FA4 -- Module 9 - Website of Akash Rattan

advertisement

Module 9: Financial reporting in the not-for-profit sector

Page 1 of 2

Module 9: Financial reporting in the not-for-profit sector

Required CICA Handbook readings for this module

z

z

z

z

z

z

Introduction to accounting standards, paragraph .04

Paragraph 1000.46

Specific areas of section 4400 as set out below:

{ Paragraphs 01-.02, .31, .46, and illustrative examples

Specific areas of section 4410 as set out below:

{ Paragraphs .26, .28-.29, .31-.34, .38-.40, .45, .47, .60, .62, .65, and .68

Specific areas of section 4430 as set out below:

{ Paragraphs .03, .06, .16, .31-.34, and .40

Paragraph 4440.06

Required readings from the textbook are listed with each topic.

Overview

This module outlines the accounting and reporting issues specific to not-for-profit

organizations (NFPOs) and the public sector. These two categories include a wide variety of

entities but, in general, profit making is not the principal goal of governments and NFPOs.

The unique characteristics and reporting requirements of these organizations have direct

implications for their financial statements.

Throughout the module, the CICA Accounting Handbook applies to governmental and nongovernmental NFPOs, government business enterprises, and business organizations. The

CICA Public Sector Accounting Handbook governs the financial accounting for governments.

Organizations falling into the CICA category of "other government organizations" use either

Handbook.

Test your knowledge

Begin your work on this module with a set of test-your-knowledge questions designed to

help you gauge the depth of study required.

Learning objectives

9.1

Define not-for-profit organizations and compare their financial reporting objectives

with those of profit-oriented organizations. (Level 1)

9.2

Explain the major financial reporting issues in not-for-profit organizations. (Level 1)

9.3

Explain the basics of accounting for, and reporting of, contributions under the

restricted fund and deferred contribution methods. (Level 1)

9.4

Determine appropriate accounting policies for not-for-profit organizations. (Levels 1

and 2)

9.5

Explain how formal recording of a budget helps NFPO managers control operations.

file://F:\Courses\2009-10\CGALU\FA4\06course\01mod\fa40910\module09\m09intro.htm

29/06/2009

Module 9: Financial reporting in the not-for-profit sector

Page 2 of 2

(Level 1)

9.6

Apply the requirements for financial instruments as they pertain to not-for-profit

organizations. (Level 2)

9.7

Explain the reporting implications of governments’ unique characteristics (Level 1),

and describe the key messages the financial statements should convey. (Level 2)

9.8

Explain the concept of the public sector, determine the Handbook applicable to each

component of the public sector, and describe the objectives of public sector financial

statements. (Level 1)

Exhibit 8: Substantive differences between Canadian GAAP and IFRS that apply to this

module

CICA Handbook

sections

referenced

Comparable IFRS

standards

Section 4400,

Not applicable

Financial statement

presentation by notfor-profit

organizations;

Comments

IFRS does not include separate

standards for not-for-profit

organizations.

Section 4410,

Contributions —

Revenue

recognition; Section

4430, Capital assets

held by not-forprofit organizations;

Section 4440,

Collections held by

not-for-profit

organizations

Source: Adapted from The CICA’s guide to IFRS in Canada,

http://www.cica.ca/download.cfm?ci_id=39765&la_id=1&re_id=0, Accessed February 3,

2009.

file://F:\Courses\2009-10\CGALU\FA4\06course\01mod\fa40910\module09\m09intro.htm

29/06/2009

9.1: Not-for-profit organizations

9.1 Not-for-profit organizations

Learning objective

●

Define not-for-profit organizations and compare their financial reporting objectives

with those of profit-oriented organizations. (Level 1)

Required textbook reading

●

●

Chapter 13, pages 614-615, up to "The Basics of Fund Accounting"

Chapter 13, page 653 "August 2007 Exposure Draft"

LEVEL 1

Note: The exposure draft detailed on page 653 was adopted by the CICA for fiscal years

beginning on or after January 1, 2009. The finalized standards differed somewhat from that

proposed. For full details see CICA Handbook — Accounting release no. 50

(September 2008).

There are two principal changes that affect this course. The first is that NFPOs may now

elect to show their net assets invested in capital assets as a separate component of equity

(as per the previous standard) or to describe this amount as internally restricted under the

category other restricted assets. The net assets invested in capital assets approach is still

permissible under GAAP, and will continue to be used by many NFPOs. For consistency with

the textbook, these module notes will adopt the net assets invested in capital assets

approach.

The second change is that the inclusion of separate sections for financing and investing

activities in an NFPO’s statement of cash flows is now mandatory. The textbook was printed

prior to the standard being adopted, and does not reflect this requirement. The examples in

the module notes and the solutions to the related questions reflect this requirement. Your

solutions to assignment, quiz, and exam questions must be in accordance with the

revised standard.

The CICA Handbook defines not-for-profit organizations (NFPOs) as entities, normally

without transferable ownership interests, organized and operated exclusively for social

educational, professonal, religious, health, charitable or any other non-for-profit purpose. A

not-for-profit organization's members, contributors and other resource providers do not, in

such capacity, receive any financial return directly from the organization.

NFPOs meet a wide variety of needs. Some provide products or services to a broad user

base and are usually perceived to be for the greater good of society, such as food banks,

hot-lunch programs, hospices, and amateur theatre groups. These organizations may

receive some government funding and cover additional expenses through donations,

fundraising activities, and, in some cases, user fees. Other NFPOs serve a specific user

group. Member-based organizations, such as the Certified General Accountants Association

of Canada, exist to provide service to their members on a cost-recovery basis. Other

professional associations, amateur sports groups, and some community groups follow this

model. Some NFPOs have been formed for a specific purpose (to meet the needs of a

defined group), and do not have a profit motive.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t01.htm (1 of 2) [29/06/2009 3:23:16 PM]

9.1: Not-for-profit organizations

Many NFPOs are hybrids — organizations that start as special-interest groups (such as a

local theatre group) but that also meet the criteria of providing a perceived societal benefit

and qualify for government funding and charitable status.

All NFPOs need to provide clear, unambiguous information to stakeholders. While a forprofit business can measure its success by profit and shareholder satisfaction, these metrics

do not exist for NFPOs. The Handbook has attempted to address some of these special

reporting needs in Sections 4400-4460.

Despite their many differences, profit-oriented organizations and NFPOs have common

financial reporting objectives; both must provide users with financial information in the

following areas:

●

●

●

Economic resources, obligations, and net assets

Changes in economic resources, obligations, and net assets

Economic performance

NFPOs must demonstrate to current and potential supporters that they behave in a

business-like way. Supporters need and want evidence that their contributions are being

used judiciously and not wasted or misappropriated. Users of financial information who rely

on the financial reporting provided by GAAP for profit-oriented companies demand a similar

type of reporting for NFPOs.

The scope of section 1540, Cash flow statements, was recently expanded to include NFPOs.

The practical effect of this is that NFPOs are now required to prepare a statement of cash

flows that includes separate information pertaining to investing and financing activities.

Also, the "out" clause for non-inclusion of a statement of cash flows is narrower than

before. Specifically, paragraph 1540.03 now provides that

A cash flow statement should be presented as an integral part of the financial

statements for each period for which financial statements are presented,

unless the reporting entity is not a public enterprise and the required cash flow

information is readily apparent from the other financial statements or is

adequately disclosed in the notes to the financial statements. When a cash

flow statement is not presented, the reason should be disclosed.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t01.htm (2 of 2) [29/06/2009 3:23:16 PM]

9.2: Not-for-profit reporting issues

9.2 Not-for-profit reporting issues

Learning objective

●

Explain the major financial reporting issues in not-for-profit organizations. (Level 1)

Required textbook reading

●

Chapter 13, pages 618-627, up to "Accounting for Contributions"

LEVEL 1

Historical development

Although many NFPOs have been audited for years, they were not subject to CICA Handbook

recommendations until January 1, 1989. Prior to that time, many such organizations had developed

accounting and reporting practices specific to the needs of their users.

CICA Handbook Section 4230, Non-profit organizations — Specific items, included recommendations to be

followed by NFPOs requiring an audit opinion. The Handbook recommended the following:

●

●

NFPOs should use the accrual basis of accounting, rather than the cash basis (which many were

using).

Donations of property, plant and equipment should be initially recorded at their fair value when this

amount is reasonably determinable.

In the 1990s, additional Handbook sections containing more substantive recommendations on accounting

policies for NFPOs replaced section 4230 for fiscal periods beginning on or after April 1, 1997: These are

sections 4400, 4410, 4420, 4430, 4440, 4450, and 4460.

Although governments and other public sector organizations are similar to not-for-profit organizations with

respect to accounting objectives and procedures, sections 4400 to 4460 apply only to not-for-profit

organizations (paragraph 4400.01). Governments have different reporting and disclosure requirements and

are guided by the recommendations of the CICA's Public Sector Accounting Board (PSAB), studied later in

this module.

Reporting issues

This topic focuses on the reporting requirements of NFPOs. Before you study these requirements, consider

two fundamental recording issues: cash versus accrual accounting and expenditure versus expense

accounting.

Cash and accrual accounting

Some NFPOs have used the cash basis of accounting whereby cash received and cash spent appeared in the

statement of operations but no receivables or payables were accrued.

Other NFPOs have preferred a modified accrual basis whereby the cash basis is used for inflows but

payables are accrued for outflows. Another common version of the modified accrual basis is to use accruals

for inflows and outflows but not to record amortization on capital assets.

Some of the arguments for and against cash basis accounting for NFPOs are as follows:

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t02.htm (1 of 6) [29/06/2009 3:23:17 PM]

9.2: Not-for-profit reporting issues

For

●

●

●

●

It is simple to use.

It is not misleading when receivables and payables are insignificant.

Pledges are not legally collectible and should not be accrued.

Benefits of accrual accounting do not outweigh the costs.

Against

●

●

●

It misstates the financial position of the NFPO.

Revenues and expenses are mismatched.

It complicates rather than expedites future cash flow estimates.

Expenditure and expense accounting

Expenditures are recognized when goods or services are acquired by the organization, regardless of

when they are used. Expenses, on the other hand, are recognized when goods or services are used or

consumed by the organization, regardless of when they are acquired.

Exhibit 9.2-1: Transaction example

The organization spent $10,000 in 20X2 for fundraising literature to be used in the 20X3 funding campaign.

Expenditure accounting

●

●

●

●

$10,000 expenditure in the 20X2 Statement of

Operations

Nothing reported in 20X3

Similar to cash basis accounting but accruals

are made for purchases not paid for at year

end

For NFPOs whose expenses do not directly

relate to their revenues, capitalization and

amortization may not be meaningful.

Expense accounting

●

●

●

●

$10,000 prepaid expenses on the 20X2

Statement of Financial Position

$10,000 expenses on the 20X3 Statement of

Operations; prepaid expenses removed from

the 20X3 Statement of Financial Position

Same basis of accounting as used for profitoriented enterprises

Expense accounting provides a truer measure

of the cost of providing goods and services

because amortization expense is included.

In the past, many NFPOs used a cash basis that measured monies received against expenditures incurred

without regard for accrual concepts such as capitalization or prepayment. Expenditure accounting is similar

to the cash basis but does allow for accrual concepts such as payables at year end.

Several sections of the CICA Handbook establish that NFPOs should use the accrual basis of accounting.

Sections 4400 through 4460 establish the reporting requirements for NFPOs. Paragraph .04 of "Introduction

to accounting standards" mentions that accounting Handbook sections are intended to apply to all types of

profit-oriented enterprises and to not-for-profit organizations as defined in "Financial statements

presentation by not-for-profit organizations" (Paragraph 4400.02). Section 1000, Financial statement

concepts, fully applies to NFPOs. Paragraph 1000.46 stipulates that items recognized in financial statements

are accounted for in accordance with the accrual basis of accounting.

Similarly, although many NFPOs have used expenditure accounting in the past, the Handbook sections are

written with the assumption that expense accounting is used. Throughout Sections 1000 and 4400, the term

"expense" is used consistently with reference to NFPOs.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t02.htm (2 of 6) [29/06/2009 3:23:17 PM]

9.2: Not-for-profit reporting issues

CICA Handbook recommendations

Financial reporting standards for NFPOs have been in a state of flux historically, governed more by an

association's or organization's policy and by generally accepted practice than by Handbook

recommendations. Because the structure and operational objectives for an NFPO are different from those of

a profit-oriented organization, creating standards that adequately addressed the specific issues of a not-forprofit organization was a difficult task. For example, the recommendations of section 4450 were considerably

influenced by the for-profit recommendations of what was then section 1581, Business combinations.

Significant controversy arose, however, in the area of reporting controlled and related entities.

Accounting professionals considered that the criteria for determining control for an NFPO, with very different

equity positions than profit-oriented firms, were vague and subjective. Even if control could be determined,

many accountants considered that consolidation was not appropriate for organizations that had different

funds, many of which were restricted in use. They were concerned that donors and other funding agencies

would be reluctant to fund operations of a parent organization if the consolidated financial statements

reported surpluses in other controlled entities or funds.

The Handbook recommendations contained in sections 4400 to 4460 were designed to close the reporting

gaps in the not-for-profit sector. However, as mentioned above, for many issues, the proposed reporting

recommendations resulted in great controversy. As a result, many of the reporting recommendations for

NFPOs are flexible, allowing NFPOs considerable choice in reporting and disclosing their operational activities.

The following exhibit summarizes the provisions described in the CICA Accounting Handbook and in the

assigned textbook reading.

Exhibit 9.2-2: Overview of financial reporting standards for NFPs

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t02.htm (3 of 6) [29/06/2009 3:23:17 PM]

9.2: Not-for-profit reporting issues

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t02.htm (4 of 6) [29/06/2009 3:23:17 PM]

9.2: Not-for-profit reporting issues

New strategic directions were approved in January 2006, after deliberation and discussion on the

responses to the draft plan Accounting Standards in Canada: Future Directions. The result is that "for

not-for-profit organizations, the AcSB will continue to apply those elements of GAAP for profit-oriented

enterprises that are applicable to their circumstances, and develop other standards dealing with the

special circumstances of the not-for-profit sector."

NFPOs face many recording and reporting issues that would not be of concern for profit-oriented

organizations. The Handbook provides recommendations on how to report donated materials and

services, donated capital assets and how to disclose these items. However, on other issues, such as

programs reporting, budgets, and supplementary information, the Handbook is silent; in these cases,

NFPOs must decide the best course of action to take. The following examines how NFPOs might address

these issues.

Additional NFP reporting

Programmatic reporting

Although not itself an accounting policy, programmatic reporting (also called reporting by program)

is a disclosure format for organizations that offer several distinct programs. Its purpose is to provide

information by significant operating sectors, similar to the purpose of segment disclosures (studied in

Module 8). Often, only a statement of operations is reported for each program and the statement of

financial position is presented for the organization as a whole.

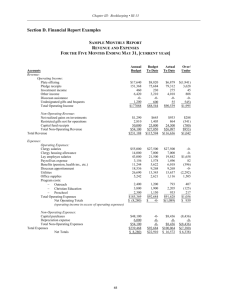

Budgets

For an NFPO, the budget is a primary control mechanism. Annual budgets approved by a finance

committee and a board of directors or their equivalent establish the spending parameters and,

implicitly, program priorities. Comparing actual figures to budget as the year progresses provides a

measure of control and feedback on the activity level of the organization.

There are no requirements for an NFPO to disclose budgetary information but it is common financial

reporting practice to include budget-to-actual comparisons. For example, the statement of operations

may include actual and budget amounts for the current year. Users may use such information for the

purpose of stewardship assessment. Often, the budget for the coming year is included as well.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t02.htm (5 of 6) [29/06/2009 3:23:17 PM]

9.2: Not-for-profit reporting issues

Supplementary information

Although the Handbook provides no guidance on what types of qualitative supplemental information

should be presented by NFPOs, funding agencies and donors require NFPOs to provide a wide variety of

supplemental non-financial information such as services offered, membership numbers, recent

accomplishments, significant events, and future plans. The board of directors can play a significant

leadership role in identifying the types of information — descriptive, statistical, and so on — that users

will analyze to determine the success of the NFPO. The following exhibit provides examples of such

information.

Exhibit 9.2-3: Examples of information used to evaluate the success of NFPOs

NFPO activity

●

Soup kitchen

Useful information

●

●

●

Counselling for recently released prisoners

●

●

●

Assistance for families with mentally or

physically challenged children

●

●

●

●

Meals served

Individuals turned away due to insufficient

food

Contact hours per client

Number of parole violations

Contact hours per client

Attendance per activity

Range of services provided

Percentage of needy families assisted

This information is rarely audited, as auditors find it difficult to comment on data not generated by the

recordkeeping system. However, auditors are responsible for reading all supplemental information in

annual reports that contain financial statements on which they have reported to ensure that the

information is consistent with the statements.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t02.htm (6 of 6) [29/06/2009 3:23:17 PM]

9.3: Introduction to fund accounting

9.3 Introduction to fund accounting

Learning objective

●

Explain the basics of accounting for, and reporting of, contributions under the restricted fund

and deferred contribution methods. (Level 1)

Required textbook reading

●

Chapter 13, pages 615-618, up to "Not-for-Profit Reporting Today," pages 627-635, up to

"Budgetary Control and Encumbrances," and pages 637-653, up to "August 2007 Exposure

Draft"

LEVEL 1

A significant difference between profit-oriented organizations and NFPOs is the use of fund accounting

by NFPOs. Nonprofits must carefully track and report on segregated accounts in the form of "funds"

as they navigate their various projects and programs. These funds must be treated as separate

entities with their own general ledger and must provide individual income statements and balance

sheet reports. They must then report in total for the entire organization. Commercial accounting

systems can maintain separate revenue and expense accounts, but they co-mingle balance sheet

accounts. This is not permitted in fund accounting.

It is important to emphasize that NFPOs are not required by GAAP to use fund accounting. They may,

however, be required to do so by specific donors or other funding agencies (such as government

agencies providing grants).

Exhibit 13.1 on page 617 provides an example of fund accounting in which Helpful Society has set up

two funds, one for day-to-day operations, the General fund, and one for the specific purpose of

accumulating funds to build a building, the Building fund. This allows readers to differentiate between

the use of unrestricted funds (General fund) and restricted funds (those designated for the building).

An NFPO would usually prepare a Statement of Financial Position, (called a Balance Sheet in the

textbook), a Statement of Operations, and a Statement of Changes in Fund Balance

(statement of changes in net assets) for each fund.

While Helpful Society's financial statements have been provided at this point to illustrate the basic

concepts of fund accounting, Helpful Society's financial statements are not consistent with the

Handbook recommendations for NFPOs because the society uses expenditure accounting —

recognizing capital assets as expenditures in the year they were purchased — rather than expense

accounting. To conform to the Handbook’s requirements, Helpful Society would have to capitalize and

amortize future capital assets since the organization’s average annual gross revenues are over

$500,000. Helpful Society cannot therefore limit the application of the section [4430.03] to the

recommendation set out in paragraph 4430.40. Also, Helpful Society should retroactively re-state

past purchases for capital assets it still owns along with accumulated amortization thereon.

Specifics of NFPOs’ financial statements

Referring to the Helpful Society example, note the following items that are specific to NFPO financial

statements.

Statement of Financial Position (Balance Sheet)

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t03.htm (1 of 6) [29/06/2009 3:23:19 PM]

9.3: Introduction to fund accounting

●

●

Assets: Pledges receivable — This represents the amounts that supporters have promised to

pay Helpful Society and that have a reasonable certainty of being collected.

Liabilities and fund balance: Fund balance — This is not a cash measure but represents the

net assets of Helpful Society.

Statement of Revenue and Expenditure and Changes in Fund Balance

Note: The Statement of Revenue and Expenditure is frequently referred to as the Operating

Statement or Statement of Operations.

●

●

●

●

The title of this statement reflects the fact that this society is not operating to earn income or

profit but simply wants to report the sources and amount of revenues compared to the types

and amounts of expenditures.

Most of Helpful Society's revenue comes from donations (contributions).

Expenditures are grouped by program, which represent the various activities undertaken by

Helpful Society. This is an illustration of the concept of programmatic reporting (explained in

Topic 9.2). The statement of revenue and expenditure in Exhibit 13.1 on page 617 provides

details of expenditures grouped by Programs A, B, and C. It is likely that further detail of these

programs would be provided in the notes.

The excess of revenue over expenditure is accumulated in the Fund balance whose December

31 balance is carried onto the statement of financial position.

The Building fund statements are much simpler since there is less activity in this area of the

organization. Note that in this case, the fund balance represents net cash and investments since the

building has not yet been built.

As noted in the required reading from the CICA Handbook, not-for-profit organizations also must

provide a cash flow statement which is similar in construction to that required by for-profit

organizations.

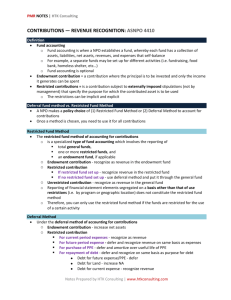

Accounting for contributions

Section 4410 provides recommendations that deal with cash and physical assets contributed or

promised to the NFPO from a variety of sources, including government and private donors.

Restricted contributions are subject to externally imposed stipulations regarding their use. Note

that only contributions can be restricted externally since contributions are, by definition, from an

external source. However, an internal restriction can be imposed upon net assets.

Endowments are similarly restricted in use; however, the intent of an endowment is that the

resources contributed are maintained permanently, while any interest or return earned should be

used as specified by the contributor.

Unrestricted contributions may be used by the NFPO for any purpose.

The following decision tree provides the accounting and reporting methods for contributions.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t03.htm (2 of 6) [29/06/2009 3:23:19 PM]

9.3: Introduction to fund accounting

Source: Adapted from the CICA Handbook, section 4400, Illustrative examples

NFPOs can recognize contributions using either the deferral method or the restricted fund method.

Both limit the NFPO's ability to manipulate the funds, and both highlight external restrictions. Even if

an NFPO has restricted contributions, it may choose either the deferral method or the restricted fund

method.

Deferral method and restricted fund method

Section 4410 provides two decision trees that summarize the accounting for contributions under both

methods. For easy reference, they are reproduced in the following exhibit.

Exhibit 9.3-1: Accounting for contributions — Decision trees

Decision tree 1

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t03.htm (3 of 6) [29/06/2009 3:23:19 PM]

9.3: Introduction to fund accounting

Decision tree 2

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t03.htm (4 of 6) [29/06/2009 3:23:19 PM]

9.3: Introduction to fund accounting

Source: CICA Handbook, section 4410, Decision trees

It is important to remember that the restricted fund method can be applied only when funds are

established on the basis of external restrictions. Funds set up based on programs or internally

imposed restrictions can be presented using separate financial statements, but their fund balances

must be reported as part of the general or operating fund. Externally restricted funds are not

reported as part of the general fund.

How would the information in Helpful Society's financial statements (as shown on page 617) be

presented using the deferral method and using the restricted fund method?

If Helpful Society had used the deferral method, the funds for the building would appear as deferred

contributions on the statement of financial position, in the liability section. This is because none of

the funds would have been spent at this point. After the building is acquired, an amount equal to the

amortization expense would be recognized as revenue, thereby decreasing the deferred liability.

Helpful Society reported a separate fund for building, although the organization could have chosen

not to report separate funds.

If Helpful Society had used the restricted fund method, the financial statement presentation would

depend on the nature of the restricted fund. For externally restricted funds, a total of externally

restricted funds and General fund is presented to give readers a picture of all resources under the

control of the organization. This is the method illustrated in the Helpful example. The total column

provides a picture of all the resources Helpful Society is entrusted with.

If we assumed that the building was set up based on an internal restriction created by the board of

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t03.htm (5 of 6) [29/06/2009 3:23:19 PM]

9.3: Introduction to fund accounting

directors, Helpful Society's presentation would show the fund balance in the Building fund as being

internally restricted.

Illustrative examples (Situation I and Situation II) of section 4400 illustrate the presentation required

under the deferral and restricted fund methods in more detail. In addition, paragraphs 4410.26

and .28 describe additional disclosures required for external restrictions under the deferral and

restricted methods.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t03.htm (6 of 6) [29/06/2009 3:23:19 PM]

9.4: Application of NFPO standards

9.4 Application of NFPO standards

Learning objective

●

Determine appropriate accounting policies for not-for-profit organizations.

(Levels 1 and 2)

Required reading

●

Reading 9.4-1: CGA-Canada 2008 Audited Financial Statements

LEVEL 1

The following comprehensive cases give you the opportunity to practise the application

of reporting standards for NFPOs and to practise the case analysis approach to problem

solving (introduced in Module 1).

Case 9.4-1 illustrates accounting for an externally restricted contribution and related

expenditures under both the deferral and restricted fund methods.

Case 9.4-1: The Petfinders Association

The Petfinders Association is a not-for-profit organization dedicated to reuniting stray

pets with their owners. Pet owners who register their pets with Petfinders are listed in a

database that is available throughout North America.

On May 1, 20X7, the beginning of its fiscal year, Petfinders received a donation of

$1,000,000 from a wealthy and grateful benefactor who had recently had a pet

returned through the organization's system. At the donor's request, the money was to

be used exclusively for purchasing and maintaining a property to house the

administrative offices and operating facility. As well, if the funds were invested for any

length of time, the interest earned was to be used for the same purpose as the original

donation. Petfinders has never had a restricted contribution before. The organization's

only sources of revenue have been user fees and donations received from an annual

door-to-door canvassing campaign.

Petfinders immediately invested the $1,000,000 in a rolling 30-day term deposit that

earned $35,000 in interest during the year. On February 1, 20X8, the following items

were purchased, in cash:

Land

Office building (estimated life of 40 years)

Operating facility (estimated life of 20 years)

$ 200,000

100,000

300,000

$600,000

In addition, $10,000 was spent during the year on maintenance costs for the operating

facility.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t04.htm (1 of 5) [29/06/2009 3:23:20 PM]

9.4: Application of NFPO standards

It is now May of 20X8. You are an independent CGA who has worked extensively in the

not-for-profit area. Based on your reputation as a CGA, Petfinders' controller,

Rayanne O'Connor, has come to you for advice on how to apply the CICA Handbook's

standards to the $1,000,000 contribution for the upcoming year end. Ms. O'Connor is

anxious to comply with Handbook requirements as the organization is required by

provincial legislation to have an audit. (For the purpose of introducing the differences

between the deferred and restricted fund methods, no data has been provided for the

General fund statements.)

Required

1. Prepare a report to Petfinders' controller that addresses the $1,000,000

contribution and related expenditures.

Solution 1

2. Prepare a complete set of financial statements excluding the statement of cash

flows but including notes for the year ended April 30, 20X8, under the deferral

method.

Solution 2

3. Prepare a complete set of financial statements excluding the statement of cash

flows but including notes for the year ended April 30, 20X8, under the restricted

fund method.

Solution 3

The following case illustrates an NFPO with financial statements that do not conform to

GAAP. This case requires that you recommend accounting policies in accordance with

GAAP and revise the financial statements accordingly.

Case 9.4-2: The Lakewood Theatre Company

LEVEL 1

The purpose of this case is to help you develop skills in identifying the recording

and reporting issues that face NFPOs. Read the following case, then spend a few

minutes drafting a response to the Required before continuing to the suggested

solution. By doing so, you will achieve a better understanding of the issues.

The Lakewood Theatre Company (Lakewood) is a small, not-for-profit repertory

company in Watermere, British Columbia. Its original and primary goal is to

provide live theatre performances for the residents of Watermere. A second

program, providing drama lessons and performance opportunities to the children of

Watermere, is in its first year. This program operates through a cost-recovery

agreement with the city's school board.

You have been a patron of the theatre for several years, and recently you were

elected to the board of directors. The board consists of dedicated volunteers, many

of whom are business and professional people in the community. Board members

serve on various committees. As you are a newly qualified CGA with many

accounting and administrative skills, you volunteered to serve on the finance

committee.

The first meeting of the finance committee that you attended was at the beginning

of June 20X8. The main item on the agenda was the preparation of financial

information for the company's first audit for the year ended May 31, 20X8. Until

this year, the organization did not need an audit because all funds donated were

raised privately. This year, however, with the receipt of school board funding for

the Drama in the Schools program, an audit is necessary. The purpose of the

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t04.htm (2 of 5) [29/06/2009 3:23:20 PM]

9.4: Application of NFPO standards

finance committee meeting was to establish which accounting policies practised by

the organization were acceptable according to generally accepted accounting

principles and to discuss alternatives for any that were not generally accepted.

The meeting developed into a heated discussion about the proper accounting

treatment of the newly acquired van. In the past, Lakewood rented trucks or vans

as required to move stage props and costumes. In June of 20X7, the organization

launched a fundraising campaign directed at the five largest employers in the city,

raising enough for Lakewood to purchase its own van. The campaign's promotional

materials had specifically mentioned that funds raised would be used for the

purchase and maintenance of vehicles. It was hoped that this campaign would be

run in a scaled-down form each year to ensure Lakewood could purchase a total of

four vans and have funds available for repairs or future additional van purchases

or replacements. The first van was purchased in December, even though some

pledges remained outstanding at the year end.

The finance committee is considering several options for reporting the van. One

member of the committee insists that the van be capitalized and amortized over its

useful life, which is expected to be five years. It is expected that the van could be

sold for $5,000 at the end of its five-year life. This approach would be a major

change for the organization since it is currently reporting on a cash basis. Up until

now, assets purchased have been expensed as soon as they were paid for. A

second member disagrees with the capitalizing approach; he has worked with

other not-for-profit organizations, and they used the expenditure basis for capital

assets. He supports the idea of writing the van off entirely in the current year.

A third committee member, although unsure about which approach is best, is

concerned that the current financial statements may not provide the information

required by the donors of the funds used to purchase the van. She considers that

the method selected should satisfy the expectations of the donors that the funds

be spent on purchasing and repairing or replacing vehicles, rather than on

operating items. She is not certain how to handle this situation. She is also

concerned because the second largest pledge received in the fundraising

campaign, which was collected on June 3, 20X8, after year end, was not intended

for the van at all; the donor requested that it be used for the proposed new

theatre building. This amount is included in pledges receivable in the year-end

statements.

The operating deficit was also cause for concern at the meeting as Lakewood has

never before had such a large operating deficit. In the middle of the debate, the

chairperson of the finance committee halted the discussion, turned to you, and

said, "I know that you are very knowledgeable about accounting standards. We

need to understand what alternative accounting practices exist, the advantages of

each, and which ones you recommend. Since this is the first year we will be

audited, the recommendations you make will have to comply with GAAP. Also,

since we will be asking the bank for a loan to build our own theatre soon, the

auditors will be looking closely at our statements.

Take a look at the statements and see if we'll have to make any changes. Oh, one

other thing has been bothering me. Is it true that we have to record the value of

all donated materials and services to meet the requirements of GAAP? Could you

prepare a report for next week's meeting that would address these issues?"

Required

1. Using the case analysis approach, prepare the report to the finance committee,

addressing each of the members' concerns. Evaluate the relevant alternatives,

giving consideration to current standards, and present your recommendations.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t04.htm (3 of 5) [29/06/2009 3:23:20 PM]

9.4: Application of NFPO standards

Solution 1

2. Prepare a revised set of financial statements using the restricted fund method

based on your recommendations. The draft statement of receipts and

expenditures for the year ended May 31, 20X8, prepared by Lakewood's

bookkeeper, is shown below.

Solution 2

THE LAKEWOOD THEATRE COMPANY

Statement of Receipts and Expenditures

for the year ended May 31, 20X8

Receipts

Mainstage production

Drama in the Schools

Fundraising

$

Expenditures

Wages and salaries

Other production expenses

Administration and amortization

Van

Fundraising

363,067

207,965

103,885

674,917

423,100

108,866

129,730

25,500

22,805

710,001

Excess (deficit) of receipts over expenditures

(35,084)

Cash and term deposits at the beginning of the year

93,633

$ 58,549

Cash and term deposits at the end of the year

Notes

1. The school board owes Lakewood $105,000 for services delivered in the schools up

to May 20X8; payment is expected within 60 days.

2. Outstanding payables at the year end:

Wages for actors and staff

Travel costs

Rent for May 20X8

$

6,700

4,500

2,500

$ 13,700

3. There is $25,000 in pledges outstanding at the end of the year, and it is expected all

will be collected in June of 20X8. Individuals who made the pledges have been called

and reminded of their commitment. Of the $25,000 of pledges outstanding, $15,000

has been specifically designated for the new theatre building.

4. The van was purchased December 1, 20X7, for $25,500.

5. The following expenses (included above) are related to the Drama in the Schools

program:

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t04.htm (4 of 5) [29/06/2009 3:23:20 PM]

9.4: Application of NFPO standards

Wages and salaries

Other production expenses

Administration and amortization

Total

$ 200,000

52,500

60,465

$ 312,965

LEVEL 2

Reading 9.4-1 presents the 2008 audited financial statements for CGA-Canada, which has

adopted the recommendations of sections 4400-4460. Note the following points from these

statements:

●

●

●

●

●

●

●

●

Four financial statements are provided: Statement of financial position, statement of

operations, statement of changes in net assets, and statement of cash flows. These

parallel respectively the balance sheet, income statement, statement of retained

earnings, and statement of cash flows for a profit-oriented company.

Assets include the Insurance Retention fund. Referring to the statement of changes

in net assets, you can see that this is an internally restricted fund and, therefore,

does not meet the requirements for restricted fund accounting. The net assets

available for this fund are included in general operations.

The internally restricted Insurance Retention fund is disclosed in the Net assets

section along with the unrestricted fund balances.

The Net assets section also discloses the amount invested in Capital assets, as

required by paragraph 4400.19. These assets are not available for other purposes

and, for this reason, are disclosed separately (paragraph 4400.23).

The statement of operations provides an example of programs reporting. Expenses

are grouped by services to affiliates and members, standards development,

recognition, international recognition, education, corporate, and administration

programs.

The net insurance fund deficit is transferred from the unrestricted fund. Note 6

provides more details of the revenues and expenses for this internal fund.

The statement of changes in net assets reconciles beginning and ending balances in

each of the three net asset amounts reported on the statement of financial position:

capital assets, insurance fund, and unrestricted.

The statement of cash flows is presented in the format that you are familiar with

from your previous study.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t04.htm (5 of 5) [29/06/2009 3:23:20 PM]

9.5: Budgetary control

9.5 Budgetary control

Learning objective

●

Explain how formal recording of a budget helps NFPO managers control operations.

(Level 1)

Required textbook reading

●

Chapter 13, pages 636-637, up to "Encumbrance Accounting"

LEVEL 1

Budgets in non-profit and public sector organizations are more than guidelines that assist in

the achievement of financial and operational goals; budgets can provide authority for and

an upper limit to spending. A fund accounting system that uses budgetary accounts and

encumbrances can provide managers with up-to-date information on amounts that are

available, committed, and/or already spent from a specific fund or for a specific purpose.

Since managers are expected to operate within their budgets, it is important that the

budget become part of the accounting and control system. Hence, the budget also serves in

part as an ethical framework for management decisions and in part as a tool for assessing

management’s performance.

Budgetary accounts

To ensure that the budget is followed, many NFPO managers record budget amounts in

control accounts. This allows day-to-day monitoring of budget-to-actual figures and

provides a quick source of information for decision making. Budget amounts for the year are

recorded in self-balancing memorandum accounts, which supplement the normal general

ledger accounts.

When the recorded revenue from the budgeted account balance is offset, the difference

represents the amount of additional revenue required to attain the budget. Similarly, the

remaining unspent budgeted amount is obtained by offsetting the expenses to date against

the budgeted expense balance.

The following example illustrates how an NFPO would incorporate a budgetary system into

its record keeping system.

Exhibit 9.5-1: Recording budgetary amounts in an NFPO

Jarma Boys and Girls Club (JBAGC) was organized on January 1, 20X8. The club received a

grant from the City of Jarma to open an after-school drop-in centre for local children from

ages 6 to 18. During the first week of January 20X8, the board of directors for the club

approved the following budget:

Revenues

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t05.htm (1 of 3) [29/06/2009 3:23:20 PM]

9.5: Budgetary control

City grant

Fund raising

Other donations

$ 500,000

100,000

100,000

700,000

Expenses

Equipment rental

Facilities rental

Food and beverages

Supplies

Wages and benefits

Budgeted surplus

50,000

150,000

25,000

125,000

320,000

670,000

$ 30,000

During the year, the following events took place:

1. The grant from the City of Jarma was received.

2. The fund-raising campaign raised a total of $176,000.

3. The United Way donated $75,000 and the March of Dimes donated supplies that the

club would otherwise have purchased for $15,000, had they not been donated. These

supplies were all used.

4. Equipment and facilities rental were paid in cash respectively for $50,000 and

$150,000. Both equipment and the facilities were long-term leases that would remain

the same each year. The leases were not capital in nature.

5. $23,500 worth of food and beverages was purchased for cash and used.

6. Supplies (not including those donated by the March of Dimes) purchased for cash

and used totalled $95,000.

7. Wages and benefits paid for the year were $365,000.

Due to the success of the centre, on June 30, 20X8, the board approved another $40,000

for wages for part-time employees.

Required

1. Prepare the journal entries required to record the budgeted amounts and actual

operating results in the records of JBAGC.

Solution 1

2. Prepare a budget to actual statement for JBAGC with budget variances.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t05.htm (2 of 3) [29/06/2009 3:23:20 PM]

9.5: Budgetary control

Solution 2

3. Prepare the closing entry for the budgeted amounts

Solution 3

Budgetary information is not required to appear in NFPO financial statements, although

many provide it for comparative purposes. Disclosure of budget-to-actual amounts is

required for governments under the recommendations of the CICA Public Sector Accounting

Handbook.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t05.htm (3 of 3) [29/06/2009 3:23:20 PM]

9.6: Financial instruments and not-for-profits

9.6 Financial instruments and not-for-profits

Learning objective

●

Apply the requirements for financial instruments as they pertain to not-for-profit organizations. (Level 2).

No required textbook reading

Note: CICA Handbook Release 52, issued in December 2008, provided that not-for-profit organizations may elect

to continue to use section 3861 governing the presentation and disclosure of financial instruments, rather than

adopt sections 3862 and 3863.

For assignment, quiz, and examination purposes, unless the question specifically states otherwise, you are

to assume that the company has adopted sections 3862 and 3863.

LEVEL 2

There are three1 variations on the special circumstances under which financial instruments are accounted in not-forprofit organizations. Those requirements are applied in the examples below:

●

●

●

In Example 9.6-1, the not-for-profit follows the deferral method of accounting for contributions.

Example 9.6-2 shows the differences if the organization followed the deferral method and also used fund accounting.

The last illustration (Example 9.6-3) follows the restricted fund method.

Example 9.6-1: NFPO A — Accounting for contributions using the deferral method

●

●

●

●

NFPO A follows the deferral method of accounting for contributions.

NFPO A receives core operating funding every year from the federal government. The amount of the funding is based

on an approved operating budget. For 20X4 and 20X5, this funding amounted to $100,000 and $105,000,

respectively. Funding is received just prior to the year to which it relates. $110,000, representing the funding for

20X6, was received at the end of 20X5.

NFPO A also receives funding for research every year from the federal government. This funding amounted to

$25,000 and $30,000 for 20X4 and 20X5, respectively. This funding is not received until after the fiscal year

being funded.

From time to time, NFPO A receives contributions for endowment. By the end of 20X4, NFPO A had

accumulated contributions for endowment amounting to $100,000. The investment income on the $100,000 is subject

to restrictions imposed by the contributor stipulating that it be spent on research activities. Dividend and interest

income earned on these restricted endowment contributions was $10,000 in 20X4 and $10,000 in 20X5. Changes

in unrealized gains on the investments were $2,000 in 20X4 and a loss of $400 in 20X5. In 20X5, NFPO A received

an additional contribution for endowment amounting to $50,000. The income earned on this contribution is

unrestricted. Dividend and interest income earned on this unrestricted endowment was $4,000 in 20X5. Unrealized

gains on the investments were $1,000 in 20X5.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (1 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

●

●

●

●

●

●

Investments are classified as "available-for-sale" financial assets.

NFPO A has annual materials and services expenses of $10,000 that are payable in U.S. dollars over the next year.

On December 1, 20X5, it enters into a U.S./Canadian dollar swap to hedge the exposure to variable cash flow

payments attributable to foreign currency risk from January 1, 20X6 to December 31, 20X6. At inception (December

1, 20X5), the fair value of the swap is zero. By December 31, 20X5, there is an increase of $50 in the fair value of

the swap, resulting from a change in the U.S./Canadian dollar exchange rate. NFPO A determines that the

hedge relationship is effective throughout the period, and credits the effective portion of the change in fair value of

the swap to unrestricted net assets.

NFPO A has land and a building that were purchased eleven years ago using funds restricted for that purpose and

that cost $50,000 and $140,000, respectively. The estimated useful life of the building is 20 years.

Part way through 20X5, NFPO A purchased another parcel of land and a building that cost $100,000 and

$400,000 respectively. This purchase was financed using unrestricted funds of $50,000 and mortgage financing

of $450,000. By the end of 20X5, $3,000 of the principal amount of the mortgage had been repaid. The estimated

useful life of the building is 20 years

Over the years, NFPO A has purchased equipment. By the end of 20X4, equipment with an original cost of $25,000

had been purchased out of unrestricted resources. Equipment with a fair value of $5,000 was contributed to NFPO A

at the beginning of 20X5. At the end of 20X5, equipment costing $10,000 was purchased using unrestricted funds.

During 20X5, NFPO A launched a building campaign to raise $500,000 for a major expansion to NFPO A’s older

building. Contributions to this campaign amounted to $78,000 in 20X5. Contributors to the building campaign do so

with the understanding that resources contributed will be invested and that the accumulated investment income will

be spent on the building expansion. Dividend and interest Investment income earned on amounts contributed was

$2,000 in 20X5. Unrealized gains on the investments were $1,400 in 20X5.

●

NFPO A runs seminars for which it charges fees.

●

NFPO A also receives contributions from XYZ Foundation, which is not related to NFPO A.

●

These statements are for an NFPO organization that uses the deferral method but not fund accounting

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (2 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (3 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (4 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

NFPO A

Notes to financial statements

December 31, 20X5

1. Purpose of the organization

NFPO A is a national organization operating programs and performing research aimed at helping those who have

lost family members in automobile accidents. NFPO A is incorporated under the Canada Corporations Actas a notfor-profit organization and is a registered charity under the Income Tax Act.

2. Significant accounting policies

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (5 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

Revenue recognition

NFPO A follows the deferral method of accounting for contributions. Restricted contributions are recognized as revenue

in the year in which the related expenses are incurred. Unrestricted contributions are recognized as revenue

when received or receivable if the amount to be received can be reasonably estimated and collection is

reasonably assured. Endowment contributions are recognized as direct increases in net assets.

Investment income includes dividend and interest income, and realized and unrealized investment gains and

losses. Unrealized gains and losses on available-for-sale financial assets are included directly in net assets or

deferred contributions as appropriate, until the asset is removed from the Statement of Financial Position.

Unrealized gains and losses on held-for-trading financial assets are included in investment income and recognized

as revenue in the Statement of Operations, deferred or reported directly in net assets, depending on the nature of

any external restrictions imposed on the investment income. Restricted investment income is recognized as revenue

in the year in which the related expenses are incurred. Other unrestricted investment income is recognized as

revenue when earned.

Seminar fees are recognized as revenue when the seminars are held.

Investments

Investments classified as available-for-sale or held-for-trading are recorded at the lower of cost and market

value. Investments classified as held-to-maturity are recorded at amortized cost.

Derivative financial instruments

NFPO A uses forward foreign exchange contracts to manage foreign exchange risk in future expenses for materials

and services. Derivative instruments are recorded on the Statement of Financial Position as assets and liabilities and

are measured at fair value. Changes in the derivative instruments’ fair value are recognized in the Statement

of Operations unless specific hedge accounting criteria are met. Changes in the fair value of effective cash flow

hedges are included directly in net assets or deferred as appropriate, until the resultant asset, liability or

anticipated transaction affects the Statement of Operations or the Statement of Changes in Net Assets, as appropriate.

5. Deferred contributions

Deferred contributions represent unspent resources externally restricted for research purposes and restricted

operating funding received in the current period that is related to the subsequent period. Changes in the

deferred contributions balance are as follows:

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (6 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

7. Building campaign

In 20X5, NFPO A launched a building campaign to raise $500,000 by 20X8 for a major expansion to one of NFPO

A’s buildings. The $81,400 Deferred building campaign contributions balance comprises $78,000 contributed to date

and related dividend and interest income earned of $2,000 and unrealized gains of $1,400, which is also

externally restricted for the building expansion.

10. Investment income

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (7 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

Example 9.6-2 shows what the difference would be if the organization followed the deferral method but also used

fund accounting.

Example 9.6-2: Using the deferral method with fund accounting

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (8 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

NFPO A

Statement of Financial Position

as at December 31, 20X5

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (9 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

NFPO A

Statement of Operations and Changes in Fund Balances

for the year ended December 31, 20X5

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (10 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

NFPO A

Notes to financial statements

December 31, 20X5

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (11 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

1. Purpose of the organization

NFPO A is a national organization operating programs and performing research aimed at helping those who have

lost family members in automobile accidents. NFPO A is incorporated under the Canada Corporations Actas a notfor-profit organization and is a registered charity under the Income Tax Act.

2. Significant accounting policies

NFPO A follows the deferral method of accounting for contributions.

Fund accounting

Revenues and expenses related to program delivery and administrative activities are reported in the Operating

fund. Revenues and expenses related to research activities are reported in the Research fund. The Capital asset

fund reports the assets, liabilities, revenues and expenses related to NFPO A’s capital assets and building

expansion campaign. Endowment contributions are reported in the Endowment fund. Dividend and interest

income earned on resources of the Endowment fund is reported in the Research or Operating fund depending on

the nature of any restrictions imposed by contributors of funds for endowment. Realized and unrealized investment

gains and losses on resources of the Endowment fund are reported in the Endowment fund.

Revenue recognition

Restricted contributions are recognized as revenue of the appropriate fund in the year in which the related expenses

are incurred. Unrestricted contributions are recognized as revenue of the appropriate fund when received or receivable

if the amount to be received can be reasonably estimated and collection is reasonably assured.

Endowment contributions are recognized as direct increases in the Endowment fund balance.

Investment income includes dividend and interest income, and realized and unrealized investment gains and

losses. Unrealized gains and losses on available-for-sale financial assets are included directly in the fund balances

or deferred contributions, as appropriate, until the asset is removed from the Statement of Financial Position.

Unrealized gains and losses on held-for-trading financial assets are included in investment income and recognized

as revenue in the Statement of Operations, deferred or reported directly in the fund balances, depending on the nature

of any external restrictions imposed on the investment income. Restricted investment income is recognized as revenue

of the appropriate fund in the year in which the related expenses are incurred.

Other unrestricted investment income is recognized as revenue when earned.

Seminar fees are recognized as revenue of the Operating fund when the seminars are held.

Investments

Investments classified as available-for-sale or held-for-trading are recorded at the lower of cost and market

value. Investments classified as held-to-maturity are recorded at amortized cost.

Derivative financial instruments

NFPO A uses forward foreign exchange contracts to manage foreign exchange risk in future expenses for materials

and services. Derivative instruments are recorded on the Statement of Financial Position as assets and liabilities and

are measured at fair value. Changes in the derivative instruments’ fair value are recognized in the Statement

of Operations unless specific hedge accounting criteria are met. Changes in the fair value of effective cash flow

hedges are included directly in the fund balances or deferred as appropriate, until the resultant asset, liability

or anticipated transaction affects the Statement of Operations or the fund balances directly, as appropriate.

5. Deferred contributions

Deferred contributions reported in the Operating fund relate to restricted operating funding received in the current

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (12 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

period that is related to the subsequent period. Changes in the deferred contributions balance reported in the

Operating fund are as follows:

20X5

Beginning balance

Less amount recognized as revenue in the year

Add amount received related to the following year

Ending balance

$105,000

(105,000)

110,000

$110,000

In addition, deferred contributions of $8,000 (20X4 –$0) are reported in the Research fund and $1,600 (20X4 –

$2,000) are reported in the Endowment fund. These deferred contributions relate to the unspent portion of dividend

and interest income earned, restricted for research purposes of $8,000 (20X4 –$0) and the unrealized gains

on Endowment fund resources restricted for research purposes of $1,600 (20X4 –$2,000).

6. Deferred contributions related to capital assets

Deferred contributions reported in the Capital asset fund include the unamortized portions of contributed capital

assets and restricted contributions with which one of NFPO A’s buildings was originally purchased. In 20X5, NFPO

A launched a building campaign to raise $500,000 by 20X8 for a major expansion to NFPO A’s existing

building. Externally restricted contributions, dividend and interest income earned and realized and unrealized gains

and losses related to the building campaign are also included in deferred contributions reported in the Capital asset fund.

The changes for the year in the deferred contributions balance reported in the Capital asset fund are as follows:

Finally, Example 9.6-3 illustrates the situation where the organization follows the restricted fund method.

Example 9.6-3: Accounting for contributions using the restricted fund method

NFPO A

Statement of Financial Position

as at December 31, 20X5

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (13 of 19) [29/06/2009 3:23:26 PM]

20X4

$100,000

(100,000)

105,000

$105,000

9.6: Financial instruments and not-for-profits

NFPO A

Statement of Operations and Changes in Fund Balances

for the year ended December 31, 20X5

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (14 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (15 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (16 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

NFPO A

Notes to financial statements

December 31, 20X5

1. Purpose of the organization

NFPO A is a national organization operating programs and performing research aimed at helping those who have

lost family members in automobile accidents. NFPO A is incorporated under the Canada Corporations Actas a notfor-profit organization and is a registered charity under the Income Tax Act.

2. Significant accounting policies

Fund accounting

NFPO A follows the restricted fund method of accounting for contributions.

The General fund accounts for the organization’s program delivery and administrative activities. This fund

reports unrestricted resources and restricted operating grants. The Research fund reports only restricted resources

that are to be used for research purposes. The Capital asset fund reports the assets, liabilities, revenues and

expenses related to NFPO A’s capital assets and building expansion campaign. The Endowment fund reports

resources contributed for endowment. Dividend and interest Investment income earned on resources of the

Endowment fund is reported in the Research or General fund depending on the nature of any restrictions imposed

by contributors of funds for endowment. Realized and unrealized investment gains and losses on resources of

the Endowment fund are reported in the Endowment fund.

Investments

Investments classified as available-for-sale or held-for-trading are recorded at the lower of cost and market

value. Investments classified as held-to-maturity are recorded at amortized cost.

Derivative financial instruments

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (17 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

NFPO A uses forward foreign exchange contracts to manage foreign exchange risk in future expenses for materials

and services. Derivative instruments are recorded on the Statement of Financial Position as assets and liabilities and

are measured at fair value. Changes in the derivative instruments’ fair value are recognized in the Statement

of Operations unless specific hedge accounting criteria are met. Changes in the fair value of effective cash flow

hedges are included directly in the fund balances or deferred as appropriate, until the resultant asset, liability

or anticipated transaction affects the Statement of Operations or the fund balances directly, as appropriate.

Revenue recognition

Investment income includes dividend and interest income, and realized and unrealized investment gains and

losses. Dividend and interest income earned on Endowment fund resources that must be spent on research activities

is recognized as revenue of the Research fund. Unrestricted dividend and interest investment income earned

on Endowment fund resources is recognized as revenue of the General fund. Realized gains and losses on

Endowment fund resources are recognized as revenue of the Endowment fund. Dividend and interest income earned

and realized gains and losses on building campaign resources are recognized as revenue of the Capital asset fund.

Other investment income is recognized as revenue of the General fund when earned.

Unrealized gains and losses on available-for-sale financial assets are included directly in the fund balances or deferred,

as appropriate, until the asset is removed from the Statement of Financial Position. Unrealized gains and losses on

held-for-trading financial assets are included in investment income and recognized as revenue in the Statement

of Operations, or deferred as appropriate.

Seminar fees are recognized as revenue of the General fund when the seminars are held.

6. Externally restricted net assets

Major categories of externally imposed restrictions on net assets are as follows:

In 20X5, NFPO A launched a building campaign to raise $500,000 by 20X8 for a major expansion to NFPO A’s

existing building. The campaign has raised contributions of $78,000 to date, which have been invested in

marketable securities. Related dividend and interest income of $2,000 and unrealized gains of $1,400, restricted for

the building expansion, are also reported in the Capital asset fund.

10. Investment income

Investment income includes dividend and interest income earned on resources held for endowment, which is reported

in the following funds:

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (18 of 19) [29/06/2009 3:23:26 PM]

9.6: Financial instruments and not-for-profits

11. Unrealized gains and losses recorded directly in fund balances

Changes in unrealized gains and losses on available-for-sale financial assets recorded directly in fund balances are

as follows:

1These illustrations are based on the material released by the Accounting Standards Board when the original

exposure drafts were issued in 2003. The original data for the illustrations is based on the material in Handbook

section 4400.

2This

line item is included for illustrative purposes as to where it appears; it is not applicable in the example provided.

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t06.htm (19 of 19) [29/06/2009 3:23:26 PM]

9.7: Financial reporting for government

9.7 Financial reporting for government

Learning objective

●

Explain the reporting implications of governments’ unique characteristics (Level 1), and

describe the key messages the financial statements should convey (Level 2).

Required reading

●

●

Reading 9.7-1: Government of New Brunswick 2008 Summary Financial Statements

Reading 9.7-2: Government of Canada Treasury Board Accounting Standard

LEVEL 1

The federal government is somewhat unique in that it uses Treasury Board Accounting Standards

(TSAB) to prepare its financial statements. Review the standards, paying particular attention to the

Illustrative Financial Statement package section. You should download the illustrative statements and

compare and contrast them to those of the Government of New Brunswick set out below. In what

aspects are they similar? How are they different?

As you will see in Topic 9.8, other governments are required to prepare their financial statements in

accordance with the Public Sector Accounting Handbook.

We will use the Government of New Brunswick’s fiscal 2008 financial statements as an example to

demonstrate the unique characteristics of governments. Open the province’s financial statements and

note that they consist of the following consolidated statements:

●

●

●

●

●

Financial Position

Operations

Cash Flow

Change in Net Debt

Change in Accumulated Deficit

Each statement reflects the unique characteristics of governments, as follows:

●

●

●

●

●

●

●

●

●

Government's goal is not to make a profit but to provide services and redistribute resources.

Most government tangible capital assets do not represent future cash inflows to the

government but rather service capability.

Government capital spending may not focus on maximizing financial return.

The principal source of revenue for governments is taxation.

The value and use of the assets held by governments outweigh the value and use of

recognized assets.

The benefits of government services cannot be measured solely by a bottom line that shows

net revenues or expenses.

A government's budget portrays public policy and is an important part of the government

accountability cycle. A comparison of actual-to-budget amounts demonstrates public

accountability for government finances.

The debt capacities of senior governments remain distinctive and unequaled by most

organizations.

Governments are held to a higher standard of accountability than other organizations.

LEVEL 2

file:///F|/Courses/2009-10/CGALU/FA4/06course/01mod/fa40910/module09/m09t07.htm (1 of 6) [29/06/2009 3:23:27 PM]

9.7: Financial reporting for government

Consistent with these unique characteristics, governments should provide the following key

messages:

In the Statement of Financial Position

●

●

●

Financial assets separated from non-financial assets, the former being used namely to