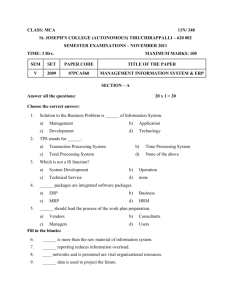

Computerized Accounting Systems: Study Notes

advertisement

ACCOUNTING IN COMPUTERISED ENVIRONMENT 1) Write short notes on a) Computerized Accounting System, b) Computer Software, c) Accounting Software. Computerized Accounting System is the system of accounting for transactions and recording of financial information in a Computerized Information Systems (CIS) Environment, i.e. using Computers and Computer Software. CIS Accounting has the following salient features – a) Processing of financial information is by one or more Computers. b) Processing is done using Computer Software (either Pre-packaged or acquired or customized / developed). c) Computer(s) may be operated either by the Entity itself or by a Third Party (i.e. Service Bureau ). Computer Software includes any program or routine that performs a desired function(s), and the documentation required to describe and maintain that program or routine. Accounting Software is a Computer Software used for the accounting functions, i.e. recording of transactions, reporting of financial information, generating analytical reports, e.g. Ageing Analysis of Debtors, etc. 2) Outline the advantages and disadvantages of a Computerized Accounting System over a Manual Accounting System. List the benefits of a Computerized Accounting System. a. Advantages / Benefits: Single Point Entry: Single Point Entry of a transaction will automatically update all the related ledgers and records. Speed: CIS Accounting System can support heavy volumes of transactions, with speed and quick recording. Accuracy: Tallying of Trial Balance, correct posting into the General Ledger and Subsidiary Ledger, etc. do not create difficulties in a CIS Accounting System. Arithmetical accuracy can be easily assured. Analytical Review: Detailed analytical review of financial data is possible, e.g. product-wise and area-wise sales analysis, percentage of each expense to total, Ratio Analysis, etc. Financial Analysis: Financial Statements can be prepared quickly. For every transaction, the effect on the B/S and P&L can be ascertained immediately. Dayto- day Cash Flow and Fund Flow Analysis can also be handled easily. Budget Comparison: GS Accounting helps in comparison with budget figures, through preparation of Variance Reports and Performance Reports. Eco-friendly: Voluminous paper use can be avoided. Only exception and summary reports can be printed. Voucher Generation: OS Accounting can be effectively used to generate vouchers and documents online, and to print them on need basis. For example, Sales Invoices generated by the system can be printed and delivered to customers, while other internally used documents need not be printed, since the system "records" the data and voucher automatically. Page No. 1 b. Disadvantages: Data Security: Data Security is a cause of concern, since data is not stored in hard copy format, but only in soft copy (i.e. data files). Unauthorized Access: Unauthorized access and copying of confidential financial information can happen without any trails or loss of data to the Owner. Unauthorized access can be had through LAN or through the internet by hacking into the Company Server. Risk of Unauthorised Access increases in case of outsourcing accounting to a Service Bureau (Third Party). Data Integrity: Loss of data due to software snags or corruption of data files is a serious threat in CIS accounting. These can happen unintentionally or inadvertently, while updating a new module or repairing an existing system. 3. What do you mean by “Codification of Accounts"? What are its benefits? Give an example of “Codified Accounts”. Codification: Codification of Accounts is a system whereby different ledger accounts are assigned Codes (i.e. Numbers) which would communicate their nature (Income, Expense, Asset, Liability, etc.) Benefits: It reduces the possibility of duplication, i.e. same account existing in several names due to spelling mistakes or abbreviations used. Codes can be used in both Manual and CIS Accounting Systems. It is beneficial where there are numerous account heads and the complexity is high. Systematic Grouping: o Meaning: Grouping refers to categorizing of different Ledger Accounts under different heads / groups e.g. Fixed Assets, Current Assets, Receivables, Term Liabilities, Suppliers, Operating Income, Non-Operating Income, etc. o Significance: Systematic Grouping is a pre-condition for proper codification, since each Ledger under a Group will have similar coding pattern. Basis for Grouping: Grouping and Codification is dependent upon the type of Enterprise and the extent of subdivision required for reporting on the basis of Profit Centers or Product Lines. 4. List the different ways of maintaining accounts In a CIS Environment. 1. Spreadsheets (Example: MS Excel), 2. Pre-Packaged Accounting Software (Example: Tally, Acc. Pro), 3. Customized Accounting Packages, i.e. specific for each entity, 4. ERP Software, and 5. Outsourcing of Accounting Functions. 5. Explain the merits and demerits of maintaining accounts through Spreadsheet Software. Page No. 2 Advantages Disadvantages 1. Spreadsheets are very simple to use, i. Spreadsheet Packages can and easy to understand. accommodate data only up to a specified 2. Grouping and re-grouping of accounts limit. can be done very easily. ii. Huge volume of data will slow down 3. Functions like calculations, the package, and at times, the Data setting formula, creating macros, etc. File may not work at all. can be easily done. iii. Simultaneous Access on a Network is 4. Presentation (using Bar Diagram, not possible, since a File is Histogram, Pie-Chart, etc.) can be "locked for editing", and only one adopted for analysis of financial person will be able to have read-write information. access at a time. 5. Security features like restricted iv. Double Entry is not automatically access, locking of cells, password completed. User has to incorporate protection of formula cells, can be repetitive formulas across a number of used. files to implement double entry 6. Highly useful for small volume accounting. analytical purposes. v. Users are required to extract data independently by checking the settings and fixing the data range, etc. 6. Explain the features of Packaged Accounting Software. What are Off-The-Shelf Accounting Packages Outline their benefits and limitations. A.Features: Pre-Packaged or Off-the-Shelf Accounting Software have the following features – Available in the market for purchase and use. Pre-defined to function in a certain manner, and provide for no or low level of customization. Can be Single User Version or Multiple User Version (i.e. for usage across the LAN). Sold by Vendors in the form of Installation Software stored in CDs, or in internet downloadable set-up files. B. Functional Utilities: i. Company Information: Creation of Company along with its details such as Address, Phone Numbers, VAT Registration No. PAN, TAN, Accounting Period, etc. ii. Creation of Accounts: Ledger Accounts are created in the Master Files under different classification / group such as Asset, Liability, Income and Expenditure. iii. Updating of Financial Data: Opening Balances in various asset and liability accounts are updated in the Ledgers created as above. iv. Updating Customers / Vendors Particulars: Customers / Vendor's Name, Address and other basic details are also entered in the Customer / Vendor's Master File. v. Inventory: System of Valuation of stock like the FIFO, UFO, Weighted Average, etc. are defined in the Product Master Files. Units of measurement can also be updated. Page No. 3 vi. Reports: Reports include items like - (a) Financial Statements, (b) Bank Reconciliation, (c) Cash and Funds Flow Analysis, (d) Ageing Analysis of Debtors, (e) Ratio Analysis, etc. C. Advantages: i. They are Inexpensive compared to Customized Software. ii. They are easy to install, with installation instructions given separately in the User Manual and also appearing on screen at different stages of installation. The Installation Process is predominantly restricted to clicking on "Yes" or "No" or "Ok" buttons for appropriate instructions. iii. Packages are generally based on GUI (Graphical User Interface), and hence are menu- driven with Help options. User Manual provides most of the solutions to problems that the User may face while using the software. iv. Pre-Packaged Accounting Software have inbuilt data backup facility also. v. They provide the basic reports which are required by a business unit. vi. These packs also provide facilities of Invoice Generation, Delivery Challans, Receipts, etc. and are very effective for small and medium sized businesses. vii.There is a good facility for up gradation and continuous Vendor Support. D. Limitations: i. Standard Package may not take care of individual complexities and peculiar feature of each business. ii. All accounting related functions may not be covered by a Pre-Packed Accounting Software. Example: Some accounting packs do not provide for facility to record Stock Movements within the Factory, i.e. From Stores Department to Production Department. iii. The Software may not be able to analyze or present reports to meet all requirements. It generates only routine reports which may not suit managerial decision-making. iv. Bugs in the Software may remain for many years before it is rectified by the Vendor. v. It may not be possible to move the accounting data to another platform / software. vi. This increases the dependency of the Enterprise on the Software Vendor, for software up gradation. vii.The Software Vendor will be able to access all confidential data while on any service maintenance duty. Once the Software Code is broken in one particular Company, the perpetrator will be able to hack the software for any other Company also. Further, many Packages do not provide for different levels of access control. 7. Outline the considerations for selection of Pre-Packaged Accounting Software. Business Requirements: The Enterprise should identify its business requirements and try to match its requirement with functionalities offered by different software providers. Reports: Software which is able to provide all the requisite reports (both routine and exception reporting) in a format understandable to the User, should be preferred. Page No. 4 Ease of Use: Software which is easier to use (both interface and performance-wise), should be considered. Software which are very high on GUI may fall short on performance (speed) while handling high volume data. Cost: Packages having more features cannot be opted because of the prohibitive high costs. Support: Vendor Support is essential for any software. A Stable Vendor with reputation and good track record will always be preferred. Regular Updates: Software which is constantly updated should be preferred against those Software where Vendors do not update their Software regularly. 8. Explain the concept of Customized Accounting Software. What are the advantages of using it? a) Meaning: Customized Accounting Software refers to software developed on the basis of requirement specifications provided by the Firm. It can be developed in-house using internal resources or by engaging third party Software Developers. Such Software is a preferred choice for meeting organization-specific needs in terms of functionality, facilities and usage. b) Process: Development of Customized Accounting Package involves activities like Feasibility Study, Defining User Requirements, i.e., Requirements Specification, System Analysis, System Design, Software Development and Design, Testing and Implementation of the Software Pack, and Documentation. c) Benefits: Functional areas that are otherwise not covered in a standard package, will now get computerized. Input Screens can be tailor-made to match the Input Documents for ease of data entry. Input Devices like Bar Code Scanners can be used effectively for data capture. User-defined Reports and Additional MIS Reports can be generated as per Firm's own requirements. The system can suitably match with the Company's existing organizational structure. d) Limitations: Requirement Specifications may be incomplete or ambiguous, resulting in a defective or incomplete system. Inadequate Testing may lead to software bugs, thereby affecting the reliability of reports. Documentation to the Development activity may not be complete. Making frequent changes with inadequate Change Management Procedure, results in System Compromise. Lack of Vendor Support with regard to Support Service or Sharing of Source Code, can lead to modification problems and delays. Timeframe can neither be fixed nor are they adhered to, when developing a Software. So, there is a delay in completion of the software. Page No. 5 There may be changeover problems in moving from existing system to new customised accounting system. e) Considerations: When Software is developed through Outside Parties, Vendor Proposals are evaluated based on – Suitability, Completeness, Cost, and Vendor Profiles including Track Record. 9. What is an ERP Package? Outline the benefits of using an Accounting Package as a part of an ERP Package. What are the disadvantages of using ERP in Accounting? a) Meaning: Enterprise Resource Planning (ERP) is a fully integrated business management system covering the functional areas of an Enterprise like Logistics, Production, Finance, Accounting, Human Resources, etc. b) Purpose: ERP Packages aim at single database, single application and single user interface for the entire Enterprise. ERP takes information from every function, and assists Employees and Managers to plan, monitor and control the entire business. c) Benefits of using ERP for Accounting: Standardized Processes: ERP is a generalized package, which covers most of the common functionalities of any specific module. Reporting: The reports in an ERP package, integrate all the financial and non- financial particulars, to help Managers make an objective analysis. Integrated: Duplication of data entry is avoided as it is an integrated package. Information Use: Reliable, accurate and relevant information is available through the ERP package. d) Disadvantages of using ERP for Accounting: Lack of Flexibility: User may have to modify their business procedure at times, to effectively use the ERP. Implementation Hurdles: Many Consultants implementing the ERP Package are not able to fully appreciate the business procedure, which affects the objective implementation of the ERP Packages. Expensive: ERP Packages are priced very high and are often beyond the reach of small Firms. Complex Software: ERP Package has large number of options to choose from. Further the parameter settings and configuration makes it a little complex for the common users. Considerations: Choice of an ERP Package is based on factors like – i. Business Requirements, ii. Reports, iii. Ease of Use, iv. Cost, and v. Vendor Profiles including Track Record. [Refer Q.7 for explanation] Page No. 6 10. Explain the concept of outstanding of accounting function. What are its benefits? Also, explain the perils of outsourcing the accounting function. 1. Meaning: Outsourcing refers to assigning a third party the responsibility of managing the accounting functions of an Enterprise. The Enterprise does not manage its accounting records. The Third Party maintains the accounting software and the Client data, does the processing, and hands over the required reports from time to time. 2. Benefits: o The Enterprise can save time, and concentrate on its operations or core area of business activity. o Accounting is entrusted to specialists in the area. Data Storage and Maintenance is done by professionals. o The Firm is not affected when any person from the Accounting Department / Function leaves the organisation. o Outsourcing Approach is more sensible economically. 3. Disadvantages: The Firm's data is handed over to a Third Party, leading to loss of data security and integrity. There have been instances of leakage of sensitive information to outsiders from Third Party Processing Units. Sometimes, services provided by Third Party Units are not of the desired quality. Vendors are not able to meet the quality standards set by the Firm. Cost may ultimately be higher than initially envisaged. Third Party Service Providers are catering to number of clients thereby processing as per priority basis. This might result in delay in obtaining of services in a timely manner. 4. Choice of Vendor: Choice of Outsourcing Vendor is made on the basis of the proposals received from these Vendors. The proposals are to be evaluated based on the following criteria – a) Amount of services provided and whether the same matches with the Firm's requirements. b) Reputation and background of the Vendor. c) Comparative Costs of the various proposals. d) Quality Assurance, Data Integrity and Security. 11. Explain the criteria for selection of the method of accounting in a CIS Environment. Considerations in choosing the appropriate method of accounting (i.e. Spreadsheet (or) Pre- Packaged Software (or) Customized Accounting Package (or) ERP (or) Outsourcing] are as follows – i. Size of Operation: For small or medium operations, a Pre-Packaged Software is sufficient. If the size of the Firm is big, and its information requirements are varied and specific to its nature, the Firm may choose either a Customised Software or an ERP Package. ii. Business Requirements: Where an organisation has several nonstandard requirements, then Customised Software is the appropriate choice. iii. Complexity: If the operation is complex with several functional areas, which needs to be computerized, either a Customised Software or an ERP Package is preferable. Page No. 7 iv. Budgetary Constraints: An internally developed software could be costly initially, and cheaper to maintain in medium term. In the long run, lack of qualified people will make its maintenance costlier, ERP Packages are costlier to procure and maintain. Spreadsheets and Pre-Packaged Software are cheaper, but they are short on utilities / features. 12. Write short notes on Report Generation from Accounting Software. System Report Generation Spreadsheet Formats and Data Range to be defined by the User, for generating (both view and print) various Reports. Use of Graphs is also possible. Packages Reports are generated from the Package, as per Standard Report Definitions given in the Package, The User has to define the period of Pre-Packaged report and type of report, and the details of data required, e.g. Narration, Voucher Number, etc. Sometimes, the data may also be Software exported to Spreadsheets. Customized Reports are generated from the Package, as per User Requirements Software and specified in the earlier Stage. Report Generation is more flexible when compared to Pre-Packaged Software. ERP Reports required are first specified to the Third Party Service Bureau, Outsourcing along with their delivery times and schedules. Page No. 8