Shareholder Voting Rights in Mergers and Acquisitions

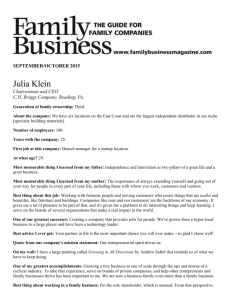

advertisement