Islamic Finance

advertisement

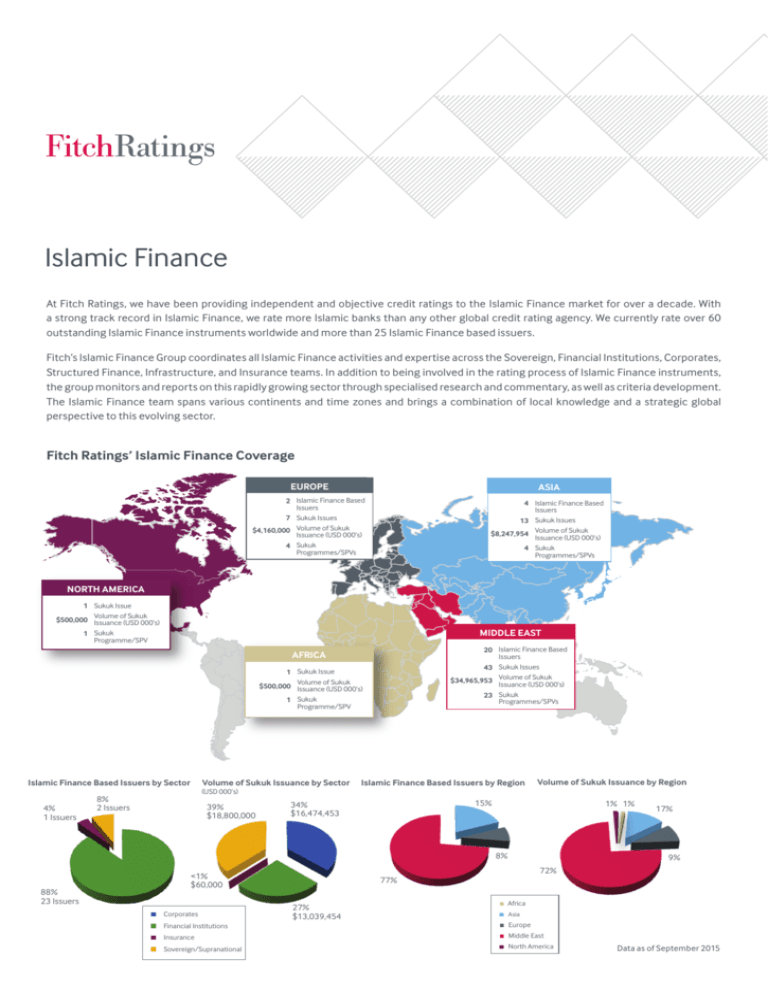

Islamic Finance At Fitch Ratings, we have been providing independent and objective credit ratings to the Islamic Finance market for over a decade. With a strong track record in Islamic Finance, we rate more Islamic banks than any other global credit rating agency. We currently rate over 60 outstanding Islamic Finance instruments worldwide and more than 25 Islamic Finance based issuers. Fitch’s Islamic Finance Group coordinates all Islamic Finance activities and expertise across the Sovereign, Financial Institutions, Corporates, Structured Finance, Infrastructure, and Insurance teams. In addition to being involved in the rating process of Islamic Finance instruments, the group monitors and reports on this rapidly growing sector through specialised research and commentary, as well as criteria development. The Islamic Finance team spans various continents and time zones and brings a combination of local knowledge and a strategic global perspective to this evolving sector. Fitch Ratings’ Islamic Finance Coverage EUROPE ASIA 2 Islamic Finance Based Issuers 7 Sukuk Issues $4,160,000 Volume of Sukuk Issuance (USD 000’s) 4 Sukuk Programmes/SPVs 4 Islamic Finance Based Issuers 13 Sukuk Issues $8,247,954 Volume of Sukuk Issuance (USD 000’s) 4 Sukuk Programmes/SPVs NORTH AMERICA 1 Sukuk Issue Volume of Sukuk $500,000 Issuance (USD 000’s) 1 Sukuk Programme/SPV MIDDLE EAST 20 Islamic Finance Based Issuers 43 Sukuk Issues $34,965,953 Volume of Sukuk Issuance (USD 000’s) 23 Sukuk Programmes/SPVs AFRICA 1 Sukuk Issue Volume of Sukuk $500,000 Issuance (USD 000’s) 1 Sukuk Programme/SPV Islamic Finance Based Issuers by Sector 4% 1 Issuers Volume of Sukuk Issuance by Sector Islamic Finance Based Issuers by Region Volume of Sukuk Issuance by Region (USD 000’s) 8% 2 Issuers 39% $18,800,000 15% 34% $16,474,453 1% 1% 17% 9% 8% 88% 23 Issuers <1% $60,000 Corporates Financial Institutions 9% 72% 77% 27% $13,039,454 Africa Asia Europe Insurance Middle East Sovereign/Supranational North America Data as of September 2015 Criteria Fitch Ratings’ dedicated Islamic Finance criteria is outlined in the criteria report Rating Sukuk and applies to originator-backed (also called asset-based) sukuk structures, in which investors rely upon obligor direct support features and contractual commitments built into the sukuk documentation. The originator typically incorporates a purchase undertaking, whereby the obligor is committed irrevocably to repurchase the assets on maturity (or earlier, in the event of any dissolution event or default), covering in full the outstanding principal, and any accrued but unpaid periodic distribution amounts in a timely manner, during the life of a sukuk or at any dissolution event. These criteria do not apply to asset-backed sukuk, which rely on underlying collateral. Research & Commentary The Islamic Finance Group publishes a wide range of specialised research and commentary across sectors and regions on major developments, industry outlooks, and market trends, including Rating Action Commentaries (RACs), Fitch Wires, and special reports. Recent examples include: • Sukuk Issuance Slows in 1H15; External Conditions Drag • Fitch Rates Noor Sukuk’s New Trust Certificate Issuance • Oman Central Bank Shows Commitment to Islamic Banking Programme ‘A-(EXP)’ • Islamic Development Bank Affirmed at ‘AAA’; Outlook Stable • Liquidity Initiatives Benefit Bahrain, UAE Islamic Banks • Saudi Sovereign Borrowing Could Spur Corporate Sukuk • Why a Centuries-Old Form of Financing is Hot Today • Two Flourishing Financial Segments Crisscross • Infrastructure Sukuk Challenge Significant But Achievable • Fitch Rates Indonesia’s Proposed PPSI-III Sukuk ‘BBB-(EXP)’ • Fitch Rates Bahrain Mumtalakat Holding Company’s Trust • Fitch Rates DIB Sukuk’s New Issuance ‘A(EXP)’ • Fitch Assigns Barwa Bank Q.S.C. ‘A+’ IDR; Outlook Stable Certificate Issuance & EMTN Programmes • New Sukuk Rules May Help UAE Expand into Regional Hub Data as of September 2015 For More Information For further information on Fitch’s Islamic Finance ratings, visit info.fitchratings.com/islamicfinance Contact us Hossam El Ansary Director Business & Relationship Management Dubai +971 4 424 1204 hossam.elansary@fitchratings.com Bashar Al Natoor Global Head of Islamic Finance Dubai +971 4 424 1242 bashar.alnatoor@fitchratings.com About Fitch Ratings Fitch Ratings is a leading provider of credit ratings, commentary and research. Dedicated to providing value beyond the rating through independent and prospective credit opinions, Fitch Ratings offers global perspectives shaped by strong local market experience and credit market expertise. The additional context, perspective and insights we provide help investors to make important credit judgments with confidence. fitchratings.com ET20033/091015 Fitch Group is a global leader in financial information services with operations in more than 30 countries. In addition to Fitch Ratings, the group includes Fitch Solutions, a leading provider of credit market data, analytical tools and risk services; Fitch Learning, a provider of learning and development solutions for the global financial services industry; and BMI Research, a provider of country risk and industry analysis specializing in emerging and frontier markets. Fitch Group is majority-owned by Hearst Corporation.