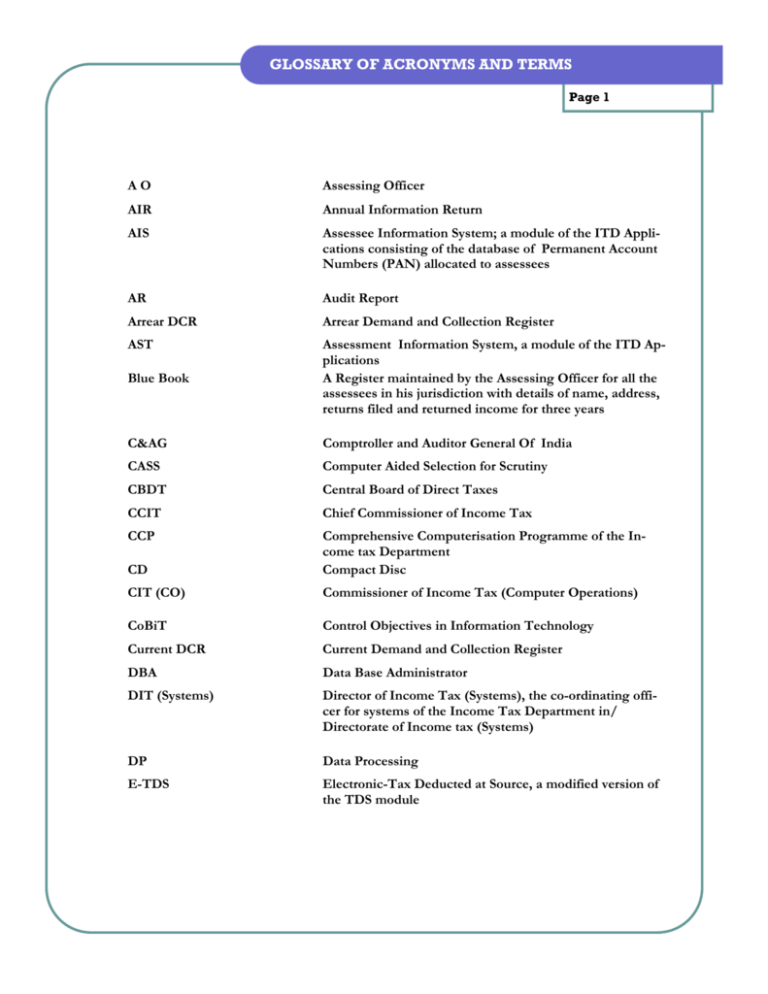

IT Audit of AST system in Deptt of Revenue, Govt of India

advertisement