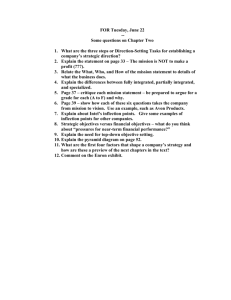

Brief History

advertisement

~ Kashif Chaudry ~ Jon Cram ~ Ellena Andoniou 1988 • Opened its first overseas offices in England to take advantage of the country's privatized power industry 1989 • Jeffrey Skilling joined the company and Enron launches its Gas Bank 1999 • Enron formed its broadband services unit • The first phase of the Dabhol project began operating • After an early rise, shares fell sharply as the year went on and the problems facing the company became apparent • Enron Online, the company's commodity trading Internet site, was formed. It quickly became the largest e-business site in the world Brief History 1985 • Houston Natural Gas merges with InterNorth based in Omaha, Nebraska 1987 • Oil traders in New York overextended the company's accounts by almost $1 billion. This lead to the development of a myriad of services 1992 • Enron acquired Transportadora de Gas del Sur, Enron's first pipeline presence in South America and the start of a push to expand on the continent 1997 • Enron Energy Services was formed to provide energy management services to commercial and industrial customers 2000 Energy Financial Group ranked Enron the sixth-largest energy company in the world • Enron and strategic investors, IBM and America Online, launched The New Power Co. to provide electric service in a deregulated market 2001 • In October, Enron released third-quarter earnings, with $1.01 billion in charges, including $35 million related to investment partnerships • The Securities and Exchange Commission launched a formal investigation into the partnerships 1 Core Business Units Enron divides its business into three main areas: • Enron Wholesale Services • Enron Energy Services • Enron's Global Assets Energy Services Enron Energy Services - the retail arm of Enron, offers companies a way to develop and execute their energy strategies. Central America and the Caribbean Dominican Republic • Puerto Plata Power Project Guatemala • Puerto Quetzal Power Project Nicaragua • Margarita II Panama • Bahia Las Minas (BLM) Puerto Rico • EcoElectrica Whole Sale Services Enron Wholesale Services- encompasses Enron's global wholesale businesses, and is divided into four business units. • Enron Americas • Enron Europe • Enron Global Markets • Enron Net Works Global Assets Enron Transportation Services • oversees Enron's regulated, interstate natural gas pipelines Portland General International South America Argentina • Transportadora de Gas del Sur (TGS) • Modesto Maranzana Power Plant Bolivia • The Bolivia-to-Brazil pipeline • TRANSREDES Brazil • Cuiaba Integrated Project ("Cuiaba Project") • CEG/CEGRio: • Elektro Electricidade e Servicos S.A. - Brazil's sixth-largest electricity distributor. 2 Europe Colombia • Centragas pipeline • Promigas Venezuela • Vengas • Compania Anonima Luz y Fuerza Electricas de Puerto Cabello (CALIFE) • Interruptores Especializados Lara (INESLA) • Accroven Asia Pacific: People's Republic of China • Chengdu Cogen Project Guam • Northern Marianas Power Project India • The Dabhol Power Project Philippines • Batangas Power Project South Korea • Gas Distribution and Liquefied Petroleum Gas (LPG) Marketing Enron in 2000 22nd • By 2000, Enron was ranked the largest company in the world & 7th in the USA (Forbes) • Stock worth $90.56/share • Enron had gone global with assets across the globe • Expansion globally lead to Enron accumulating more debt than they could service • What would be done to service such a debt? • Answer: create partnerships using complex accounting practices Italy • Sarlux Power Project Poland • Nowa Sarzyna power plant Turkey • Trakya Power Project What Went Wrong? Enron’s Downfall Partnerships • An Enron asset, which had potential, lost money and mounting debt cut into the companies bottom line and hindered their credit rating • Lower credit ratings would cost more for Enron to borrow and minimize expansion • Enron would then would look for an investor who would be able to buy at least 3% of that asset • The investor received a bank loan to buy the rest using Enron stock as collateral which are falsely valued at the time 3 Partnerships (cont’d) Partnerships (cont’d) • Limited Partnership was then formed between Enron and the investor (legal) • “Partnerships” were also formed between Enron’s board of directors and Enron itself • However, these directors did not invest 3% (which they had claimed) rendering an illegally formed limited partnership • October 16, 2001: Enron’s stock crashed due to a slip in the economy which caused a limited partner to default on their bank loan • Bank threatened to seize Enron’s stock as collateral $560 million worth • Investors began to lose faith in the company leading to the stock falling even more • Partners were in need of the stock to pay off debts but stock diluted (minimal worth) • Partnerships collapsed as they are unable to pay loans Corruption? Oh oh!! $60 billion debt for Enron!! Corruption • As Enron’s stock fell during the recession, several company executives began selling shares • Kenneth Lay (founder) sold 627,000 shares in 8 months • Skilling unexpectedly resigned as CEO • Investors: “Something’s wrong…”, lose confidence in Enron Corruption • During late October, Enron’s worth drops $1.7 billion in a matter of days • On October 17, Enron freezes their employee’s stock heavy 401k plans: a savings/retirement plan in which employees were encouraged to invest in and buy Enron stock • Result: workers lost up to hundreds of thousands of dollars and basically all of their savings • The day before Enron declared bankruptcy, bonus checks over $55 million were written to company executives on top of another $50 million bonuses written a few weeks earlier 4 Dabhol, India- Business Case Study • Largest development project, and foreign direct investment in India’s history • Project begun in 1992, in Maharashtra state, and was scheduled to open in 1997, supplying one fifth of new energy needed by India • The plant was to be the largest electricity generating plant in the world, and was estimated to cost $3 billion • The plant was a joint venture of three U.S. companies: Enron Corporation, General Electric, and the Bechtel Corporation • Enron was responsible for developing and operating the plant, Bechtel was to design and construct it; GE was to supply the equipment • From the outset the project was criticized for lacking transparency, lacking economic feasibility due to high costs, potential environmental impacts and human rights violations • The project, from the outset, was also mired amidst great controversy as Enron and corrupt Indian officials rush the project through • Enron filed for Chapter 11: Bankruptcy on December 2, 2001 • The Indian government, GE and Bechtel are scrambling to find buyers to rescue the project and limit the millions in losses they have already incurred • Phase I of the two part project started operating May 1999 despite international, national and local concerns, tensions flare • In June of 2001, the project about 90 percent complete came to a grinding halt, because of poor business practices and environmental as well as human rights concerns. Dabhol has turned into a rusting ghost town Why Did the Project Fail? The project failed in part due to Enron’s bankruptcy but also because of: • unsavory business practices-Enron secured an agreement with the government of the Indian state of Maharashtra to build the plant with no competitive bidding and on terms that were completely one-sided. • the MSEB was obligated to buy power from the Dabhol power plant at full capacity charges, which were triple the amount a locally owned power plant charged, the MSEB and the government were going broke just by purchasing power from Enron • by the end of June 2000, MSEB owed DPC $50 mn, and debt was increasing as the price for a unit of electricity soared to 7.80 Rs • by January 2001, less than a year after the plant first supplied energy, MSEB was in arrears and Enron invoked a central government guarantee to clear outstanding bills for $17 mn and then threatened to cash another guarantee for $33 mn (this was the first time ever that a foreign power had invoked a guarantee) • eventually the MSEB terminated its contract to buy power from DPC Enron succeeded in bankrupting the state electricity board, from whom consumers directly bought power 5 Does Enron Still Exist? • Restructuring • The future of Enron • Preventative Measures Restructuring Enron • Enron is still located in Houston Texas • Stephen Cooper has been brought in to rescue Enron, and reorganize the companies holdings, making it a smaller, but much stronger company • Cooper plans to bring the company out of bankruptcy by selling $ 11 bn in pipelines, returning to old fashion business principles, and focusing on supplying energy to the public • Cooper also plans to pay most creditors about one-fifth of about $66.4 billion they are owed in cash and stock • Chapter 11 Bankruptcy has permitted Enron to restructure itself while it is enjoys protection from creditors • Part of their new strategy involves selling off its global assets • The company intends to focus on energy infrastructure, transportation, distribution, generation and production of natural gas as well as electricity in North and South America • Enron will emerge as two independent companies with different names. The domestic company-CrossCountry Energy Corporation will be comprised of three North American natural gas pipelines. The second-Prisma Energy International Incorporated will be comprised of international pipelines and power operations in South America The Future of Enron • Uncertainty surrounding Enron and its future still looms • However, Enron’s stock will be cancelled and the two emerging companies will have independent entities and their stock will be sold on the New York Stock Exchange • The future of CrossCountry Energy Corporation appears to be the more stable and robust of the two new companies. Prisma Energy International Incorporated is a much weaker entity and much uncertainty surrounding its performance exists • Enron sold its trading arm to Swiss investment bank UBS Warburg, which bought Enron’s trading desk for $1 and a share of potential profits for the next 10 years and depending on Warburg’s success Enron may potentially gain between $40 million and $3 billion Preventative Measures • Many policy makers fear that increased restrictions may be counterproductive, however they agree that the system needs to be repaired and have made several very general proposals: • Accounting rules need to be tightened especially for ‘special purpose entities’ • Greater auditor independence, and strengthening company audits to ensure integrity • Barring chief executives from holding chairmanships simultaneously • Buyer/investor beware 6 • Bar auditor conflicts • auditors should not be permitted to act as internal and external auditors • Increase disclosure • the public should be entitled to information regarding financial relationships of executives and board members particularly of publicly traded companies • Tighten Ethics Rules • companies should tighten ethics rules by keeping some information confidential • Set New Standards • methods to protect independent and small investors • create a fund which reimburses shareholders who fall victim to corporate dishonesty • increased regulation of the energy futures trading business Conclusion • Enron was a corporation that had much potential. It was a truly global company, extending beyond national boundaries, but due to unethical business practices and a shortsighted management team, Enron quickly became one of the largest bankruptcy cases in the world. • Enron attempted to become too much too fast 7