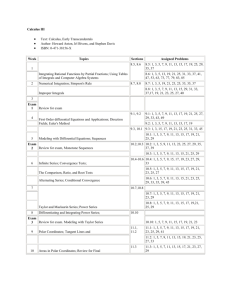

BA 211 - Summer 2011

advertisement

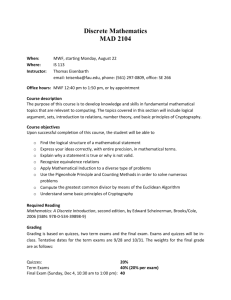

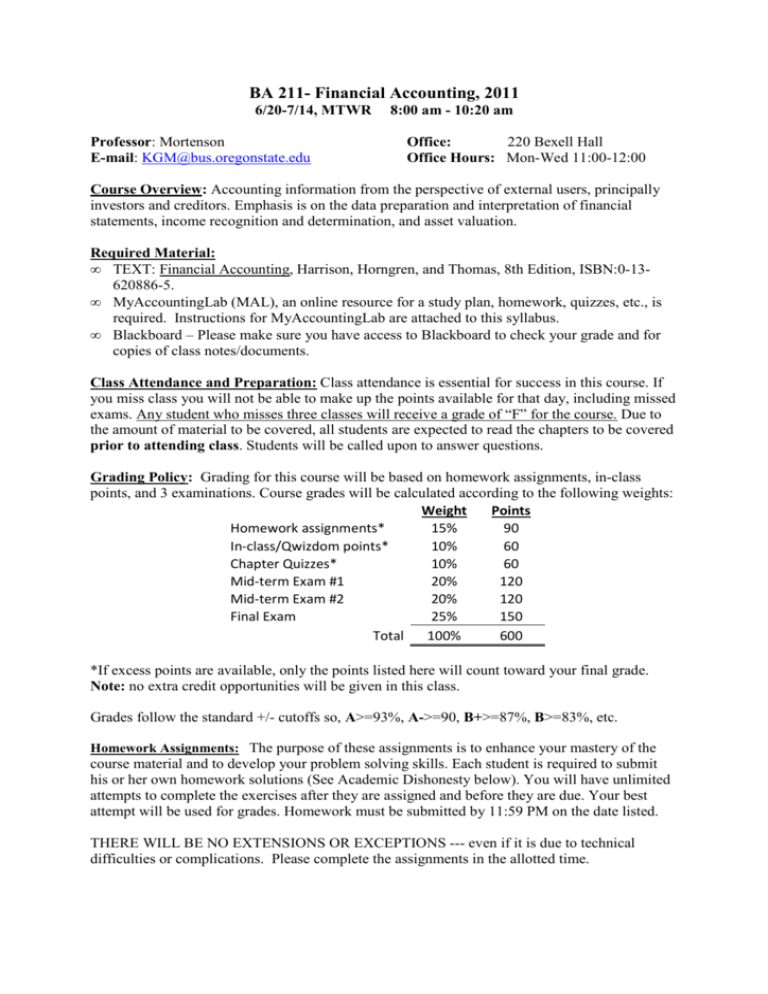

BA 211- Financial Accounting, 2011 6/20-7/14, MTWR Professor: Mortenson E-mail: KGM@bus.oregonstate.edu 8:00 am - 10:20 am Office: 220 Bexell Hall Office Hours: Mon-Wed 11:00-12:00 Course Overview: Accounting information from the perspective of external users, principally investors and creditors. Emphasis is on the data preparation and interpretation of financial statements, income recognition and determination, and asset valuation. Required Material: • TEXT: Financial Accounting, Harrison, Horngren, and Thomas, 8th Edition, ISBN:0-13620886-5. • MyAccountingLab (MAL), an online resource for a study plan, homework, quizzes, etc., is required. Instructions for MyAccountingLab are attached to this syllabus. • Blackboard – Please make sure you have access to Blackboard to check your grade and for copies of class notes/documents. Class Attendance and Preparation: Class attendance is essential for success in this course. If you miss class you will not be able to make up the points available for that day, including missed exams. Any student who misses three classes will receive a grade of “F” for the course. Due to the amount of material to be covered, all students are expected to read the chapters to be covered prior to attending class. Students will be called upon to answer questions. Grading Policy: Grading for this course will be based on homework assignments, in-class points, and 3 examinations. Course grades will be calculated according to the following weights: Weight Points Homework assignments* 15% 90 In-class/Qwizdom points* 10% 60 Chapter Quizzes* 10% 60 Mid-term Exam #1 20% 120 Mid-term Exam #2 20% 120 Final Exam 25% 150 Total 100% 600 *If excess points are available, only the points listed here will count toward your final grade. Note: no extra credit opportunities will be given in this class. Grades follow the standard +/- cutoffs so, A>=93%, A->=90, B+>=87%, B>=83%, etc. Homework Assignments: The purpose of these assignments is to enhance your mastery of the course material and to develop your problem solving skills. Each student is required to submit his or her own homework solutions (See Academic Dishonesty below). You will have unlimited attempts to complete the exercises after they are assigned and before they are due. Your best attempt will be used for grades. Homework must be submitted by 11:59 PM on the date listed. THERE WILL BE NO EXTENSIONS OR EXCEPTIONS --- even if it is due to technical difficulties or complications. Please complete the assignments in the allotted time. In-class/Qwizdom: Most class periods will include question slides that will require a Qwizdom device to provide an answer. Two slides will be randomly selected and you will earn the available points only for correct answers. All other slides will be used to measure your understanding and attendance for the length of the class. You will receive points on these slides if you provide an answer, whether or not it is correct. If you do not bring your Qwizdom device or are not present when a question slide is presented, you will not earn the points. Failure to provide an answer to a question slide may be used as evidence of absence in enforcing the class attendance policy (See above). Quizzes: There will be at least seven chapter quizzes on MAL throughout the term. The purpose of these quizzes is to encourage you to read the chapters and class notes carefully and be well prepared. THERE WILL BE NO EXTENSIONS OR EXCEPTIONS --- even if it is due to technical difficulties or complications. Please complete the Quizzes in the allotted time. Examinations: There will be three in-class, closed book examinations. The first two mid-term exams will consist of 40 multiple choice questions. The final exam will be comprehensive with approximately 50 multiple choice questions. Sharing of calculators during exams is not permitted. No cell phones, head phones or computers may be used during exams. ACCOUNTING DEPARTMENT POLICIES REGARDING EXAMS • MIDTERM EXAMS: Attendance is mandatory on scheduled test dates in the section in which you are enrolled. There will be no "make-up" midterm exams. • NO MAKE UP OR EARLY FINAL EXAMS will be allowed. • All exams (midterm and final) will be retained by the department. Any student who fails to turn in all or part of an exam will receive an F (zero points) on the exam. Students with Disabilities: Accommodations are collaborative efforts between students, faculty and Disability Access Services (DAS). Students with accommodations approved through DAS are responsible for contacting the faculty member in charge of the course prior to or during the first week of the term to discuss accommodations. Students who believe they are eligible for accommodations but who have not yet obtained approval through DAS should contact DAS immediately at (541) 737-4098. Academic Dishonesty: According to OSU student conduct regulations, academic dishonesty is defined as an intentional act of deception in which a student seeks to claim credit for the work or effort of another person or uses unauthorized materials or fabricated information in any academic work. All cases of suspected academic dishonesty will be handled in strict accordance with University and College Policy. Please refer to Office of Student Conduct website for more information. Students are expected to follow University [http://oregonstate.edu/admin/stucon/achon.htm] and College policies. Professionalism and Instructor prerogative: The instructor reserves the right, at his discretion, to adjust grades downward up to two whole letter grades for any unprofessional conduct between or among students and/or between the instructor and any student(s). Tentative Class Schedule Day 20-Jun 21-Jun 22-Jun 23-Jun 27-Jun 28-Jun 29-Jun 30-Jun Class Content Introduction: Syllabus, MAL, & Blackboard Ch 1 Ch 1 & 2 Ch 2 & Ch 3 Ch 3 & Review Homework/Quizzes/etc., Check MyAccountingLab and Balckboard DAILY! Mid-term 1 Ch 5 Ch 5 & 6 Ch 6 & 7 4-Jul 5-Jul 6-Jul 7-Jul No-Class Ch 7 & Review 11-Jul 12-Jul 13-Jul 14-Jul Ch 9 Ch 10 Review Mid-term 2 Ch 8 Final Learning Outcomes: • • • • • • Each student shall be able to analyze basic business economic events to determine their effect on accounts and financial statements. Each student shall have a basic understanding of the accounting cycle, be able analyze economic events and prepare simple journal entries. Each student shall be able to interpret and analyze accrual and cash flow information presented in accounts. Each student shall be able to interpret and analyze financial statements. Each student shall have a basic understanding the principles of internal control and be able to apply them to relatively straight forward situations to identify strengths and weaknesses. Each student shall be able to analyze issues relating to inventory, receivables, long-lived assets, liabilities and stockholders’ equity and recommend appropriate accounting treatment. " ' - (55 ! # ! ' ' !"( ) , / + 1 6 ' $ 5 7 ' $ 9 8 : ' $ !" % $ % ( * +,, - % # 5! 58 #B ! C & & +.,, $ !" 2 $ % 0 $) # $3 4 4 ' $ $ = % $ > 4 @ * " A < $ $ * !" 0 ' $ $ ;! ; !" ? $ 8 2 3 $ , / + 1 (55 $ % , ! 2 $ 3 % % :5,@5+.,, >(99 D