Form 5500 reporting changes

for the 2009 plan year

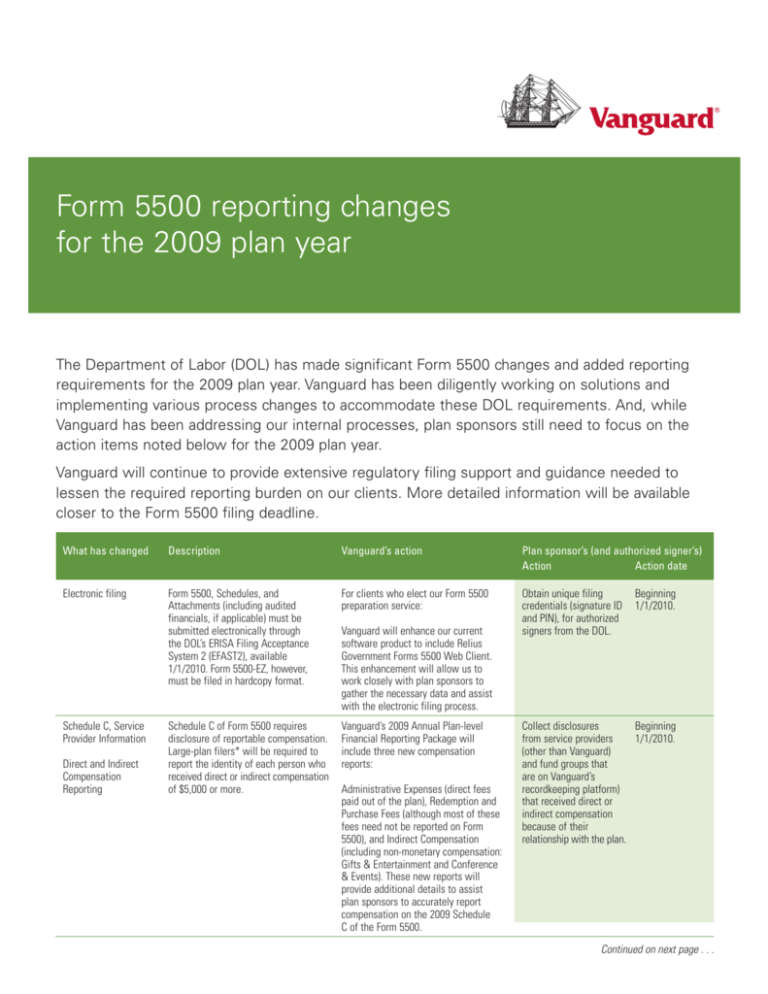

The Department of Labor (DOL) has made significant Form 5500 changes and added reporting

requirements for the 2009 plan year. Vanguard has been diligently working on solutions and

implementing various process changes to accommodate these DOL requirements. And, while

Vanguard has been addressing our internal processes, plan sponsors still need to focus on the

action items noted below for the 2009 plan year.

Vanguard will continue to provide extensive regulatory filing support and guidance needed to

lessen the required reporting burden on our clients. More detailed information will be available

closer to the Form 5500 filing deadline.

What has changed

Description

Vanguard’s action

Plan sponsor’s (and authorized signer’s)

Action

Action date

Electronic filing

Form 5500, Schedules, and

Attachments (including audited

financials, if applicable) must be

submitted electronically through

the DOL’s ERISA Filing Acceptance

System 2 (EFAST2), available

1/1/2010. Form 5500-EZ, however,

must be filed in hardcopy format.

For clients who elect our Form 5500

preparation service:

Obtain unique filing

credentials (signature ID

and PIN), for authorized

signers from the DOL.

Schedule C, Service

Provider Information

Direct and Indirect

Compensation

Reporting

Schedule C of Form 5500 requires

disclosure of reportable compensation.

Large-plan filers* will be required to

report the identity of each person who

received direct or indirect compensation

of $5,000 or more.

Vanguard will enhance our current

software product to include Relius

Government Forms 5500 Web Client.

This enhancement will allow us to

work closely with plan sponsors to

gather the necessary data and assist

with the electronic filing process.

Vanguard’s 2009 Annual Plan-level

Financial Reporting Package will

include three new compensation

reports:

Administrative Expenses (direct fees

paid out of the plan), Redemption and

Purchase Fees (although most of these

fees need not be reported on Form

5500), and Indirect Compensation

(including non-monetary compensation:

Gifts & Entertainment and Conference

& Events). These new reports will

provide additional details to assist

plan sponsors to accurately report

compensation on the 2009 Schedule

C of the Form 5500.

Beginning

1/1/2010.

Collect disclosures

Beginning

from service providers

1/1/2010.

(other than Vanguard)

and fund groups that

are on Vanguard’s

recordkeeping platform)

that received direct or

indirect compensation

because of their

relationship with the plan.

Continued on next page . . .

What has changed

Description

Vanguard’s action

Plan sponsor’s (and authorized signer’s)

Action date

Action

Schedule C, Service

Provider Information

(See previous page)

Vanguard is requesting Form 5500,

Schedule C disclosures from outside

(non-Vanguard) fund companies, for

which Vanguard provides participant

recordkeeping services, to help

consolidate indirect compensation these

firms received. Vanguard will make

these disclosures available to affected

plan sponsors.

Collect disclosures

Beginning

from service providers

1/1/2010.

(other than Vanguard

and fund groups that are

on Vanguard’s recordkeeping platform)

that received direct or

indirect compensation

because of their

relationship with the plan.

Direct and Indirect

Compensation

Reporting

(continued)

Vanguard will provide a Form 5500

Indirect Compensation Disclosure Guide

of Vanguard funds that will be available

on the Vanguard Plan Sponsor Bridge®.

ERISA 403(b)

Plan Reporting

Plan sponsors of ERISA 403(b)

plans will be required to file a full

Form 5500 along with all financial

schedules. The annual reporting

requirement for ERISA 403(b) plans

will now be the same as for

401(k) plans. This includes the

requirement for an accountant’s

opinion for large-plan filers*.

Form 8955-SSA

(formerly Schedule SSA,

Annual Registration

Statement Identifying

Participants with

Deferred Vested Benefits)

Schedule SSA will no longer be

part of the Form 5500 filing beginning

with the 2009 plan year. This form has

been replaced with the Form 8955-SSA

and will need to be submitted to the IRS.

Form 5500 SF, Short

Form Annual Return/

Report of Small

Employee Benefit Plan

Form 5500-SF is a new form available

for the 2009 plan year for eligible plans

(generally, plans with fewer than

100 participants). This Short Form

is intended to simplify reporting

requirements.

*Large-plan filers are generally plans covering 100 or more participants.

Vanguard will provide certified annual

plan-level financial statements to

assist the preparer with much of the

data needed.

Form 5500 preparation service also

will be offered for plans for which

Vanguard is the single vendor and

the service is elected.

For clients who elect our Form 5500

preparation service:

Large-plan filers*

will need to identify

and engage a qualified

public accountant to

prepare the necessary

accountant’s opinion to

include with the

Form 5500.

Beginning

1/1/2010.

Complete Form 5500

will need to be prepared

and filed electronically

with the DOL.

Prior to the last

day of the 7th

month after the

end of plan year

(plus extension).

Mail paper copy to IRS

by due date.

Prior to the last

day of the 7th

month after the

end of plan year

(plus extension).

None

Beginning

1/1/2010.

Vanguard will prepare Form 8955-SSA

and post to the Vanguard Plan

Sponsor Bridge.

For clients who elect our Form

5500 preparation service:

Vanguard will use the simplified form

beginning with the 2009 plan year.

P.O. Box 2900

Valley Forge, PA 19482-2900

Connect with Vanguard® > institutional.vanguard.com > 800-523-1036

© 2010 The Vanguard Group, Inc.

All rights reserved.

CAPMAT 032010