Managerial Economics Final Exam

advertisement

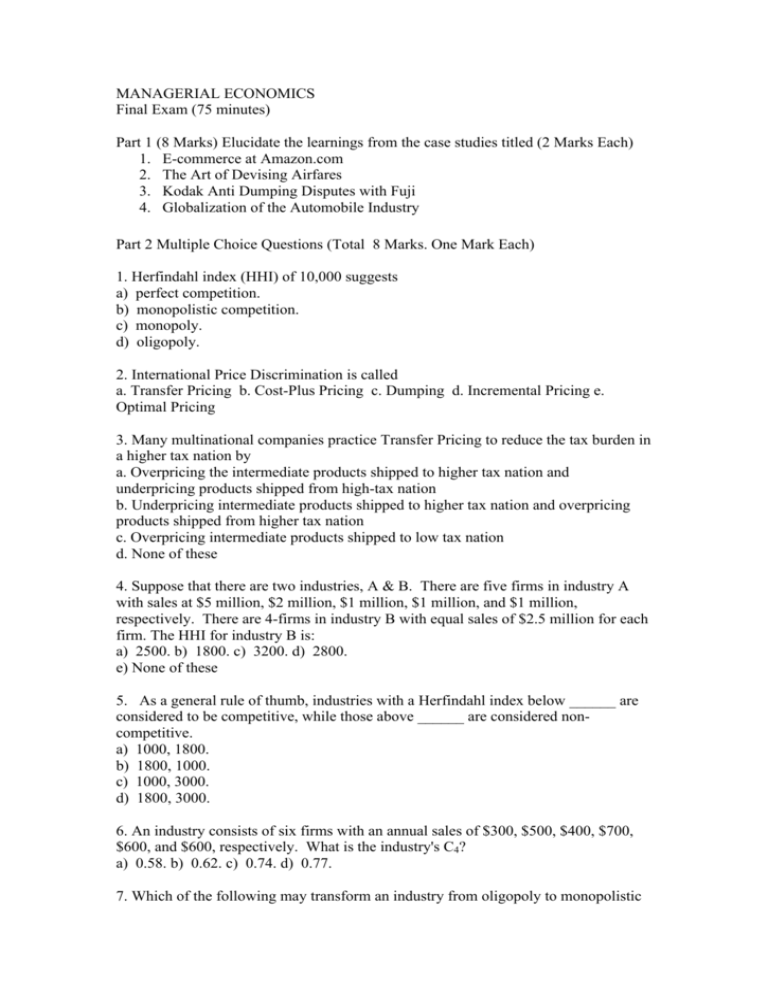

MANAGERIAL ECONOMICS Final Exam (75 minutes) Part 1 (8 Marks) Elucidate the learnings from the case studies titled (2 Marks Each) 1. E-commerce at Amazon.com 2. The Art of Devising Airfares 3. Kodak Anti Dumping Disputes with Fuji 4. Globalization of the Automobile Industry Part 2 Multiple Choice Questions (Total 8 Marks. One Mark Each) 1. Herfindahl index (HHI) of 10,000 suggests a) perfect competition. b) monopolistic competition. c) monopoly. d) oligopoly. 2. International Price Discrimination is called a. Transfer Pricing b. Cost-Plus Pricing c. Dumping d. Incremental Pricing e. Optimal Pricing 3. Many multinational companies practice Transfer Pricing to reduce the tax burden in a higher tax nation by a. Overpricing the intermediate products shipped to higher tax nation and underpricing products shipped from high-tax nation b. Underpricing intermediate products shipped to higher tax nation and overpricing products shipped from higher tax nation c. Overpricing intermediate products shipped to low tax nation d. None of these 4. Suppose that there are two industries, A & B. There are five firms in industry A with sales at $5 million, $2 million, $1 million, $1 million, and $1 million, respectively. There are 4-firms in industry B with equal sales of $2.5 million for each firm. The HHI for industry B is: a) 2500. b) 1800. c) 3200. d) 2800. e) None of these 5. As a general rule of thumb, industries with a Herfindahl index below ______ are considered to be competitive, while those above ______ are considered noncompetitive. a) 1000, 1800. b) 1800, 1000. c) 1000, 3000. d) 1800, 3000. 6. An industry consists of six firms with an annual sales of $300, $500, $400, $700, $600, and $600, respectively. What is the industry's C4? a) 0.58. b) 0.62. c) 0.74. d) 0.77. 7. Which of the following may transform an industry from oligopoly to monopolistic competition? a) Entry of new firms. b) Significant vertical integration. c) Exit of firms. d) A series of mergers. 8.The type of industry organization that is characterized by recognized interdependence and non-price competition among firms is called A. D. monopoly. B. perfect competition. C. oligopoly. monopolistic competition. E. None of these PART 3 -TECHNICAL QUESTIONS (11 Marks) 1. HHI in an industry is 8550. If you are thinking about entering into this industry as a small (tiny) entrepreneur, what would be your decision based on this Index Value? 1 Mark 2. The Chocolate industry is comprised of six firms of varying sizes. Firm 1 has 35 percent of the market. Firm 2 has 25 percent, and the remaining firms have 10 percent each. a). What is the Herfindahl-Hirschman index for this industry? b). Based on the U.S. Department of Justice merger guidelines described in the text, do you think the Justice Department would be likely to block a merger between 2 firms ? 3 Marks 3. Sharp’s TV plant a capacity output of 20,000 TVs per year, and the plant’s manager regards 80% of capacity as standard output. The projected Average Variable Cost and the Average Fixed (Overhead) Cost for the standard output are estimated to be 600$ and 720$ respectively. The manager wants to apply 20% mark up on cost. What price should Sharp charge for a TV? 2 Marks 4. GSK operates in a highly competitive market. While there are few other firms in the industry due to the high costs of entry, rival firms are very aggressive in their pricing strategies. Of the products sold in the industry, over 80 percent have 10 years of patent protection remaining. Does this industry meet an economist’s definition of a perfectly competitive industry? 2 Marks 5. Discuss Game theory with an example. 3 Marks True or False Questions (3 Marks. Each Question carried One Mark) 1. Market Experiment is conducted at actual marketplace unlike consumer clinics which are conducted under lab condition. Kinked Demand Curve is a characteristic feature of Monopolistic Competition For most goods, the income elasticity of demand is negative.