2q2007 results - Hunza Properties Berhad

advertisement

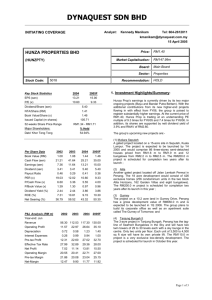

DYNAQUEST SDN BHD Analyst: 2Q2007 RESULTS Neoh Soon Kean / Kennedy Manikam Tel: 604-2612011 nsk@dynaquest.com.my 8 February 2007 Price: HUNZA PROPERTIES BHD Market Capitalisation: (HUNZPTY) Stock Code: 5018 2006 2007F EPS (sen) 17.08 30.00 P/E (x) 13.11 7.47 Dividend/Share (sen) 5.40 7.30 NTA/Share (RM) 1.66 1.88 1.66 1.88 Issued Capital (m shares) 115.79 115.83 52-weeks Share Price Range RM1.07 - RM2.25 Book Value/Share (RM) % Held Major Shareholders: Dato' Khor Teng Tong * Yayasan Bumiputera Pulau Pinang Koperasi Felda Note: F – Forecast. RM259.46 m Board: Main Board Sector: Properties Recommendation: Key Stock Statistics RM2.24 BUY Weekly Share Price Chart of Hunza Prop. 2.20 2.00 1.80 1.60 1.40 58.03% 8.04% 5.28% 1.20 1.00 Jan-04 May-04 Sep-04 Jan-05 May-05 Sep-05 Jan-06 May-06 Sep-06 Jan-07 May-07 1. 2Q2007 Result Highlights: Per Share Data Book Value (RM) 2004 1.44 2005 1.55 2006 1.66 2007F 1.88 Cash Flow (sen) 25.21 27.53 29.69 48.00 (RM m) 2Q06 1Q07 2Q07 % Change Y-o-Y Q-o-Q Earnings (sen) 13.21 14.13 17.08 30.00 Revenue 31.10 36.35 39.28 26.3% 8.0% 5.40 5.40 5.40 7.30 Operating Profit 8.73 10.86 13.33 52.6% 22.8% -27.2% -7.4% Net Dividend (sen) 0.41 0.38 0.32 0.24 Depreciation 0.28 0.22 0.20 16.96 15.85 13.11 7.47 Interest Expenses 0.00 0.01 0.01 P/Cash Flow (x) 8.89 8.14 7.54 4.67 Pre-tax Profit 8.73 10.85 13.33 52.6% 22.8% P/Book Value (x) 1.55 1.44 1.35 1.19 Net Profit 4.79 7.24 8.41 75.5% 16.2% Dividend Yield (%) 2.41 2.41 2.41 3.26 29.86 33.94 20.9% 13.7% ROE (%) 9.15 9.10 10.31 15.92 Operating Margin (%) 28.08 28.07 Pre-tax Margin (%) 29.84 33.92 20.9% 13.7% 43.32 70.59 80.24 85.00 Net-Margin (%) 15.40 19.90 21.40 39.0% 7.5% Payout Ratio (x) PER (x) Net Gearing (%) Note: F – Forecast. P&L Analysis (RM m) 2004 2005 2006 2007F Year-end: June Revenue 117.30 112.26 116.64 180.00 26.21 31.55 34.12 57.65 Depreciation 1.23 0.78 0.88 0.90 Net Interest Expenses 0.94 1.15 0.02 4.50 Pre-tax Profit 27.02 31.83 34.81 53.15 Effective Tax Rate (%) 29.36 28.89 28.32 29.00 Net Profit 13.81 16.36 19.78 34.74 Operating Margin (%) 22.34 28.10 29.25 32.03 Pre-tax Margin (%) 23.04 28.35 29.84 29.53 Net-Margin (%) Note: F – Forecast. 11.77 14.58 16.96 19.30 Operating Profit 25.0% -16.7% Hunza Prop’s financial results for 2Q07 ended 31 Dec 2007 were largely within expectation. The group registered a 52.6% y-o-y rise in PBT to RM13.3 m on the back of a 26.3% y-o-y increase in revenue to RM39.3 m. Q-o-q, the group’s PBT recorded a 22.8% and 8.0% rise in PBT and revenue respectively. Underpinned by contributions from its Alila project in Penang and Phase 4 of Bandar Putra Bertam, the substantial y-o-y rise in its earnings reflected the additional contribution from Mutiara Seputeh in Kuala Lumpur. Mutiara Seputeh was launched in April 2006 while Alila was officially launched in September 2005. For 1H07, the group registered a 53.2% y-o-y rise in PBT to RM24.2 m and a 32.4% y-o-y increase in revenue to RM75.6 m. The y-o-y improvement in its PBT margins was mainly due to higher margins derived from its two new projects and for shop-offices at Bandar Putra Bertam. Despite a marginal increase in its tax rate (28.96% vs Page 1 of 2 DYNAQUEST SDN BHD 28.71%), Hunza Prop's net profit rose by a more significant 72.4% y-o-y to RM15.6 m due to the decline in profits attributable to minority interests. This arises as the Bandar Putra Bertam project is a 70:30 joint-venture development with Yayasan Bumiputra Pulau Pinang. Supported by the good take-up rates for its Alila and Mutiara Seputeh projects, we expect its financial results in the second half to continue to improve in tandem with the heightened pace of construction work on these projects. The unbilled sales for Alila currently stand at RM83.0 m and Mutiara Seputeh at RM36.2 m. For the whole of FY07, we are maintaining our EPS projection of 30.0 sen for the group. Hunza Prop will be launching its Gurney commercial project and the seafront Infinity super-condo project soon. However, their contributions to the group’s results would only be felt in FY08. 2. Recent Development Koperasi Felda has emerged as a substantial shareholder of Hunza Prop following the acquisition of a 5.28% equity stake on 19 January 2007 via a private placement. 3. Recommendation Since our BUY recommendation in February 2006, Hunza Prop’s share price has appreciated by a significant 74%. We think its share price benefited from the revival of investor interest in the higher-end property development companies, particularly after the recent abolishment of FIC’s approval for property purchases made by foreigners. As it is, approximately 25% of the sales at Alila and Mutiara Seputeh are foreign purchases. While Hunza Prop’s prospective PE multiple has expanded to 7.3 times in line with its share price, the valuation remains relatively undemanding more so with the recent crystallisation of its strong earning prospects as its multiple high-end projects comes to fruition. As such, we are maintaining the BUY call on its shares. Given its stronger earnings phase and manageable gearing position, higher future dividend payout is expected. Based on an estimated net dividend of 7.3 sen for CY07, its share provides a net yield of 3.3%. The information in this report has been obtained from sources which DYNAQUEST SDN BHD believes to be reliable. We do not guarantee its accuracy or completeness. Any opinions expressed herein reflect our judgement at this date and are subject to change without notice. This report is for information only and should not be construed as specific advice to sell or buy the securities referred to herein. We accept no liability for any direct or indirect loss arising from the use of this document. DYNAQUEST SDN BHD, its associates, directors, officers and/or employees may have an interest in the securities and/or companies mentioned herein. Our definitions of stock recommendations/ratings are as follows:- 1. BUY -- The total return from stocks of this category is expected to outperform the KLCI or the EMAS indices over the next 12 months. We would expect the stocks to provide a positive absolute return over the same time period. 2. BUY ON WEAKNESS -- While stocks of this category is expected to outperform the KLCI or the EMAS over the next 12 months; the margin of out-performance is expected to be of smaller magnitude than the first category. In order to provide a margin of safety, we would recommend the purchase of these stocks at a somewhat lower price level than prevailing currently. We would expect these stocks to provide a positive absolute return over the next 12 months. 3. HOLD -- The total return from stocks of this category is expected to be close to the total return provided by the KLCI or EMAS over the next 12 months. The expectation is that over the long run, this category of stocks is expected to provide a positive total return. 4. SELL ON STRENGTH -- While stocks of this category is expected to under-perform the KLCI or the EMAS over the next 12 months; the margin of under-performance is expected to be of smaller magnitude than the last category. Thus, the probability of a positive absolute return from this category of stocks is limited. Further price rise from the current level would further decrease the probability of a positive absolute return over the next 12 months. 5. SELL -- The total return from stocks of this category is expected to underperform the KLCI or the EMAS indices over the next 12 months. We believe that the stocks in this category will not be able to provide a positive absolute return over the same time period. Page 2 of 2