Fayetteville State University

School of Business and Economics

Department of Accounting, Finance, Healthcare and Information Systems

FINC 311-45 (Principles of Finance)

I.

Locator Information

FSU Policy on Electronic Mail: Fayetteville State University provides to each student,

free of charge, an electronic mail account (username@broncos.uncfsu.edu) that is easily accessible via

the Internet. The university has established FSU email as the primary mode of correspondence

between university officials and enrolled students. Inquiries and requests from students pertaining to

academic records, grades, bills, financial aid, and other matters of a confidential nature must be

submitted via FSU email. Inquiries or requests from personal email accounts are not assured a

response. The university maintains open-use computer laboratories throughout the campus that can

be used to access electronic mail.

II.

Course Description

A course in basic financial management, including the study of the nature of financial management, financial

analysis, working capital management, and long-term investment decisions. This course covers fundamental

financial concepts and principles. Emphasis is placed on practical problem solving skills based on these

concepts and principles. Topics include the role of the financial manager, time value of money, risk and

return, cash flow analysis, and valuation.

III.

Disabled Student Services

In accordance with Section 504 of the 1973 Rehabilitation Act and the Americans with Disabilities Act

(ACA) of 1990, if you have a disability or think you have a disability to please contact the Center for

Personal Development in the Spaulding Building, Room 155 (1 st Floor); 910-672-1203.

IV.

Required Text and Materials

1. Textbook

Gitman, Lawrence J. and Chad J. Zutter, Principles of Managerial Finance, 13th Edition, Boston, MA:

Pearson Prentice Hall (2012)

2. Financial Calculator

Students will need to use a financial calculator in this course. The calculator must at least have the following

keys: PV, FV, PMT, I or I/YR, n, NPV, IRR, square root, e x, and yx. Calculators with these keys include the

HP-10BII, HP-12C, and TI BAII Plus among others. The instructor uses a HP-10BII calculator in class.

Each student is responsible for reading the calculator manual in order to become proficient in the use of the

calculator. Students should know how to set their calculator to 4 decimal places and to one payment per

period. Finally, students shall have sole responsibility to know how to use their calculator before we begin to

1

discuss Chapter 5 material in class.

V.

Student Learning Outcomes

Upon completion of this course, students will be able to:

1) Identify the different issues examined in finance and the activities of a financial manager;

2) Identify and relate the different forms of business organization to investor objectives;

3) Identify factors that determine stock prices;

4) Characterize different types of financial markets;

5) Differentiate between the mechanisms that facilitate the transfer of capital in the economy;

6) Make simple business tax computations;

7) Identify the periodic financial statements supplied by public corporations;

8) Understand the structure of and the relationship between the different financial statements;

9) Extract information from financial statements and compute financial ratios;

10) Classify and interpret financial ratios;

11) Describe the financial planning process;

12) Compute present and future value of a single sum and annuities;

13) Differentiate between nominal, periodic, and effective interest rates;

14) Make time value of money computations involving uneven cash flows and multiple compounding

periods per year;

15) Use time value of money techniques to prepare loan amortization schedule;

16) Use investment cash flows to compute rates of return;

17) Differentiate between expected rate of return and realized rate of return;

18) Describe measures risk such as coefficient of variation, standard deviation, and beta;

19) Relate the level of risk to expected rate of return;

20) Relate risk reduction of portfolio diversification;

21) Differentiate between market and diversifiable risk;

22) Identify factors that determine interest rates;

23) Provide simple explanation of how the level of interest rates is affected by various factors;

24) Relate bond values to bond characteristics and be able to compute the value of bonds;

25) Differentiate between coupon rate, required return, and yield to maturity of bonds;

26) Explain how funds are raised through the issuing of stocks;

27) Value stocks with using multiple techniques.

VI.

Course Requirements and Evaluation Criteria

Evaluation Criteria and Grading Scale

Scores

Grade

Meaning

Attendance Requirements

Students are expected to attend all classes (Refer to the Fayetteville State University Undergraduate Catalog).

Only Fayetteville State University approved absences will be considered unless prior approval is obtained

from the instructor. It is the responsibility of students who miss class to find out from their classmates what

material was covered and to do the extra work necessary to keep up with the remainder of the class.

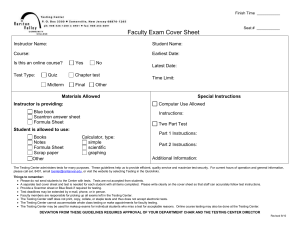

Exams (85% of course grade)

Exams will consist of multiple choice problems and theory questions. A clear understanding of the material

is required to do well on the exams, particularly the theory questions. The questions on each exam may

incorporate any material covered in the earlier chapters. Each student may prepare and use an 11” x 8.5” crib

2

sheet (one side only) for each exam. The crib sheet must be turned in with the exam and will be considered

as part of your exam for grading purposes. The information on the sheet must be legible and written (or

typed) in English; and remember, no copying or cutting and pasting. The information on the sheet must

include your name, course title and the date of the exam. (Use of photocopy material on the crib sheet will be

considered cheating.) The final exam will be comprehensive.

Quizzes (7% of course grade)

Quizzes will be given at the beginning of class and will last approximately 5 minutes. If a student arrives late

for class, no extra time can be afforded since other class activities will be taking place. There are no make-up

quizzes; therefore, the lowest quiz grade or one missed quiz will not count towards your grade.

Assessment Assignment (3% of course grade).

A special homework assignment will be provided during the semester to assess student learning of material

critical to the successful completion of the degree in Business Administration requirements. The assignment

will be graded and included as part of the course grade. The exercise is an important component of

university’s ongoing activities to maintain the AACSB accreditation, which certifies the high quality of your

business degree earned at Fayetteville State University. The following rubric will be used to evaluate and

grade your understanding of financial ratios.

Rubric

Exceeds expectation

Does not meet

Traits

Meets expectation

expectation

Use of financial

Demonstrates

Lacks complete

Cannot clearly

statements

understanding of major

understanding of different differentiate types of

financial statements and

financial statements

financial statement and

how they interrelate

has difficulty computing

financial ratios

Student relates

Computes financial

Computes most financial

Unable to compute most

financial ratios to

ratios, interprets financial ratios Limited

financial ratios.

improved

ratios and relate financial interpretation of financial Misinterprets financial

business decisions ratios to appropriate

ratios and has difficulty

ratios; makes

financial decisions.

making the connection

inappropriate decision

between ratios and

choices.

financial decisions.

All students should strive to earn a rating of “Exceeds expectation” on both traits.

Class Participation (5% of course grade)

Classroom participation is incorporated to encourage students to engage in academic discussion related to the

material covered in this course. Students may contribute through the asking or answering of questions, and

the sharing of relevant information reported in the financial press. When referencing information reported in

the financial press a copy of the article should be provided to the instructor. Being present in class is

requirement to earn credit for class participation.

Homework

Successful completion of all homework problems is an important component of this course, which is

essential to your success on the exams. Students should prepare and bring their homework to class. The

instructor will randomly review homework throughout the semester and provide extra credit. Since students

will not know which assignments will earn the extra credit, they should always have their assignment ready

at the beginning of each class. Deadline for each homework assignment to be reviewed will be announced in

class and posted on Blackboard; however you will not know which assignments will earn extra credit.

Assigned homework problems and solutions will be placed on Blackboard.

Students should first attempt to do the problems by themselves then seek the assistance of a classmate before

checking the solutions provided by the instructor. Students, who need additional help with their homework

problems after checking the solutions and the graded material is returned, should contact the instructor for

further assistance during office hours or by making an appointment. To be successful in the course, students

should develop the skill and knowledge necessary to eventually be able to do all of the homework problems

3

without assistance.

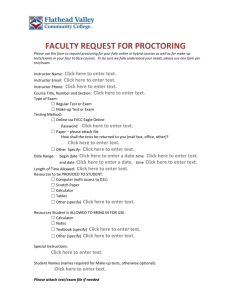

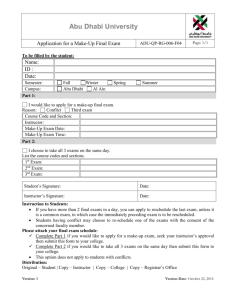

Make-up Policy

There are no scheduled make-up exams; however, the instructor may consider each request, provided it is

made in writing before the exam and is consistent with the university’s policy for excused absences. The

written request for a make-up exam submitted by the student should clearly state the reason for the request

and should be accompanied by the documentation required by the university to substantiate the claim. When

approved, make-up exams will be scheduled at a mutually agreeable time. Unexcused absence from an exam

will result in a zero score for that exam. Assignments are due at the beginning of the class period and late

submissions will not be accepted.

Academic Integrity

Students are expected to adhere to ethical academic practices. Anyone participating (actively or passively) in

the use or exchange of information during an exam, or engaged in unethical practices during the pursuit of

this course will be subjected to the university’s Dishonesty in Academic Affairs policy (Refer to the

Fayetteville State University Undergraduate Catalog).

Request for Review

A student may request a review of graded exams, or quizzes in writing within 5 days after they are returned

or the date it is made available to the student, whichever is earlier. The student must clearly state the

specifics of the issue he/she would like the instructor to address. All requests for review must be in writing.

Web Enhancement

To assist students to be successful in this course, a substantial amount of material is posted on Blackboard,

with additional postings throughout the semester. This online support is intended to help students assimilate

the material that is covered in the course. Supplemental reading materials may also be provided on

Blackboard. Please visit Blackboard on a regular basis to access new material that is posted.

Prerequisites

ACCT 211 and ECON 211 or ECON 212, with grade of “C” or better in each course.

Conduct of Class

Students will be evaluated on the basis of quizzes, exams, and class participation. The instructor reserves the

right to change the assigned chapters or parts of chapters and, thereby, the homework assignments and exam

dates without it having any effect on the remainder of this syllabus; and reassign the weights for grading

purposes. It is imperative that students preview the chapters before the class during which the material will

be covered. Students are also required to read additional materials assigned during the semester. Materials

from the additional readings may be included on the exams.

Students are required to read current business publications including The Wall Street Journal and other

financial publications (print or electronic). Students will have an opportunity during the first week of class to

sign-up for a subscription to The Wall Street Journal at a special discount rate for students.

The Code of the University of North Carolina (of which FSU is a constituent institution) and the FSU Code

of Student Conduct affirm that all students have the right to receive instruction without interference from

other students who disrupt classes.

FSU Core Curriculum Learning Outcome under Ethics and Civic Engagement (6.03): All students will

“prepare themselves for responsible citizenship by fulfilling roles and responsibilities associated with

membership in various organizations.” Each classroom is a mini-community. Students learn and

demonstrate responsible citizenship by abiding by the rules of classroom behavior and respecting the rights

all members of the class.

The FSU Policy on Disruptive Behavior (see FSU website for complete policy) identifies the following

behaviors as disruptive:

1.

Failure to respect the rights of other students to express their viewpoints by behaviors such as

4

2.

3.

4.

5.

6.

7.

8.

9.

repeatedly interrupting others while they speak, using profanity and/or disrespectful names or labels

for others, ridiculing others for their viewpoints, and other similar behaviors;

Excessive talking to other students while the faculty member or other students are presenting

information or expressing their viewpoints.

Use of cell phones and other electronic devices (including calculators on cell phones and similar

electronic devices)

Overt inattentiveness (sleeping, reading newspapers)

Eating in class (except as permitted by the faculty member)

Threats or statements that jeopardize the safety of the student and others

Failure to follow reasonable requests of faculty members

Entering class late or leaving class early on regular basis

Do not leave trash behind.

The instructor may take the following actions in response to disruptive behavior. Students should recognize

that refusing to comply with reasonable requests from the faculty member is another incidence of disruptive

behavior.

1.

2.

3.

4.

5.

6.

Direct student to cease disruptive behavior.

Direct student to change seating locations.

Require student to have individual conference with faculty member. At his meeting the faculty

member will explain the consequences of continued disruptive behavior.

Dismiss class for the remainder of the period. (Must be reported to department chair.)

Lower the student’s final exam by a maximum of one-letter grade.

File a complaint with the Dean of Students for more severe disciplinary action.

Students who believe the faculty member has unfairly applied the policy to them may make an appeal with

the faculty member’s department chair.

Students should not conduct private conversations while the class is in session.

University policy prohibits non-enrolled students from being present in the classroom.

VII.

Academic Support Resources

Refer to Homework and Web Enhancement under Course Requirements and Evaluation Criteria and

University College Learning Center.

VIII.

Course Outline

Chapter 1:

The Role of Managerial Finance

Chapter 2:

The Financial Market Environment

Chapter 3:

Financial Statements and Analysis

Chapter 4:

Cash Flow and Financial Planning

Exam 1

Chapter 5:

Time Value of Money

Chapter 8:

Risk and Return

Exam 2

Chapter 6:

Interest Rates and Bond Valuation

5

Chapter 7:

Stock Valuation

Final Exam Schedule: Thursday, October 9, 2014, 6:00 p.m. – 7:50 p.m.

IX.

Teaching Strategies

The course includes class lectures, discussion of current issues related to financial management, readings

from the financial press, assigned homework problems, and problems done in class.

X.

Bibliography

Brigham, Eugene and Joel F. Houston, Fundamentals of Financial Management, 12th Edition, Mason, OH:

South-Western (2010).

Ross, Stephen A., Randolph W. Westerfield and Bradford D. Jordan, Essentials of Corporate Finance, 6 th

Edition, New York, NY: McGraw-Hill Irwin (2008).

Appendix to Course Syllabus (FINC 311-45)

6