security-market indicator series

advertisement

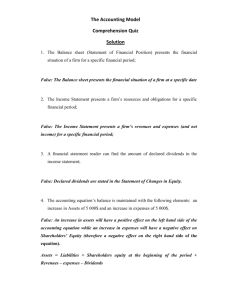

Training Workshop II: Doing Financial Forecast for Business Plan Writing Hong Kong Social Enterprise Challenge 2012 Training Workshop II- Doing Financial Forecast FINANCIAL REPORTING AND FINANCIAL STATEMENT Financial reporting To provide information about performance, financial position, changes in financial position Financial Statement Income statement, balance sheet & cash flow statement Cash flow projection for business project And their inter-relationship HKITI © 2012 p.2 Training Workshop II- Doing Financial Forecast INCOME STATEMENT Net income = Revenues – Expenses Sample Income Statement for the period from 1 Jan 20x1 to 31 Dec 20x1 +/+/- - - +/+/- HKITI © 2012 Revenues (Sales) Operating expenses Depreciation Other income Unusual or infrequent items ------------------------------------EBIT Interest expenses --------------------------------------Pretax earning from continuing operation Tax expenses --------------------------------------Income from continuing operation Income(loss) from Discontinued Operation (net of tax) Extraordinary item (net of tax) ------------------------------------------Net income p.3 Training Workshop II- Doing Financial Forecast BALANCE SHEET A snapshot at the year-end (usually Dec 31) on the company’s worth. ASSET A form of storing wealth future economic benefits obtained or controlled by the company Current Asset Cash Marketable securities Account receivables Inventories Prepaid expenses Long-term Asset Property Plant & Equipment Intangibles Goodwill Current assets – are expected to be liquidated or used up within one year or one operating cycle. Cash Short-term Certificate of Deposits (CD), high-quality commercial paper, treasure bills (< 3mths). Short-term investment (marketable securities) Stocks, bonds that are traded in a public market. Easily convert to cash within one operating cycle Usually have maturities >90 days Account receivables Sales on credit To be collected in short-term Uncollectible allowances will be made each year Inventories Goods to be sold within next year Inventories include raw materials, partially finished products to finished products Prepaid expenses Money paid in advance for services being used by the company next year e.g. insurance premiums, rental payments Long-term assets Have useful life of more than one year To appropriately charge the company each year, such assets are depreciated over their estimated lives. HKITI © 2012 p.4 Training Workshop II- Doing Financial Forecast LIABILITIES A future sacrifices of benefits (expenses) of the company Current liabilities Accounts payable Accrued expenses Income tax payable Short-term debt Current portion of long-term debt Long-term liabilities Long-term debt Lease obligations Deferred tax liabilities Accounts payable Money need to be paid to suppliers soon Accrued expenses Expenses that have been allocated this year but are payable next year. e.g., accrued wages, accrued interest Future outlay of cash Current portion of long-term debt GAAP requires that the principal portion of long-term liabilities be classified as a current liabilities Income tax payable Taxes are not due until after the year-end. The company still records a liability for tax in the current year-end, so that this expenses is matched with the revenues it earned this year Product warranties Warranties and guarantees offered by the company. Liabilities (commitments) sooner or later to be satisfied. A liability reserves has to be set up for such allowances Vacation liabilities or Contingent liabilities Long-term liabilities HKITI © 2012 Not expected to be repaid within one year Eg. Bonds payable, mortgages payable, long lease obligations, unfunded pension, deferred income tax liabilities p.5 Training Workshop II- Doing Financial Forecast EQUITY Equity is the residual interest in the net assets of a company that remains after deducting its liabilities Equity = Asset – Liabilities 1. Capital 2. Additional paid-in capital – proceeds from common stocks sales in excess of par value (Share repurchases are represented in the contra account treasury stock) 3. Retained earnings – cumulative net income that has not been distributed as dividends 4. Other comprehensive income – changes due to currency translation, minimum pension liability changes and unrealized gain/loss on investments HKITI © 2012 p.6 Training Workshop II- Doing Financial Forecast Cash flow Statement Operating activities Investing activities Financing activities Classification Descriptions Operating Activities Sales of goods to customers (R) Costs of providing goods (X) Income tax expenses (X) Hold short-term assets (inventory) (A)(L) Investing Activities Purchase or sale of Assets (A) Purchase or sale of equity & debt in other entities (A) Financing Activities Issue or repurchase of firm’s stock or preferred stock (E) Issues or repay debt (L) Pay dividend (E) Assets (A), Liabilities (L), Equity (E), Revenues (R), Expenses (X) Other information Notes and supplementary schedules MD&A Auditor reports HKITI © 2012 p.7 Training Workshop II- Doing Financial Forecast ACCOUNTING PRINCIPLES Matching principle and Accrual concept Revenues are recognized when goods/services are performed. The relevant expenses are then matched to those revenues recognized. Due to the matching principle, some revenues are not recognized even though the cash have been received. For example, the magazine subscription fees received in advance for 3 years. You would recognize the revenues over a 3-year period rather than record the money received on day one. On the other hand, some costs are not recognized even though the cash have been paid. For example, prepayment of rent for next year. Accrual concepts recognize revenues occurring at the time when an economic exchange takes place, rather than at the time that cash is received. Prepaid expenses – an asset; cash decreases Accrued expenses – a liability; while expenses (income statement) increase Going concern assumption – the valuation of assets & liability on the balance sheet assumes that the company is continuing its operation in future Historical cost – the value of asset and liability is stated on the balance sheet its costs on the date of acquisition. HKITI © 2012 p.8 Training Workshop II- Doing Financial Forecast FIVE STATEMENTS AND THEIR INTER-RELATIONSHIPS 1. Balance Sheet 2. Income Statement The net income, after deducting any dividend paid to shareholders, will be added to the equity section (as retained earnings) on the balance sheet 3. Statement of Cash Flows Cash receipts or payments during the period Classified into a) operating, b) investing and c) financing activities HKITI © 2012 p.9 Training Workshop II- Doing Financial Forecast Basic Equation Asset - Liability = Equity Equity = contributed capital + retained earnings Retained earnings (End) = Retained earnings (Beg) + Net Income – Dividend Increases in Asset = Use of cash Increase in Liability = Source of cash △ in Asset & Liability = Net Cash Flow △ Retained earnings = Net income – Dividend declared Liab. Asset Equity HKITI © 2012 p.10 Training Workshop II- Doing Financial Forecast CHARACTERISTICS OF ACCOUNTING INFORMATION 1. Relevance Relevant to decision-making Timeliness, information losses its value rapidly in today’s financial world 2. Reliability Verifiable, such as historic cost accounting Representational faithfulness 3. Consistency and Comparability (secondary qualities) Same measurement methods across all accounting periods Comparable to different firms or different periods 4. Materiality Which data is important to be included in financial statements HKITI © 2012 p.11 Training Workshop II- Doing Financial Forecast INCOME STATEMENT REVENUE RECOGNITION To recognizes revenues in the income statement, two conditions 1. Completion of Earning Process The company has provided all or virtually all the services, the company transferred to the buyer the significant risks and rewards of the ownership of goods 2. Assurance of Payment The revenue and cost can be measured reliably EXPENSES MATCHING Match the revenues Period cost – less directly match the timing of revenues such as administrative cost Depreciation HKITI © 2012 p.12 Training Workshop II- Doing Financial Forecast ANALYSIS OF CASH FLOW Generate enough cash flow from operation to sustain the business Enough cash to continue investing new assets Highlight the needs for additional finance Basic classifications CFO + CFI + CFF = NCF CFO – cash from operating activities, such as sale of goods & services, payment paid or money received. CFI – cash from investing activities, such as spending on a new machine, building a new plant, sales of asset (fixed assets) CFF – cash from financing activities, such as obtaining loan from banks (creditors), raising money from shareholders, repaying outstanding loans, paying dividends to shareholders Cash is unable to be manipulate The NCF (net cash flow) should reconciled with the beginning and year-end amount of cash at hand shown on the balances sheet HKITI © 2012 p.13 Training Workshop II- Doing Financial Forecast BALANCE SHEET INVENTORY VALUATION Basic Equation BI + P – COGS = EI BI = Beginning Inventory P = Purchase for the year COGS = Cost of Goods Sold EI = Ending Inventory Beginning Inventory (BI) Purchase (P) Available for sale Ending Inventory (EI) COGS 100 units 800 units -------------------------900 units (150 units) --------------------------750 units How to value the inventory at the year-end ? Costs of inventory – includes purchasing, transport, inspecting, and manufacturing overheads. Some costs known as period costs are expensed in the period rather than report as part of inventory – such as selling costs, storage costs, adm. overhead & abnormal waste of materials. HKITI © 2012 p.14 Training Workshop II- Doing Financial Forecast LONG-TERM ASSETS Held for more than one operating cycle Not for resale All costs incurred until the asset is ready to be used must be capitalized Invoice price Sales tax Insurance Transportation Installation Depreciation of Fixed Assets 1. Straight-line 2. Accelerated depreciation a. Double declining balance 3. Unit-of-production Straight-line Depreciation A plant costs $12,000 to buy and is going to last for 4 years. The estimated residual value is $2,000. Compute the depreciation charge for each year. (Cost – RV) / Total Life Yr Income statement Depreciation Balance Sheet Acc. Dep NBV 1 2 3 4 HKITI © 2012 p.15 Training Workshop II- Doing Financial Forecast CASH FLOW PROJECTION (CAPITAL BUDGETING) Capital, like other resources, is valuable because its supply is limited. Steps in Capital Budgeting 1. 2. 3. 4. Generating ideas Analyzing proposals Planning the Budget Monitoring and Auditing Principles of Capital Budgeting Only cash flow is used in evaluating projects, accounting income is needed to adjust for the non-cash elements. 1. Sunk Cost is irrelevant 2. Opportunity cost is counted – for example, an idle land can be sold at $300,000. If it is used to build a new factory, such cost should be counted as part of the initial investment though the land was purchased long-time ago. 3. Incremental cash flow is the cash flow resulted directly from the decision to undertake the project. 4. Externality refers to the effect on other cash flow of the company. Positive externality is the benefits that arise in other part of the company by undertaking a project, e.g. to build a ferry pier for an island where the company has a lot of resort hotels. Negative externality is also known as cannibalism HKITI © 2012 p.16 Training Workshop II- Doing Financial Forecast LEVERAGE Business Risk Associate with operating income (EBIT) The higher the fixed cost, the higher the Operating Leverage Firm A Firm B 1,000,000 500,000 100,000 1,000,000 200,000 400,000 400,000 400,000 Firm A Firm B 1,100,000 550,000 100,000 1,100,000 220,000 400,000 450,000 (↑12.5%) 480,000 (↑20%) Sales Variable cost Fixed Cost EBIT If both firms increase sales by 10% Sales (↑10%) Variable cost Fixed Cost EBIT DOL %EBIT %Sales Q( P V ) Q( P V ) F Q = quantity of goods sold P = unit price V= variable cost per unit F= fixed cost (P-V) also known as the contribution margin per unit HKITI © 2012 p.17 Training Workshop II- Doing Financial Forecast Breakeven Analysis Operating Breakeven = Qbreak-even = Total Breakeven = Qbreak-even = F P V FI P V Breakeven measures how many units needed to be sold in order to cover the fixed costs. Each unit contributes its contribution margin (P-V) towards the fixed cost (F). HKITI © 2012 p.18 Training Workshop II- Doing Financial Forecast Common Pitfalls in Cash Flow Projection 1. Economic responses – a successful investment may induce competitions, usually profit will be erode by competitions and revert to normal level 2. Standardized templates may not be suitable for a particular project 3. Use EPS/ Net income/ ROE or other accounting measures for decision-making 4. Omit relevant cash flow, double-count cash flow or mishandle tax 5. Fail to consider other investment alternatives, opportunities costs. HKITI © 2012 p.19 Training Workshop II- Doing Financial Forecast DEVELOP YOUR OWN RATIO FOR YOUR PROJECT Ratio Descriptions Retail Ratio Same store sales Sales per square foot Measure how well we do in the same store as compare to last year’s figure How much sales we generate for the rent we paid Education/ Service Companies Revenue per employee How well should I paid my staff Net income per employee Hotel Average daily rate Room revenue / number of room sold Occupancy rate Number of room sold/ number of room available. Creative/ IT Revenue per program Revenue per design Different Industries Retail Rent and sales per sq ft is important Inventory should be considered Initial investment in fitting, decoration depreciation Services/ IT Usually not about fixed asset, but may need to buy intangibles such as copyright, patent, software Education Employees are the key. Not much upfront investment Website Website development costs should be expensed. HKITI © 2012 p.20 Training Workshop II- Doing Financial Forecast CHECKLIST FOR YOUR PREPARATION Before you prepare the cash flow projection, income statement & balance sheet, please answer the assumptions & reasoning for your financials. Item/ Assumptions Initial Investment - Phase 1 - Phase 2 Data $ Does the initial investment 1) a physical asset, 2) intangible asset or 3) an expense? - if it is (1) or (2), what is the depreciable life? Give a simple description of your product/ service What is the unit price? $ How much is the direct cost associated with the sale of one unit? $ Contribution $ How many unit can you sell in o o o o o o 1st month 2nd month 6th month 12th month 2nd year 3rd year Why ?? How much is the promotion costs needed in order to generate the above sales? $ Will it change after 1st year? How much is the fixed cost per month? (don’t forget to incl. your salary) $ Will the fixed cost change after 1st year? $ HKITI © 2012 p.21