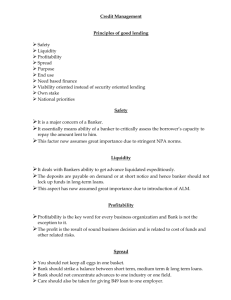

Disbursement Handbook - African Development Bank

advertisement