Regional Results - BASF Online Report 2014

advertisement

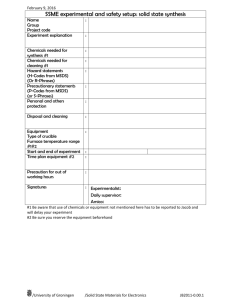

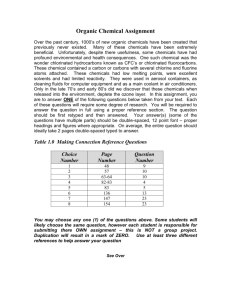

92 Management’s Report The BASF Group business year — Regional results BASF Report 2015 Regional results Regions (in million €) Sales by location of company Sales by location of customer Income from operations before special items1 2015 2014 Change in % 2015 2014 Change in % 2015 2014 Change in % 38,675 42,854 (10) 36,897 40,911 (10) 4,527 4,759 (5) 28,229 32,241 (12) 13,483 15,126 (11) 2,038 1,994 2 North America 15,665 15,467 1 15,390 15,213 1 1,425 1,566 (9) Asia Pacific 11,712 11,643 1 12,334 12,341 0 409 614 (33) 4,397 4,362 1 5,828 5,861 (1) 378 418 (10) 70,449 74,326 (5) 70,449 74,326 (5) 6,739 7,357 (8) Europe Thereof Germany South America, Africa, Middle East 1 By location of company Europe North America ▪▪ At €38,675 million, sales down by 10% from level of previous year ▪▪ Ludwigshafen Verbund site strengthened by further investments ▪▪ Sales rise by 1% to €15,665 million compared with previous year ▪▪ Startup of dispersions plant in Freeport, Texas, and formic acid production in Geismar, Louisiana At €38,675 million, sales at companies headquartered in the region Europe in 2015 were 10% below the level of 2014. This was largely due to lower sales prices in addition to the asset swap with Gazprom completed at the end of September, through which the the natural gas trading and storage business in particular ceased its contributions to the Oil & Gas segment in the fourth quarter of 2015. The Chemicals segment saw a mainly price-related decline in sales. With volumes stable, sales in the Performance Products segment were slightly below the previous year’s level. In the Functional Materials & Solutions segment, we were able to compensate for lower prices through higher demand and positive currency effects. Sales rose slightly in the Agricultural Solutions segment. This was primarily the result of positive price developments. Income from operations before special items amounted to €4,527 million, a decrease of 5% compared with 2014. This was mainly because of the significantly lower contribution from the Oil & Gas segment on account of the lower price of oil as well as considerably lower earnings in Other. The sharp earnings improvement in the chemicals business1 could only partly offset this. We want to continue expanding our position on the market and with our customers through investments and innovations. For this reason, we strengthened the Ludwigshafen Verbund site with further investments. A multiple-product facility for special amines with multifaceted applications began production in 2015, and the new TDI complex gradually started opera­tions beginning in November 2015. Sales at companies headquartered in North America grew by 1% year-on-year to €15,665 million. In local currency terms, they fell by 15% in the region. The sales increase was essentially due to positive currency effects in all divisions, which more than compensated for raw material cost-related price drops in the chemicals business – especially in the Petrochemicals division – as well as an overall slight decline in sales volumes. In 2015, income from operations before special items fell to €1,425 million and therefore decreased by 9% compared with the previous year, mainly as a result of unfavorable sales and margin developments in the Chemicals segment. A lower contribution came from the Performance Products segment, as well. Considerable earnings improvement in the Functional Materials & Solutions segment and a slight increase in Agricultural Solutions partially offset the decrease. In this region, we continue to focus on innovation, attractive market segments and cross-business initiatives in order to ensure profitable growth. At the same time, we are enhancing our operational excellence through ongoing improvements. Attractive growth prospects in North America and cost-­ effective raw material prices are strengthening our investment plans in the region. At our site in Freeport, Texas, we commenced operations at a new dispersions plant and began construction of a new ammonia plant together with Yara. Our production facility for formic acid started up in Geismar, Louisiana, making us the first formic acid producer in North America. We are explor­ ing an investment in a world-scale methane-to-propylene complex on the U.S. Gulf Coast. 1 Our chemicals business comprises the Chemicals, Performance Products and Functional Materials & Solutions segments. BASF Report 2015 Management’s Report The BASF Group business year — Regional results Sales by region (Location of company) Income from operations before special items by region 5 1 Germany 40% 2 Europe (excl. Germany) 15% 3 North America 22% 4 Asia Pacific 17% 5 South America, Africa, Middle East 6% 4 4 1 €70,449 million 3 1 Germany 30% 2 Europe (excl. Germany) 37% 3 North America 21% 4 Asia Pacific 6% 5 South America, Africa, Middle East 6% 5 1 3 2 €6,739 million 2 Asia Pacific South America, Africa, Middle East ▪▪ Sales grow by 1% to €11,712 million ▪▪ Local production bolstered by startup of several plants in China ▪▪ Sales grow by 1% to €4,397 million ▪▪ New production complex for acrylic acid and ­superabsorbents inaugurated in Camaçari, Brazil With decelerating market growth, sales at companies headquartered in the Asia Pacific region rose by 1% to €11,712 million. In local currency terms, sales declined by 12%. Considerable sales increases, primarily in the Catalysts, Coatings and Care Chemicals divisions, were able to more than compensate, in particular, for declines in the Petrochemicals and Monomers divisions as well as in Other. Currency effects posi­tively influenced sales, especially in the first half of the year. In the Chemicals segment in particular, lower raw material costs and higher production capacities on the market resulted in falling prices. Sales were furthermore weighed down by the disposal of our shares in the Ellba Eastern Private Ltd. joint opera­tion in Singapore and by the divestiture of our textile chemicals business. Income from operations before special items fell by 33% to €409 million. Significant factors here were higher fixed costs stemming from the startup of new plants and from lower plant capacity utilization, which was mainly attributable to several scheduled maintenance shutdowns in the first half of the year. As part of our regional strategy, we are striving to further raise the proportion of sales coming from local production in Asia Pacific in the years ahead. We once again made progress toward this goal: In China, we started operations at new production sites and plants in Chongqing, Nanjing, Maoming and Shanghai. Further investment projects are currently in the construction phase, as planned. The continuing expansion of our Innovation Campus Asia Pacific in Shanghai, China, strengthens the presence of this growth region within the global Research Verbund. To improve profitability in Asia ­Pacific, we intensified our measures to increase efficiency and effec­tiveness. Sales at companies headquartered in the region South America, ­Africa, Middle East grew by 1% to €4,397 million compared with 2014. In local currency terms, sales were up by 7%. Gross domestic product shrank in South America as a consequence of the recession in Brazil and the deteriorating economic environment in other countries in the region. Our sales declined slightly under these conditions. We were only partly able to offset negative currency effects, especially from the depreciation of the Brazilian real, by raising prices. Sales decreased in the chemicals business but rose in the crop protection business and in the Oil & Gas segment. Companies in Africa and in the Middle East showed considerable sales growth, driven by volumes and currencies. In Africa, we raised sales primarily in the Functional Materials & Solutions segment. In the Middle East, substantially increased demand in the Construction Chemicals division had a positive effect on sales. Income from operations before special items declined by 10% to €378 million, essentially because of higher fixed costs in the Petrochemicals and Care Chemicals divisions from starting up the acrylic acid and superabsorbent production complex in Camaçari, Brazil, in the second quarter of 2015. In addition to our growth strategy, we implemented a ­series of structural measures in South America that increase our productivity and sharpen the focus on our customers’ needs. With operations beginning at the production complex in Camaçari, Brazil, we are well positioned to take part in the ­region’s growing demand, viewed over the long term. We continued to expand our local presence in Africa in 2015 with a range of measures. This included inaugurating a production plant for concrete additives in Lagos, Nigeria, in October 2015. 93