The Role of Mobile Strategy and Use Case in Driving Business Value

Introduction

With the introduction of the smartphone, organizations have wrestled with how to appropriately

establish mobility as a core technology, whether in response to demands for BYOD, the need for

secure data and network access, or to the LOBs clamoring for mobile apps. Projections are that, within

two years, three-quarters of customer interactions will originate from mobile devices. That may help

explain why the CIO – once among the biggest skeptics of mobility – has become one of its biggest

champions.1

Current estimates are nine out of ten CIOs expect to deploy mobile apps over the next 12 months.2

But, here’s the problem – research reveals that only about one-half of organizations have a mobile

strategy.3 A strategy is needed to ensure the effort and outcomes truly benefit the organization.

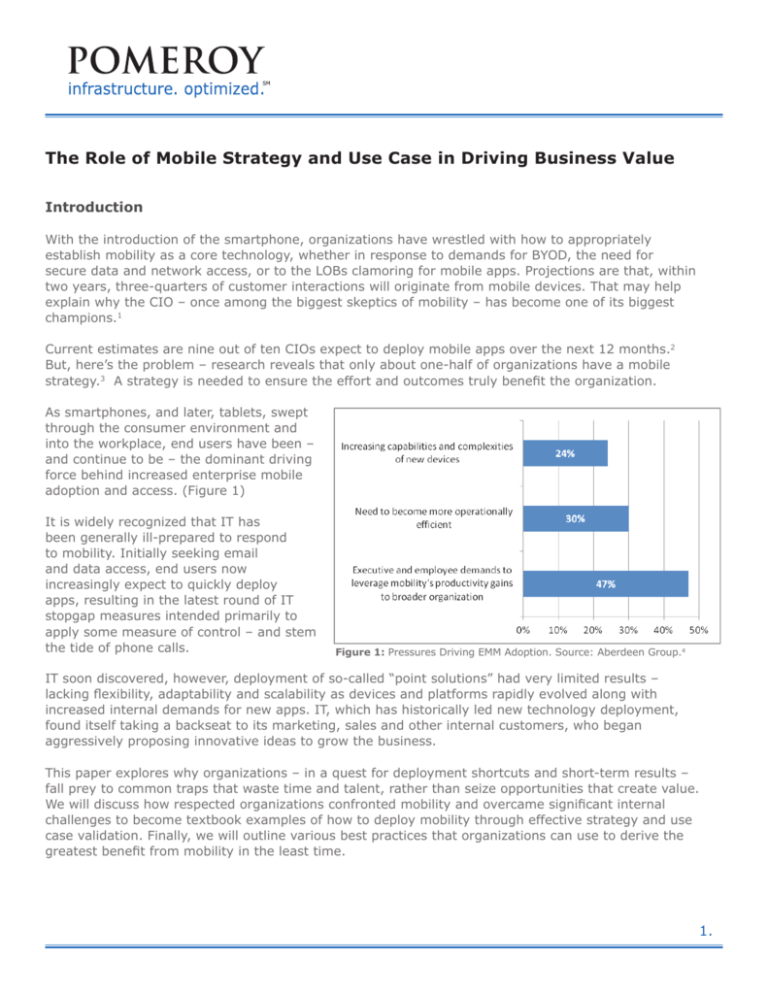

As smartphones, and later, tablets, swept

through the consumer environment and

into the workplace, end users have been –

and continue to be – the dominant driving

force behind increased enterprise mobile

adoption and access. (Figure 1)

It is widely recognized that IT has

been generally ill-prepared to respond

to mobility. Initially seeking email

and data access, end users now

increasingly expect to quickly deploy

apps, resulting in the latest round of IT

stopgap measures intended primarily to

apply some measure of control – and stem

the tide of phone calls.

Figure 1: Pressures Driving EMM Adoption. Source: Aberdeen Group.4

IT soon discovered, however, deployment of so-called “point solutions” had very limited results –

lacking flexibility, adaptability and scalability as devices and platforms rapidly evolved along with

increased internal demands for new apps. IT, which has historically led new technology deployment,

found itself taking a backseat to its marketing, sales and other internal customers, who began

aggressively proposing innovative ideas to grow the business.

This paper explores why organizations – in a quest for deployment shortcuts and short-term results –

fall prey to common traps that waste time and talent, rather than seize opportunities that create value.

We will discuss how respected organizations confronted mobility and overcame significant internal

challenges to become textbook examples of how to deploy mobility through effective strategy and use

case validation. Finally, we will outline various best practices that organizations can use to derive the

greatest benefit from mobility in the least time.

1.

MDM is not a strategy.

On the Mobile Maturity

scale (of IT mobile life

cycle support capabilities),

Mobile Device Management

(MDM) is the first phase

of deployment for most

organizations – establishing

control and governance over

corporate-liable devices

and an increasing array of

personal devices, on both the

platform (e.g., iOS, Android,

BlackBerry), and form factor

(e.g., tablet, smartphone,

laptop) levels. (Figure 2)

Mobile Life Cycle

Management

Mobile Service

Management

Mobile Device

Management

•Organizational Readiness

•IT Readiness

•Strategy Development

•Device and Service

•Provisioning and Security

•Mobile Operations and Support

•Service Desk Support

•Compliance and Security

•Data Loss Prevention

•Expense Management

•Full Mobilization and Productivity

•App Development, Provisioning and Management

•Analytics

•Activity Tracking, Trending and Reporting

•Continual Service Improvement

Some IT organizations

are content to stop there;

Figure 2: Three Stages of Mobile Maturity

however, all they have

accomplished is a defensive (reactive) maneuver – one that fails to exploit the strategic potential of

mobility and provide a return on investment.

IT and the LOBs must step back to see the big picture – the short and long-term needs and

opportunities for the enterprise, as well as those of end users. While the big picture includes end

users and LOBs as primary drivers of technology adoption and app development, it must include a

broader enterprise plan with a timeframe extending 12-18 months.

An app is not a strategy, either.

A global manufacturer’s sales organization was requesting senior level approval to develop new

mobile apps. One field sales app promised to dramatically enhance sales call productivity by

enabling remote network access of secure company and customer data, allowing the sales rep to

identify unmet customer needs and close more sales.

The LOBs assured senior leadership all necessary due diligence had been performed – risk and

security assessments, and cost/benefit analysis – and an MDM technology solution had been

identified. IT, which had not been a party to use case development, expressed concerns regarding

security risks and app support requirements.

For its part, senior leadership expressed doubts whether the organization was prepared to

proceed, citing the lack of a strategy and risk mitigation. It raised questions about broader internal

capabilities to deliver the desired outcomes, and the commitment to provide ongoing availability

management and support.

Outside mobility experts were engaged to evaluate organizational readiness, make

recommendations regarding people, processes and technology, and establish a strategy and tactical

roadmap. Following a two-week study, the strategy and deployment plan were approved on the

basis of thorough readiness and risk assessments and use case validation. Several apps with the

2.

greatest short-term impact were prioritized for immediate development. As a result, measurable

business value would be realized in a matter of weeks through a new collaborative effort between

the LOBs and IT.

According to Propelics, a leading mobile strategy and app development company, it is vital to

understand the difference between an app and a strategy. “It’s important to understand what you

hope to achieve with mobile. Is it to increase revenue, shorten sales cycles, improve the customer

experience, or make your employees more productive? It could be all of them.”

Ready… Fire… Aim! How the best intentions derail the realization of value.

“It’s not uncommon for LOBs to act in their own self interest rather than

seeing the corporate implications of their wants/needs. A balance is required

in assessing mobile apps to ensure they meet the needs not only of the

LOB, but also the needs of the organization as a whole.” 5

Too many organizations launch mobility with a tendency to be ill-prepared – armed with suboptimal

solutions and insufficient analysis regarding exactly where they are going, what resources are

required, and what long-term success looks like.

Perhaps because mobility is relatively new and creates a sense of urgency, it encourages a

pioneering spirit among champions and end users. Too often, however, mobility isn’t subjected to

the discipline of stakeholder analysis, risk assessment and use case scrutiny typically required in

other enterprise or IT infrastructure initiatives. As a result, there are four key areas where this

breakdown becomes evident and significant.

Vision and Strategy. Too few companies invest the intellectual capital necessary to establish from

the outset a vision and strategy for mobility. Because some IT and LOB managers are short-sighted

and reactive, they fall into the trap of reacting to BYOD end-user demands, departmental pet

projects, or LOB concerns over losing ground to competition.

Strategy revolves around the rationalization of demand – the identification of business drivers

and evaluation of stakeholder and customer needs. It comprehends the type and maturity of use

cases coming from the LOBs. The strategy articulates how overall mobile success is defined and

how the use cases create value. Cool apps have no place in the marketing portfolio if it cannot be

established how they improve business results in terms of:

• productivity

• revenue

• profitability

• customer loyalty

Process. Companies often fail to follow a deterministic process when deploying mobility, evaluating

use cases and building a roadmap. This can be largely attributed to the fact mobility brings with it a

wide range of complex issues that are unfamiliar to organizations – for example, making it difficult

to get a grip on IT policies, processes and end-user support; and governance, risk and compliance

issues.

The often overwhelming demand to enable devices results in a rush to deployment, whereby use

cases are not adequately evaluated on the basis of demonstrated value. A process must be

3.

established that identifies and prioritizes valid use cases – those with the greatest potential value,

and deployable in a short amount of time.

Analysis. Organizations run the risk of not performing thorough due diligence on several levels,

including analysis that –

• establishes enterprise and stakeholder needs

• assesses infrastructure, network and data security

• establishes cost/benefit

• identifies management and support requirements, capability gaps, and IT - organizational

readiness – the people, processes and technology required to deploy and support mobility.

Resources. At the end of the LOB presentation, the CFO wanted to know, “And how exactly will

this be paid for?” The all too common lack of planning invariably leads to the realization that

funding is either inadequate or nonexistent, leading managers to scramble for sponsors who can

fund the mobility initiative.

More significant, however, is the short supply of knowledgeable professionals on mobile technology

process and design. Will the organization have the people to plan, develop, deploy and support

the proposed use cases? More than a few managers have seen their mobility initiatives come to a

sudden halt due to lack of resources.

Organizations must decide early in the planning process if they are capable of objectively

evaluating organizational readiness, risk exposure, business and governance requirements, and

capability gaps. Too much is at stake for managers to acquiesce to internal overconfidence that

the organization can get it right. As the manufacturer learned in the earlier case study, outside

expertise may be the best insurance to make sure the vision is relevant, the strategy achievable,

and the delivery of business value, assured.

What drives value? A healthcare organization plays ‘whack a device.’

A respected, metropolitan healthcare organization found itself wrestling with the chaotic onset of

BYOD, driven by departmental end users with various use cases for mobility. While IT appropriately

established itself as governance gatekeeper – requiring acceptable use agreements, controlling

network access, tagging corporate assets, and providing limited end-user hardware and software

support – departments were allowed wide discretion in device purchasing and virtually unrestricted

device use.

For example, some physicians were allowed to use tablets for collaboration, meeting notes and

email. In other areas of the hospital, patients’ families were provided loaner tablets for personal

entertainment, with IT setting up and wiping the devices with each use. Meanwhile, in other areas

of the hospital, few mobile devices were similarly adopted.

Nevertheless, IT was reacting daily to a random series of end-user requests, crisscrossing devices

and platforms that were beginning to stress the hospital’s clinical wireless network. Without a

corporate strategy, an almost anything-goes environment was effectively sanctioned.

The organization has yet to determine the value that might be realized if mobility were applied to

the entire stakeholder community – taking advantage of emerging opportunities to improve peer

collaboration or patient care across the entire organization. As it stands, hospital administrators

and IT are just beginning to recognize their current mobile practices are unsustainable.

4.

“…mobility is one of the most transformational movements in healthcare

and represents the new face of user engagement. HDO (health delivery

organization) CIOs need to assess how mobility opportunities and

challenges will impact their organizations.” 6

Whether in healthcare, manufacturing or retail, mobility must drive value in one or more ways –

through productivity, revenue or new business opportunities. The chart below is a good starting

point for framing discussions around strategy, business drivers, rationalizing use cases and the

creation of value.

Theme

Drivers

Examples

Mobility as

Productivity

Enhancer

Mobility as

Productivity

Enhancer

Mobility as New

Business Model

Enabler

Run the business better

Grow the business

Transform the business

• Productivity

• Faster response time

• Improve brand image with

potential hires

• Increase revenue

• Increase customer satisfaction

• Increase customer engagement

• Customer loyalty

• Competitive response

• Brand image with customers

• New revenue stream

• New market

• Business model disruption

• New products and services

• B2E: Email, calendaring,

virtual desktop access, field

force enablement, management

dashboards

• B2C: Store applications, store

locator

• M2M: Remote monitoring of

equipment, devices, processes

• B2E: Sales force enablement,

mobile POS

• B2B: Agent enablement

• B2C: Mobile couponing

• M2M: Vending machine telemetry

• M2M: Connected car,

connected home, smart grid

• B2C: Retail ‘geofencing’

Figure 3: Mobility Value Map. Source: Gartner.

Strategy and use cases that drive the greatest value in the least time

Today, enterprise IT functions are based upon large applications – ERP, CRM, sales force

automation and supply chain management – and these are being rapidly adapted for mobility. By

2015, 50% of business application use by managers and end users alike will be by mobile device.7

Aberdeen Group, in its annual study

of enterprise mobile app adoption

analyzed B2C, B2B and B2E (business to

employee) app adoption plans among 345

organizations worldwide. The research

reveals not just current app development

plans, but how enterprise priorities

are shifting, e.g., to help drive internal

productivity.8 (Figure 4)

Mobility has the greatest impact on the

enterprise when applications are based

upon validated use cases that enhance

employee ability to do their jobs, or make

it easier for existing and new customers

to acquire your products and services.

The improvement in employee or sales

productivity should be measureable - and

Figure 4: Mobile Software Strategy Evolution, 2011-12. MSI – Mobile

Software Initiative. EMA – Enterprise Mobile Apps

5.

be measured - over time to establish both value and life cycle effectiveness, as the life expectancy

of applications is generally a matter of months in many cases.

As noted earlier, developing an effective mobile strategy includes evaluating and prioritizing use

cases, first by rationalizing the business demand and running them through validation “filters,”

because some apps will not result in a return on investment.9

• How will customers want to interact with the business in the future? What about employees,

distributors and resellers?

• What are the productivity, revenue enhancement and business transformation opportunities?

• What apps do we need and how do we prioritize them?

• How do we evaluate the need for MDM, cloud/SaaS or on-premise solutions?

• How will we demonstrate apps will deliver measurable business value vs. perceived value?

A critical step is to understand current state maturity to develop, deploy and support the highest

priority use cases and do so in a logical manner. These should be accomplished in small steps

as part of a methodical process that does not require significant expense or capital, but which

results in a short time-to-market. This evaluation – including a go-to-market tactical plan – can be

accomplished in as little as 2-4 weeks.

• What new competencies and capabilities (people, processes and technology) are required by

IT and LOBs?

• How do we integrate various mobile devices with our corporate data stores?

• What type of policies must be established, including regulatory, legal and human resource

issues?

• What infrastructure and security aspects must be evaluated, including network, data and

device/platform?

A retailer rationalizes use cases to find the “critical few” winners.

Recently, a specialty footwear retailer, the largest in the western hemisphere, planned to deploy

mobility in its retail environment of over four thousand stores. IT managers engaged the business

teams to better understand their needs, identifying 10-12 use cases designed to support both

sales associates and consumers. IT also initiated broader discussions to analyze the needs of an

expanded group of stakeholders – operations, distribution and store development.

The analysis dramatically changed their working assumptions on device, platform, infrastructure

and security requirements, as the number of primary stakeholders increased dramatically, and

use cases swelled to over 120. A deadlock inevitably ensued among stakeholders due to a lack of

consensus over how – and whose – use cases would be prioritized and funded.

A breakthrough occurred as this paper was in development. Senior managers charged IT and

the LOBs with developing a strategy and assessing readiness – to include people, process and

technology capability gaps; risk exposure; security, business, long-term support and funding

requirements.

At this writing, it appears the strategy and ultimate deployment will take a prudent approach in

recognition of internal resource constraints. Rather than commit to too much, too soon, the tactical

roadmap being prepared will be based upon “bite-sized” objectives, targeting development of a

6.

critical few use cases. These select use cases would represent the best opportunities for “quick

wins,” and delivery of improved sales associate productivity, sales revenue and time-to-market of

just a few weeks.

Are we ready and where do we start?

It isn’t difficult to avoid the common dilemmas organizations encounter – lack of strategy, process,

analysis and adequate resources. A balanced approach is required, one that comprehends both

short and longer term perspectives – an understanding of the organization’s needs over the next

12-18 months.

Know where you’re going. Step one is to develop a basic plan, even if it doesn’t cover the entire

organization. What do we want mobility to accomplish for us and our customers? The plan can

start out small, limited to the first few use cases that allow you to get mobility off the ground, and

establish a logical framework that says, if we do “x” to accomplish “y,” we can expect a benefit of

“z.”

Know you’re working on the right things. In many respects, this is the most straight-forward

task of all – picking those use cases that are most meaningful to the company, and whose value

can be measured. These use cases will have sponsors and funding. They will align to the direction

of the company and to the needs of stakeholders. The best use cases have a short time-to-market

and payback.

Understand your requirements and limitations. As with any initiative seeking to modify or

transform some aspect of the organization or IT infrastructure, it is critical to understand the

people, processes and technology issues related to mobility. Short-term mindsets can conflict with

the need for thorough risk assessment, business and policy requirements, or cost/benefit and

capability gap analyses – yet these are the foundation that determines how successful we will be.

Fortunately, the due diligence involved does not require a significant amount of time to accomplish.

Organizations conduct IT and organizational readiness assessments and build actionable plans in as

little as four weeks.

Forge an IT – LOB partnership. IT Service Management (ITSM) espouses a service-oriented

approach for IT – viewing stakeholders as customers, and making it a practice to understand their

needs in order to better support them. Unlike most technology deployments where IT is the SME,

under mobility, LOBs bring the critical perspective – how the technology will be applied, and the

value derived from it. For this reason, IT should form a working partnership with end users. As a

result, IT receives the infrastructure, management, support and security mechanisms it requires,

while, at the same time, enabling the LOBs to quickly deploy mobile solutions.

Seek expert input and process expertise.

“Enterprises are turning to external service providers for help in mobility

initiatives for the following reasons: lack of internal capabilities, new set of

unfamiliar issues, quest for innovative thinking on the “art of the possible”

and the need for speed.” 10

7.

Most organizations lack the specialized skill sets – internal capabilities, process mindset and

innovative thinking required to effectively plan, design, build, deploy and support mobility. If

there’s one take-away from the experiences of the organizations discussed earlier, it is simply this—

they were making significant decisions without benefit of strategy or adequate understanding of the

risks and requirements. Most crippling of all, they lacked both a process and roadmap to effectively

accomplish these critical tasks.

As these organizations struggled with the issues of mobile deployment, they ultimately decided that

objective, outside expertise would be critical to success – helping them focus their efforts, uncover

critical gaps, increase speed to market, and measurably improve their business results.

Final Thoughts

In our view mobility will continue to represent a significant challenge for organizations at all

levels of mobile maturity for some time because, as IBM and others have observed, “… enterprise

mobility is not simply a layer on top of existing business processes, but is instead transformative to

the entire organization.”11

Perhaps that helps explain why, according to surveys, while most CIOs now embrace mobility, they

readily admit BYOD is still very much a problem to be addressed. Of course, it’s much bigger than

that – organizations continue to struggle with how to manage corporate-owned devices, as well.

In our experience, it is only when organizations rationalize use cases based upon business drivers,

requirements and value, that the people, process and technology issues come onto focus for the

first time.12, 13

As with any aspect of the IT infrastructure, the successful deployment of mobility is dependent

on two fundamentals – effective planning and execution. Both of them, in turn, are dependent on

leadership at every level of the enterprise.

About Pomeroy

Pomeroy provides high quality managed IT infrastructure services, professional and staffing

services and procurement and logistics services to Fortune 500 corporations, global outsourcers

and the public sector throughout the U.S., Canada and Europe. A recognized leader in the service

desk and managed desktop services markets, Pomeroy’s ITIL certified professionals employ a

process-centric approach to working with clients, either remotely or on-premise, to plan, design,

deploy, manage and ultimately optimize each client’s IT infrastructure, leading to the creation of

tangible business value and return on IT investments. Learn more at www.pomeroy.com.

8.

REFERENCES

1

“Mobile and the Nexus of Forces: Creating the New Experience,” Gartner, June, 2012. 2“The ‘Enterprization’ of Mobile Apps:

Moving from Corporate Liability to Business Asset,” J. Gold Associates, December, 2012. 3“The Need for IT to Get in Front

of the BYOD Problem,” Osterman Research, October, 2012. 4“Enterprise Mobility Management 2012 – The SoMoClo™ Edge,”

Aberdeen Group, April, 2012. 5“The ‘Enterprization’ of Mobile Apps: Moving from Corporate Liability to Business Asset,” J.

Gold Associates, December, 2012. 6“As the Mobility Movement Gains Momentum, Healthcare Delivery Organizations Must

Prepare to Adapt,” Gartner, May, 2012. 7“Mobile and the Nexus of Forces: Creating the New Experience,” Gartner, June,

2012. 8“Mobile Software Strategy Evolution, 2011-2012,” Aberdeen Group, December, 2012. 9“IT Strategy to Support

Mobile,” Propelics, November, 2012. 10“Emerging Service Analysis: Enterprise Mobility Consulting, Application Development

and Integration Services,” Gartner, December, 2011. 11“Market Alert: IBM Goes All Out, Puts Mobile First,” Aberdeen

Group, February, 2013. 12“The Need for IT to Get in Front of the BYOD Problem,” Osterman Research, October, 2012.

13

“Emerging Service Analysis: Enterprise Mobility Consulting, Application Development and Integration Services,” Gartner,

December, 2011.

© Pomeroy, 2013. All rights reserved. All trademarks, trade names, service marks referenced herein are the property of

their respective companies. V1313.

Would you like to speak with us about the clients featured in this paper? Click here.

9.

![CHEER Seminar Promo: 2nov2015 [DOC 142.50KB]](http://s3.studylib.net/store/data/007520556_1-22ae8f83ff74a912c459b95ac2c7015c-300x300.png)