Lecture Notes in Management Science (2012) Vol. 4: 169–178

4th International Conference on Applied Operational Research, Proceedings

© Tadbir Operational Research Group Ltd. All rights reserved. www.tadbir.ca

ISSN 2008-0050 (Print), ISSN 1927-0097 (Online)

Differences between financial

options and real options

Tero Haahtela

Aalto University, BIT Research Centre, Helsinki, Finland

tero.haahtela@aalto.fi

Abstract. Real option valuation is often presented to be analogous with financial options

valuation. The majority of research on real options, especially classic papers, are closely

connected to financial option valuation. They share most of the same assumption about

contingent claims analysis and apply close form solutions for partial difference equations.

However, many real-world investments have several qualities that make use of the classical

approach difficult. This paper presents many of the differences that exist between the financial

and real options. Whereas some of the differences are theoretical and academic by nature,

some are significant from a practical perspective. As a result of these differences, the present

paper suggests that numerical methods and models based on calculus and simulation may

be more intuitive and robust methods with looser assumptions for practical valuation. New

methods and approaches are still required if the real option valuation is to gain popularity

outside academia among practitioners and decision makers.

Keywords: real options; financial options; investment under uncertainty, valuation

Introduction

Differences between real and financial options

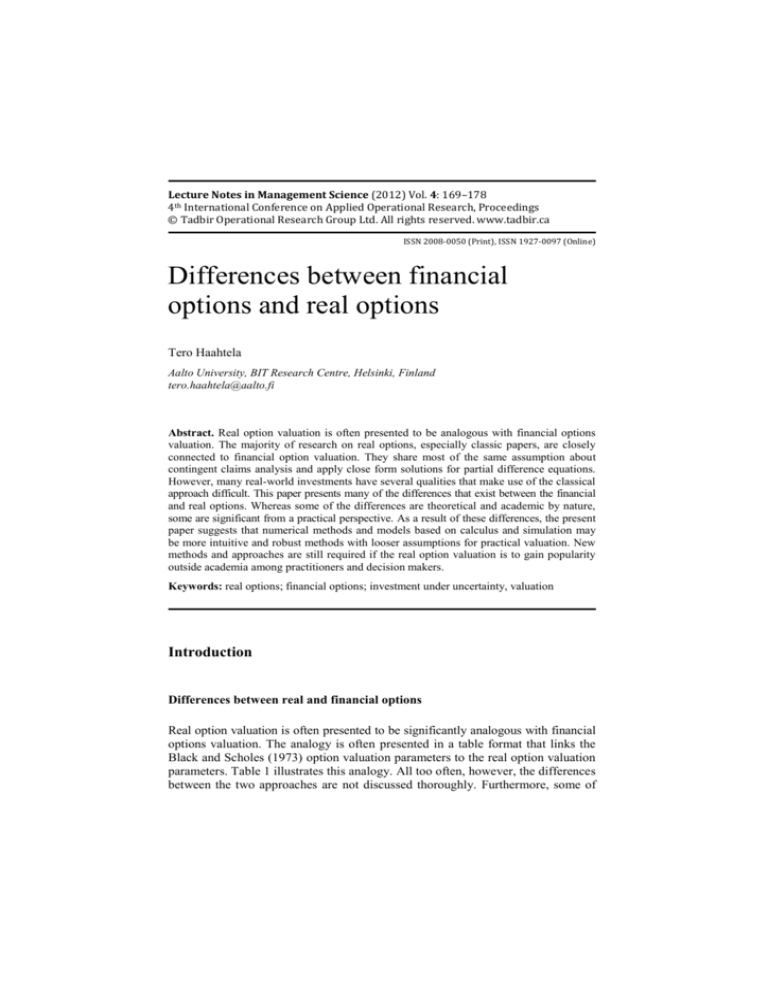

Real option valuation is often presented to be significantly analogous with financial

options valuation. The analogy is often presented in a table format that links the

Black and Scholes (1973) option valuation parameters to the real option valuation

parameters. Table 1 illustrates this analogy. All too often, however, the differences

between the two approaches are not discussed thoroughly. Furthermore, some of

170

Lecture Notes in Management Science Vol. 4: ICAOR 2012, Proceedings

these arguments are rather academic by nature and do not reflect the practical concerns

of real option valuation. Discussion about the interpretation of the calculated result

and its theoretical correctness may be irrelevant, because the underlying assumptions

often contradict the reality quite harshly.

Table 1. Analogy between financial and real options.

Financial option

S

X

T

R

D

Real option

Value of the underlying asset, i.e. Present value of project’s or investment’s

stock price

cash flows

Amount of money to be invested or

Exercise (strike) price

received in launching (exercising)

the action (option)

Time until the option expires

Time until the decision must be made

Standard deviation (volatility) of Uncertainty about the future value

the value of the underlying asset (probability distribution)

Risk-free rate of interest

Risk-free discount rate

Dividends paid out by

Dividend like cash outflows or inflows of

the underlying asset

project over its life-cycle

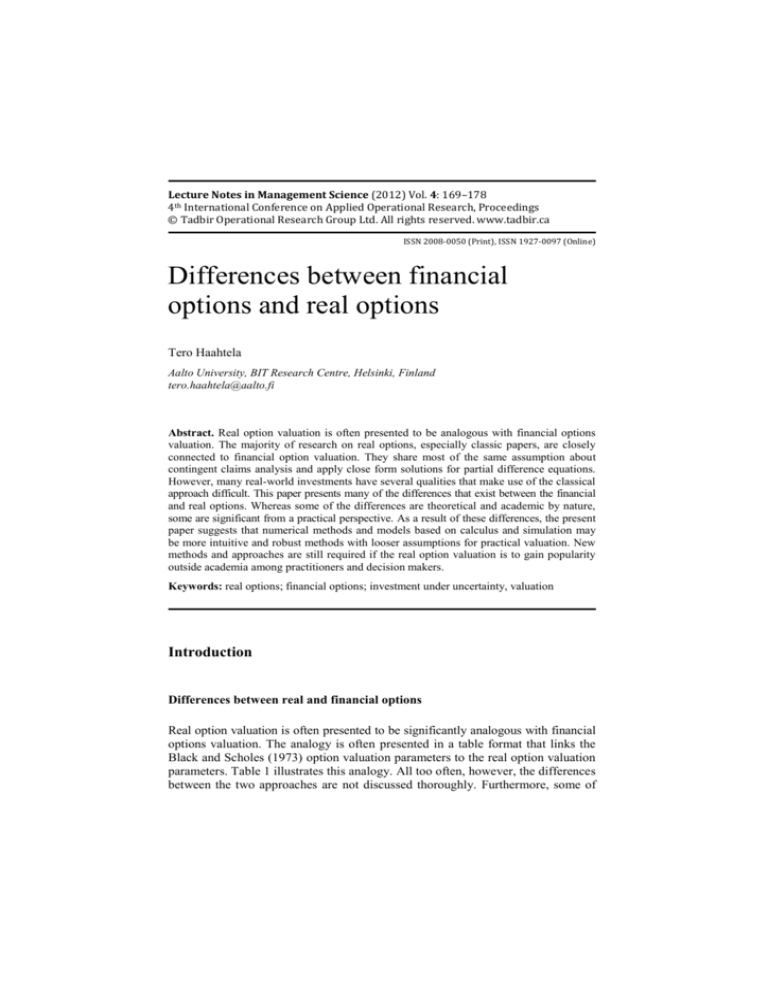

Many real option valuation procedures derived from the financial option valuation

have the problem that they do not necessarily follow the same assumptions. For

example, financial option values may never be negative, whereas some real options

may have negative underlying asset values. If the valuation method does not take

this into account, it may provide strange and misleading results. Another significant

difference is that information on financial option valuation parameters is often

easily available for everyone in the markets. This does not hold for real options,

and this ambiguity should be considered both in the practical valuation and in

interpreting the calculated results. Also, the length of the investment periods is

typically different; as a result, uncertainty changes (usually reduces) more during

the real option investment. Table 2 is not a comprehensive listing of the differences

but instead shows certain elementary issues with several example references for

each topic.

Table 2. Differences between the financial and real options.

Financial option

Short maturity (usually

months)

Real option

References

Longer maturity with several Mun (2002); Triantis

years

(2005); Brach (2003)

Time-varying, usually

Brach (2003); Majd &

Volatility sufficiently stable

diminishing, volatility

Pindyck (1987)

Rather mean reverting in the Laughton & Jacoby

Follows better gBm

long run

(1993)

T Haahtela

Financial option

Real option

Underlying variables are

Underlying variable is equity free cash flows driven by

or asset price

competition, demand and

management

Not necessarily traded and

Marketable and traded

proprietary in nature, with

comparables information

no market comparables

Managerial decisions and

No possibility to control and

flexibility increase option

manipulate option value

value

Actively acquired by

Side bets

management

171

References

Mun (2002); Kyläheiko

et al. (2002)

Brach (2003); Copeland

& Antikarov (2005)

Copeland &Antikarov

(2001)

Copeland & Antikarov

(2001)

Mun (2002); Copeland

Management assumptions & Antikarov (2005);

Management assumption

and actions drive the value Kodukula & Papudesu

have no effect on valuation

of the real option

(2006); Kyläheiko et al.

(2002)

Competition and market

Competition and market

Trigeorgis (1996);

value drive value of the

value do not affect valuation

Trigeorgis (1988)

strategic option

Usually small (proportional)

Large scale decisions

Mun (2002)

values

Numerical accuracy more

Framing the option case

Amram & Kulatilaka

important

more important

(1999 );

Often rainbow and comTrigeorgis (1996);

Often single options

pound options (parallel and Copeland & Antikarov

sequential) with interactions (2005); Brosch (2008)

Closed-form solutions

Solved usually using closedand binomial lattices with

form PDE’s and simulation /

Mun (2002); Copeland

simulation of the underlying

variance reduction tech& Antikarov (2005)

variables (not on the option

niques

analysis)

Have existed for more than Practical use for

Mun (2002)

30 years

approximately two decade

Dependent on both

risk-free interest rate and

Dixit & Pindyck

Depends only on risk-free

risk-adjusted premium or (1994); Kulatilaka

interest rate

equilibrium rate in dynamic (1995); Teisberg (1995)

programming context

Different and sometimes

Ordinary payoff functions

Zhou (2010)

complex payoff functions

172

Lecture Notes in Management Science Vol. 4: ICAOR 2012, Proceedings

Financial option

Real option

References

Volatility increase after

Huchzermeier & Loch

committed investments may

(2001); Brosch (2008)

have negative effect

Expected value may be

Option value known at

known, but it may still have Brach (2003)

exercise

fluctuations in the future

Majd & Pindyck

Timing of option payoff

(1987); Perlitz, Peske &

Timing of option payoff

delayed, not precisely

Schrank (1999);

known (immediate)

known, and may spread

Kodukula & Papudesu

over a period of time

(2006)

Exercise time or time period Exercise time, especially

Brach (2003); Copeland

(for American option) known optimal one, not necessarily & Tufano (2004); Triin the beginning

known

antis (2005)

May not have price for

Trigeorgis (1996);

Option has certain price to

acquiring the option or the Kodukula & Papudesu

acquire

price is unknown

(2006)

Can be leveraged

Cannot often be leveraged (Brach 2003)

(Brach 2003); Pindyck

Strike price may also be

Strike price often known

(1993); Kodukula &

stochastic

Papudesu (2006)

Triantis (2005);

Shared and proprietary

Proprietary possibilities

Trigeorgis (1996);

nature

Trigeorgis (1988)

Managerial skills and

Managerial skills and

incentives do not prevent

incentives may prevent

Triantis (2005)

value maximization

value maximization

May have information

Usually no information

Brach (2003); Copeland

asymmetries with arbitrage

asymmetries

& Antikarov (2005)

possibilities

May have fuzziness or amPrecise parameterization

Brach (2003)

biguity in parameter values

Owned, created and exer- Triantis (2005);

cised by the cooperative

Trigeorgis (1996);

Owned by one party

activity of more than one Smit & Trigeorgis

company

(2004)

Copeland & Antikarov

May not have negative

Underlying asset may have

(2005); Camara

values

negative values

(2002); Haahtela (2006)

Discrete information flow

Lint & Pennings

Continuous information flow with occasional managerial

(2000); Willner (1995)

reactions

Volatility increases always

beneficial

T Haahtela

Financial option

Real option

Mostly European by nature

Mostly American by nature

Computational efficiency

important

Can be diversified

Computational efficiency

less important

Cannot be diversified

Valuation parameters are

Valuation parameters mostly often secondary, derived

primary and observable

and estimated from the

variables

primary parameters of the

cash flow simulation

Sensitivity analysis based on More complex sensitivity

the ‘Greeks’

analysis

All options are known in the Some options may be

beginning

acquired during the project

Not necessarily ability to

Can be hedged

hedge

173

References

Copeland & Antikarov

(2005)

Amram & Kulatilaka

(1999)

Brandao et al. (2005)

Haahtela (2011b)

Haahtela (2010b,

2011b)

Brach (2003)

Copeland & Antikarov

(2001)

Another common problem is that many practitioners view the existing real option

valuation models as too complicated to use and even more so to explain (Triantis,

2005). These real options models are like “extreme sports” that looks impressive

but are hardly something that could be applied in a real business setting.

Another problem, once again more academic, is that the real options are investigated

according to the financial options lens far too often. Some purists may argue that

real option valuation should not be used unless it can be justified with a replicating

portfolio or a risk-neutral valuation approach. In practice, both of these approaches

require that the underlying asset and its information be available in the financial

markets. These arguments hold for financial options, but Stewart Myers (1977) who

originally suggested using options logic for valuing real investments, did not present

this requirement. Late, he also emphasized (e.g. in Cirano newsletter, 2004) the strategic

thinking behind the real option valuation and compared real options valuation as an

alternative for the net present value calculation. Luenberger (1997) in his book

Investment Science, also challenges the strict requirement for market-based data

and considers real options instead as a way to apply a backward rolling valuation

approach. Armstrong and Bailey (2005), rather than speaking of options, suggested

that several possibilities could be referred to as (operational) alternatives.

Borison (2005) and comments on his work of different real option valuation

approaches explain the distinction between different ‘schools’ of real option valuation.

Some authors tend to believe that the same strict assumptions that hold for financial

options valuation are required, whereas others believe that the same arguments of

comparable investments used to justify the net present value calculation are sufficient

for real options valuation. Woolley and Cannizzo (2005) stated that real options

should be shown and treated as a complement to rather than a replacement for

174

Lecture Notes in Management Science Vol. 4: ICAOR 2012, Proceedings

discounted cash flow (DCF) by showing how real options are consistent with and

extends the power of DCF.

Another significant difference is related to the precision of the real option

valuation. Real option valuation, however, is no more precise or imprecise than

the quality of its input parameters. The so-called ‘garbage-in, garbage-out’ sentiment

also holds for real options, similar to other valuation methods. A high-quality real

option analysis with thorough sensitivity analysis is capable of revealing to the

decision maker how reliable the calculated results are. Also, as stated by Amram

(2005), valuing patents and early-stage technologies is intrinsically difficult, because

the degree and types of uncertainty that attend such projects effectively rule out

the possibility of precise valuation results. New thinking and models are needed,

and over time, a natural cycle of the model and data refinement emerges.

Several authors have recognized the need for new approaches in real option

valuation. Triantis (2005) stated that one must be careful about specifying

distributions for the underlying assets in a model, whether it is a specific

commodity price or demand or a bundled uncertainty in the form of the underlying

project value. In real options, distributions of the underlying asset differ often

significantly from the geometric Brownian motion assumed in Black-Scholes and

other related models. Models based on new distribution specifications will continue to

make valuable contributions to the academic literature and practice, as will research

that provides better guidance on how to estimate the nature of the distribution and

the key parameters involved. Another significant difference is the complexity of

the real options compared to the financial options. Real investments may have

several interacting real options, whereas financial options usually have straightforward

payoff functions.

Real option valuation approaches for tomorrow

Financial options can be valued using closed-form solutions and many tailored

one-of-a-kind –valuation procedures for different option types. Unfortunately, this

does not hold for real options. Whereas analytical closed-form models may provide

generalized scientific knowledge and managerial insights, they are not necessarily

of practical use in appraising investments. As Charnes (2007) noted, many purists

prefer to use only models that avail themselves of an analytic solution. When

confronted with a realistic complication that precludes an analytic solution, the

complication is simply assumed away. Practitioners, in contrast, wish to include

realistic complications and are happy to accept the trade-off of obtaining an

approximate solution using a simulation.

One alternative is to use simulation-based methods. Techniques that were

previously considered to be computationally expensive and not feasible are today

often the method of choice (Jäckel, 2002). Rather than using simulation directly

for path sampling (as Boyle, 1977, originally suggested) or numerical integration,

Monte Carlo simulation can be used to consolidate cash flow calculation uncertainties.

Most well-known of these approaches are the valuation framework of Copeland

T Haahtela

175

and Antikarov (2001) with the consolidated logarithmic volatility estimation and

the pay-off approach of Datar and Matthews (2004; 2007).

Lattice and tree-based methods are another suggested alternative. They are

accurate, robust, and intuitively appealing tools to value financial and real options

(Hahn, 2005). Lattices are also explained to and accepted easily by management,

because the methodology is straightforward to understand. This is valuable particularly

with sequential and parallel compound options, which is often the case in real

applications (Trigeorgis, 1996; Copeland and Antikarov, 2001). They can also be

applied to stochastic processes other than gBm, including mean-reverting, jumpdiffusion, and displaced diffusion processes. The present alternatives are much

more flexible and usable for real option practitioners than the original binomial

tree methods used for valuing financial options (e.g., Cox, Ross, & Rubinstein, 1979).

One example of an enhanced lattice method for real option valuation is

Haahtela’s (2010a) recombining trinomial lattice with changing volatility. It is

based on a displaced diffusion process that allows negative underlying asset values

and has a much wider spectrum of possible distribution forms than a commonly

assumed lognormal gBm process (Haahtela, 2006). The volatility (or displaced

volatility) is both time- and state dependent, which is essential for practical real

option valuation. The parameterization of the process is based on a simulated cash

flow; furthermore, it is straightforward and intuitive with a regression sum of

squares error method (Haahtela, 2011). This cash flow calculation may also include

embedded options whose values are based on choosing the optimal decision in

each time step during a single simulation run (Haahtela, 2010c). The trinomial tree

remains recombining and stable even with the changing volatility. Also, the forwardlooking cash flow estimators of the approach can be applied to sensitivity analysis

(Haahtela, 2010b; 2011b). Thus, decision makers can investigate how a project

value with several interacting options may change as a result of changes in uncertain

cash flow calculation parameters. The method also allows the decision maker to

inspect whether the uncertainty is in the form of ambiguity or volatility (Haahtela,

2008; Haahtela, 2012).

Another novel approach for real option valuation is to use the fuzzy pay-off

method (Collan et al., 2009). Fuzzy logic (Zadeh, 1965) was originally used for

financial option and real option valuation by applying it to the Black -Scholes

environment (see e.g., Carlsson and Fuller, 2000; Zmeskal, 2001; Yoshida, 2003;

Collan, 2004). As the name suggests, however, the fuzzy payoff method approach

combines the use of fuzzy logic with the idea of the payoff method (see e.g.,

Boyle, 1977; Angelis, 2000, 2002; Datar and Matthews, 2004, 2007). The approach

uses fuzzy numbers to represent the future distribution of expected option value

and applies fuzzy mathematics to calculate the option value. The future will

determine whether this stream of real option research and its applications will become

more widely applied than the other aforementioned approaches.

176

Lecture Notes in Management Science Vol. 4: ICAOR 2012, Proceedings

Conclusions

As a result of the topics mentioned and listed in the previous two chapters, real option

researchers should focus on new streams of research that find practical valuation

approaches that are managerially more appealing, robust and intuitive. At the same

time, they should retain most of the good qualities of the more accurate option

valuation approaches. In practice this means that numerical methods and calculus

should be used rather than difficult mathematics. Simulation and lattice methods

are examples of such robust methods that allow simultaneously taking into account

many of the differences presented in Table 2. Closed form solutions are available

that can take into account one or two of the aspects mentioned in Table 2, but not

the majority.

In the end, the real value of any method is based on its practical relevance and

ability to help practitioners make correct and timely investments, or at least avoid

making clearly incorrect decisions. Academic real option research, rather than

holding too strictly to the theoretical correctness of the models, should focus more

on finding innovative and robust ways to value flexibility and investment under

uncertainty. These methods may be based on simulation, using fuzzy logic, system

dynamic models, new ways to apply decision trees, or even to some completely

novel approaches.

References

Amram M and Kulatilaka N (1999). Real Options: Managing Investment in an Uncertain

World. Harvard Business School Press

Amram M (2005). The Challenge of Valuing Patents and Early-Stage Technologies. Journal

of Applied Corporate Finance 17:2 68-81

Armstrong M and Bailey W (2005). The Option Value of Acquiring Information in an Oilfield

Production Enhancement Project. Journal of Applied Corporate Finance 17:2 99-104

Angelis D (2000). Capturing the Option Value of R&D. Research technology Management

July-August 2000 31-34

Angelis D (2002). An option model for R&D valuation. Int. J. Technology Management

24:1 44-56

Black F and Scholes M (1973). The pricing of options and corporate liabilities. Journal of

Political Economy 81: 637–659

Borison A (2005). Real options: Where are the emperor’s clothes? Journal of Applied Corporate

Finance 17:2 17–31

Boyle P (1977). Options: A Monte Carlo Approach. Journal of Financial Economics

4(1977) 323-338

Brach M (2003). Real options in practice. Wiley & Sons

Brandão L and Dyer J (2005). Decision Analysis and Real Options: A Discrete Time Approach

to Real Option Valuation. Annals of Operations Research 135 21-39

Brosch R (2008). Portfolios of real options. Springer

Camara A (2002). The Valuation of Options on Multiple Operating Cash Flows. 6th Annual

Real Options Conference, 4-6 July, Paphos, Cyprus

T Haahtela

177

Carlsson C and Fuller R (2000). On fuzzy real option valuation. Turku Centre for Computer

Science, TUCS Technical Report No 367

Charnes J (2007). Financial Modeling with Crystal Ball and Excel. Wiley Finance

Cirano News Letter (2004). Putting Real Options to Work: An Interview with Stewart Myers

Collan M (2004). Giga-Investments: Modelling the Valuation of Very Large Industrial Real

Investments. Dissertation, Turku Centre for Computer Science Dissertations No 57,

November 2004

Collan M, Fuller R and Mezei J (2009). A Fuzzy Pay-Off Method for Real Option Valuation.

Journal of Applied Mathematics and Decision Sciences. vol. 2009, 14 pages

Copeland T and Antikarov V (2001). Real Options: A Practitioner’s Guide. Texere

Copeland T and Antikarov V (2005). Real Options: Meeting the Georgetown Challenge.

Journal of Applied Corporate Finance 17:2 32-51

Copeland T and Tufano P (2004). A Real World Way to Manage Real Options. Harvard

Business Review 82:3 90-99

Cox J, Ross S and Rubinstein M (1979). Option pricing: a simplified approach. Journal of

Financial Economics 7 229-263

Datar V and Matthews S (2004). European real options: an intuitive algorithm for the

Black- Scholes formula. Journal of Applied Finance 14:1 45–51

Datar V and Matthews S (2007). A practical method for valuing real options: the Boeing

approach. Journal of Applied Corporate Finance 19:2 95–104

Dixit A and Pindyck R (1994). Investment under Uncertainty. Princeton University Press

Haahtela T (2006). Extended binomial tree valuation when the underlying asset distribution

is shifted lognormal with higher moments. 10th Annual Int. Conf. on Real Options, New

York, USA, 14-17.6.2006. SSRN: http://ssrn.com/abstract=1932408

Haahtela T (2008). Volatility and Ambiguity in Simulation-based Volatility Estimation.

12th Annual International Conference on Real Options, 9-12 July, Rio de Janeiro, Brazil

Haahtela T (2010a). Recombining Trinomial Tree for Real Option Valuation with Changing

Volatility. 14th Annual International Conference Real Options - Theory Meets Practice,

Rome, Italy, 16-19.6.2010. SSRN: http://ssrn.com/abstract=1932411

Haahtela T (2010b). Regression sensitivity analysis for cash flow simulation based real option

valuation. 6th International Conference on Sensitivity Analysis of Model Output, 19-22

July, 2010, Milano, Italy

Haahtela T (2010c). Cash Flow Simulation Embedded Real Options. Proc 2nd International

Conference on Applied Operational Research, August 25-27, 2010 Turku, Finland 418-430

Haahtela T (2011a). Estimating Changing Volatility in Cash Flow Simulation-Based Real

Option Valuation with the Regression Sum of Squares Error Method. Journal of Real

Options 1:1 33-52

Haahtela T (2011b). Sensitivity Analysis for Cash Flow Simulation Based Real Option

Valuation. 15th Annual International Conference on Real Options, June 15-18, 2011,

Turku, Finland SSRN: http://ssrn.com/abstract=1864909

Haahtela T (2012). Increasing uncertainty in cash flow simulation-based volatility estimation for

real options: Actual increase in volatility or symptom of excess unresolved ambiguity

uncertainty. 4th Int. Conf. on Applied Operational Research, 25-27 July, Bangkok, Thailand

Hahn J (2005). A Discrete-Time Approach for Valuing Real Options with Underlying

Mean-Reverting Stochastic Process. Dissertation, May 2005, Texas University of Austin

Huchzermeier A and Loch C (2001). Project Management Under Risk: Using the Real Options

Approach to Evaluate Flexibility in R&D. Management Science 47:1 85-101

Jäckel P (2002). Monte Carlo methods in finance. Wiley Finance

Kodukula P and Papudesu C (2006). Project Valuation Using Real Options: A Practitioner's

Guide. J. Ross Publishing

178

Lecture Notes in Management Science Vol. 4: ICAOR 2012, Proceedings

Kulatilaka N (1995). The Value of Flexibility: A General Model of Real Options. in Real

Options and Business Strategy, ed. Trigeorgis, L. Risk Books, 89-120

Kyläheiko K, Sandström J and Virkkunen V (2002). Dynamic capability view in terms of

real options. International Journal of Production Economics 80:1 65-83

Laughton D and Jacoby H (1993). Reversion, Timing Options, and Long-Term DecisionMaking. Financial Management Autumn 1993 22:3 225-240

Lint O and Pennings E (2000). A Business Shift Approach to R&D Option Valuation, in

Real Options and Business Strategy, (ed.) Trigeorgis, L. Risk Books, 117-132

Luenberger D (1997). Investment Science. Oxford University Press, USA

Majd S and Pindyck R (1987). Time to build, option value, and investment decisions. Journal

of Financial Economics 18: 7-27

Mun J (2002). Real options analysis –Tools and techniques for valuing strategic investments and

decisions. John Wiley & Sons, USA

Myers S (1977). Determinants of Corporate Borrowing. Journal of Financial Economics,

5:2 147-176

Perlitz M, Peske T and Schrank R (1999). Real options valuation: the new frontier in R&D

project evaluation? R&D Management 29:3 255-270

Pindyck R (1993). Investments of uncertain cost. Journal of Financial Economics 34: 53-76

Teisberg E (1995). Methods for Evaluating Capital Investment Decisions under Uncertainty.

In: Real options in capital investment: models, strategies, and applications, (ed).

Trigeorgis, L., Praeger 1995, USA, 31-46

Smit H and Trigeorgis L (2004). Strategic Investment: Real Options and Games. Princeton

University Press, USA

Triantis A (2005). Realizing the Potential of Real Options: Does Theory Meet Practice?

Journal of Applied Corporate Finance 17:2 8-16

Trigeorgis L (1988). A Conceptual Options Framework for Capital Budgeting. Advances in

Futures and Options Research 3: 145-167

Trigeorgis L (1996). Real Options: Managerial Flexibility and Strategy in Resource Allocation.

MIT Press

Willner R (1995). Valuing Start-up Venture Growth Options. In: Real options in capital

investment: models, strategies, and applications, (ed). Trigeorgis, L., Praeger 1995,

USA, 221-239

Woolley S and Cannizzo F (2005). Taking Real Options Beyond the Black Box. Journal of

Applied Corporate Finance 17:2 94-98

Yoshida Y (2003). The valuation of European options in uncertain environment. European

Journal of Operational Research 145:1 221–229

Zadeh L (1965). Fuzzy sets. Information and Control 8: 338–353.

Zhou J (2010). Real options valuation in energy markets. Dissertation, Georgia Institute of

Technology, May 2010

Zmeškal Z (2001). Application of the fuzzy-stochastic methodology to appraising the firm

value as a European call option. European Journal of Operational Research 135:2 303-310.