H2 > 0, (Oqlay)

<

0.

Thus, an increase in uncertainty leads to a decline in the firm's output,

if absolute risk aversion is decreasing. Note that Sandmo (1971), among

many others, has been unable to obtain the predictable effects of a change

in variance alone on the risk-averse firm's output.

III.

The Supply Function

This section is devoted to the analysis of the firm's supply function.

Specifically, we wish to determine the firm's output response to a change

in the expected price. The problem may be formulated as this: Let price

be written as p + 0 where 0 again is the shift parameter. A change in 0

shifts the probability distribution to the left or to the right and changes

the expected value of price without altering the shape of the probability

distribution.

Differentiating (5) and (6) with respect to 0 and evaluating the derivatives at 0 = 0, we obtain

A1 g} + B1

O

= -E[U"(&r)(pfL-

w)q + fLU'(7r)]

=

F1 (24)

B1 At + A2 A = -E[U"(7c)(pfK-

r)q + fKU'(7t)]

=

F2. (25)

and

The solution of this system yields

AL _ A2F1 - B1F2

Ao

D

(26)

K = A1F2 - B1Fj

Ao

D

(27)

and

Since A1 and A2 are negative and D > 0, our problem now is to pin

down the signs of B1, F1, and F2. Using (13) in (10) gives us

B1 = E[U"(n)(pfK

= E [U" () (pfL

-

r)

-

w)(IKIIL)

(fLafK)

(28)

+ fKLU'(l)P]

?KLU (T)P].

+

Utilizing (12) and the new expression for B1 and the expressions for F

and F2 in (26) and (27), we obtain

8L

80

E(U'p) {E(U') + (q/fK)E[U"(pfK D

AK

E(U'p){E(U')

+ (q/fL)E[U"(pfL

-

r)]}(fKfKL

W)]}(fLfKL

-LfKK)

fKfLL)

29

,(2)

(30)

545

COMPETITIVE FIRM

We will show later in this section that E[U"(pfKr)] and E[U"(pfL w)] are positive under the hypothesis of decreasing absolute risk aversion

or increasing absolute risk preference. If we further assume that fi < 0

andfKL > 0, it is clear that aL1ao> 0 and UK/IO> 0. These results

continue to hold if the firm is risk neutral so that U" = 0. In other words,

a rise in the expected price will induce the firm to hire more inputs.

However, iffKL < 0, then the results are not clear even iffij < 0. The

expression for the change in output can be obtained by using (29) and

(30). Thus, noting that (pfK - r)/fK = (PIL -w)IfL,

E(U'p){E(U')

aq

ao

_

+ (q/fK)E[U"(pfK(2ILfKfKL

-fLfKK

r)]}

fKILL)

(31)

D

Evidently, risk neutrality, decreasing absolute risk aversion, or increasing

absolute risk preference are sufficient to ensure that a rise in the expected

price will induce the firm to increase its output. It is interesting to note

that the effects of an increase in price on input demand and output under

price uncertainty are the same as the corresponding results available in

the certainty case.11

It is high time that we define the concepts of the firm's attitude toward

risk. Following Pratt (1964) and Arrow (1965), let us define the firm's

risk attitude (Ra) as Ra(7t) = - [U"(7r)]/[U'(Q)], where Ra(7t) is commonly called the absolute risk-aversionfunction.12 For risk-averse firms,

Ra(7r)is positive, for risk preferrersnegative, and for risk-indifferentfirms

zero. For risk-averse firms, Arrow suggests that Ra(7t) is decreasing in 7t.

This is the hypothesis of decreasing absolute risk aversion. However, if

Ra(7) < 0, it seems reasonable that -Ra(7t) be an increasing function of

7r.If a firm prefers risk, then its risk preference should normally increase

with the rise in profits. This we call the hypothesis of increasing absolute

risk preference.

Following the line of reasoning suggested by Sandmo, we will now

show that under these hypotheses E [U"(7t)(pfK- r)] > 0. Let 7l be the

profit level when p = rTfK.Since (ptfK- r)IfK = (pfLw)/IL, p also

=

equals WIfK. If Ra(7t) > 0 and Ra'(Z) < 0, then - [U"(7r)]/[U'(ic)]

?

Ra(7) < Ra(n) for p

rTfKwhere Ra(fi) is a given number. Multiplying both sides by - U'(7t)(pfK - r), we obtain U"(7)(ptfK - r) 2

In the certainty case, it can be easily seen that aL/ap = [P(fKfKLILJK)]ID,

=

and (aq/ap) = [p(2fLJKIKL

[P(fLfKL

-fKJLL)]ID,

fJKK

fK fLL)]ID.

The effects of a change in p on the input demand and output under certainty as well as

uncertainty are the same in the sense that, in both situations, the effects are determined

by the signs of the same expressions. Now, if the same expressions have different signs

under certainty versus uncertainty, then that is a different matter. However, if we assume

concave production functions, then the effects of price changes in both situations are

similar.

12

Also, see McCall 1971 and Sandmo 1971.

aK/ap

546

JOURNAL OF POLITICAL ECONOMY

Ra(if) U'(ir) (pfK

-

r) for all p. Taking expectations

on both sides and

noting (6), E[U"(t)(pfK

r)] ? Ra(f)E[U'(T)(PfK

r)] = 0.

The same proof also applies to the case where -RRa > 0 and -R' (i)

>

0. Here [U" (r)]/[U' (i)] = -Ra(7t) ? -Ra(ir) for p > rilK, so that

r)] ? -Ra(Tr)E[U'(7t)(pfK

E[U"(rc)(pfK

r)] = 0 for allp. Therefore, E[U"(7t)(pfK -r)]

is positive.

IV.

The Input Demand Functions

We now turn to the effect of a change in the price of any input on the

firm's demand for the two factors. For the sake of simplicity, suppose there

occurs a change in the wage rate but r remains unaltered. Differentiating

the first-order conditions (5) and (6) totally with respect to w alone and

remembering that dr = 0, we obtain A1(aL/aw) + B1(aK/aw) = C1

and B 1(L/aw) + A 2(aK/aw) = C2 where C1 = LE[U"(r) (pfL - w)] +

and C2 = LE[U"(7t)(pfK - r)]. Following

E[U'(7r)]

exactly the

procedure established in the earlier section, we find that

-

A2E(U')fK

+ LE(U'p)E[U"(PfK

aw

-

r)1(fLIKK

-fKfKL)

DfL

A IE (U')fK + [E (U'p)] {LE [ U"(pfL

aK

+

E(U')}(fKfLL

aw

-

W)]

-fLfKL)

(32)

DfL

and

aq

-

{LE[U"(pfK + fKE(U')

(fLfKK

r)](fL

fKK

+fK fLL

2fLIfKfKL)

(33)

-fKfKL)E(U'p)}.

The results, as usual, depend on our hypotheses of the firm's attitude

toward risk as well as the signs Of KL and fi. In the certainty case,

aL/aw < 0, whereas the signs of aK/aw and aq/8w depend on the sign

offKL.13

These results continue to hold when the firm is risk neutral for

then aL/aw < 0, whereas the sign of aqlaw depends, among other things,

on the sign OffKL. In the case of aK/aw, once it is realized that with risk

neutrality A1 now reduces to fLLE[U'(n)p],

it can be clearly seen that

the sign of aK/aw depends only on the sign OffKL.

The results, however, are not so clear and interpretable when the firm

is not risk indifferent. If we assume thatfKL

> 0 andfij

< 0, then under

the hypothesis of decreasing absolute risk aversion or increasing absolute

13

( fLL

In the certainty case, aL/w =

KEfL), and aq/lw = [P(fLfLL

(PfLL)/(fLLfKK

-fKfKL)]I(fLLfK

-

fK.L)l

aK/aw

-fKL)

=

-

(PfL)l

COMPETITIVE FIRM

547

risk preference which ensures that E[U"(7t) (pfK- r)] > 0, aL/aw < 0

and aq/aw < 0. However, the sign of aK/awis still indeterminate because

the second term in (32) is negative, whereas the first term, with A, < 0

from (7), is positive.

The differences between these results and those available under

certainty must now be ostensible. The main differences are:

i) Under uncertainty, the sign offKL also enters into the determination

of the sign of OL/aw,whereas in the certainty casefKL plays no such role,

and as a result the sign of aL/awis unambiguously negative.

ii) Under certainty, the sign of aK/awis determined solely by the sign

offKL, whereas under uncertainty the sign of aK/awis ambiguous.

The crux of this discussion is that with well-behaved production

functions (so that fc < 0 andfKL > 0) and with our hypotheses concerning the firm's risk attitude, a rise in the price of any input induces the

firm to reduce the demand for that input and lower its output. However,

the firm's response toward the demand for the other input is indeterminate.

V.

Conclusions

Using a two-input, long-run equilibrium model of the competitive firm

facing price uncertainty, we have derived the following results in the

foregoing sections.

1. The concavity of the production function is both necessary and

sufficient to ensure the firm to reach an optimum only if the firm is risk

neutral. If the firm is risk averse, concavity is sufficient but no longer

necessary, whereas if the firm is a risk preferrer, the opposite is true,

provided the firm's objective is to maximize expected utility from profits.

2. The risk-averse firm utilizes smaller quantities of inputs and thus

produces a lower output than a firm operating under certainty, even

though the former minimizes the unit cost of production of whatever

output it chooses to produce. Furthermore, an increase in uncertainty

leads to a decline in the firm's output if its absolute risk aversion is

decreasing in profits.

3. The marginal and overall impacts of uncertainty need not be the

same for input demand, although for the output level, they continue to be

the same.

4. The presence of uncertainty makes no difference to the effects of

an increase in price on input demand and the output.

5. In the certainty case, a rise in the price of an input induces the

firm to lower the utilization of that input. In the uncertainty case, however, we need a well-behaved production function to ensure this result.

Furthermore, under uncertainty the effects on the demand for the other

input are unpredictable.

548

JOURNAL OF POLITICAL ECONOMY

References

Arrow, K. J. Aspectsof the Theoryof RiskBearing.Helsinki: Jahnssonin Sfiitid, 1965.

De Groot, M. H. OptimalStatisticalDecisions.New York: McGraw-Hill, 1970.

Hadar, J. MathematicalTheoryof EconomicBehavior.Reading, Mass.: AddisonWesley, 1971.

Theory-a MathematicalApproach.

Henderson, H., and Quandt, R. E. Microeconomic

2d ed. New York: McGraw-Hill, 1971.

Horowitz, I. DecisionMaking and Theoryof the Firm. New York: Holt, Rinehart

& Winston, 1970.

Leland, H. E. "Theory of the Firm Facing Uncertain Demand." A.E.R. (June

1972), pp. 278-91.

McCall, J. J. "Competitive Production for Constant Risk Utility Functions."

Rev. Econ.Studies34 (October 1967): 417-20.

. "Probabilistic Microeconomics." Bell J. Econ. and ManagementSci.

(Autumn 1971), pp. 403-33.

32

Pratt, J. W. "Risk Aversion in the Small and in the Large." Econometrica

(January/April 1964): 122-36.

Rothenberg, T. J., and Smith, K. R. "The Effect of Uncertainty on Resource

Allocation in a General Equilibrium Model." Q.J.E. 85 (August 1971): 440-59.

Rothschild, M., and Stiglitz, J. E. "Increasing Risk I: A Definition." J. Econ.

Theory2 (September 1970): 225-43.

"Increasing Risk II: Its Economic Consequences." J. Econ. Theory3

(March 1971): 66-84.

Sandmo, A. "The Effect of Uncertainty on Saving Decisions." Rev. Econ. Studies

37 (July 1970): 353-60.

. "Competitive Firm under Price Uncertainty." A.E.R. (March 1971),

pp. 65-73.

. "Discount Rates for Public Investment under Uncertainty." Internat.

Econ.Rev. 13 (June 1972): 287-302.

Smith, K. R. "The Effect of Uncertainty on Monopoly Price, Capital Stock and

Utilization of Capital." J. Econ. Theory1 (June 1970): 48-59.

Production

andProfit.Princeton, N.J.:

Tisdell, C. A. The Theoryof Price Uncertainty,

Princeton Univ. Press, 1968.