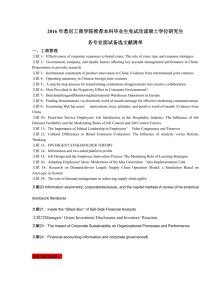

Information Asymmetry, Institutional Trading, and Cost of Capital

advertisement