2014 Cost Basis Reporting

advertisement

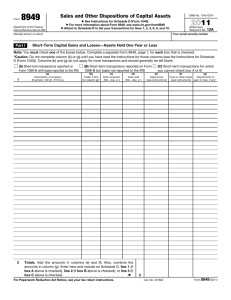

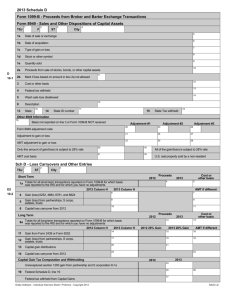

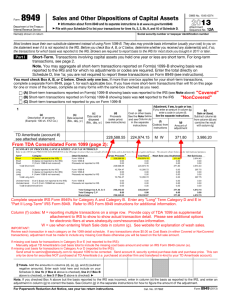

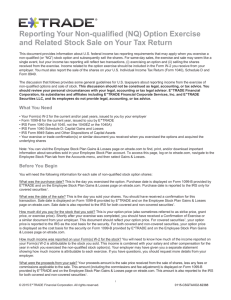

Plain & Simple Tax Information from Pioneer 2014 1099-B and Cost Basis Information Dear Shareowner, Internal Revenue Service (IRS) regulations require Pioneer to calculate and report to the IRS both the proceeds and the cost basis of shares that were held in eligible accounts and were redeemed or exchanged in 2014. In conjunction with reporting cost basis, Pioneer will calculate and report to shareowners the gain or loss for those transactions. We urge shareowners to read this brochure and carefully examine their enclosed IRS Form(s)1099-B. Your Form 1099-B includes all the information required by the IRS, which Pioneer hopes it has presented in a manner that should help you when completing Form 8949 and Schedule D for your 2014 tax return. If you have questions about your Form 1099-B please contact Pioneer at 1-800-225-6292 and one of our Customer Services Representatives will be happy to assist you. Thank You, Pioneer Investment Management Shareholder Services, Inc. Understanding your Form 1099-B Your IRS Form 1099-B reports gross proceeds from sales of mutual fund shares and, when available, the cost basis of those shares. Pioneer reports 1099-B information in separate categories depending on the holding period of the shares sold (long-term or short-term) and whether or not the cost basis is being reported to the IRS. There may be only one or there may be multiple categories on your 1099-B. It is important to note that the information in each section of your 1099-B corresponds directly to a section of IRS Form 8949 (discussed below), which you must complete and file with your Federal Tax Return. The separate sections on your Form 1099-B enable you to more easily complete Form 8949. The cost basis for covered shares is reported to you and the IRS, whereas the cost basis for noncovered shares is only reported to you. A redemption or exchange can include both covered and noncovered shares because the redemption can be comprised of shares purchased at different times. The redemption transaction will be reported in the appropriate category by covered shares or noncovered shares and by long-term or short-term gain and loss. A transaction where the type of gain or loss is undetermined or unknown will be reported in the undetermined category. Please carefully read “Form 1099-B Instructions for Recipient” and “Cost Basis Information” on the back or last page of your 1099-B mailing. These two sections provide important information such as definitions of Covered and Noncovered shares, Holding Period and the various cost basis methods. IRS Form 1040-Schdedule D and IRS Form 8949 In addition to Schedule D, IRS Form 8949 is now required to report sales of securities. The information you enter on Form 8949 gets summarized and included on Schedule D. You may be required to file multiple Forms 8949 depending on the nature of your securities transactions and the boxes that you are required to check near the top of Form 8949. When completing Form 8949, you should carefully follow the instructions on the Form as well as carefully review each section on your Form 1099-B. The information you need to complete Form(s) 8949 is provided on Form 1099-B and is presented in a manner that we hope makes it easier for you to complete Form 8949. Special Situations Return of Capital Distributions For both covered and noncovered shares, the cost basis on your Form 1099-B has been adjusted for non-taxable distributions (return of capital). Your cost basis has been reduced by the amount of the return of capital distributions. Wash Sales This occurs when shares are redeemed at a loss and all or a portion of the shares are repurchased (including reinvested dividends) within a 61-day period, beginning 30 days before the sale and ending 30 days after the sale. All or a portion of any loss resulting from that sale is disallowed and must be added into the basis of the repurchased shares. Note - Due to covered and noncovered shares of the same fund held in the same account being treated as if held in separate accounts for tax reporting purposes, your 1099-B will not show a wash sale for any covered share purchase that may have otherwise resulted in a wash sale on a redemption of noncovered shares. You will be required to compute and track such adjustments for tax reporting purposes. Please refer to the instructions for Schedule D. Sales Load Basis Deferral A redemption may be adjusted for a sales load basis deferral when applicable. This applies when shares are purchased and a front-end sales load is paid, then redeemed within 90 days of their purchase and later repurchased into the same account using a reinvestment right where no load is charged. The amount of the sales load must be subtracted from the cost basis of the shares redeemed and added to the basis of the repurchased shares. Your cost basis on your Form 1099-B has already been adjusted to reflect any applicable sales load basis deferral. Tax-Exempt Interest and Capital Gain Dividends You may be required to adjust your basis and/or holding period if you redeemed shares that you held for six months or less at a loss and received a tax-exempt dividend or a capital gain dividend on those shares. Important Cost Basis Information The Emergency Economic Stabilization Act, HR 1424, was signed into law on October 3, 2008. It included provisions from the Energy Improvement and Extension Act of 2008 requiring mutual funds to provide cost basis reporting to their customers and to the IRS for “covered shares” (shares acquired and subsequently redeemed on or after January 1, 2012). Pioneer is required to report gross proceeds and basis from the redemption of covered shares on Form 1099-B to the IRS. Additionally, Pioneer is required to report a shareowner’s adjusted basis in the security and whether any gain or loss on the sale is classified as short-term or long-term (the holding period). Useful Tools and Information IRS Publication 550 – Investment Income and Expenses, includes information regarding mutual fund distributions IRS Publication 551 – Basis of Assets Publications are available free from the IRS by calling 1-800-829-3676 (1-800-TAX-FORM) or by visiting www.irs.gov. They provide helpful information about mutual funds and taxes. This material is not intended to replace the advice of a qualified attorney, tax adviser, investment professional, or insurance agent. Before making any financial commitment regarding the issues discussed here, consult with an appropriate professional adviser. Pioneer Investments 60 State Street, Boston, MA 02109 ©2015 Pioneer Investments • us.pioneerinvestments.com 20027-08-0115 00127934