The Determinants of Issue Cycles for Initial Public Offerings

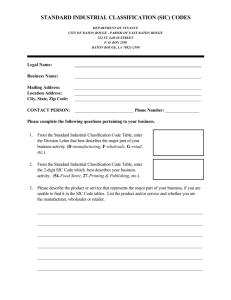

advertisement