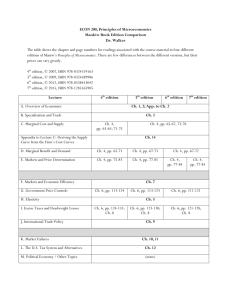

Commerce & Management

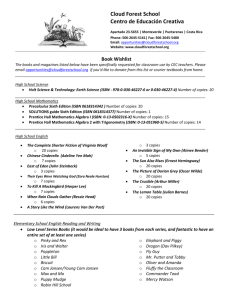

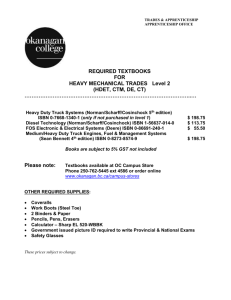

advertisement