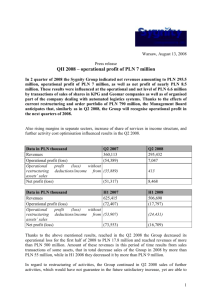

COMARCH S.A. KRAKOW, AL. JANA PAWŁA II 39A FINANCIAL

advertisement