advertisement

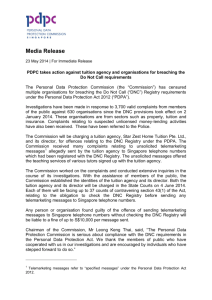

Singapore Data Protection Act Compliance in Asian Wealth Management Forum - 2015 Date 22 Jan 2015 Prepared for Hubbis (HK) Limited Presentation by Rajesh Sreenivasan Designation Lawyer Partner Contact details +65 6232 0751 Overview of Rajah & Tann Singapore 2 Not to be reproduced or disseminated without permission. Overview of Rajah & Tann Singapore Largest law firm in Singapore and Southeast Asia Full service firm with the largest regional footprint Highly regarded for its leading lawyers and practices 3 Not to be reproduced or disseminated without permission. Overview of Rajah & Tann Singapore Lex Mundi World's top independent alliance of leading law firms Rajah & Tann - the member firm for Singapore Providing clients a truly global reach 4 Not to be reproduced or disseminated without permission. Practice Areas Admiralty & Shipping Energy & Resources Appeals & Issues Entertainment & Media Banking & Finance Family, Probate & Trusts Business Finance & Insolvency Financial Institutions Capital Markets Commercial Litigation Competition & Antitrust and Trade Law Hospitality Insurance & Reinsurance Construction & Projects Integrated Regulatory Corporate Real Estate Intellectual Property, Sports and Gaming Employment & Executive Compensation 5 Funds and Investment Management Not to be reproduced or disseminated without permission. International Arbitration Medical Law Mergers & Acquisitions Private Client Project Finance Tax Technology, Media & Telecommunications White Collar Crime Overview of Rajah & Tann Asia Regional Offices Affiliate/ Associate Firms Regional Desks 6 Not to be reproduced or disseminated without permission. Rajah & Tann Singapore LLP | Technology, Media & Telecommunications Practice Rajah & Tann LLP is one of the largest full-service law firms in Singapore and the Asia Pacific. We are at the leading edge of Asian law, having worked on many of the biggest and highest profile cases in the region. As a result, we've developed a near-instinctive understanding of the issues, opportunities and challenges facing those doing business here. We also have the reach and the resources to deliver excellent service to clients all over the region, with offices in Shanghai, Kuala Lumpur, Vietnam and Laos, as well as specialist practice groups focusing on Japan, South Asia and Indonesia. 7 • Our Technology, Media and Telecommunications practice is one of the most established and respected practices in its field in the Asia Pacific region. With clients ranging from state governments and statutory boards to multinational corporations in the telecommunications, computer hardware and software sectors, we’ve been involved in many of the largest and most complex IT and telecommunications projects of recent years • Led by Rajesh Sreenivasan who has over 15 years’ experience in this highly specialised area, and is the only Asian lawyer nominated in the Expert Guides Best of the Best Information Technology 2013, the team and its partners have won numerous awards and accolades for excellence in legal service over the years. The experience and expertise of all our team members in Singapore and across the region, some of whom have worked in the telecommunications industry, complement one another. • The work spans across the region and is not confined to Singapore. “This well-rounded TMT group has an excellent reputation…The firm’s strength on the media side indicated by high-profile client wins…When it comes to TMT law, they are at the cutting edge. They do all they can to protect their client’s interests…” Chambers Asia-Pacific (2013 Edition) Not to be reproduced or disseminated without permission. Rajesh Sreenivasan, Partner Head, Technology, Media & Telecommunications Rajesh Sreenivasan has been advising clients on matter relating to data protection, telecommunications, electronic commerce, IT contracts, digital forensics and digital media for over fifteen years. In the telecoms sector, Rajesh has structured complex IT and telecoms infrastructure procurement agreements based on traditional and PPP models and was the lead telecoms lawyer in the first MVNO arrangements in both Singapore in 2002 and in Malaysia in 2007 as well as lead counsel for on the of the largest domestic submarine cables, the US$1.5 billion Palapa Ring project in Indonesia. On the regulatory front, Rajesh has assisted the telecoms regulator in Brunei in formulating Brunei’s telecoms licensing regime, as well as the Ministry overseeing ICT in the Kingdom of Lesotho, Africa, to draft its ICT legislation. Rajesh was also engaged by the ASEAN Secretariat to facilitate a pan-ASEAN forum on legislative and regulatory reforms to collectively address convergence of IT, telecoms and broadcasting across all 10 member countries and by the Commonwealth Secretariat to co-lead an e-government capacity building exercise involving all member Caribbean nations. From a legal-commercial perspective, Rajesh has assisted leading organisations in Malaysia and Indonesia in drafting and negotiating complex IT procurement contracts, shared services and outsourcing arrangements. Rajesh has frequently been engaged by telecoms service providers and equipment manufacturers to secure telecoms regulatory clearance in Singapore and the Asia-Pacific region. His clients include state governments and multinational corporations in the telecoms, computer hardware and software sectors government linked companies and statutory boards. 8 Not to be reproduced or disseminated without permission. Scope Reception and Enforcement of Singapore’s PDPA Main Implication for Advisors and Other Financial Institution Personnel Implications for Banks from a Governance Perspective How are the Banks responding - Balancing the PDPA with Other Banking Obligations Q&A 9 Not to be reproduced or disseminated without permission. Reception and Enforcement of the PDPA 10 Not to be reproduced or disseminated without permission. 10 Overview of the PDPA Came into force on 2 July 2014 9 Data Protection Obligations Personal Data Protection Act (‘PDPA’) 2012 Personal Data Definition 11 Not to be reproduced or disseminated without permission. Do-Not-Call (‘DNC’) Provisions came into force on 2 Jan 2014 The Data Protection Obligations Consent Purpose Limitation Openness Transfer Limitation Notification 9 Data Protection Obligations Access and Correction Retention Limitation Protection 12 Not to be reproduced or disseminated without permission. Accuracy Personal Data - Definition Personal data relates to a natural person, • whether living or deceased, who can be identified from that information • Covers both electronic and non-electronic data • In order to determine whether data falls under the category of “personal data”, the following criteria should be observed: • Identifiability: Does the data allow the identification of an individual? • 13 The data should relate to a specific individual. Not to be reproduced or disseminated without permission. Reception of PDPA Organisations Consumers - > 80% are aware of DNC requirements and how the DNC Registry works - 7 in 10 organisations are aware of their obligations under the PDPA - 1 in 2 organisations indicated that they have compliance measures in place - 4,986 organisations created a DNC Registry account - 469 million numbers checked *Source: PDPC Website 14 Not to be reproduced or disseminated without permission. - 7 in 10 noticed a reduction in the number of telemarketing messages received - 6 in 10 saw improvement in organisations’ practices such as obtaining consent for telemarketing messages and including their contact information in the telemarketing messages sent - > 767,391 unique numbers registered in various registers Enforcement of PDPA The Personal Data Protection Commission • (“PDPC”) has been set up to oversee the implementation of the DP law PDPC given the powers to • • • issue guidelines • give directions to remedy non-compliance • review complaints • initiate investigations • impose financial penalties (up to $1 million) Any person who suffers loss or damage as a result of infringement of the DP law can also institute civil proceedings against the infringing organization 15 Not to be reproduced or disseminated without permission. Enforcement of PDPA • 27 August 2014 – Star Zest Home Tuition agency and its director, Mr Law Han Wei, were each fined S$39,000 for 13 charges of failing to check the DNC Register • 16 January 2015 – Reported that both the company and the director are under investigation again for breaches of the DNC policy • 20 October 2014 – Mr Kuan Chow Sheng, a property agent, was fined S$27,000 for 9 charges of failing to check the DNC Register The PDPC has investigated more than 3,500 valid complaints against various organisations since the DNC provisions took effect on 2 Jan 2014* *Source: PDPC Website 16 Not to be reproduced or disseminated without permission. Main Implications for Advisors 17 Not to be reproduced or disseminated without permission. 17 Main Implications for Advisors Under the DNC provisions of the PDPA, financial advisors, and other financial • institutions personnel dealing directly with clients and their personal data, must ensure that they do not make calls or send texts messages that contain marketing elements without first checking the DNC registry. Covers messages sent via • • Telephone calls • SMS/MMS • Fax • 3 registers – one for each type of message covered • Persons in breach of DNC rules would be liable to penalties of up to $10,000 per breach, and up to $1,000 in composition fines 18 Not to be reproduced or disseminated without permission. Main Implications for Advisors Check DNC Registry Receive DNC Registry Results* Not on DNC Registry – May proceed to make the call or send the message On DNC Registry – Do not proceed to make the call or send any messages *DNC Results are valid for 30 days 19 Not to be reproduced or disseminated without permission. Main Implications for Advisors • Exemption To The Requirement To Check • The Personal Data Protection (Exemption from Section 43) Order 2013 announced on 26 December 2013 introduced an exemption from the requirement to check. • An “ongoing relationship” exemption to check the DNC registry will apply to text or fax messages, but not to voice calls. • Also, if the individual has given unambiguous consent to receiving such marketing messages or calls, then there is no requirement to check 20 Not to be reproduced or disseminated without permission. Main Implications for Advisors Officers of a body corporate can be held liable of the office with • the body corporate and punished accordingly if the offence is proved: • to have been committed with his or her consent or connivance, or • to be attributable to any neglect on his part Liability of employers for acts of employees: • • Any act done or conduct engaged in by a person in the course of his employment shall be treated as done or engaged in by his employer as well as him whether or not it was done or engaged in with the employer’s knowledge or approval. Breaches by an employee can be imputed to the Employer as well! 21 Not to be reproduced or disseminated without permission. Implication for Banks from a Governance Perspective 22 Not to be reproduced or disseminated without permission. 22 Implication for Banks from a Governance Perspective Risk Management 23 Are there adequate measures, policies and protocols put in place to ensure compliance with the obligations under the PDPA? Are employees educated about the institution’s data protection protocols? Is there a process for dealing with and escalating matters or complaints relating to personal data? Have both the PDPA and other obligations imposed by the MAS been complied with? Not to be reproduced or disseminated without permission. Implication for Banks from a Governance Perspective • Briefly, some measures organization are to carry out: • Appoint a DPO to be in charge of data protection issues; • Set up a DP task force; • Carry out an internal audit to ascertain where and how personal data is currently collected, stored, used and disclosed; • Have Compliance Manual, internal guidelines, policies drafted and put in place to map processes, for compliance with the PDPA; • Implement best practices to protect the organisation from unauthorized loss or damage, security measures in preventing, detecting and dealing with breaches, and staff selection and training; 24 Not to be reproduced or disseminated without permission. Implication for Banks from a Governance Perspective Organisations should review existing practices: Ensure that compliance programs that are in place comply with both the • PDPA and obligations imposed by the MAS • I.e. Banks must comply with both the security obligation under the PDPA as well as the MAS Notice/Guidelines on Technological Risk Management • For instance, does the company allow employees to bring their own devices? If so, what security measures are in place to ensure that there is no data leakage? Check and assess contracts entered into and compliance with DP law in • dealings with contracting parties; • I.e. Must comply with both the PDPA and regulations imposed on Financial Institutions, i.e. MAS Outsourcing Notice/Guidelines 25 Not to be reproduced or disseminated without permission. Implication for Banks from a Governance Perspective Organisations should review existing practices: Monitoring of the company’s employees’ use of company equipment and • network • Personal data of the company’s employees may be captured • May fall within the exception of being for the purpose of managing or terminating an employment relationship • However, the company is still required to inform its employees of the purposes of such collection, use or disclosure PDPA does not prescribe manner of notification • • Can be by way of employment contracts, employee handbooks, or notices in the company intranet • 26 New purposes may be notified by way of company email or internal memos Not to be reproduced or disseminated without permission. Implication for Banks from a Governance Perspective Personal Data of Existing Clients: Financial Institutions may possess personal data of existing clients that was • collected before the PDPA came in to force. Note that under the PDPA, such personal data can only be used for the purposes • that was it originally collected for. These personal data cannot be use to market new funds to existing clients, • particularly those on the DNC registry. 27 Not to be reproduced or disseminated without permission. Implication for Banks from a Governance Perspective Personal Data of Existing Clients: DNC: the “Ongoing Business Relationship” exemptions may be applicable, but only • to text and fax messages. Potential solution to marketing new funds to existing clients: • • Fund Managers to email (in compliance with the anti-spam legislation) and ask for clear, unambiguous consent. • Once consent is obtained, Fund Managers can market to existing clients through calls. 28 Not to be reproduced or disseminated without permission. How are the Banks Responding - Balancing the PDPA with other Banking Obligations 29 Not to be reproduced or disseminated without permission. 29 How are the Banks Responding? Most financial institutions have completed compliance programs for their organizations Financial Institutions distribute research reports periodically to existing clients and potential investors. Such reports may constitute an inadvertent release of information. Internally - This includes drafting compliance manuals, conducting training for employees, assessing contracts with subcontractors or third party vendors Can the exemption for research data apply? Short answer: No. Externally – This includes making a privacy policy publicly available, sending data protection notifications to existing customers and amending forms and contracts to obtain consent to collect, use and disclose personal data from new clients. PDPA obligations will still apply with regard to obtaining consent from individual for the use of their personal data for such purposes. Unlikely the conditions of the exemption will be satisfied. 30 Not to be reproduced or disseminated without permission. Balancing Other Banking Obligations and the PDPA • Amendments of AML/CFT Notices on 1 July 2014 • Amendments provided that customers will generally have the right to access and correct their factual identification data (including personal data) • Access and correction rights also subject to certain exceptions provided for in the PDPA, e.g. where a request for access would unreasonably interfere with the operations of the organisation • “Connected parties” includes company directors, partners and natural persons with executive authority , and covers any individual on whom Financial Institutions are required to do AML/CFT related customer due diligence. MAS seeks to further refine this definition in the future 31 Not to be reproduced or disseminated without permission. Balancing Other Banking Obligations and the PDPA • Amendments of AML/CFT Notices on 1 July 2014 • Financial institutions may as per existing practice, collect, use and disclose personal data without customer consent whether directly or through a third party (rules governing data intermediaries as per PDPA) • The MAS also observed that as no customer consent is required in this context, it is not possible for a customer to withdraw consent. 32 Not to be reproduced or disseminated without permission. Balancing Other Obligations and the PDPA • MAS Circular On IT Security Risks Posed by Personal Mobile Devices – Sept 2014 • Circular was issued to CEOs of all financial institutions (‘FIs’). • The Circular highlighted the growing trend of FIs allowing their employees to access corporate email, calendars, applications and data from personal mobile devices. • There is a tension between such a practice and the MAS Technology Risk Management Guidelines, whereby FIs are expected to develop a comprehensive data loss prevention strategy to safeguard sensitive or confidential customer information. This includes protecting data processed in end point devices, data in transmission as well as data stored in servers. • Similarly, there is an obligation under the PDPA to take reasonable security measures to protect personal data. 33 Not to be reproduced or disseminated without permission. Balancing Other Obligations and the PDPA • MAS Circular On IT Security Risks Posed by Personal Mobile Devices – Sept 2014 • The Circular highlighted the potential risks involved in adopting such a practice, and emphasised that FIs need to be aware of the heightened security risks associated with allowing employees to use their personal mobile devices due to challenges in securing, monitoring and controlling such devices. • It was held in the Circular that FIs should not proceed with the BYOD implementation if they are unable to adequately manage the associated security risks. • Should BYOD be implemented, FIs are reminded to remain vigilant and keep pace with technology advancement and emergent threats in the mobility space. Regular vulnerability assessment and penetration testing must be carried out on the BYOD infrastructure to ensure that any security gaps are identified and rectified promptly. 34 Not to be reproduced or disseminated without permission. Balancing Other Obligations and the PDPA • MAS Notice/Guidelines on Outsourcing (Under Consultation) – Sept 2014 • The MAS Notice and Guidelines on Outsourcing stipulates that Financial Institutions are to include contractual provisions to require the service provider in outsourcing arrangements to protect the confidentiality of customer information that may be transferred. • Such provisions include the right to audit and inspect the security measures employed by the service provider, the requirement to separate customer information from other data and restrictions on further disclosure of customer information unless required under a purpose relating to the outsourcing arrangements. 35 Not to be reproduced or disseminated without permission. Balancing Other Obligations and the PDPA • MAS Notice/Guidelines on Outsourcing (Under Consultation) – Sept 2014 • Similarly, under the PDPA, organisations will be liable for data breaches caused by data intermediaries who process personal data on the organisation’s behalf. • It is therefore advisable that organisations who engage data intermediaries also include in their contracts provisions requiring the data intermediaries to comply with the data protection obligations under the PDPA. • Though the MAS Outsourcing Notice and Guidelines are stricter in scope, there appears to be a consistency between it and the PDPA. 36 Not to be reproduced or disseminated without permission. How are they balancing the PDPA with the Banking Act Obligations? PDPA vs Banking Act (‘BA’) • Under the BA, banks are obliged to maintain banking secrecy and may only disclose customer information (which includes personal data) in circumstances specified by the BA. • Similarly, the PDPA provides that personal data can only be disclosed with the individual’s consent, or so long as the disclosure falls within certain specified exceptions. • There is an inconsistency between both Acts, as the BA provides for a more limited set of circumstances where disclosure of personal data is permitted. 37 Not to be reproduced or disseminated without permission. How are they balancing the PDPA with the Banking Act Obligations? PDPA vs Banking Act (‘BA’) • In accordance with the PDPA, the provisions of other written law shall prevail in the event of an inconsistency between the provisions of the PDPA and the other written law. • This approach has been affirmed by the Advisory Guidelines on Key Concepts in the PDPA. • However, where the BA does not address issues relating to personal data protection, the PDPA will continue to apply 38 Not to be reproduced or disseminated without permission. How are they balancing the PDPA with the Banking Act Obligations? Association of Banks Feedback to PDPC • The Association of Banks (‘ABS’) sent their feedback on the PDPA to the PDPC on 20 June 2014. • The ABS submits that Financial Institutions and / or Banks should be granted certain concessions from the PDPA. • However, it is unclear what other types of Financial Institutions apart from Banks the ABS is referring to. • No news as of yet on the status of PDPC's position with regard to ABS' feedback, but FIs should monitor this. 39 Not to be reproduced or disseminated without permission. Questions & Answers 40 Not to be reproduced or disseminated without permission. 40 Thank you 41 Not to be reproduced or disseminated without permission. 41 Disclaimer The material in this presentation is prepared for general information only and is not intended to be a full analysis of the points discussed. This presentation is also not intended to constitute, and should not be taken as, legal, tax or financial advice by Rajah & Tann. The structures, transactions and illustrations which form the subject of this presentation may not be applicable or suitable for your specific circumstances or needs and you should seek separate advice for your specific situation. Any reference to any specific local law or practice has been compiled or arrived at from sources believed to be reliable and Rajah & Tann does not make any representation as to the accuracy, reliability or completeness of such information. 42 Not to be reproduced or disseminated without permission. 43 Not to to be be reproduced reproducedor ordisseminated disseminated without without permission. permission.