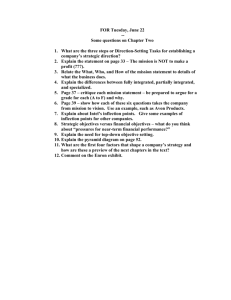

Enron is one of the largest and most innovative companies

advertisement