2014 Annual Report

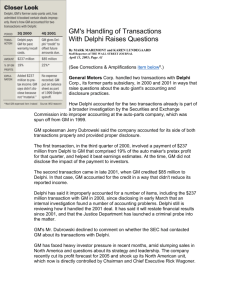

advertisement