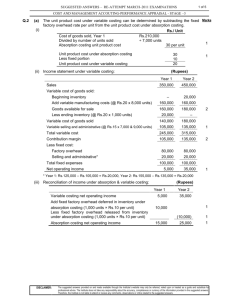

Answers to extra questions for Chapter 3 Cost assignment

advertisement