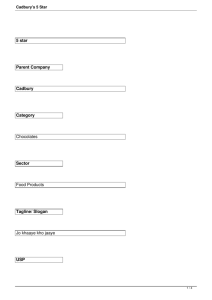

2013 Annual Report - Cadbury Nigeria Plc

advertisement