Wealth Management Solutions Campaign (“the Campaign”) Terms

advertisement

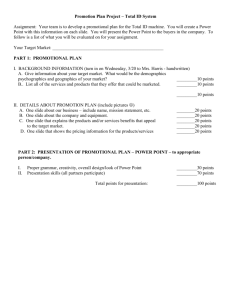

Wealth Management Solutions Campaign (“the Campaign”) Terms and Conditions 1. The Campaign Period 1.1 The Campaign is organized by CIMB Islamic Bank Berhad (“the Bank”) and commences on 2 January 2014 and ends on 30 June 2014, both dates inclusive (“Campaign Period”). The Bank reserves the right to change the duration, commencement and or expiry dates of the Campaign Period upon giving adequate notice. 2. Eligibility 2.1 The Campaign is open to all individuals residing in Malaysia, including Malaysian citizens, permanent residents or non Malaysian citizens, of 18 years and above, sole-proprietorships, partnerships, charitable / non-profit organizations, corporate and commercial customer who make the relevant investment during the Campaign Period subject to the terms and conditions herein (“Eligible Customer(s)”). The terms and conditions of the CIMB Preferred Member can be found in www.cimbpreferred.com 2.2 Employees of the Bank, CIMB Bank Berhad and CIMB Investment Bank Berhad, are not eligible to participate in the Campaign. 3. Campaign 3.1 The Campaign consists of the following promotions: 3.1.1 Promotional Sales Charge for Investment in Participating Equity Shariah-compliant Unit Trust Funds 3.1.2 Promotional Sales Charge for Investment in Participating Equity Shariah-compliant Unit Trust EPF Funds 3.1.3 Promotional Sales Charge for Regular Investment Plan via Periodical Payment Instruction 3.1.3 Promotional Sales Charge for Investment in Shariah-compliant Private Retirement Scheme (PRS) 3.1.4 Special Sales Charge for 1 time Investor (Only for CIMB Preferred Customers and CIMB Prime Banking st Customers. 3.1.5 4. Complimentary Gift for Investment in Participating Equity Shariah-compliant Unit Trust Funds Promotional Sales Charge for Investment in Participating Equity Shariah-compliant Unit Trust Funds 4.1 Eligible Customers who invest in any selected Shariah-compliant unit trust funds from selected Unit Trust Management Companies which shall be determined by the Bank at its sole and absolute discretion (“Participating Equity Shariah-compliant Unit Trust Fund(s)”) during the Campaign Period will, subject to the terms and conditions herein, be entitled to enjoy the relevant promotional sales charge (“Promotional Sales Charge”) as specified in the table below based on the relevant investment amount. Promotional Sales Charge 4.2 Investment Tier Individual Customers (Mass) CIMB Prime Banking Customers CIMB Preferred Customers RM10,000 – RM99,999 3.50% 3.50% 3.50% RM100,000 – RM499,999 3.00% 2.80% 2.50% RM500,000 and above 2.50% 2.30% 2.00% To be entitled to the Promotional Sales Charge, the Eligible Customer must invest a minimum of RM10,000 in a single transaction in a Participating Equity Shariah-compliant Unit Trust Fund. Combination of investment amount in different Participating Equity Shariah-compliant Unit Trust Funds is permitted provided the investment is in a single transaction during the Campaign Period for purposes of ascertaining the investment amount and the Promotional Sales Charge applicable. Wealth Management Solutions Campaign (“the Campaign”) 4.3 To be entitled to the Promotional Sales Charge for CIMB Preferred/CIMB Prime Banking Customers, the Eligible Customer must be a CIMB Preferred/CIMB Prime Banking customer at the point of investment in the Participating Equity Shariah-compliant Unit Trust Fund. 4.4 The list of Participating Equity Shariah-compliant Unit Trust Funds is available upon request and is subject to change from time to time by the Bank at its absolute discretion upon giving adequate notice. 4.5 The Promotional Sales Charge shall not be applicable for Eligible Customers who invest in any of the Participating Equity Shariah-compliant Unit Trust Funds using their Employees Provident Fund (EPF). In the event any investment made by an Eligible Customer is to be partially paid using withdrawal from EPF (the “EPF Portion”), the EPF Portion shall be excluded from the computation of the investment amount in the Participating Equity Unit Trust Funds. 5. Promotional Sales Charge for Investment in Participating Equity Shariah-compliant Unit Trust EPF Funds 5.1 Eligible Customers who invest in any Participating Equity Shariah-compliant Unit Trust EPF Funds during the Campaign Period will be entitled to enjoy the promotional sales charge (“EPF Promotional Sales Charge”) as specified in the table below. 5.2 Investment Amount EPF Promotional Sales Charge RM1,000 and above 2.88% To be entitled to the EPF Promotional Sales Charge, Eligible Customers must invest a minimum of RM1,000 through the Bank in any Participating Equity Shariah-compliant Unit Trust EPF Funds using monies from their Employees Provident Fund (EPF). Combination of investment amount in different Participating Equity Shariahcompliant Unit Trust EPF Funds is permitted provided the investment in the Participating Equity Shariah-compliant Unit Trust EPF Fundsis from one (1) of the selected Unit Trust Management Companies.. 5.3 The Participating Equity Shariah-compliant Unit Trust EPF Funds shall be determined by the Bank at its sole and absolute discretion. The list of Participating Equity Shariah-compliant Unit Trust EPF Funds is available upon request and is subject to change from time to time by the Bank at its absolute discretion upon giving adequate notice. 6. Promotional Sales Charge for Regular Investment Plan via Periodical Payment Instruction 6.1 Eligible Customers who sign up for any new Periodical Payment Instruction (PPI) during the Campaign Period in any of the Participating Equity Unit Trust Funds as referred to in Clause 4, with a minimum monthly investment amount of RM200 will be entitled to the PPI Promotional Sales Charge as specified in the table below in relation to the periodical monthly investment: Periodical Payment Instruction with Minimum Monthly Investment Amount PPI Promotional Sales Charge RM200 2.00% Wealth Management Solutions Campaign (“the Campaign”) 7. Promotional Sales Charge for Investment in Shariah-compliant Private Retirement Scheme (PRS) 7.1 Eligible Customers who invest in Shariah-compliant Private Retirement Schemes (“PRS”) from CIMB-Principal Asset Management Berhad (“CIMB-Principal”) during the Campaign Period will be entitled to enjoy the relevant PRS Promotional Sales charge (“PRS Promotional Sales Charge”) as specified in the table below based on the relevant investment amount and subject to the terms and conditions herein. Investment Amount PRS Promotional Sales Charge Single Investment Single investment amount of less than RM3,000 1.50% Single investment amount more than or equal to RM3,000 0.00% For Eligible Customers with age between 20-30 years old and invest with a minimum investment of RM1,000 and above 0.00% 7.2 Combination of investment amounts in different Shariah-compliant PRS funds from CPAM is permitted provided the investment is in a single transaction during the Campaign Period for purposes of ascertaining the investment amount and the PRS Promotional Sales Charge applicable. 7.3 Eligible Customers who sign up for any new Monthly Regular Investment via Direct Debit during the Campaign Period in Shariah-compliant PRS from CPAM will be entitled to the PRS Promotional Sales Charge as specified in the table below : Investment Amount PRS Promotional Sales Charge Monthly Regular Investment via Direct Debit 8. Monthly investment amount of less than RM250 1.50% Monthly investment amount of more than or equal to RM250 0.00% st Special Sales Charge for 1 time Investor 8.1 Eligible Customer who are CIMB Preferred Customers/CIMB Prime Banking Customers at the point of investment and are new unit trust investors with the Bank i.e. with no unit trust account with the Bank whether as primary or joint secondary account holder, are entitled to enjoy the Special Sales Charge as specified in the table below: Investment Amount RM50,000 and above 8.2 Participating Shariahcompliant Funds Participating Shariahcompliant Equity and Sukuk Unit Trust Funds Special Sales Charge CIMB Preferred Customer 1.38% CIMB Prime Banking Customer 1.58% To be entitled to the Special Sales Charge, the Eligible Customer must invest a minimum of RM50,000 in a single transaction in any Participating Equity and Sukuk Shariah-compliant Unit Trust Funds. Combination of investment amount in different Participating Equity and Sukuk Shariah-compliant Unit Trust Funds is permitted. 8.3 The Participating Equity and Sukuk Shariah-compliant Unit Trust Funds shall be determined by the Bank at its sole and absolute discretion. The list of Participating Equity and Sukuk Shariah-compliant Unit Trust Funds is available upon request and is subject to change from time to time by the Bank at its absolute discretion upon giving adequate notice. 8.4 Each CIMB Preferred Customer/CIMB Prime Banking Customers shall be entitle to the Special Sales Charge once only on a one-off basis For the avoidance of doubt the Special Sales Charge shall not be applicable for subsequent transactions in any Participating Equity and Bond Unit Trust Funds during the Campaign Period. 8.5 The Special Sales Charge shall not be applicable for Eligible Customers who invest using their Employees Provident Fund (EPF). Wealth Management Solutions Campaign (“the Campaign”) 8.6 The Special Sales Charge is not valid in conjunction with other offers and promotion (if any) offered by the Bank in relation to investment in the Participating Equity and Bond Unit Trust Funds. For the avoidance of any doubt, investment amount made by CIMB Preferred Customers/CIMB Prime Banking Customers in the Participating Equity Shariah-compliant unit trust Funds which has enjoyed the Special Sales Charge shall be excluded from the computation of the investment amount referred to in Clause 9 for purposes of entitlement to the Complimentary Gift. 9. Complimentary Gift for Investment in Participating Equity Shariah-compliant Unit Trust Funds 9.1 Eligible Customers who invest in the Participating Equity Shariah-compliant Unit Trust Funds with total combined accumulated investment amount (“Accumulated Investment Amount”), stated in the table below during each calendar quarter term (“Quarter”) will be entitled to the following corresponding Complimentary Gift (“Complimentary Gift”) RM50,000-RM99,999 Complimentary Gift First Quarter : 2 January – 31 March 2014 PowerBank worth RM169/- RM100,000-RM199,999 Royal Selangor Zodiac, Horse Figurine (Gold Plated) worth RM250/- RM200,000-RM499,999 Digital Camera worth RM699/- RM500,000-RM999,999 Airfryer worth RM1,199/- RM1mil and above iPad Air Wi-Fi (16GB) worth RM1,599/- Accumulated Investment Amount 9.2 9.3 The periods for each Quarter are : 9.2.1 First Quarter : 2 January 2014 to 31 March 2014 9.2.2 Second Quarter : 1 April 2014 to 30 June 2014 The Complimentary Gift will be delivered to the Eligible Customer’s address in the Bank’s record within 60 working days from the end of the each relevant Quarter. 9.4 Combination of Accumulated Investment Amount from both Quarters for the consideration of the Complimentary Gift is not allowed. 9.5 In the event any investment made by an Eligible Customer is to be fully or partially paid using withdrawal from the st EPF and/or invested under Special Sales Charge for 1 time Investor for CIMB Preferred/CIMB Prime Banking Customers, the investment portion(s) or amount(s) shall be excluded from the computation of the Accumulated Investment Amount and shall be deemed to be a separate transaction. 9.6 Each Eligible Customer shall be entitled to a maximum of one (1) Complimentary Gift for each Quarter period set out under Clause 9.2. For joint investments, only the primary account holder or principal investor shall be entitled to the Complimentary Gift. 9.7 The details of Complimentary Gifts for the Second Quarter as referred to in Clause 9.2.2 shall be made available from 31 March 2014 upon request from the Bank’s sales staff. 9.8 The Complimentary Gift(s) will be delivered to the Eligible Customer’s address in the Bank’s record within 60 working days from the end of the each relevant Quarter. Wealth Management Solutions Campaign (“the Campaign”) 10. Other Conditions 11.1 By participating in the Campaign, Eligible Customers are deemed to have read, understood and agreed to be bound by the terms and conditions stated herein and agree that any and all decisions made by the Bank in relation to every aspect of the Campaign including but not limited to the eligibility to participate in the Campaign, entitlement to enjoy the Promotional Sales Charges, EPF Promotional Sales Charge, PPI Promotional Sales Charge, PRS Promotional Sales Charge, Special Sales Charge for 1 st time investor for CIMB Preferred Customer/CIMB Prime Banking Customer, entitlement to the Complimentary Gift shall be final, binding and conclusive. 11.2 In the event Eligible Customers exercise their cooling-off right, or the investment is rejected or cancelled by any parties for whatsoever reason, the Eligible Customers shall not be entitled to the Complimentary Gift under the Campaign. 11.3 The Complimentary Gift is non-exchangeable for cash, credit or kind, whether in part or in full. The Complimentary Gift shall be subject to the terms and conditions of the supplier, manufacturer and/or merchant of the relevant Complimentary Gift which terms and conditions are separate from the Bank’s terms and conditions governing the Campaign. 11.4 To the fullest extent permitted by law, the Bank expressly exclude and disclaim any representations, warranties, or endorsements, express or implied, written or oral, including but not limited to any warranty of quality, merchantability or fitness for a particular purpose in respect of the Complimentary Gift. 11.5 The Bank reserves the right to substitute any Complimentary Gift under the Campaign with another item of similar value upon giving adequate prior notice. 11.6 The Eligible Customer is required to sign all relevant standard documents and comply with all terms and conditions in respect of his/her investment in the relevant products under the Campaign, which are separate from these terms and conditions. 11.7 The Bank shall not be liable to any Eligible Customer or any party for any loss or damage of whatsoever nature suffered by the Eligible Customer or any party (including but not limited to, loss of income, profits or goodwill, direct or indirect, incidental, consequential, exemplary, punitive or special damages of any party) howsoever arising, in relation to the participation or non-participation in the Campaign. 11.8 The Bank reserves the right to cancel, terminate or suspend the Campaign upon giving adequate notice. For the avoidance of doubt, cancellation, termination or suspension by the Bank of the Campaign shall not entitle the Eligible Customer or any other persons whatsoever to any claim or compensation against the Bank for any losses or damages suffered or incurred as a direct or indirect result of the act of cancellation, termination or suspension. 11.9 The Bank reserves the right upon giving adequate notice to vary (whether by addition, deletion, modification, amendment or otherwise howsoever) (“the Amendment”) any of the terms and conditions herein. Notification to the Eligible Customer in respect of the Amendment shall be effected at the Bank’s absolute discretion through any one of the following means of communication, namely, by ordinary mail to the Eligible Customer’s last known address or by posting a notice regarding the Amendment at each of the Bank’s branches where detail provisions regarding the Amendment may be provided in the notice itself or may be provided to the Eligible Customer upon request or by effecting an advertisement regarding the Amendment in one newspaper of the Bank’s choice, or via the Bank’s website or via electronic mail or by any other means of notice which the Bank may select and the Amendment shall be deemed as binding on the Eligible Customer as from the date of notification of the Amendment or from such other date as may be specified by the Bank in the notification. 11.10 These Terms and Conditions, as the same may be amended from time to time pursuant to Clause 11.9, shall prevail over any provisions or representations contained in any other promotional material advertising the Campaign. Wealth Management Solutions Campaign (“the Campaign”) 11.11 Investments in the Shariah-compliant Unit Trust Funds are not obligation of, deposits in, guaranteed or insured by the Bank and are subject to investment risks, including the possible loss of the principal amount invested. Eligible Customers are advised to read the Prospectus of the relevant Fund(s) before investing. Eligible Customers should also consider all fees and charges involved before investing. Past performance of the relevant Fund(s) is not an indication of future performance and income distributions are not guaranteed. Eligible Customers should rely on their own evaluation to assess the merits and risks of any investment. Eligible Customers who are in doubt as to the action to be taken should consult their professional advisers immediately. 11.12 In the event of any complaints related to the Campaign, Eligible Customers may contact the Bank’s Customer Resolution Department (CRU) bearing the following address, telephone, facsimile numbers and e-mail address (or bearing such other address, telephone, facsimile numbers and e-mail address which the Bank may change by notification to the Eligible Customers): Customer Resolution Unit, Level 19, Menara Bumiputra-Commerce, 11, Jalan Raja Laut, 50350 Kuala Lumpur; Tel: 1-300-880-900; e-mail address: cru@cimb.com. 11.13 The Eligible Customer is not covered by the compensation fund under section 152 of the Capital Markets and Services Act 2007 (CMSA). The compensation fund does not extend to the Eligible Customer who has suffered monetary loss as a result of a defalcation or fraudulent misuse of moneys or other property, by a director, officer, employee or representative of the Bank. Where the Eligible Customer suffers monetary loss in the above circumstances related to the acts of the Bank’s employees, the Eligible Customer may lodge a complaint with the Bank’s Customer Resolution Unit (CRU) as set out in clause 11.12. The Eligible Customer who is not satisfied with the Bank’s CRU's decision may refer the case to the Financial Mediation Bureau or the Securities Industry Dispute Resolution Centre within six (6) months of receiving a final decision from CRU. The Eligible Customer should note that his/her complaint will only be dealt with by either one of the above channel that the Eligible Customer chooses to refer his/her case to. 11.14 If there is any inconsistency, conflict, ambiguity or discrepancy between the Bahasa Malaysia and English version or other language version of these terms and conditions, the English version of these terms and conditions shall prevail. Notwithstanding the aforementioned where request had been made by the Eligible Customer and noted and acknowledged by the Bank in its records that the Bahasa Malaysia version of the terms and conditions shall govern the operation of the Eligible Customer’s unit trust account, then the Bahasa Malaysia version of the terms and conditions herein shall prevail.