Drake-produced PDF

advertisement

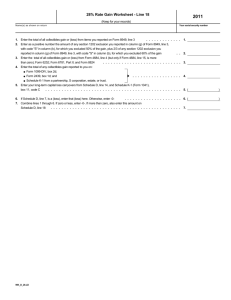

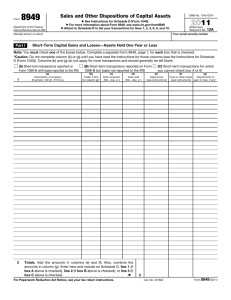

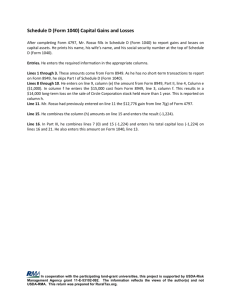

2013 Schedule D Form 1099-B - Proceeds from Broker and Barter Exchange Transactions Form 8949 - Sales and Other Dispositions of Capital Assets TSJ D 10-1 1 F 2 ST 3 City 4 5 1a Date of sale or exchange 1b Date of acquisition 1c Type of gain or loss 1d Stock or other symbol 1e Quantity sold 2a Proceeds from sale of stocks, bonds, or other capital assets 2b Mark if loss based on amount in box 2a not allowed 3 Cost or other basis 4 Federal tax withheld 5 Wash sale loss disallowed 8 Description 13 State 6 7 8 9 10 11 12 13 14 15 16 14 State ID number 17 15 State Tax withheld 18 Other 8949 Information 19 Basis not reported on line 3 or Form 1099-B NOT received Adjustment #1 Form 8949 adjustment code Adjustment to gain or loss AMT adjustment to gain or loss Only this amount of gain/(loss) is subject to 28% rate AMT cost basis Adjustment #2 Adjustment #3 20 23 26 21 24 27 22 25 28 29 30 31 32 All of the gain/(loss) is subject to 28% rate U.S. real property sold by a non-resident Sch D - Loss Carryovers and Other Entries TSJ 1 ST 2 City 3 Short Term D2 10-2 2012 Proceeds 4 for all short-term transactions reported on Form 1099-B for which basis 1a Totals was reported to the IRS and for which you have no adjustments 2012 Column H 2013 Column H 4 Gain (loss) 6252, 4684, 6781, and 8824 5 Gain (loss) from partnerships, S corps, estates, trusts 6 Capital loss carryover from 2012 12 Gain (loss) from partnerships, S corps, estates, trusts 13 Capital gain distributions 14 Capital loss carryover from 2012 8 9 10 11 2012 Federal tax withheld from Capital Gains Drake Software - Individual Interview Sheet / Proforma - Copyright 2013 12 2012 28% Gain Cost or other basis 2013 13 2013 28% Gain AMT if different 15 16 17 18 19 20 21 22 Unrecaptured section 1250 gain from partnership and S corporation K-1s Federal Schedule D, line 19 Proceeds 14 Capital Gain Tax Computation and Withholding 19 AMT if different 7 for all long-term transactions reported on Form 1099-B for which basis 8a Totals was reported to the IRS and for which you have no adjustments 2012 Column H 2013 Column H Gain from Form 2439 or Form 6252 5 6 Long Term 11 Cost or other basis 2013 23 2013 2012 24 25 26 27 SALE.LD