Federal Budget 2014-15

advertisement

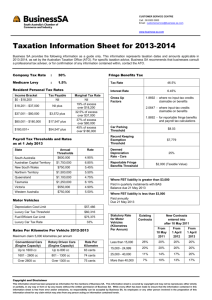

Federal Budget 2014-15 Building a healthy economy 1 Executive summary Structural savings and a $50 billion Federal infrastructure spend between now and 2020 make up the centre pieces of Treasurer Joe Hockey’s first Budget. While there will always be winners and losers, Pitcher Partners welcomes this Budget as being fiscally responsible. John Brazzale // Victorian Managing Partner Contents Building a healthy economy Executive summary 1 Providing certainty for business around tax reform 3 Personal tax 4 Company tax 5 Re-introduction of fuel excise indexation 6 Employment tax 7 Research and development 8 Exploration development incentive 8 Tax compliance 9 Superannuation and retirement 10 2 Strengthening Australia’s balance sheet Since the GFC, our clients in the middle market have been working tirelessly paying down debt, managing costs, improving productivity and growing their businesses. It is pleasing to see the Government is following this lead, dealing with their own budget deficits and mounting debt. The rate of growth in Government spending was unsustainable and with an ageing population, the country was facing revenue risks had nothing been done. Tonight’s Budget reduces the forecast deficit from $49.9 billion to $2.8 billion over the three year forecast period. Addressing the structural imbalance Net Debt had risen to $0.67 trillion as a result of measures taken to defend Australia from the impacts of the GFC, together with underlying structural issues in the Budget. It was important that the Government took the necessary measures to rebuild the country’s financial buffers to protect us from any future shocks. The Government has chosen to focus the bulk of its fiscal restraint on health and welfare spending and at the same time is seeking to grow the economy by focussing on infrastructure spending. This at a time when the capital investment in the mining sector is scaling back. The combined infrastructure budgets of the various levels of Government and private interests will be in excess of $125 billion and will generate thousands of jobs, starting immediately. A focus on smaller Government and red tape reduction We welcome the comments by the Treasurer that businesses will enjoy the benefits of a “smaller less interfering Government” that focuses on cutting red tape. There is no doubt that the myriad layers of complexity and bureaucracy in dealing with Government agencies has stifled and inhibited the growth of Australian businesses for many years. We await the positive outcomes from these initiatives. Finally some business tax relief Middle market business in Australia has continued to punch above its weight and do the heavy lifting throughout the GFC. The change in the corporate tax rate from 30% to 28.5% for all but the biggest businesses finally provides some reward for their effort. The reduced corporate tax rate will be well received by businesses who are looking to reinvest their after tax profits back into their businesses to fund growth. Confidence? Businesses are likely to remain wary about the impacts on consumer confidence as a result of this Budget’s changes to pensions, fuel taxes and family tax benefits which impact directly on consumers’ hip-pockets and their propensity to save rather than spend. Those most affected are likely to include: Retail, Hospitality, Travel and Tourism and those reliant on discretionary spending. More still to come For the last two weeks the media have been speculating how the Government would react to the 86 recommendations of the Commission of Audit. Whilst a number have been touched on within the Budget papers, many more have been deferred for further analysis and debate. The Government has flagged the production of a White Paper which will provide Pitcher Partners the opportunity to further advocate on behalf of our clients. Key Budget items $50 billion in infrastructure spending $20 billion investment in Medical Research Future Fund Change in corporate tax rate to 28.5% 2% debt levy on $180,000 plus income earners Re-introduction of fuel excise indexation Prescriptions to cost $5 more $7 co-contribution for doctors visits 1 2 3 4 5 6 7 3 Providing certainty for business around tax reform As compared to previous years, the level of tax reform measures announced in this Budget is likely to be considered unremarkable. The Government has maintained the commitment made prior to being elected to seek a second term mandate at the next election for a further, more broad, tax reform agenda. A number of carry over measures from the last Budget have now been rejected and the Government has gone with an approach of seeking business certainty rather than seeking to change the tax laws during this intermediary period. A White Paper on the Reform of Australia’s Tax System is to be developed in consultation with various stakeholders. The Government has committed to finalising its preferred policy positions in this White Paper which is anticipated to be released in 2015, and which the Government will take to the next election. It is expected that the White Paper will examine many of the structural issues with our tax system and will consider significant reform approaches to broaden the tax system. Pitcher Partners will be actively involved in the consultation process. We have outlined the impact of the few tax changes announced in the Budget over the following pages. 4 Personal tax Income tax rates As anticipated, the Government announced that a temporary budget repair levy will apply to individuals at a rate of 2% on taxable incomes in excess of $180,000. This measure has been announced as being temporary, whereby it will apply for three years only from 1 July 2014 to 30 June 2017. 2014-15 The Medicare Levy is also to be increased from 1.5% to 2% from 1 July 2014 to fund DisabilityCare Australia. Individuals with taxable incomes over $180,000 will therefore pay tax at a rate of up to 49% from 1 July 2014. For the years ending 30 June 2015, 2016 and 2017, tax (excluding the Medicare Levy) will be as follows. 2015-16 and 2016-17 Taxable Income Tax Payable 2014-15 Taxable Income Tax Payable 2015-16 and 2016-17 0 - $18,200 Nil 0 - $19,400 Nil $18,201 - $37,000 19% of excess over $18,200 $19,401 - $37,000 19% of excess over $19,400 $37,001 - $80,000 $3,572 + 32.5% of excess over $37,000 $37,001 - $80,000 $3,344 + 33% of excess over $37,000 $80,001 - $180,000 $17,547 + 37% of excess over $80,000 $80,001 - $180,000 $17,534 + 37% of excess over $80,000 $180,000+ $54,547 + 47% of excess over $180,000 $180,000+ $54,534 + 47% of excess over $180,000 Top-up tax on franked dividends Tax receipts and simpler income tax returns For taxpayers who rely on dividend income, the tax cost will increase significantly under the changes. The personal “topup” tax payable on a franked dividend will increase from a maximum rate of approximately 24% to 29% of the cash component of the dividend received. The full impact of these changes could apply to dividends paid from 1 July 2015. From 1 July 2014, up to 1.4 million taxpayers with simple tax affairs will have the option of no longer lodging tax returns. Instead their tax return will already be filled in by ATO systems and they can simply “accept” that return online from a computer or mobile device. Building a healthy economy Simple tax returns only contain income from salary, wages, allowances, interest, dividend and/or assessable Government payments. Deductions need to be added but will be limited to work expenses, tax related expenses and donations. Offsets will be also limited to senior, pensioner, zone and overseas forces tax offsets. More complex personal tax returns will still have to be completed as usual. 5 Company tax Reduction in company tax rate Minor integrity announcements The Government has confirmed that it will reduce the company tax rate from 30% to 28.5% from 1 July 2015. For large companies with taxable income exceeding $5 million, the savings from this measure will be offset by a 1.5% paid parental leave scheme levy. Accordingly, these companies will remain on a 30% tax rate, with franking credits likely to be recorded at 28.5%. The Government has announced additional minor changes that will apply to corporate taxpayers. The fact that these changes are only minor technical amendments are a positive indication from the Government that they are committed to increasing certainty for business taxpayers and that they will not be making significant changes during this term of Government unless appropriately justified. Overall, this is a positive measure for companies that will be able to invest the savings into growing their own businesses. The measure is expected to benefit up to 800,000 companies. If the current Board of Taxation proposal relating to the use of trusts with companies is implemented, this will also benefit trusts that operate businesses that distribute to corporate entities. However, it is noted that the benefit will be lost once the company pays the after tax profits as a dividend. That is, once dividends are paid to shareholders, the reduced franking credits (provided at 28.5%) will result in an increased amount of top-up tax at the shareholder level. The rate will increase from approximately 24% to 29% at the top marginal rates. This will mean that companies and shareholders will need to consider the tax effect of the payment of dividends closely over the next 12 months. These minor amendments relate to the application of the tax consolidation measures to accounting liabilities for securitised assets, amending the application date of measures applying to certain deductible liabilities and related items under tax consolidation, and minor technical changes relating to capital gains tax on the disposal of shares held by non-residents. The Government also announced that it will continue to consult on a new measure to prevent certain deductions claimed in relation to the financing of offshore investment by Australian businesses. In addition, the Government will not be proceeding with the measure to address inconsistencies in the tax treatment of Multiple Entry Consolidated (“MEC”) Groups. Instead, Treasury will begin consultation to extend the application of the unrealised loss rules to MEC Groups and on other minor technical measures. Reduction in the company tax rate from 30% to 28.5% from 1 July 2015 Deferred reforms The commencement of some previously announced reforms were deferred in this Budget. These include the deferral of the new tax system for Managed Investment Trusts to 1 July 2015 (previously 1 July 2014), legislative elements of the measure to improve tax compliance through third party reporting and data matching to 1 July 2016 and reforms to the offshore banking unit regime to income years commencing on or after 1 July 2015. The Government has announced that it will secure funding for additional road infrastructure by re-introducing indexation of excise and exciseequivalent customs duty for all fuels except aviation fuels. Biannual indexation will commence from 1 August 2014 and will be based on the consumer price index (CPI). The increase in fuel excise as a result of indexation is projected to generate additional revenue of $2.2 billion over the forward estimates period. This includes allowance for a $1.8 million increase in Ethanol Production Grants in 2014-15 and a $0.7 million increase in the Cleaner Fuel Grants Scheme. The Government has stated that it will amend the legislation to ensure that the amount spent on road infrastructure funding is greater than the net revenue from the reintroduction of indexation on fuel excise. The fuel excise rate has been frozen at 38.143 cents per litre since March 2001 when former Prime Minister John Howard abolished fuel excise indexation in the wake of the introduction of the GST. Based on historical CPI figures, we estimate that if the fuel excise rate had been indexed to CPI over the last five years for example, it would have resulted in a five cent per litre increase in the price of fuel over that period. This increase over the next five years will have an impact on businesses across a wide range of industries to the extent that they cannot claim a credit for the fuel excise under the Fuel Tax Credits system. The critical issue is likely to be whether businesses impacted by the increase in the fuel excise will have to absorb some or all of the increased cost of fuel, or whether they can pass it on to their customers. Businesses that operate in price sensitive markets or on low margins may not be able to simply increase the prices of their goods or services to cover the additional fuel cost. We expect that the decision of whether to pass on the cost increase will be made on an industry by industry and sector by sector basis. If businesses cannot pass on the excise increase, the cost will have a direct and ongoing impact on their bottom line. Building a healthy economy 6 Re-introduction of fuel excise indexation 7 Employment tax Increase in the FBT from 1 April 2015 In line with the increase in the top marginal tax rate for the temporary Budget Repair Levy, the FBT rate will increase to 49% from 1 April 2015 to 31 March 2017. This change will have a flow on effect to the Type 1 and Type 2 FBT gross up rates, which will change to 2.1463 and 1.9608 respectively. The increase in FBT rates will be in force for a period of two years, in contrast to the three year increase in the individual top marginal personal tax rate. Accordingly, for the nine months to 1 April 2015, taxpayers on the top marginal rate may be able to access a reduced FBT rate where benefits are salary packaged. In addition, however, the increase in the FBT rates will have the unintended effect of increasing the effective tax paid by many individuals earning less than $180,000 that engage in salary sacrifice arrangements (e.g. a novated lease). Taxpayers in this category may therefore wish to review their salary packaging arrangements. FBT exempt and rebatable employers The Government has announced the cash value of concessions received by FBT exempt and rebatable employers (e.g. certain schools, public hospitals, public benevolent institutions etc.) will be protected by increasing the annual FBT caps. The FBT rebate will also be changed to align with the FBT rate from 1 April 2015. Employee Share Scheme rules The Budget was silent with respect to anticipated reforms to the Employee Share Scheme (“ESS”) taxation rules. Although the existing rules have only operated since 1 July 2009, they have been criticised for their complexity and failure to encourage equity participation by employees. This is particularly an issue for start-up companies, who need to attract and retain talented employees through incentives like employee share schemes. Whilst we understand that Government support exists for reform to the ESS taxation rules, we have yet to see any positive developments in this area. Building a healthy economy Reduction in R&D tax incentive rates Both the refundable research and development (“R&D”) tax offset (for companies with aggregated turnover of less than $20 million) and the non-refundable R&D tax offset (for companies with aggregated turnover of greater than $20 million) will be reduced by 1.5% with effect from 1 July 2014. This means that the refundable tax offset of 45% will reduce to 43.5%, and the non-refundable tax offset of 40% will decrease to 38.5%. The rationale behind the change is to reduce the benefit obtained from the R&D tax incentive in line with the proposed reduction in the company tax rate of 1.5% from 1 July 2015. This will mean that companies undertaking R&D activities should be no worse off after the change. Interestingly though, the changes to the R&D offsets will occur one year earlier than the proposed reduction to the company tax rate. It is also worth noting that there is currently a Bill before Parliament to deny the R&D offset for companies with turnover of greater than $20 billion. For clients undertaking eligible R&D activities, the benefit of the R&D tax offset will effectively be reduced for the 2014/15 financial year before the reduction in the company tax rate occurs. This may lead to a reduction in R&D activities at a time when the Government should be encouraging R&D to assist in stimulating the economy. Clients should therefore start considering whether to bring forward eligible R&D expenditure to the 2013/14 financial year, where possible, prior to the change in rate. Exploration development incentive The Government plans to introduce an Exploration Development Incentive (“EDI”) to encourage increased investment into mining exploration. Under the EDI, small mineral exploration companies with no taxable income undertaking greenfields exploration will be able to provide exploration credits in the form of refundable tax offsets to Australian tax resident shareholders. Whilst the mechanism to facilitate the offset has yet to be developed, and the Government plans to limit the EDI refundable offset to $100 million over three years beginning 1 July 2014, we welcome this development as Australian junior explorers have lobbied for such a measure for some time and the global competition for capital remains fierce. The aim of the EDI is to turn non-usable capital losses into refundable tax offsets for investors in unsuccessful mineral exploration companies. Such a measure has been successfully implemented in Canada with positive results on investment levels into Canadian explorers. 8 Research and development 9 Tax compliance ATO review For taxpayers seeking a review of ATO decisions on their affairs in the future, the Government has announced several changes to the tax system’s review structures. The tax complaints function will move from the Office of the Ombudsman to the Inspector General of Taxation. In addition, the Government will be amalgamating most of the existing review tribunals into a single tribunal from 1 July 2015. Reduction in ATO funding The planned reduction of 1,600 staff at the Australian Taxation Office, which was due to occur in 2015/16, will now be brought forward by one year and represents the largest single reduction in the public sector announced in the Budget. This can be compared to prior years, where the ATO have been given extra funding for audit activities. This may have a direct impact on ATO activity and resource allocation in the short to medium term. Data matching initiatives deferred Taxpayers concerns in respect to increased ATO access to third party reporting and data matching have been alleviated to some extent by the Government’s announcement that it will defer the start date from 1 July 2014 to 1 July 2016. The Government states it needs time to analyse stakeholder concerns raised in submissions responding to the Treasury Discussion Paper on this previously announced Budget measure. Building a healthy economy There were no real surprises in the Budget with the Government announcing no significant changes to superannuation rules and the majority of age pension changes already out in the media. Indirectly, however, we note that the proposed corporate tax rate cuts may have an impact on super funds investing in Australian equities, whereby the reduction in the corporate tax rate will decrease franking credits and investment returns. While this may have an impact on overall returns, we do not expect to see the reduction in the corporate tax rate leading to a change in investment behaviour in the superannuation market. Age pension As confirmed before the Budget the age pension qualifying age will increase by six months every two years so the qualifying age will be age 70 by 1 July 2035. Practically the change will increase the age pension eligibility age for those born after 1 July 1958 in accordance with the table below: Date of birth Age pension eligibility 1 July 1952 and 31 December 1953 65½ 1 January 1954 and 30 June 1955 66 1 July 1955 and 31 December 1956 66½ 1 January 1957 and 30 June 1958 67 1 July 1958 and 31 December 1959 67½ 1 January 1960 and 30 June 1961 68 1 July 1961 and 31 December 1962 68½ 1 January 1963 and 30 June 1964 69 1 July 1964 and 31 December 1965 69½ 1 January 1966 and later 70 From a personal perspective, however, we still see superannuation as a tax effective savings structure that clients should be seeking to use to generate wealth for retirement even if the Government limits access to age 65 as anticipated. Commonwealth seniors health card Eligibility for the Commonwealth Seniors Health Card, which broadly provides access to the Pharmaceutical Benefits Scheme for self-funded retirees who do not qualify for the age pension, will be indexed annually to CPI from 20 September 2014. The current income thresholds of $50,000 per annum for singles and $80,000 per annum for couples have not changed since 2001. Income for the purposes of the thresholds will now include superannuation payments to individuals over age 60 even though they are exempt for income tax purposes. Superannuation guarantee rate The Government confirmed the superannuation guarantee Rate will rise to 9.5% from 1 July 2014 as currently legislated. The rate will remain at 9.5% until 30 June 2018. From 1 July 2018 the rate will increase by 0.5% each year until it reaches 12% on 1 July 2022. There will be some claw back of age pension entitlements by pausing income and asset test indexation for three years from 1 July 2017 and permanently linking age pension increases to the Consumer Price Index (CPI) from 1 September 2017, instead of the more generous indexation that may apply under exiting arrangements. Excess contributions tax While not announced in the Budget, we expect there will probably be an increase in the age where individuals can access their super, probably to age 65, to align the super system with the increase in pension eligibility age. This is likely to be addressed as part of the Government’s Financial System Inquiry and apply to individuals born after 30 June 1969. If the individual chooses to withdraw, no excess contributions tax will be payable and any related earnings will be taxed at the individual’s marginal tax rate. The Government will allow excess non-concessional contributions, and any associated earnings, made on or after 1 July 2013 to be withdrawn by the individual as an alternative to excess contributions tax applying. If the individual leaves their excess contributions in the fund, top marginal rate will continue to be applied on the excess. 10 Superannuation and retirement Get in touch... Melbourne Sydney Perth +61 3 8610 5000 partners@pitcher.com.au +61 2 9221 2099 partners@pitcher-nsw.com.au +61 8 9322 2022 partners@pitcher-wa.com.au Adelaide Brisbane Newcastle +61 8 8179 2800 partners@pitcher-sa.com.au +61 7 3222 8444 partners@pitcherpartners.com.au +61 2 4911 2000 newcastle@pitcher.com.au MELBOURNE John Brazzale Managing Partner Adelaide Tom Verco Managing Partner +61 3 8610 5110 +61 8 8179 2800 john.brazzale@pitcher.com.au tom.verco@pitcher-sa.com.au SYDNEY BRISBANE Scott Treatt Nigel Fischer Partner, Tax Consulting Managing Partner +61 2 9228 2284 +61 7 3222 8444 streatt@pitcher-nsw.com.au nfischer@pitcherpartners.com.au PERTH NEWCASTLE Bryan Hughes Greg Farrow Managing Director Managing Partner +61 8 9322 2022 +61 2 4931 6000 hughesb@pitcher-wa.com.au greg.farrow@pitcher.com.au