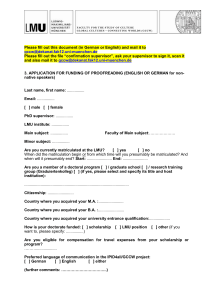

HP 12C

advertisement

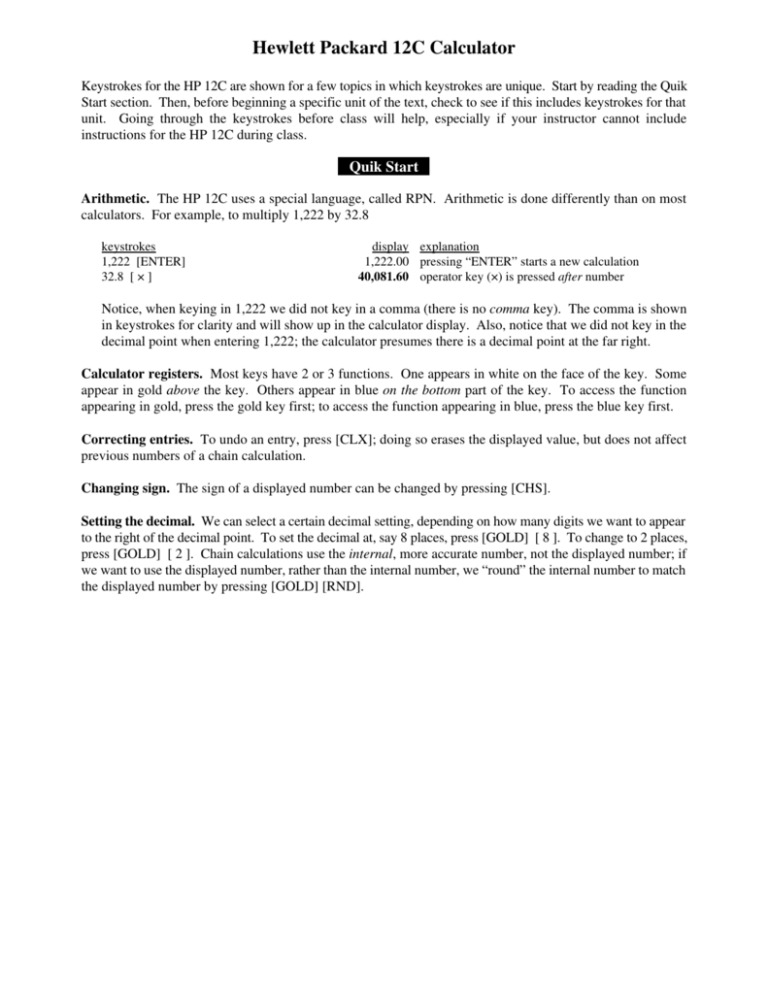

Hewlett Packard 12C Calculator Keystrokes for the HP 12C are shown for a few topics in which keystrokes are unique. Start by reading the Quik Start section. Then, before beginning a specific unit of the text, check to see if this includes keystrokes for that unit. Going through the keystrokes before class will help, especially if your instructor cannot include instructions for the HP 12C during class. Quik Start Arithmetic. The HP 12C uses a special language, called RPN. Arithmetic is done differently than on most calculators. For example, to multiply 1,222 by 32.8 keystrokes 1,222 [ENTER] 32.8 [ × ] display explanation 1,222.00 pressing “ENTER” starts a new calculation 40,081.60 operator key (×) is pressed after number Notice, when keying in 1,222 we did not key in a comma (there is no comma key). The comma is shown in keystrokes for clarity and will show up in the calculator display. Also, notice that we did not key in the decimal point when entering 1,222; the calculator presumes there is a decimal point at the far right. Calculator registers. Most keys have 2 or 3 functions. One appears in white on the face of the key. Some appear in gold above the key. Others appear in blue on the bottom part of the key. To access the function appearing in gold, press the gold key first; to access the function appearing in blue, press the blue key first. Correcting entries. To undo an entry, press [CLX]; doing so erases the displayed value, but does not affect previous numbers of a chain calculation. Changing sign. The sign of a displayed number can be changed by pressing [CHS]. Setting the decimal. We can select a certain decimal setting, depending on how many digits we want to appear to the right of the decimal point. To set the decimal at, say 8 places, press [GOLD] [ 8 ]. To change to 2 places, press [GOLD] [ 2 ]. Chain calculations use the internal, more accurate number, not the displayed number; if we want to use the displayed number, rather than the internal number, we “round” the internal number to match the displayed number by pressing [GOLD] [RND]. Time-saving registers. Suppose we want to calculate the total monthly rent on a 72-unit apartment building in which 36 units rent for $850 each, 24 rent for $900 each, and 12 rent for $925 each. One approach would be to write down subtotals, then add subtotals: 36 × $850 24 × $900 12 × $925 Total $30,600 21,600 + 11,100 $63,300 We could instead use time-saving features of the HP 12C. A few are shown below. keystrokes use storage registers 36 [ENTER] 850 [ × ] [STO] 1 24 [ENTER] 900 [ × ] [STO] 2 12 [ENTER] 925 [ × ] [RCL] 1 [+] [RCL] 2 [+] use chain calculation feature 36 [ENTER] 850 [ × ] 24 [ENTER] 900 [ × ] [+] 12 [ENTER] 925 [ × ] [+] display explanation 30,600.00 21,600.00 11,100.00 30,600.00 41,700.00 21,600.00 63,300.00 first subtotal, stored in register 1 second subtotal, stored in register 2 third subtotal (no need to store) recalled first subtotal added first subtotal to third subtotal second subtotal added second subtotal to previous running total 30,600.00 21,600.00 52,200.00 11,100.00 63,300.00 first subtotal second subtotal second subtotal added to first third subtotal third subtotal added to previous running total Unit 3.1 Mathematical symbols and expressions Example 2 Use a calculator to find the value of: a. 232 keystrokes 23 [ENTER] 2 [ yx ] 4 [ENTER] 5 [ yx ] b. 45 display explanation 529.00 result 1,024.00 result Unit 4.2 The percent formulas Example 1 (Arithmetic portion) Multiply 5,600 by 70%. keystrokes multiply by a decimal number 5,600 [ENTER] .70 [ × ] multiply by a percent 5,600 [ENTER] 70 [ % ] display explanation 3,920.00 answer 3,920.00 answer Note: With the HP12C, we can multiply by a percent, but cannot divide by a percent. If we need to divide by a percent, divide instead by the decimal equivalent. For example, if asked to divide 4,000 by 80%, divide 4,000 by .80, getting 5,000. Unit 4.3 Increase and decrease problems Example 1 You buy a TV for $350. You must also pay sales tax of 6%. First find the amount of sales tax. Then, determine the total amount you must pay. keystrokes 350 [ENTER] 6 [%] [+] display 350.00 21.00 371.00 explanation price of TV sales tax total amount due Example 3 You retain a real estate agent to help sell your home. The home sells for $200,000, and you have agreed to pay your real estate agent a 7% commission. First find the commission. Then, determine the net amount you will receive after the commission. keystrokes 200,000 [ENTER] 7 [%] [-] Example 5 display 200,000.00 14,000.00 186,000.00 (Arithmetic) Tuition at a college has increased from $2,820 per year to $3,435 per year. What is the percent increase? keystrokes 2,820 [ENTER] 3,435 [∆%] Example 6 explanation selling price commission net, after the commission display 2,820.00 3,435. 21.81 explanation original amount new amount percent increase (Arithmetic) In a certain state, highway deaths decreased from 231 last year to 212 this year. Calculate the percent decrease. keystrokes 231 [ENTER] 212 [∆%] display 231.00 212. -8.23 explanation original amount new amount percent decrease Unit 6.1 Markup The HP 12C does not have special markup registers. Chapters 10 & 11 Compound interest formulas Using a calculator properly is essential in working with the compound interest formulas of Illustration 10-1. An example will be given for each of the 8 compound interest formulas. We will begin with Formula 1A. Before starting, here are a few things worth noting: C There are several ways to do the arithmetic; the keystrokes shown in this section are only one choice. The keystrokes shown may, in some cases, be longer than another method but are used because the method is considered to be more conceptually sound and easier to remember. C Here is a tip: Try your own keystrokes before looking at ours. If your approach makes sense, use it because it will be easier to remember. If you have difficulty, then review our suggested keystrokes. C The displayed values shown in the keystrokes have 2 decimal places. Having our decimal set at more or less places will not affect the final answer, provided we use chain calculations (remember that chain calculations use the internal, more accurate value, not the displayed value). Formula 1A Example 1 of Unit 10.2 You get an income tax refund of $1,700 and deposit the money in a savings plan for 6 years, earning 6% compounded quarterly. Find the ending balance using compound interest formulas. FV = PV (1 + i) n = $1,700 (1.015) 24 = $2,430.15 keystrokes 1.015 [ENTER] 24 [ yx ] 1,700 [ × ] display explanation 1.43 1.015 to the 24th power 2,430.15 answer Example 2 of Unit 10.2 Suppose a “wise man” had deposited $1 in a savings account 2,000 years ago and the account earned interest at 2% compounded annually. If the money in the account today were evenly divided among the world’s population, how much would each person receive, based on a world population of 7 billion? FV = PV (1 + i) n = $1 (1.02) 2000 keystrokes [GOLD] 9 1.02 [ENTER] 2000 [ yx ] 7,000,000,000 [ ÷ ] [GOLD] 2 Then divide by 7,000,000,000. display ?.????????? 1.586147 17 22,659,247.54 22,659,247.54 explanation set decimal at 9 places to see more digits account balance, in scientific notation amount per person set decimal back to 2 places (for next problem) Formula 1B Example 4, Unit 10.2 You deposit $100 at the end of each year for 4 years, earning 6% compounded annually. Use compound interest formulas to find the balance in 4 years. FV ' PMT (1 % i) n & 1 i 4 = $100 (1.06) & 1 = $437.46 .06 keystrokes 1.06 [ENTER] 4 [ yx ] 1 [ - ] .06 [ ÷ ] 100 [ × ] display 0.26 4.37 437.46 explanation value of numerator value inside of brackets FV Formula 2A Example 1 of Unit 10.3 Your aunt says she will give you $2,430.15 in 6 years. Assuming that you can earn 6% compounded quarterly, what is the real value of her promise, in today’s dollars? PV ' FV (1 % i) n ' $2,430.15 (1.015)24 keystrokes 1.015 [ENTER] 24 [ yx ] [STO] 1 2,430.15 [ENTER] [RCL] 1 [÷] = $1,700.00 display 1.43 1.43 1.43 1,700.00 explanation value of denominator this value is stored in register 1 recalled the value answer Formula 2B Example 2 of Unit 10.3 You are selling a valuable coin. You have two offers. The first offer is for $5,500 cash. With the second offer, the buyer will pay you $2,000 at the end of each year for 3 years. Assuming that you can earn 8% compounded annually on your money, which offer is better? 1 & PV ' PMT 1 (1 % i) i 1 & n = $2,000 keystrokes 1.08 [ENTER] 3 [ yx ] [1/x] [CHS] 1 [+] .08 [ ÷ ] 2,000 [ × ] 1 (1.08)3 .08 display 1.26 0.79 -0.79 0.21 2.58 5,154.19 = $5,154.19 explanation 1.08 to the third power 1 over (1.08 to the third power) changed the sign value of the numerator value inside the brackets answer Formula 3 Example 1 of Unit 11.4 Dale bought a rare baseball card 3 years ago for $1,500. He just sold the card for $2,000 to get some money for his college tuition. What interest rate, compounded annually, did Dale earn on the investment? i ' FV PV 1 n & 1 = $2,000 $1,500 1 3 & 1 = .100642 . 10.0642% (with 4 decimal places) keystrokes 2,000 [ENTER] 1,500 [ ÷ ] 1 [ENTER] 3 [ ÷ ] [ yx ] 1 [ - ] [GOLD] 6 [GOLD] 2 display 1.33 1.10 0.10 0.100642 0.10 explanation value inside of parentheses previous value to the 1/3 power rate, in decimal form, with decimal at 2 rate, in decimal form, with decimal at 6 put decimal back at 2 places Formula 4A Example 2 of Unit 11.1 You want to accumulate $200,000 for retirement in 40 years. You can earn 6.75% compounded monthly. What amount must you deposit at the end of each month in order to accumulate $200,000 in 40 years? PMT ' FV ( i ) (1 % i) n & 1 = $200,000 (.005625) (1.005625) 480 & 1 keystrokes 1.005625 [ENTER] 480 [ yx ] 1 [ - ] [STO] 1 200,000 [ENTER] .005625 [ × ] [RCL] 1 [÷] = $81.71 display 13.77 13.77 1,125.00 13.77 81.71 explanation value of denominator stored the value value of numerator denominator, recalled answer Formula 4B Example 2 of Unit 11.2 Suppose you have accumulated $500,000, perhaps from many years of savings or from an inheritance. You put the money in a savings plan earning 6% compounded monthly. You want the plan to last 40 years. How much can you withdraw at the end of each month? PMT ' PV ( i ) $500,000 (.005) = = $2,751.07 1 1 1 & 1 & (1 % i) n (1.005) 480 keystrokes 1.005 [ENTER] 480 [ yx ] [1/x] [CHS] 1 [+] [STO] 1 500,000 [ENTER] .005 [ × ] [RCL] 1 [÷] display 10.96 0.09 -0.09 0.91 0.91 2,500.00 0.91 2,751.07 explanation 1.005 to the 480th power 1 over (1.005 to the 480th power) changed the sign value of denominator stored the value value of numerator recalled the denominator answer Formula 5 Example 3 of Unit 11.1 You want to start a restaurant business and estimate it will take $28,000 to get started. You currently have $3,000 and can deposit an additional $425 at the end of each month. If your savings will earn 9% compounded monthly, in how many months can you start your business? For Formula 5 we must use proper sign convention for PV, FV, and PMT: PV = negative $3,000 (negative because you pay this amount into a savings plan) FV = $28,000 (positive because you will get this amount back from the savings plan) PMT = negative $425 (negative because you pay this amount into a savings plan) PV % ( & ln n ' PMT ) i PMT & FV i ln (1 % i ) &$3,000 % & ln = &$425 .0075 &$425 & $28,000 .0075 ln (1.0075) = 46.83 months keystrokes display explanation Step 1: Compute and store (-$425 over .0075) 425 [CHS ] [ENTER] .0075 [ ÷ ] -56,666.67 value of ( - $425 over .0075) [STO] 1 -56,666.67 stored in register 1 Step 2: Compute and store the bottom half of the numerator 28,000 [ - ] -84,666.67 value of the bottom half of the numerator [STO] 2 -84,666.67 stored in register 2 Step 3: Compute and store the value of the entire numerator [RCL] 1 -56,666.67 recall value of ( - $425 over .0075) 3,000 [ - ] -59,666.67 value of the top half of the numerator [RCL] 2 -84,666.67 recall bottom half of the numerator [ ÷] 0.70 total value inside of large brackets [BLUE] [LN] -0.35 the natural log of the previous value [CHS] [STO] 3 0.35 entire numerator stored in register 3 Step 4: Compute and store the value of the main denominator 1.0075 [BLUE] [LN] 0.01 the natural log of 1.0075 [STO] 4 0.01 main denominator stored in register 4 Step 5: Get answer [RCL] 3 0.35 recall the value of the entire numerator [RCL] 4 0.01 recall the value of the main denominator [ ÷] 46.83 answer Chapters 14, 15, and 19 Financial calculators Keystrokes will be shown for problems in which keystrokes are unique—those same examples of the text that show keystrokes for the HP 10BII and the TI BAII PLUS. The time-value-of-money registers for the HP12C are the same as those of most financial calculators. The “i” register represents the interest rate per period, and the “n” register represents the total number of periods. To see what is in a TVM register, press [RCL] [ n ], [RCL] [PV], etc. Keystrokes shown on the following pages assume the calculator is in “End” mode when we start the problem. Example 1 of Unit 14.2 Sebastian Xavier is a soda pop “addict” and wonders how much money he could accumulate if he stopped drinking soda pop and deposited the $150 per month he spends on the stuff into a savings plan. Sebastian just turned 20. If his savings plan earns 6% compounded monthly and his first deposit is a month from now, what amount would he have at retirement, 40 years from now? keystrokes Step 1: Clear TVM registers [GOLD] [FIN] Step 2: Enter given data 150 [CHS] [PMT] 40 [ENTER] 12 [ × ] [ n ] 6 ENTER 12 [ ÷ ] [ i ] Step 3: Solve for unknown [FV] display explanation ?.?? clear TVM registers; previous display remains -150.00 amount deposited (paid) 480.00 total number of periods* (see shortcut below) 0.50 periodic rate* (see shortcut below) 298,723.61 balance in 40 years *Note: In future keystrokes we will use a shortcut for entering n and i in which there are 12 periods per year. In the above problem, we can enter the n-value by pressing 40 [BLUE]n; by pressing the blue key, 40 is multiplied by 12 and the result of 480 is entered in the n-register. We can enter the i-value by pressing 6 [BLUE] i; by pressing the blue key, 6 is divided by 12 and the result of 0.50 is entered the i-register. Warning: The blue key shortcut only works when there are 12 periods per year (monthly); don’t press the blue key to enter i or n for situations that are not monthly periods. Example 2 of Unit 14.2 You have the chance to buy a promissory note in which you would receive 28 quarterly payments of $500, starting 3 months from now. If you want to earn 8% compounded quarterly, what price should you pay for the note? keystrokes Step 1: Clear TVM registers [GOLD] [FIN] Step 2: Enter given data 500 [PMT] 28 [ n ] 8 ENTER 4 [ ÷ ] [ i ] Step 3: Solve for unknown [PV] display explanation ?.?? clear TVM registers; previous display remains 500.00 quarterly payment (received) 28.00 total number of periods 2.00 periodic rate -10,640.64 amount you can pay to earn 8% compounded quarterly Example 5 of Unit 14.3 You deposit $100 at the beginning of each year for 4 years, earning 6% compounded annually. Find the balance in 4 years. keystrokes Step 1: Clear TVM registers [GOLD] [FIN] Step 2: Enter given data 100 [CHS] [PMT] 4 [N] 6 [ i ] Step 3: Solve for unknown [BLUE] [BEG] [FV] [BLUE] [END] display explanation ?.?? clear TVM registers; previous display remains -100.00 amount deposited (paid) 4.00 total number of periods 6.00 rate 6.00 “BEGIN” in bottom of display 463.71 balance assuming deposits at beginning of each year put back in “end” mode Example 1 of Unit 19.1 Tara got a $160,000 15-year mortgage loan at 7.25% on April 1. Calculate her monthly payment. Then, using the amortization registers of your calculator, find interest, principal, and remaining balance for the first two payments. Note: To get accurate results when amortizing, we must have the decimal set at 2 places. keystrokes clear TVM registers [GOLD] [FIN] calculate monthly payment 160,000 [ PV ] 15 [BLUE] [ n ] 7.25 [BLUE] [ i ] [PMT] amortize (must have decimal at 2) 1 [GOLD] [AMORT] [x/y] [RCL] [ PV ] 1 [GOLD] [AMORT] [x/y] [RCL] [ PV ] display explanation ?.?? clear TVM registers 160,000.00 180.00 0.60 -1,460.58 loan amount blue key multiplied by 12; 180 months blue key divided by 12; periodic rate = 0.60 monthly payment -966.67 -493.91 159,506.09 -963.68 -496.90 159,009.19 interest, payment 1 principal, payment 1 balance after payment 1 interest, next payment (#2) principal, payment 2 balance after payment 2 Note: Don’t clear calculator; the next example is a continuation. Example 2 of Unit 19.1 Refer to Example 1 (above). Calculate interest, principal, and remaining balance for each of the first 3 calendar years. Note: Tara got her loan on April 1, so she makes 8 payments the first calendar year. keystrokes (continued from Example 1) 160,000 [ PV ] 8 [GOLD] [AMORT] [x/y] [RCL] [ PV ] 12 [GOLD] [AMORT] [x/y] [RCL] [ PV ] 12 [GOLD] [AMORT] [x/y] [RCL] [ PV ] display 160,000.00 -7,648.76 -4,035.88 155,964.12 -11,096.50 -6,430.46 149,533.66 -10,614.51 -6,912.45 142,621.21 explanation must re-enter (PV decreases when amortizing) interest, first 8 payments principal, first 8 payments balance after payment 8 interest, second calendar year principal, second calendar year balance at end of year 2 interest, third calendar year principal, third calendar year balance at end of year 3 Note: Don’t clear calculator; the next example is a continuation. Example 3 of Unit 19.1 Refer to Examples 1 and 2 (above). Calculate the total interest Tara will pay on her 15-year loan. keystrokes (continued from Example 2) 160,000 [ PV ] 180 [GOLD] [AMORT] [x/y] [RCL] [ PV ] display 160,000.00 -102,904.73 -159,999.67 0.33* explanation must re-enter (PV decreases when amortizing) interest, entire 15 years principal balance Note: Because of rounding each payment to the nearest penny and because interest for each payment is rounded to the nearest penny, the balance after the final payment is rarely $0.00. Tara’s final payment will be 33¢ greater ($1,460.91) so the loan will be fully repaid. Tara will make 179 monthly payments of $1,460.58 and a final payment of $1,460.91. Example 6 of Unit 19.2 (Condensed). Tara got a $160,000 mortgage loan at 7.25%. Her total loan costs, for APR purposes, is $8,060. Assume Tara will pay off the loan at the end of 7 years. Calculate her real APR, reflecting the early payoff. keystrokes display explanation clear TVM registers [GOLD] [FIN] ?.?? clear TVM registers calculate monthly payment 160,000 [ PV ] 160,000.00 loan amount 15 [BLUE] [ n ] 180.00 blue key multiplied by 12; 180 months 7.25 [BLUE] [ i ] 0.60 blue key divided by 12; periodic rate = 0.60 [PMT] -1,460.58 monthly payment calculate balance after payment 84 (must have decimal at 2) 84 [GOLD] [AMORT] -68,847.53 interest first 84 payments [RCL] [PV] 106,158.81 balance after 84 payments calculate APR (loan paid off in 7 years) [CHS] [FV] -106,158.81 unpaid balance entered in FV register as a negative value 7 [BLUE] [ n ] 84.00 number of periods for payoff 160,000 [ENTER] 8,060 [ - ] [ PV ] 151,940.00 net proceeds [i] 0.70 periodic (monthly) rate 12 [ × ] 8.35 APR, reflecting the early payoff Example 1 of Unit 19.5 Four years ago, you purchased some corporate stock for $2,000. You received dividends as follows: $100 at the end of year 1, $150 at the end of year 2, nothing at the end of year 3, and $125 at the end of year 4. Immediately after receiving the final dividend check, you sold the stock for $2,700. What is your annual rate of return? keystrokes [GOLD] [FIN] 2,000 [CHS] [BLUE] [CFo] 100 [BLUE] [CFj] 150 [BLUE] [CFj] 0 [BLUE] [CFj] 125 [ENTER] 2,700 [ + ] [BLUE] [CFj] [GOLD] [IRR] display ?.?? -2,000.00 100.00 150.00 0.00 2,825.00 12.06 explanation clear TVM registers initial cash flow (negative) entered in CFo register remaining cash flows entered in CFj register cash flow at end of year 2 cash flow at end of year 3 total cash flow at end of year 4 IRR Example 3 of Unit 19.5 (Condensed). Florence Curtis decides to sell her office supply business. Michael Gabriel offers to buy the business by paying $2,000 at the end of each month for 10 years, followed by $3,000 at the end of each month for 5 years. Assuming that money is worth 8.5% compounded monthly (that is the rate that Florence can earn on her money), what is the present value of Michael’s offer? keystrokes [GOLD] [FIN] 0 [BLUE] [CFo] 2,000 [BLUE] [CFj] 99 [BLUE] [Nj] 2,000 [BLUE] [CFj] 21 [BLUE] [Nj] 3,000 [BLUE] [CFj] 60 [BLUE] [Nj] 8.5 [BLUE] [ i ] [GOLD] [NPV] display ?.?? 0.00 99.00 21.00 60.00 0.71 223,994.61 explanation clear TVM registers there is no cash flow at the beginning of the first period 99 payments of $2,000 (maximum Nj value is 99) 21 additional payments of $2,000 60 payments of $3,000 periodic (monthly) rate present value of Michael’s offer Enrichment Topic ARMS, GEMS, Etc. Example 1 You get a 30-year $60,000 ARM. The interest rate is 7.5% for the first year, 8.25% the second year, and 8.125% the third year. Calculate the monthly payment for each year. keystrokes display [GOLD] [FIN] ?.?? calculate payment, year 1 30 [BLUE] [ n ] 360.00 7.5 [BLUE] [ i ] 0.63 60,000 [ PV ] 60,000.00 [PMT] -419.53 calculate payment, year 2 (decimal must be set at 2) 12 [GOLD] [AMORT] -4,481.23 [RCL] [ PV ] 59,446.87 8.25 [BLUE] [ i ] 0.69 29 [BLUE] [ n ] 348.00 [PMT] -450.18 calculate payment, year 3 12 [GOLD] [AMORT] -4,885.11 [RCL] [ PV ] 58,929.82 8.125 [BLUE] [ i ] 0.68 28 [BLUE] [ n ] 336.00 [PMT] -445.11 Example 2 explanation clear registers 360 months periodic rate loan amount monthly payment interest, first 12 months balance, end year 1 periodic rate for year 2 treat as new 29-year loan monthly payment, year 2 interest, second 12 months balance, end year 2 periodic rate for year 3 treat as new 28-year loan monthly payment, year 3 You get an 8% $3,000 loan from your Aunt Matilda to replace your leaky roof. You agree to repay her $150 per quarter for the first 2 years. After you finish college in 2 years, you will increase the quarterly payment to $300. How long will it take to pay off the loan? keystrokes display [GOLD] [FIN] ?.?? input data, first 2 years 8 [ENTER] 4 [ ÷ ] [ i ] 2.00 3,000 [ PV ] 3,000.00 150 [CHS] [PMT] -150.00 payment changes to $300 (decimal must be set at 2) 8 [GOLD] [AMORT] -427.53 [RCL] [ PV ] 2,227.53 300 [CHS] [PMT] -300.00 [n] 9.00* 8 [+] 17.00 4 [÷] 4.25 explanation clear registers periodic rate loan amount quarterly payment, first 2 years interest, first 2 years balance, end year 2 quarterly payment, second 2 years remaining number of payments add first 8 payments = total of 17 payments years * Note: When solving for “n” on the HP 12C, the value is always rounded up (actual n-value is 8.12) Enrichment Topic Sample Studies Example 2 (Condensed) A tent manufacturing company observes 6 sewing specialists and records the time it takes each to sew a tent: 83 minutes, 77 minutes, 91 minutes, 73 minutes, 80 minutes, and 82 minutes. Calculate (a) the average (mean) time, (b) the standard deviation for this group, and (c) the standard deviation, assuming this is a sample study. keystrokes [GOLD] [ G ] 83 [ G+ ] 77 [ G+ ] 91 [ G+ ] 73 [ G+ ] 80 [ G+ ] 82 [ G+ ] [BLUE] [ x ] [BLUE] [ s ] [BLUE] [ x ] [ G+ ] [BLUE] [ s ] display 0.00 1.00 2.00 3.00 4.00 5.00 6.00 81.00 6.10 81.00 7.00 5.57 explanation clear statistics registers first value entered second value entered third value entered fourth value entered fifth value entered sixth value entered mean standard deviation, sample study * mean number of entries + 1 * standard deviation, this group (population study) * Note: The [ s ] key is for a standard deviation for a sample study, and therefore is based on the number of entries minus 1; to get a standard deviation for a population study, we must add the mean to the list, which increases the number of entries by 1. Enrichment Topic Linear Regression Examples 2-4 Lofgren’s Furniture Store advertises in a regional newspaper. Historical data is shown in the table below. Estimate weekly sales based on the following advertising: (a) none, (b) 40 sq in., and (c) 100 sq in. Then find (d) how many sq in. of advertising are required for $10,000 of weekly sales. Determine (e) the b-value, and (f) the m-value of the regression line. Finally, determine (g) the correlation coefficient. week sq in. of advertising sales 1 25 $5,700 2 55 $8,000 3 30 $6,700 4 30 $6,000 5 70 $8,700 With two-variable statistics for the HP 12C, the dependent variable (sales) is entered first. keystrokes [GOLD] [ G ] Example 2 5,700 [ENTER] 25 [ G+ ] 8,000 [ENTER] 55 [ G+ ] 6,700 [ENTER] 30 [ G+ ] 6,000 [ENTER] 30 [ G+ ] 8,700 [ENTER] 70 [ G+ ] 0 [BLUE] [ í,r ] 40 [BLUE] [ í,r ] 100 [BLUE] [ í,r ] 10,000 [BLUE] [x,r ] Example 3 0 [BLUE] [ í,r ] [STO] 9 1 [BLUE] [ í,r ] [RCL] 9 [-] [GOLD] 6 Example 4 [GOLD] 2 1 [BLUE] [ í,r ] [x/y] display explanation 0.00 clear statistics registers 1.00 2.00 3.00 4.00 5.00 4,321.57 6,891.50 10,746.41 88.38 first set of data second set of data third set of data fourth set of data fifth set of data estimated sales based on 0 sq in. of advertising estimated sales based on 40 sq in. of advertising estimated sales based on 100 sq in. of advertising sq in. of advertising needed for $10,000 of sales 4,321.57 4,321.57 4,385.82 4,321.57 64.25 64.248366 b-value of regression line (sales with $0 adver) stored in non-statistics register sales with $1 of advertising sales with $0 advertising, recalled sales for each $1 of advertising (m-value) m-value with 6 decimal places 64.25 back to 2 decimal places 0.97 correlation coefficient Example 5 You own a theater complex, and are preparing budgets for the upcoming 2 years. Ticket revenues for the last 5 years are as follows: $862,400 (year 1), $847,800 (year 2), $908,500 (year 3), $1,072,400 (year 4), and $1,208,000 (year 5). Assuming that movie attendance and ticket price trends continue, project ticket revenues for the next 2 years. Then, find the correlation coefficient to determine the quality of the trend. keystrokes [GOLD] [ G ] 862,400 [ENTER] 1 [ G+ ] 847,800 [ENTER] 2 [ G+ ] 908,500 [ENTER] 3 [ G+ ] 1,072,400 [ENTER] 4 [ G+ ] 1,208,000 [ENTER] 5 [ G+ ] 6 [BLUE] [ í,r ] 7 [BLUE] [ í,r ] [x/y] display 0.00 1.00 2.00 3.00 4.00 5.00 1,254,560.00 1,346,140.00 0.93 explanation clear statistics registers data for year 1 data for year 2 data for year 3 data for year 4 data for year 5 estimated ticket revenues, year 6 estimated ticket revenues, year 7 correlation coefficient