Enron Annual Report 2000

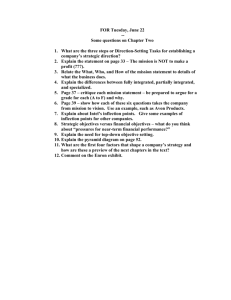

advertisement