dynaquest sdn bhd - Hunza Properties Berhad

advertisement

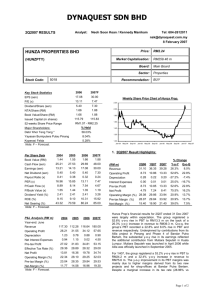

DYNAQUEST SDN BHD Analyst: INITIATING COVERAGE Kennedy Manikam Tel: 604-2612011 kmanikam@dynaquest.com.my 15 April 2005 Price: HUNZA PROPERTIES BHD Market Capitalisation: (HUNZPTY) Stock Code: 5018 2004 2005F EPS (sen) 13.21 15.00 P/E (x) 10.60 9.33 Dividend/Share (sen) 5.40 NTA/Share (RM) 1.41 Book Value/Share (x) 1.46 Issued Capital (m shares) 105.71 52-weeks Share Price Range RM1.34 - RM1.71 Major Shareholders: % Held Dato' Khor Teng Tong 54.94% 2002 2003 2004 Book Value (RM) 1.00 1.08 1.44 1.46 Cash Flow (sen) 21.21 41.64 25.21 35.00 Earnings (sen) 7.36 11.64 13.21 15.00 Dividend (sen) 3.41 3.41 5.40 5.40 Payout Ratio 0.46 0.29 0.41 0.36 19.03 12.02 10.60 9.33 6.60 3.36 5.55 4.00 P/Cash Flow (x) 2005F P/Book Value (x) 1.39 1.30 0.97 0.96 Dividend Yield (%) 2.44 2.44 3.86 3.86 ROE (%) Net Gearing (%) P&L Analysis (RM m) 7.31 10.81 9.15 10.30 36.79 59.52 43.32 50.30 2002 2003 2004 2005F Year-end: Jun Revenue 56.30 112.53 117.30 130.00 Operating Profit 11.57 22.97 26.64 35.10 Depreciation 0.72 0.58 1.23 1.40 Interest Expenses 0.26 0.99 0.94 1.00 Pre-tax Profit 12.31 22.60 27.02 32.70 Effective Tax Rate 27.99 32.89 29.36 28.00 7.02 11.14 13.81 15.50 20.55 20.41 22.71 27.00 Pre-tax Margin 21.86 20.08 23.04 25.15 Net-Margin 12.47 9.90 11.77 11.92 Net Profit Operating Margin Main Board Sector: Properties HOLD 1. Investment Highlights/Summary: Hunza Prop’s earnings is currently driven by its two major ongoing projects (Bayu and Bandar Putra Bertam). With the additional contributions from its new higher-end projects flowing in with effect from FY06, the group is poised to register substantially higher earnings. At the current price of RM1.40, Hunza Prop is trading at an undemanding PE multiple of 9.3 times for FY6/05 and 7.4 times for FY6/06. In addition, its shares are supported by nett dividend yield of 3.9% and RNAV of RM2.60. The group’s upcoming new projects are:- Per Share Data PER (x) RM147.99m Board: Recommendation: Key Stock Statistics RM1.40 (1) Mutiara Seputeh A gated project located on a 15-acre site in Seputeh, Kuala Lumpur. The project is expected to be launched by 1H 2005 and would comprise 86 three-storey semi-detached houses priced from RM1.6 m to RM1.9 m and 12 bungalows from RM2.2 m to RM2.5 m. The RM200.0 m project is scheduled for completion two years after its launch ; (2) Alila Another gated project located off Jalan Lembah Permai in Penang. The 18 acre development would consist of 426 exclusive homes (256 condominium units in the two block Alila Horizons, 162 Garden Villas and eight bungalows). The RM200.0 m project is scheduled for completion two years after its launch in this year ; (3) Gurney The project on a 10.2 acre land in Gurney Drive, Penang has a gross development value of RM650.0 m and is expected to be launched in 1Q 2006. The group plans to build its corporate office as well as an apartment suite called The Gurney of Tomorrow; and (4) Tanjung Bungah II The 3-acre project in Tanjung Bungah, Penang has the tagline of Seafront Bungalows in the Sky and will have two twin towers of 29 to 30 levels each with a sky lounge in the centre. Only two units per floor. Each unit of 3,500 to 4,500 sq ft size will have its own private lift. The RM110.0 m project is a very exclusive low-density development. The project is scheduled for launch in October this year. Page 1 of 3 DYNAQUEST SDN BHD 3. Valuation: 2. Background: Corporate Profile Making its listed debut on the local bourse on 23.3.00, Hunza Properties is an established developer of high rise residential units of low to high cost apartment/condominium blocks in the northern region. The major projects it had completed included Greenlane Heights and Marina Bay on the Penang Island, and Sungai Baong in Seberang Prai. Its secondary activities include property investment and trading of building materials. Hunza Prop, currently, has two major ongoing projects which are expected to drive its earnings in the near term. The first is the 585-acre Bayu development project in Sungai Petani. The second is a 70:30 joint-venture development with Yayasan Bumiputra Pulau Pinang for a township called Bandar Putra Bertam (BPB), which was launched in 4Q02. BPB spans over 701 acres of the land in Bertam, Kepala Batas, Seberang Prai Utara. When the remaining undeveloped land in Sungai Petani (393 acres) and Bertam land (490 acres) is excluded, Hunza Prop’s undeveloped land bank is small totalling approximately 43 acres (as at 31.12.04). Nevertheless, these land are located in strategic prime locations and, hence, have high development potential. For comparative valuation, three better quality second-tier listed property developers have been chosen. As seen in the table, Hunza Prop’s current share price valuation is not the most attractive in terms of PE multiple and P/NTA although it is cheap relative to the overall stock market. The low valuation for these property developers partially reflects the present investor sentiments for the property sector. Comparative Valuation Share Price (RM) @ 15/4 Mkt. Cap (RM m) Avg. Daily Vol. (m) ACTIVITIES % HELD Hunza Holdings Investment holding 100.0 - do - 100.0 Property construction & rental of properties, plant & machinery 100.0 Hunza Trading Trading of building materials 100.0 Hunza Prop (North) Property development 100.0 Hunza Parade Dev - do - 92.5 Bandar Kepala Batas - do - 70.0 Perda Hunza - do - 40.8 TURNOVER PBT 2003 2004 2003 2004 1.2 0.9 6.4 16.5 4.1 3.0 0.1 0.2 Property development 94.0 97.1 20.6 25.2 Trading 13.2 16.2 0.7 0.9 - - -5.1 -15.8 112.5 117.3 22.6 27.0 Total: 0.05 0.19 0.04 0.02 10.60 10.72 5.06 3.65 P/E FY04 (x) 9.33 8.72 5.00 4.57 P/NTA 0.99 0.46 0.61 0.44 Yield 3.86 4.59 3.60 2.81 Share Price Chart of Hunza Prop. Asas Dunia, Hua Yang & Plenitude. RM 1.70 1.50 1.30 0.90 0.70 Mar-04 May-04 HUNZPTY Jul-04 Sep-04 ASAS Nov-04 HUAYANG Jan-05 Mar-05 PLENITU For 1H05 ended 31.12.04, Hunza Properties registered a substantial 50.6% y-o-y rise in net profit to RM6.9 m on the back of a 29.9% y-o-y increase in revenue to RM58.2 m. The strong improvement in its financial results was mainly due to the higher profit contribution from its Bandar Putra Bertam Phase 2A project. Construction Elimination 1.28 172.80 4. Earnings Outlook: Business Investment holdings 1.00 90.00 1.10 Masuka Bina (RM ‘m) 0.79 147.99 150.40 1.90 SUBS/ASSOC Hunza Usaha Ventures 1.40 Hua Plenitude Yang P/E FY03 (x) 2.10 Corporate Structure Hunza Asas Prop Dunia With contributions kicking in from its Bandar Putra Bertam Phase 2B and 4A as well as Taman Seri Bayu II A, the group is set to post higher earnings in 2H05. As such, we are projecting its EPS at a higher 15.0 sen for FY6/05. Over the next two years, Hunza Prop’s earnings outlook is positive underpinned by the launches of four new higherend projects in strategic locations in Penang and Kuala Lumpur. Page 2 of 3 DYNAQUEST SDN BHD 5. Recent Developments: Hunza Prop has proposed to undertake a proposed private placement of up to 10% of its issued and paid-up share capital at an issue price of RM1.37 per placement share. 6. Investment Risk: Being in a cyclical sector such as property development, Hunza Prop's prospect is highly dependent on the state of the economy particularly in the states where its projects are located. As the economy is currently chugging along nicely and is expected to continue doing so over the next 12 months, we think the group’s performance would be satisfactory despite the increased competition and higher costs of raw materials. However, the current shortage of labour in the property development sector, following the deportation of illegal workers, may affect the launching dates of its projects. 7. Balance Sheet: Balance Sheet and Other Financial Data (RM m) FY2002 FY2003 FY2004 Total Assets 218.1 247.7 311.6 Fixed Assets 23.4 22.5 23.1 Current Asset 194.7 221.2 274.6 LT Assets 23.4 26.5 37.1 Current Liabilities 75.5 67.4 40.3 LT Liabilities 29.3 57.3 105.6 Share Capital 60.4 60.5 104.5 Shareholders Funds 96.1 103.1 151.0 In early 2004, Hunza Prop issued 41.77 m free warrants in relation to its two-call rights issue of 41.77 m shares at RM1.00 (cash call of RM0.85 and RM0.15 non-cash) with free warrants on the basis of 2 shares plus 2 warrants for every 3 existing shares. The exercise price of the warrants is at RM1.50 and its maturity date is 10 March 2009. Based on the BlackScholes Model using a risk-free rate of 6%, the fair value of its warrant is RM0.43. Its warrant is currently trading at RM0.25. 8. Recommendation: Trading at an undemanding PE multiple of 9.3 times for FY6/05 and 7.4 times for FY6/06, low P/RNAV of 0.5 times, and backed with a decent nett dividend yield of 3.9%, Hunza Prop's share price is undervalued. However, we are inclined to rate its share a HOLD at the present time due to the current market environment when investors' appetite particularly for the smaller-sized property development companies are lacking. We may upgrade our recommendation should investors' interests in the sector return and/or Hunza Prop's forward PE multiple contracts as a result of earnings that sharply exceed our forecast and/or share price weakness. The information in this report has been obtained from sources which DYNAQUEST SDN BHD believes to be reliable. We do not guarantee its accuracy or completeness. Any opinions expressed herein reflect our judgement at this date and are subject to change without notice. This report is for information only and should not be construed as specific advice to sell or buy the securities referred to herein. We accept no liability for any direct or indirect loss arising from the use of this document. DYNAQUEST SDN BHD, its associates, directors, officers and/or employees may have an interest in the securities and/or companies mentioned herein. Page 3 of 3