P.O. Box 2600

Valley Forge, PA 19482-2600

Connect with Vanguard® > vanguard.com

© 2014 The Vanguard Group, Inc.

All rights reserved.

Vanguard Brokerage Services is a division

of Vanguard Marketing Corporation, member

FINRA and SIPC.

VBSCBSS 012014

Changes to your

tax reporting and

Vanguard Brokerage

1099-B

Tax preparation assistance

for brokerage investors

Reminders for using

Form 1099-B

Regulatory changes to cost basis reporting, which took

effect in 2011, triggered updates to IRS Form 1099-B, part

of the Vanguard Brokerage Tax Information Statement.

Vanguard is required to report cost basis information to

the IRS on Form 1099-B for shares that were acquired

on or after the dates listed below and later sold.

Effective dates for covered shares

Shares acquired beginning January 1, 2011:

For more information

Please see IRS Publication 550, Investment Income

and Expenses, for additional information. For copies,

call the IRS at 800-829-3676 or visit irs.gov.

Questions?

A Vanguard Brokerage investment professional will be

happy to answer questions about information provided

on your Form 1099-B. Call us at 800-662-2739 on

business days from 8 a.m. to 10 p.m. or on Saturdays

from 9 a.m. to 4 p.m., Eastern time.

•S

tocks.*

•E

xchange-traded funds (ETFs) organized as unit

investment trusts (UITs).*

Shares acquired beginning January 1, 2012:

•M

utual funds.**

• ETFs organized as regulated investment companies

other than UITs.

• Stocks acquired through a dividend reinvestment

plan (DRIP).

Bonds and options acquired

beginning January 1, 2014:

•L

ess complex bonds.***

• Most options.

Bonds and options acquired

beginning January 1, 2016:

• More complex bonds.†

• Certain options involving more complex bonds.

Visit our tax center

Go to vanguard.com/taxcenter

for Vanguard tax-related

information, forms, and the

Tax Information Statement

reference guide.

Shares that were acquired before these dates (noncovered shares) may also have cost basis information, but

this information won’t be reported to the IRS.

Sign up for e-delivery

Vanguard applies default cost basis methods unless

you’ve selected a specific method. Average cost is the

default for mutual funds, while first in, first out (FIFO)

is the default for other holdings. Consult a tax advisor

to determine the best method for you to use.

You can now receive your

Vanguard tax forms and tax

brochures by e-delivery. Sign up

at vanguard.com/edelivery.

*If your stock or ETF organized as a UIT is part of a DRIP, it isn’t

considered covered until January 1, 2012.

**Excluding money market funds.

***Generally, these are bonds and other debt obligations with fixed yield

and maturity dates.

†Generally, these are bonds and other debt obligations without fixed

yield and maturity dates.

Adjustments to cost basis

Vanguard is required to make certain adjustments

to the initial cost basis of covered securities

acquired in an account. We’ll adjust the basis of

securities for commissions and transfer taxes

related to the acquisition of the security. We’ll

also adjust the basis for any organizational actions

reported by the issuer. However, we generally

won’t adjust for transactions, elections, or other

events occurring outside the account.

Wash sales: Under tax rules, the deduction

for a loss realized on the sale of a security is

disallowed if, within 30 days before or after the

sale, a substantially identical security is acquired.

Any loss that is disallowed is added to the basis

of the acquired security. Vanguard will adjust the

basis of securities held in the account for losses

that are disallowed due to a wash sale, but only

if both the purchase and sale of an identical

security (a security with the same CUSIP) occur

in the same account. You must adjust the basis

of a security if a wash sale occurs as a result of:

• The purchase of a substantially identical

security that isn’t an identical security.

• A purchase that occurs in a different account

than the sale.

Another adjustment we’ll make: Vanguard will

also adjust the basis of a security issued by a

regulated investment company (RIC) or real estate

investment trust (REIT) that has undistributed

long-term capital gains during the year.

A. For shares of noncovered securities that

you may have sold, Vanguard will report the

information to you on Form 1099-B, when available.

However, Vanguard won’t report any basis

information that we have to the IRS on noncovered

shares. For these shares, you must determine the

cost basis information, and you may use another

cost basis method if you meet the requirements. For

covered shares, you must use Vanguard’s default

cost basis method unless you provided Vanguard

with another cost basis method at the time of the

sale. However, it’s important to understand that

what Vanguard is required to report to the IRS may

be different from what you must report to the IRS,

and you may need to make adjustments on IRS

Form 8949. Having your own records will certainly

help you make these adjustments, if any are needed.

Adjustments we won’t make: Vanguard doesn’t

consider constructive sales or mark-to-market

adjustments in determining the holding period of

securities sold for a gain or loss.

Frequently asked questions

Q. What adjustments haven’t been

incorporated into my cost basis?

Q. What’s a wash sale?

A. Brokers are only required to make some of

“substantially identical” security is purchased up

to 30 days before or 30 days after the date of the

sale, the loss is disallowed and can’t be deducted.

The disallowed loss is added to the basis of the

purchased security, thereby reducing future gains or

increasing future losses. Vanguard will make some,

but not all, of the adjustments for wash sales.

the possible wash sale adjustments that must

be considered in order to file your income tax

return. We won’t make wash sale adjustments

when the purchases and sale occur in different

accounts or when they are between substantially

identical securities that have different CUSIPs.

We also won’t make the following adjustments:

adjustments.

short-term losses.

• Hedging transactions or offsetting positions.

(See IRS Publication 550.)

7

Form 1099-B has up to five separate sections

to clearly identify whether the cost basis is

reported to you and the IRS, reported only to

you, or not available. These separate sections are

created dynamically based on the activity in your

account and will make it easier for you to complete

IRS Form 8949, Sales and Other Dispositions of

Capital Assets.

You must determine short-term or long-term and

report on Form 8949, Part I, with Box B checked,

or on Form 8949, Part II, with Box E checked, as

appropriate.

Section 1: Short-term transactions for which basis

is reported to the IRS—Report on Form 8949, Part I,

with Box A checked.

Box 1c is labeled “Short-Term,” and Box 6b is

labeled “Basis reported to IRS.”

Section 2: Short-term transactions for which basis

is not reported to the IRS—Report on Form 8949,

Part I, with Box B checked.

after January 1, 2012, which are subsequently sold.

All other information is provided to you as a courtesy

and isn’t sent to the IRS.

8

Vanguard will display cost basis information for

covered and noncovered shares for securities

on Form 1099-B if we have complete information.

If a portion of the position doesn’t contain

complete cost basis information, it’ll be reported

in Section 5 on Form 1099-B.

Vanguard is required to report the sales of

covered securities by S corporations if the

securities were acquired on or after January 1,

2012. Prior to the 2012 tax year, you received

a courtesy Form 1099 Consolidated. Now we’ll

identify the covered transactions to show which

ones will be reported to the IRS.

We’re required to treat your corporation as an

S corporation unless we received a Form W-9

indicating that it’s a C corporation.

Box 1c is labeled “Long-Term,” and Box 6b is

labeled “Basis reported to IRS.”

A. We report information about shares purchased

How Vanguard displays

cost basis information

S corporation reporting

Section 3: Long-term transactions for which basis

is reported to the IRS—Report on Form 8949,

Part II, with Box D checked.

Q. What information does Vanguard report

to the IRS about S corporations?

• Constructive sales and mark-to-market

Section 5: Transactions for which basis is not

reported to the IRS and for which short-term or

long-term determination is unknown (to Vanguard).

Box 1c is labeled “Short-Term,” and Box 6a is

labeled “Noncovered security.” The information in

Boxes 1b, 1c, 3, and 5 reflects Vanguard’s records

and won’t be reported to the IRS. You’re solely

responsible for the recordkeeping and accuracy of

this information.

A. When a security is sold for a loss and a

• RIC and REIT adjustments with respect to certain

6

5 separate sections of Form 1099-B

Q. I track my own cost basis; do I have

to use Vanguard’s information?

Nondividend distributions (return of capital):

Vanguard will make adjustments to your cost basis

by the amount of the nontaxable distribution for

the purpose of calculating the gain or loss once

the security is sold. These adjustments mainly

occur due to return of capital. The amount that

exceeds your adjusted basis is reported as long- or

short-term capital gain on Schedule D, depending

on your holding period. Please review your Form

1099-DIV, Box 3 to determine if any dividends

received represent a return of capital.

Section 4: Long-term transactions for which basis

is not reported to the IRS—Report on Form 8949,

Part II, with Box E checked.

Box 1c is labeled “Long-Term,” and Box 6a is

labeled “Noncovered security.” The information in

Boxes 1b, 1c, 3, and 5 reflects Vanguard’s records

and won’t be reported to the IRS. You’re solely

responsible for the recordkeeping and accuracy of

this information.

2

3

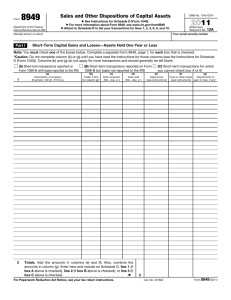

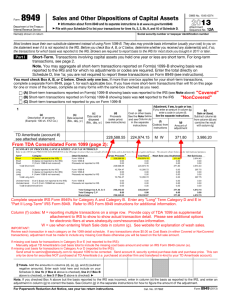

How to report a sale of shares purchased over time

Short-term covered securities

In the example below, you’ve purchased 500 shares of IBM Corporation over time. You then sell all 500 shares

in one transaction. Prior to 2011, the proceeds were reported to you in one section on the 1099-B,

but this is no longer the case. The sale must now be reported by us in the appropriate sections of Form 1099-B,

and you must report it to the IRS on the appropriately checked Form 8949 and on Schedule D.

TransactionQuantity

Date

Buy3001/2/2009

Buy1003/1/2013*

Buy1004/1/2013*

Long-term noncovered securities

Form 1099-B

Long-term noncovered:

• Reported to you in Section 4 of Form 1099-B.

• Reported to the IRS on Form 8949, Part II, with Box E checked.

A

Short-term covered:

• Reported to you in Section 1 of Form 1099-B.

• Reported to the IRS on Form 8949, Part I, with Box A checked.

A

C

B

D

E

H

A

A

C

B

D

E

H

Form 8949

Sell50011/1/2013

Use the appropriate Form 1099-B (see top images to the right), your personal records, and the instructions

below to complete IRS Form 8949 (middle images to the right), and Schedule D (bottom images to the right)

for covered or noncovered shares. Enter the details of each transaction on a separate line of Form 8949

(see the actual form for more detailed instructions and for exceptions). Use as many Forms 8949 as needed.

A Description of property. Enter the description

F

shown on your Form 1099-B, Box 1e and Box 8.

B

C

Date acquired. Enter the date you purchased your

shares shown on your Form 1099-B, Box 1b.

instructions for Form 8949 for a detailed

listing of possible codes to be entered.

G

Date sold. Enter the date of the sale or exchange

shown on your Form 1099-B, Box 1a.

D Sales price. Enter the sales price reported to

you on Form 1099-B, Box 2a.

E

Cost or other basis. Enter the cost basis

amount shown on your Form 1099-B, Box 3,

if available. Otherwise, use your personal

records such as past statements, transaction

history, and your tax returns to obtain cost

information.

Code, if any. Please see the IRS

H

Adjustments to gain or loss, if any. Enter

any adjustments to gain or loss required

because of the code entered in column (f).

Enter negative amounts in parentheses.

A

A

B

C

D

E

F

G

B

C

D

E

F

G

H

H

Schedule D

Gain/Loss. Enter this amount in column (h)

on both the Form 8949 and Schedule D.

After subtotaling columns (d), (e), (g), and (h) on

Form 8949, transfer the figures to those same

columns on Schedule D.

The sample forms used in this brochure are

for illustration only.

D

D

E

G

E

G

H

H

*A sale that represents multiple acquisition dates will display as blank in Box 1b of Form 1099-B,

and as “various” on Form 8949.

4

5

How to report a sale of shares purchased over time

Short-term covered securities

In the example below, you’ve purchased 500 shares of IBM Corporation over time. You then sell all 500 shares

in one transaction. Prior to 2011, the proceeds were reported to you in one section on the 1099-B,

but this is no longer the case. The sale must now be reported by us in the appropriate sections of Form 1099-B,

and you must report it to the IRS on the appropriately checked Form 8949 and on Schedule D.

TransactionQuantity

Date

Buy3001/2/2009

Buy1003/1/2013*

Buy1004/1/2013*

Long-term noncovered securities

Form 1099-B

Long-term noncovered:

• Reported to you in Section 4 of Form 1099-B.

• Reported to the IRS on Form 8949, Part II, with Box E checked.

A

Short-term covered:

• Reported to you in Section 1 of Form 1099-B.

• Reported to the IRS on Form 8949, Part I, with Box A checked.

A

C

B

D

E

H

A

A

C

B

D

E

H

Form 8949

Sell50011/1/2013

Use the appropriate Form 1099-B (see top images to the right), your personal records, and the instructions

below to complete IRS Form 8949 (middle images to the right), and Schedule D (bottom images to the right)

for covered or noncovered shares. Enter the details of each transaction on a separate line of Form 8949

(see the actual form for more detailed instructions and for exceptions). Use as many Forms 8949 as needed.

A Description of property. Enter the description

F

shown on your Form 1099-B, Box 1e and Box 8.

B

C

Date acquired. Enter the date you purchased your

shares shown on your Form 1099-B, Box 1b.

instructions for Form 8949 for a detailed

listing of possible codes to be entered.

G

Date sold. Enter the date of the sale or exchange

shown on your Form 1099-B, Box 1a.

D Sales price. Enter the sales price reported to

you on Form 1099-B, Box 2a.

E

Cost or other basis. Enter the cost basis

amount shown on your Form 1099-B, Box 3,

if available. Otherwise, use your personal

records such as past statements, transaction

history, and your tax returns to obtain cost

information.

Code, if any. Please see the IRS

H

Adjustments to gain or loss, if any. Enter

any adjustments to gain or loss required

because of the code entered in column (f).

Enter negative amounts in parentheses.

A

A

B

C

D

E

F

G

B

C

D

E

F

G

H

H

Schedule D

Gain/Loss. Enter this amount in column (h)

on both the Form 8949 and Schedule D.

After subtotaling columns (d), (e), (g), and (h) on

Form 8949, transfer the figures to those same

columns on Schedule D.

The sample forms used in this brochure are

for illustration only.

D

D

E

G

E

G

H

H

*A sale that represents multiple acquisition dates will display as blank in Box 1b of Form 1099-B,

and as “various” on Form 8949.

4

5

Adjustments to cost basis

Vanguard is required to make certain adjustments

to the initial cost basis of covered securities

acquired in an account. We’ll adjust the basis of

securities for commissions and transfer taxes

related to the acquisition of the security. We’ll

also adjust the basis for any organizational actions

reported by the issuer. However, we generally

won’t adjust for transactions, elections, or other

events occurring outside the account.

Wash sales: Under tax rules, the deduction

for a loss realized on the sale of a security is

disallowed if, within 30 days before or after the

sale, a substantially identical security is acquired.

Any loss that is disallowed is added to the basis

of the acquired security. Vanguard will adjust the

basis of securities held in the account for losses

that are disallowed due to a wash sale, but only

if both the purchase and sale of an identical

security (a security with the same CUSIP) occur

in the same account. You must adjust the basis

of a security if a wash sale occurs as a result of:

• The purchase of a substantially identical

security that isn’t an identical security.

• A purchase that occurs in a different account

than the sale.

Another adjustment we’ll make: Vanguard will

also adjust the basis of a security issued by a

regulated investment company (RIC) or real estate

investment trust (REIT) that has undistributed

long-term capital gains during the year.

A. For shares of noncovered securities that

you may have sold, Vanguard will report the

information to you on Form 1099-B, when available.

However, Vanguard won’t report any basis

information that we have to the IRS on noncovered

shares. For these shares, you must determine the

cost basis information, and you may use another

cost basis method if you meet the requirements. For

covered shares, you must use Vanguard’s default

cost basis method unless you provided Vanguard

with another cost basis method at the time of the

sale. However, it’s important to understand that

what Vanguard is required to report to the IRS may

be different from what you must report to the IRS,

and you may need to make adjustments on IRS

Form 8949. Having your own records will certainly

help you make these adjustments, if any are needed.

Adjustments we won’t make: Vanguard doesn’t

consider constructive sales or mark-to-market

adjustments in determining the holding period of

securities sold for a gain or loss.

Frequently asked questions

Q. What adjustments haven’t been

incorporated into my cost basis?

Q. What’s a wash sale?

A. Brokers are only required to make some of

“substantially identical” security is purchased up

to 30 days before or 30 days after the date of the

sale, the loss is disallowed and can’t be deducted.

The disallowed loss is added to the basis of the

purchased security, thereby reducing future gains or

increasing future losses. Vanguard will make some,

but not all, of the adjustments for wash sales.

the possible wash sale adjustments that must

be considered in order to file your income tax

return. We won’t make wash sale adjustments

when the purchases and sale occur in different

accounts or when they are between substantially

identical securities that have different CUSIPs.

We also won’t make the following adjustments:

adjustments.

short-term losses.

• Hedging transactions or offsetting positions.

(See IRS Publication 550.)

7

Form 1099-B has up to five separate sections

to clearly identify whether the cost basis is

reported to you and the IRS, reported only to

you, or not available. These separate sections are

created dynamically based on the activity in your

account and will make it easier for you to complete

IRS Form 8949, Sales and Other Dispositions of

Capital Assets.

You must determine short-term or long-term and

report on Form 8949, Part I, with Box B checked,

or on Form 8949, Part II, with Box E checked, as

appropriate.

Section 1: Short-term transactions for which basis

is reported to the IRS—Report on Form 8949, Part I,

with Box A checked.

Box 1c is labeled “Short-Term,” and Box 6b is

labeled “Basis reported to IRS.”

Section 2: Short-term transactions for which basis

is not reported to the IRS—Report on Form 8949,

Part I, with Box B checked.

after January 1, 2012, which are subsequently sold.

All other information is provided to you as a courtesy

and isn’t sent to the IRS.

8

Vanguard will display cost basis information for

covered and noncovered shares for securities

on Form 1099-B if we have complete information.

If a portion of the position doesn’t contain

complete cost basis information, it’ll be reported

in Section 5 on Form 1099-B.

Vanguard is required to report the sales of

covered securities by S corporations if the

securities were acquired on or after January 1,

2012. Prior to the 2012 tax year, you received

a courtesy Form 1099 Consolidated. Now we’ll

identify the covered transactions to show which

ones will be reported to the IRS.

We’re required to treat your corporation as an

S corporation unless we received a Form W-9

indicating that it’s a C corporation.

Box 1c is labeled “Long-Term,” and Box 6b is

labeled “Basis reported to IRS.”

A. We report information about shares purchased

How Vanguard displays

cost basis information

S corporation reporting

Section 3: Long-term transactions for which basis

is reported to the IRS—Report on Form 8949,

Part II, with Box D checked.

Q. What information does Vanguard report

to the IRS about S corporations?

• Constructive sales and mark-to-market

Section 5: Transactions for which basis is not

reported to the IRS and for which short-term or

long-term determination is unknown (to Vanguard).

Box 1c is labeled “Short-Term,” and Box 6a is

labeled “Noncovered security.” The information in

Boxes 1b, 1c, 3, and 5 reflects Vanguard’s records

and won’t be reported to the IRS. You’re solely

responsible for the recordkeeping and accuracy of

this information.

A. When a security is sold for a loss and a

• RIC and REIT adjustments with respect to certain

6

5 separate sections of Form 1099-B

Q. I track my own cost basis; do I have

to use Vanguard’s information?

Nondividend distributions (return of capital):

Vanguard will make adjustments to your cost basis

by the amount of the nontaxable distribution for

the purpose of calculating the gain or loss once

the security is sold. These adjustments mainly

occur due to return of capital. The amount that

exceeds your adjusted basis is reported as long- or

short-term capital gain on Schedule D, depending

on your holding period. Please review your Form

1099-DIV, Box 3 to determine if any dividends

received represent a return of capital.

Section 4: Long-term transactions for which basis

is not reported to the IRS—Report on Form 8949,

Part II, with Box E checked.

Box 1c is labeled “Long-Term,” and Box 6a is

labeled “Noncovered security.” The information in

Boxes 1b, 1c, 3, and 5 reflects Vanguard’s records

and won’t be reported to the IRS. You’re solely

responsible for the recordkeeping and accuracy of

this information.

2

3

Reminders for using

Form 1099-B

Regulatory changes to cost basis reporting, which took

effect in 2011, triggered updates to IRS Form 1099-B, part

of the Vanguard Brokerage Tax Information Statement.

Vanguard is required to report cost basis information to

the IRS on Form 1099-B for shares that were acquired

on or after the dates listed below and later sold.

Effective dates for covered shares

Shares acquired beginning January 1, 2011:

For more information

Please see IRS Publication 550, Investment Income

and Expenses, for additional information. For copies,

call the IRS at 800-829-3676 or visit irs.gov.

Questions?

A Vanguard Brokerage investment professional will be

happy to answer questions about information provided

on your Form 1099-B. Call us at 800-662-2739 on

business days from 8 a.m. to 10 p.m. or on Saturdays

from 9 a.m. to 4 p.m., Eastern time.

•S

tocks.*

•E

xchange-traded funds (ETFs) organized as unit

investment trusts (UITs).*

Shares acquired beginning January 1, 2012:

•M

utual funds.**

• ETFs organized as regulated investment companies

other than UITs.

• Stocks acquired through a dividend reinvestment

plan (DRIP).

Bonds and options acquired

beginning January 1, 2014:

•L

ess complex bonds.***

• Most options.

Bonds and options acquired

beginning January 1, 2016:

• More complex bonds.†

• Certain options involving more complex bonds.

Visit our tax center

Go to vanguard.com/taxcenter

for Vanguard tax-related

information, forms, and the

Tax Information Statement

reference guide.

Shares that were acquired before these dates (noncovered shares) may also have cost basis information, but

this information won’t be reported to the IRS.

Sign up for e-delivery

Vanguard applies default cost basis methods unless

you’ve selected a specific method. Average cost is the

default for mutual funds, while first in, first out (FIFO)

is the default for other holdings. Consult a tax advisor

to determine the best method for you to use.

You can now receive your

Vanguard tax forms and tax

brochures by e-delivery. Sign up

at vanguard.com/edelivery.

*If your stock or ETF organized as a UIT is part of a DRIP, it isn’t

considered covered until January 1, 2012.

**Excluding money market funds.

***Generally, these are bonds and other debt obligations with fixed yield

and maturity dates.

†Generally, these are bonds and other debt obligations without fixed

yield and maturity dates.

P.O. Box 2600

Valley Forge, PA 19482-2600

Connect with Vanguard® > vanguard.com

© 2014 The Vanguard Group, Inc.

All rights reserved.

Vanguard Brokerage Services is a division

of Vanguard Marketing Corporation, member

FINRA and SIPC.

VBSCBSS 012014

Changes to your

tax reporting and

Vanguard Brokerage

1099-B

Tax preparation assistance

for brokerage investors