Tech-Savvy Thailand

advertisement

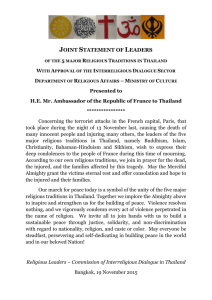

February 2015 Volume 25 No. 2 Tech-Savvy Thailand CONTENTS Page Tech-Savvy Thailand 1 News Bites / BOI Net Applications 2 Thailand: Increased Consumer and Investor Confidence 4 Industry Focus: E&E Industry 5 Company Interview: Seagate Technology 7 PWC CEO Survey 9 Bangkok, A Visitors Choice Destination 10 BOI’s Missions and Events 11 Thailand Economy-At-A-Glance 12 As Thailand surges up the ladder of economic development, the country naturally has moved away from an over-reliance upon labour-intensive industries to a more tech-savvy, knowledge-based economy. To further support this move towards a high value-added economy, the government has prioritised the development and promotion of science, research and development, technology and innovation. The Ministry of Science and Technology is now looking to increase the budget on research and development to one per cent of GDP, enhance SME’s access to technology and improve the education system, incentive system, regulations and laws. Furthermore, large funding initiatives to help Thailand develop its own technologies will be promoted in certain sectors such as clean energy, railways, automotive, electricity, water and waste management. Thailand’s National Innovation Agency (NIA) supports the nation’s innovation development with a focus on three strategic areas, namely, Bio-Business, Eco-Industry and Design & Solutions. There are also programmes to upgrade innovation capacity in the Bioplastics Industry and the Organic Agriculture Business. The National Innovation Awards is one of the NIA’s mission to promote an innovative culture in Thailand. To celebrate the 10th anniversary of the National Innovation Awards, 25 top innovative projects in the area of economic and social contribution awarded in the last decade were published in the BrandAge Essential Magazine. You can learn more about some of these projects below. Continued on P. 3 February 2015 NEWS BITES BOI NET APPLICATIONS Government Accelerating Infrastructure Development in Special Economic Zones The Government is accelerating infrastructure development, especially the logistics system, in special economic zones. The government’s policy is to promote connectivity and regional economic development on a sustainable basis. There are currently 13 major border economic areas in Thailand, with trade and investment valued at almost 800 billion baht a year. At a meeting of the Committee on the Special Economic Development Zone Policy, 19 January 2015, the Government approved an infrastructure development plan in special economic zones. The plan comprises 45 projects for 2015, which require a budget of 2.6 billion baht. Another 79 projects, worth 7.9 billion baht, will be carried out in 2016. The Ministry of Labor has been instructed to seek ways to manage migrant labor in these zones. Migrant workers will be allowed to work here and return to their countries on the same day. Moreover, relevant government agencies were told to prepare for the establishment of the zones, in terms of local public health, education, and safety measures. Bureaucratic Reform in Facilitating the Granting of Official Permission 2012 (US$ = 31.57 THB) 2014 (US$ = 32.90 THB) Number of projects Value Number of projects Value Number of projects Value Total Investment 2,582 46,773 2,237 34,334 3,469 66,738 Total Foreign Investment 1,584 20,525 1,132 16,227 1,573 31,094 Agricultural Products 85 1,026 64 742 116 2,188 Minerals / Ceramics 34 506 28 1,144 60 3,155 Light Industries / Textiles 80 1,080 59 327 80 954 Automotive / Metal Processing 532 7,424 378 7,668 458 8,348 Electrical / Electronics 289 4,943 207 2,784 267 4,138 Chemicals / Paper 228 2,665 124 722 260 7,382 Services 336 2,881 272 2,838 332 4,929 Japan 872 11,846 562 8,746 672 8,916 Europe 166 1,697 132 972 234 4,672 Taiwan 53 280 53 216 75 789 USA 53 783 55 359 74 3,979 Hong Kong 72 1,669 39 624 45 781 Singapore 134 858 93 704 127 1,337 Zone 1 417 2,618 366 3,339 381 3,309 Zone 2 922 14,867 586 7,897 857 19,749 Zone 3 245 3,040 180 4,990 335 8,028 By Sector By Economy By Zone Unit: US$ Million Note: Investment projects with foreign equity participation from more than one country are reported in the figures for both countries. People will find it easier to seek official permission from all government agencies in Thailand, as the country’s Facilitation of Official Permission Granting Act 2015 was published in the Royal Gazette on 22 January 2015 and will be effective within 180 days. The principles of good governance were taken into consideration in order to increase efficiency in the public sector and reduce costs for the people. In order to facilitate the granting of official permission, a “guidebook for the people” will be offered to provide them with details about applications for various services, such as the steps for submitting documents, the length of time, and service fees. The clear information will enable the people to work out their business plans and make it possible for officials to work with greater transparency. A new channel through electronic media will also be provided, so that people will not have to come to government offices themselves for the applications. Page 2 2013 (US$ = 32.34 THB) February 2015 Continued from P. 1 family members can download the free Dinsow Application onto their smartphone to start a video call with the patient. Family members using the smartphone application can turn the robot’s head and see what the robot sees in real time. This allows doctors and family members to react immediately if there is an emergency. The developers decided to give the robot a characteristic of a 10 year old boy because this is the age when children are cute, curious and carefree. Dinsow Mini comes in two sizes, one weighs less than 20kg and the other less than 10kg. The smaller version is aimed at countries such as Japan where residence space is more limited. The fourth version of the Dinsow Mini with moving ability is under development and expected to be completed in the second half of 2015. The fifth and sixth versions which will be designed to care for the elderly with specific illnesses are in the pipeline. BLURIBBON – DRESSING FOR HARD TO HEAL WOUNDS DINSOW MINI – ROBOT FOR THE ELDERLY Dinsow Mini was developed by CT Robotics. It is the first robot in the world that cares for the elderly people and was awarded “Honorable Mention Consolation Prize” for Social Contribution from the NIA in 2014. Other uses for the robot have also been found such as being waiters in a restaurant in Sweden. The impetus for developing the Dinsow Mini stems from the increase proportion of the elderly population who may sometimes have to care for themselves at home. In order to meet the actual needs of the elderly, the developers of the robot did extensive field work to collect data directly from the elderly, caretakers and family members. While the first few versions of the Dinsow Mini were focused on entertainment and basic conversations, the current version has become more sophisticated and is the result of various technologies working together, such as image processing, voice recognition and telemedicine. It is particularly suitable for elderly people with limited mobility or those who are bed-ridden usually from the age of 80 years onward. The Dinsow Mini can prevent the elderly from falling, by detecting them through its monitor, and also act as an alarm by reminding them to eat and exercise at the right time. In addition, it can also collect health data such as blood pressure and if anything is abnormal, it will send a signal to a smartphone to seek medical attention from doctors. Family members who live far away can upload various contents onto the robot to entertain their elderly relatives such as movies, music or photos. The robot can also help the elderly maintain good mental health. Even though it cannot completely replace a human, it can still help the patient relax and act as a companion. Doctors and “BluRibbon” is a world-class innovative, advanced wound dressing product developed by Novatec Healthacare, a Thai medical device company awarded winner of National Innovation Awards 2012 for Social Contribution and Gold Medal Award from the Grand Prix of the 40th International Exhibition of Inventions in Geneva 2012. BluRibbon was developed from the combination of two technology platforms, namely, nano-biocellulose technology and engineered Blue Silver Nanotechnology. BluRibbon can speed up the wound healing process due to maintaining a moist wound environment and helping to clean the wound with its autolytic debridement and anti-microbial action. Preclinical and clinical tests have shown that BluRibbon has a better and faster wound healing effect especially for hard to heal wounds such as diabetic foot ulcer, pressure sore and cavity wounds. The company is aiming to list BluRibbon as a standard treatment for diabetic foot ulcer with the World Health Organization. BluRibbon also allows easy and painless removal with no wound residue left. Unlike normal wound dressings which must be changed daily, BluRibbon can be changed two to three times a week to be effective for moist wounds. The colour of the dressing changes after the release of Silver ions which indicates the proper time to change the dressing. BIOMASS GASIFICATION PLANTS: RECYCLING MATERIALS FOR SUSTAINABLE ENERGY With rising energy needs and prices, it has become important for Thailand to produce environmentally-friendly, alternative energy at a low cost. One of the options available that has an important role for energy sustainability in Thailand is biomass due to the abundance of waste from the local agriculture industry. A Thai company, Alternative Energy Systems, has developed small biomass power plants using gasification process, a simple and environmentally-friendly technology that also promotes local labour and can produce energy without water. Small power plants Continued on P. 4 Page 3 February 2015 Continued from P. 3 are particularly suitable for small communities in rural areas due to its low investment. The innovation received “Silver Prize” in the economic category of the National Innovation Awards in 2014. The first plant was built in Chiang Rai province with a production capacity of 160 kilowatts per hour in 2007. At least 40 000 tons of corn cropped in the area which is usually burnt as waste each year is now being used as fuel for the plant. In 2010, the company expanded its business to Roi Et province and built a biomass power plant with a larger production capacity of 350 kilowatts per hour using eucalyptus waste as fuel. Currently there are three biomass power plants using gasification technology in Thailand. Alternative Energy Systems is now looking to develop a prototype plant to produce low-cost liquid fuel from biomass in Thailand. By the Thai Office of Science and Technology, Brussels Thailand: Increased Consumer and Investor Confidence The United Nations Economic and Social Commission for Asia and the Pacific (ESCAP) released its 2014 year end update of the Economic and Social Survey of Asia and the Pacific. According to ESCAP the Survey “… has been monitoring regional progress, providing cutting-edge analyses and guiding policy discussion on the current and emerging socioeconomic issues and policy challenges to support inclusive and sustainable development in the region since 1947.” The region, writes ESCAP, will see a moderate increase in growth to 5.8% in 2015 from 5.6% in 2014, with inflation dropping to 3.5 percent from 3.9 percent over the same period. Driving this change is the improved economic situation in a number of countries, including Thailand. The report notes among the challenges that confront the region is a lack of infrastructure which has held back growth in manufacturing and trade. “At the domestic level, the contribution of the private sector to infrastructure development can be significantly increased through growth in capital markets and better use of public-private partnerships (PPPs).” It is pertinent to note that the government in Thailand has announced its intention to embark on infrastructure enhancement, with attention being given to connectivity to neighboring countries. Already several bridges have been built across the Mekong in order to boost investment, trade and tourism with Thailand’s neighbors, and plans are underway to improve rail connections. In fact, the Survey recognizes the actions being taken by Thailand to enhance infrastructure development. The forecast for Thailand’s economic growth this year is for 3.9 percent, which is in line with the estimates offered by government officials at approximately 4 percent, marking a significant improvement over the previous year. ESCAP writes that “The assumption of power of a military government in mid-2014 has increased consumer and investor confidence in the short-term as it has brought a halt to an extended period of political instability. Page 4 The main economic action of the government in 2014 has been to resume government budgetary spending and planning for large infrastructure spending.” In terms of exports, “ESCAP forecasts that merchandise export growth could increase to 6.8% for the developing Asia-Pacific region in 2015. This rebound will be conditional upon several factors, including among others (a) sustained recovery and growth in developed economies and (b) policy support measures being put in place to stimulate trade in major developing countries in the region.” On a positive note for Thailand, ESCAP estimates that for energy-importing countries a $10 per barrel fall in the oil price in 2015 would translate into an increase in GDP growth of up to 0.5 percentage points. Some investment sources have already made crude oil price forecasts as low as $31 by the end of the first quarter of 2015. This is in stark contrast to the 2013 OPEC Reference Basket average of US$106/b. ESCAP notes that Thailand is among the energy importing countries that would benefit from the drop in oil prices, and that “Thailand would experience the highest increase in current account balance, of 2.2% of GDP.” The beginning of the ASEAN Economic Community is seen as something that will “further improve the business environment and contribute to growth performance across the subregion.” The Survey refers to the ASEAN summit meeting held last November, noting that “82.1% of the 229 prioritized deliverables identified for 2013 and an additional 61 deliverables for 2014-2015 under the AEC Blueprint had been implemented. The priority for 2015 is to fast track the implementation of remaining measures aimed at: addressing non-tariff barriers; realizing the customs single window; and deepening services and investment liberalization.” While risks and challenges remain, it is clear from the Survey that Thailand continues to make progress in strengthening its economy, and will benefit from the coming AEC. February 2015 INDUSTRY FOCUS E&E Industry The Kingdom of Thailand is renown throughout the world for its highly productive automotive sector, its wide-ranging tourism industry, and quality food production, just to mention a few notable segments of the Thai economy. Yet the country has a dynamic electronics and electrical appliances industry (hereafter referred to as E&E) that manufactures and exports to markets around the globe. Indeed, the sector has long been important to Thailand, first as a manufacturer of “white goods,” then computers and parts, and now integrated circuits, hard disk drives, and printed circuit boards. Constituting a nearly US$100 billion industry, Thailand’s E&E sector has thrived and expanded continuously for almost three decades. Throughout the years, the E&E industry not only has played an increasingly significant role in the national economy as a major export earner, but also has positioned Thailand as the regional leader in Southeast Asia. Recognizing the need for sustainable development of the E&E industry as a priority for the Kingdom, the Thai government has launched proactive investment policies and measures, which have resulted in capital infusions from many multinational companies and caused the industry to experience further prosperity. When surveying the overall E&E sector, Thailand’s exports were US$55 billion in 2014, 30% of total exports. It is an industry that Thai officials vigorously promote, particularly as it contributes to the country’s goal of becoming a knowledge-based economy, and it has strong supply chain network. Thailand is ASEAN’s largest production base for electrical appliances, and is the world’s 2nd largest producer of air conditioning units and 4th largest producer of refrigerators. In 2013, Thailand’s electrical appliance exports were valued at US$22.6 billion, while exports of electronics reached US$30.8 billion. Major export destinations for Thailand’s electrical appliances include ASEAN, Japan, European Union, US, and China. With over 800 electrical appliance factories across the country, the Kingdom has attracted numerous world-renowned foreign and joint-venture companies from across the globe. Japanese manufacturers constitute half of the industry: JVC, Sony, Orion, Nikon, Pioneer, Panasonic, Canon, Sharp, Hitachi, Mitsubishi, Toshiba, TDK, NEC, Stanley, Rohm, Alps Electric, Epson, Alpine, Minebea, NHK, Seiko, Sanyo and Fujitsu, among many others are represented in Thailand. Additional prominent international firms include Tatung and Acer from Taiwan; LG and Samsung from South Korea; Western Digital, Seagate, Hutchinson, Honeywell, Carrier, Emerson and Spansion from the US; as well as Europe’s Electrolux, Philips, Stiebel Eltron, Schneider, BHS, ABB and Fasco. These companies have established facilities for a diverse scope of purposes, from production and assembly to testing and R&D. In 2013, Thailand’s main electronics exports WEre hard disk drives (HDD) and integrated circuits (IC), which accounted for approximately US$11.79 billion and US$7.42 billion worth of total electronics exports, respectively. Major HDD producers – Western Digital, Seagate, Hitachi and Toshiba – have production facilities in Thailand. Similarly, the country is recognized as a leader in the IC and semiconductor industries, and boasts one of the largest concentrations of assembly plants in Southeast Asia for these products. Looking at 2015, overall production of the E&E industry should expand 1-2%, owing to an increase in exports of air conditioners to ASEAN members, Thailand’s major trading market. Semiconductors and integrated circuits should escalate, resulting from higher demand due to their use in communication systems, such as smart phones, tablets, Bluetooth, touch screens, video games (Sony PS4 and Microsoft Xbox), consumer electronics, and other electronic devices designed specifically for the automotive industry. Meanwhile, the production of hard disk drives (HDDs) should be stable when compared with the previous year. The MPI prediction for 2015 should grow 2-4%, stemming from economic stimulus measures and expansion of the digital television market, which could lead to a recovery of the country’s consumer purchasing power in 2015. Moreover, electrical appliance exports to ASEAN should increase in accordance with the region’s economic growth and greater confidence on the part of ASEAN consumers in products manufactured in Thailand. A hard disk drive (HDD) is a data storage device used for storing and retrieving digital information. Introduced by IBM in 1956, HDDs became the dominant secondary storage device for general-purpose computers by the early 1960s. Continuously improved, HDDs have maintained this position into the modern era of servers and personal computers. More than 200 companies produce HDD units, though Seagate, Toshiba and Western Digital manufacture most current devices. Worldwide disk storage revenues were US $32 billion in 2013, down 3% from 2012. HDD production in Thailand began in around 1983 after Seagate Continued on P. 6 Page 5 February 2015 Continued from P. 5 Technology shifted its head-stack assembly (HSA), the most labor-intensive segment in the HDD production process, out of Singapore. It was relatively low-wage labor as well as a favorable investment climate in the Kingdom that enticed HDD makers. Back then, the imported content of HSA exports was close to 80%. Despite the presence of high tariffs, HDD manufacturers were eligible for exemption schemes as their products were principally for export. Accordingly, since the early 1980s, production capacity expanded considerably and new activities related to HDD manufacturing were added, while numerous parts suppliers and other HDD makers entered the market. In 1987, Seagate augmented its operations as well as started high-volume production of HeadDrive Assembly (HDA) in the Kingdom. Later, IBM formed a joint venture with the Thai conglomerate, Saha Union, in 1991 and commenced operations in 1995, followed by its own production facility in 1997. By the end of 1990s, IBM affiliates in Thailand accounted for approximately two-thirds of the company’s global output of HDDs. into account in the calculation of corporate income tax exemption cap. The original cost of used machines will not be regarded as an investment. If these requirements are met, the project can receive the following incentives: • 8-year corporate income tax exemption, accounting for 100% of investment (excluding cost of land and working capital); • Exemption of import duty on machinery; • Exemption of import duty on raw or essential materials used in manufacturing export products for 1 year, which can be extended as deemed it appropriate by the Board; and • Other non-tax incentives. Expansion of the HDD sector continued in the 1990s so that industrial clustering occurred often throughout the decade. Such an expansion induced parts suppliers to set up their affiliates nearby. Concentrated in the country’s central and northeastern regions near Bangkok, Thailand’s HDD cluster today provides companies the ideal combination of efficiency, cost-savings and readily-available expertise. Furthermore, several Thai government agencies and organizations support the growth and development of the E&E industry. For instance, there is the Electrical and Electronics Institute (EEI), Hard Disk Drive Program, International Drive Equipment and Manufacturers Association (IDEMA), Asian Institute of Technology (AIT), Institute of Field Robotics (FIBO), National Electronics and Computer Technology Center (NECTEC), and the Thailand Science Park (TSP), which is operated by the National Science and Technology Development Agency (NSTDA). The Thailand Board of Investment (BOI) offers a wide range of fiscal and non-tax incentives to investors keen on the E&E industry. With the recent announcement of the Seven-Year Investment Promotion Strategy (2015-2021), the BOI has introduced new criteria and project classifications that apply to the HDD sector. Let’s examine them individually. This particular activity falls under category A2, however the areal density of hard disk drives must not be less than 2,000 gigabits per square inch. And secondly, the cost of refurbishment of used machines is to be regarded as an investment and will be taken Page 6 Similarly, the manufacture of hard disk drives and/or parts (excluding top covers, base plates or peripherals) must abide by the guideline that the cost of refurbishment of used machines shall be regarded as an investment and will be taken into account in the calculation of corporate income tax exemption cap. The original cost of used machines shall not be regarded as an investment. Moreover, because it is considered as a Group A3 activity such projects shall receive the following incentives: • 5-year corporate income tax exemption, accounting for 100% of investment (excluding cost of land and working capital) unless specified in the list of activities eligible for investment promotion that the activity shall be granted corporate income tax exemption without being subject to a corporate income tax exemption cap; • Exemption of import duty on machinery; • Exemption of import duty on raw or essential materials used in manufacturing export products for 1 year which can be extended as deemed it appropriate by the Board; and • Other non-tax incentives. Finally, there is the manufacture of top covers, base plates or peripherals for hard disk drives. This is a Group A4 activity and accordingly shall receive the following incentives: • 3-year corporate income tax exemption, accounting for 100% of investment (excluding cost of land and working capital); • Exemption of import duty on machinery; • Exemption of import duty on raw or essential materials used in manufacturing export products for 1 year, which can be extended as deemed it appropriate by the Board; and • Other non-tax incentives. Considering the increase in global demand for high-technology consumer electronics, including computers, flat panel displays, February 2015 tablets, gaming consoles, and wireless devices, Thailand is the ideal destination for the sector. Currently, the HDD and the electronics segments of the E&E industry have contributed a great deal to the Thai economy. There are more than 100,000 workers employed by the HDD industry and more than 300 billion baht worth in exports. However, there are challenges that the country must confront in order to maintain its status as the world’s number one HDD production base, for example, competing with other developing countries, such as China and Malaysia. In addition, Thailand is focused on enhancing its R&D capacity regarding the use of advanced technologies in HDD production and developing the requisite infrastructure for supporting the growth of the HDD segment in the future. The Kingdom’s strategic location in Southeast Asia and highoutput manufacturing facilities has made it a premier production base for the global E&E industry. Foreign companies are drawn by the low-cost yet highly-skilled Thai labor force and government initiatives that forge constructive partnerships between the private sector and public research institutes. Despite the fact that Thailand is a world leader in the production of HDDs, many components like semiconductor devices, transistors, and diodes are still imported, leaving an opening for more foreign direct investment and further opportunity for local manufacture. With strong growth in demand as well as with comprehensive support from the government, Thailand finds itself on the path towards becoming a real international hub of the E&E industry. COMPANY INTERVIEW Seagate Technology When one thinks about Thailand, certain postcard images come to mind, but certainly not electronics. And yet, the Kingdom functions as one of the largest assembly bases in the AsiaPacific region. It is a global leader in hard disk drive (HDD) production and a leading manufacturer of integrated circuits (IC) and semiconductors (SC). Actually, Thailand produces more than 40% of the world’s HDD output, contributing significantly to the Thai E&E industry’s US$55 billion in annual exports. Many leading advanced electronics firms are present in the Kingdom but one company stands out. Seagate Technology is a global data storage company that was established in 1979. At present, it is incorporated in Dublin, Ireland and has its principal executive office in Cupertino, California, USA. Seagate offers the industry’s broadest portfolio of hard disk drives, solid state drives and solid state hybrid drives. In addition, the company provides an extensive line of retail storage products for consumers and small businesses, as well as cloud storage systems and solutions, along with data recovery services for any brand of hard drive and digital media type. Since opening its operations in Thailand in 1983, Seagate has invested more than US$2.5 billion in capital and it has built two manufacturing facilities with over 16,000 employees. Seagate’s Teparuk, Samut Prakan facility initiated operations in 1988. This world-class facility employs state-of-the-art manufacturing technology and machinery to produce head gimbal assembly (HGA) and head stack assembly (HSA), R&D and Global Financial Services. The facility occupies a land area of 18.1 acres with a built-up area of 800,000 square feet. Meanwhile, the Korat campus began production in 1996. It is the largest hard drive facility in the world. This facility produces slider, head gimbal assembly (HGA), head stack assembly (HSA), and drive assembly and R&D. The plant occupies a land area of 59.6 acres and has a built-up area of about 2,500,000 square feet. Interestingly, neither campus is located in an industrial estate. Not long ago the Thailand Investment Review team was afforded the opportunity to interview Mr. Jeffrey Nygaard, Senior Vice President of Global Head Operations. It was a fitting moment to learn more about Seagate as a corporate organization, its business activities in Thailand, and the company’s future plans. Glancing at his resume, Mr. Nygaard has more than 20 years of experience in design and operations. In 1994 he joined Seagate and held a variety of managerial and executive positions in both the US and Asia. Twelve years later, in August 2006, he returned to the Kingdom as the Vice President and Country Manager for Thailand operations. Then in June 2009, his role was expanded to include operations in Penang, Malaysia. Later, in 2013, Mr. Nygaard was promoted to the position he currently occupies. Accordingly, he now has responsibilities for Seagate’s wafer fabrication in the US and Ireland, in addition to the Slider and HGSA manufacturing in Thailand, Malaysia, and China. The six sites situated across three continents comprise about US$3.6 billion in capitalization and 19,000 employees. To begin, Mr. Nygaard explained that a key asset of Seagate is its human resources. The overwhelming majority of the company’s team members are locally-hired Thais. Upon closer inspection, 90% of Seagate operators have high school diploma, while the remaining 10% graduated with a bachelor degree or continued on to the master degree level. Seagate technicians have a two-year associate degree that qualifies them to work with the sophisticated machinery used in production. The assembly floor at Seagate is fully automated and therefore it is essential that the skills and knowledge of the work force be upgraded on a consistent basis through training. At the professional level, to support Operations, R&D, and Global Finance Services, 73% have bachelor degree, 26% hold a master degree, and 1% have a PhD, primarily in the fields of physics and engineering. Continued on P. 8 Page 7 February 2015 Continued from P. 7 Mr. Nygaard mentioned that a number of Thai employees are given the chance to gain overseas experience through either normal business travel or the Seagate exchange program. This can last from three months to one year depending on the qualifications of the job and involves the participation of some 16 to 20 staff per quarter. As Seagate is a vertically integrated company and its supply chains are interrelated on a global scale, it is vital that Thai team members understand the business operations of Seagate not only on a national level, but also worldwide. Consequently, the development of the company’s Thai human resources occurs regularly by way of intra-firm transfers or off-site training sessions. Meanwhile, between six to seven expatriates work at Seagate’s Thai facilities at any one time. Contrary to the standard multinational model, these expat team members are focused primarily on either technology transfer and support or management and leadership development. With a very employee-centric environment in place, the attrition rate is low. It is obvious that for Mr. Nygaard a skilled work force is a major reason for the success Seagate has attained in Thailand. For the past 15 years, Seagate’s Thailand R&D center has developed technical expertise in manufacturing processes, such as high-precision assembly and fabrication processes, nanometrology, complex test and analysis. Manufacturing-related R&D ownership transfers (i.e. complex process technology, sophisticated automation and advanced metrology) have been made from the US to Thailand in the past several years as well. Further, over the past several years, there is an increasing focus on product development. Without a doubt, Seagate has significant R&D activities in Thailand and its R&D spending in Thailand amounted to US$55.4 million for fiscal year 2014. Likewise, Seagate collaborates closely with local universities in R&D activities. Since 2003, the company has launched engineering hubs with Khon Kaen University (KKU), Suranaree University of Technology (SUT), and King Mongkut Institute of Technology - Latkrabang (KMITL). The aim is to give graduate students hands-on activities and experience with recording technology as well as to supplement Seagate’s own personnel development purposes. This partnership was boosted significantly during 2007-2011 with the Thai government’s support through the HDDI initiative of the National Science and Technology Development Agency (NSTDA). As a result, R&D ownership transfers have occurred from the US to Seagate’s Thailand campuses in the areas of process technology, process metrology, and automation technology. Another outstanding feature of Seagate is its strong culture of corporate social responsibility. During the Thailand floods in 2011-2012, the company sponsored US$1 million for its Thailand floods relief and recovery fund. Being a environmentally friendly company, Seagate has taken many steps to minimize the environmental impact of its operations. Seagate is committed to Corporate Social Responsibility efforts to raise the interest of the young in science, technology, engineering and math (STEM) education through hands-on learning opportunities for children. As part of this focus, Seagate looks to inspire tomorrow’s digital creators, consumers and innovators by catalyzing students’ interest in STEM education. The company also places an importance on extending these learning experiences to the disadvantaged as part of its outreach to surrounding communities. Similarly, Mr. Nygaard highlighted how Seagate affords the opportunity to its assembly workers of completing their high school education by providing subsidized classes on-site during Page 8 off-hours. Additionally, Seagate has set aside US$3.5 million for R&D projects and joint scholarships with top Thai universities as well as sponsoring 10 company scholarships for higher education. Corporate social responsibility is not just about helping one’s neighbors or looking after the environment, but improving the lives of the employees. Earlier this month, Seagate made headlines for its announcement regarding an investment of Bt15.3 billion over five years to expand its manufacturing and development facility in Nakhon Ratchasima province, also known as the Korat campus – already its largest hard drive manufacturing plant in the world. “The expansion is to accommodate the new wave of technology for making cloud-based storage equipment, ranging from storage components to computing systems,” Mr. Nygaard announced to the Bangkok Post. The new building will open in 2016 and become fully operational by 2020, thereby creating 2,500 jobs. Seagate’s expanded Korat campus will focus on data-storage components, finished products and R&D. To illustrate the importance of Seagate to the Thai economy, Ms. Ajarin Pattanapanchai, senior executive adviser to the Board of Investment, affirmed that over the past eight years, the BOI had incentivised Seagate to make hard-disk drives and components. “Under the long-term investment policy to promote the electronics industry in Thailand, we have approved eight projects of Seagate Technology that together have the value of Bt55.6 billion. This investment is one of them,” she was quoted by The Nation. In a recent article published by the Bangkok Post, Mr. Nygaard declared that the prospects of data storage looked very promising, as it is a strong growth industry. He cited demand for video content, social media, big data analytics and cloud-based services. Data storage will continue to expand at 26% per year through 2020, when the data storage market is expected to be three or four times its current size and about 60% of it will be in the cloud. More big data is to come as demand keeps increasing from governments and the private sector, especially manufacturing, retail, media, banking, real estate and science. Asia is the largest revenue source for the industry. When asked to identify some of the principal trends in the industry, Mr. Nygaard was quick to highlight the following: Interconnectedness of people, Video, and Big Data. Seagate is at the forefront in advancing these technologies but the market contains other heavy hitters so the contest to remain in the lead is intense. Regarding the HDD sector, there is plenty of competition in Thailand but this environment acts as a catalyst for better productivity, greater efficiency, product innovation, and enhanced creativity in problem-solving. Seagate is committed to Thailand. It was reported by The Nation that the company will continue to invest in the Kingdom for three reasons – it has strong teams, both technical and operating, Asia is a high-growth market for data storage, and the cost structure for professionals, both engineers and technicians, is still good. Plus, the four largest manufacturing bases in Asia for Seagate are in Thailand, China, Malaysia and Singapore. Taken as a whole, Asia contributes more than 40% of the company’s total revenue. In fact, Seagate exported Bt110 billion worth of hard drives in 2014. Turning to the matter of the Board of Investment (BOI), Seagate’s Senior Vice President of Global Head Operations remarked that there has been productive and substantive interaction and collaboration between the two organizations over the span of three decades. As examples, he indicated BOI’s active February 2015 consultation with Seagate concerning policies involving the HDD sector, BOI’s mechanics, particularly its one-stop services for staff, and the BOI’s assistance in navigating the connections to the Thai government. “The BOI is trying to promote industries in the country that promote the types of businesses that the government and the people of Thailand want in the country”, observed Mr. Nygaard. the horizon, Mr. Nygaard commented that elements of the AEC that enable the movement of goods and people across ASEAN is likely a good things but we need to understand the specifics of AEC regulations. The company has a strong logistical team that is ready to move and it is confident to retain the best and the brightest of its team members in order to take Seagate to the next level. Furthermore, with the ASEAN Economic Community (AEC) on PWC CEO Survey “It’s not simply economic fundamentals that worry CEOs. Overregulation is cited by 78% as a concern. And these concerns are not limited to industry-specific regulations but go much broader into areas like trade and employment” writes Dennis M. Nally, chairman, PricewaterhouseCoopers International Limited in the PWC 18th Annual CEO Survey entitled A marketplace without boundaries? Responding to disruption. The Survey interview 1,322 CEOs in 77 countries. against the fact that only 37% are optimistic about global growth prospects, compared to 44% last year. “Of course, digital change throws up as many opportunities as risks. We think that’s why there’s an underlying sense of optimism for many CEOs, despite the picture they’re painting this year of an increasingly fluid and disrupted business environment.” The top three key threats identified by CEOs in the Survey are first, as noted above, over regulation, at 78% which is a 6% increase over last year. Second is the availability of key skills at 73%, and sharing third place at 72% is both Government response to fiscal deficit and debt burden, and Geopolitical uncertainty. CEOs have identified regulatory change as the number one disruptor within their industries over the next five years, followed by increased competition and changes in customer behavior. Many business leaders are rethinking their approach to customers and markets, with 54% saying that they have entered a new sector or sub-sector in the past three years and 56% considering it likely to compete in new industries over the next three years. This applies to large corporations as well as smaller firms with revenue up to $100 million, with 51% entering new sectors or sub-sectors in the past three years. Source: PWC as of February 2014 “No matter how CEOs choose to rethink their capabilities, there are three factors they’ve told us are vital for success: 1. Creating new value in new ways through digital transformation 2. Developing diverse and dynamic partnerships 3. Finding different ways of thinking and working.” When asked about the extent digital technologies are creating value for their organization, 88% indicated a positive effect on operational efficiency and on other cost structures. Of course, with benefits come risks, cyber security has seen the biggest jump in the list of concerns expressed. Concern about the speed of technological change saw the second biggest jump in concerns expressed. Source: PWC as of February 2014 At the outset, the Survey points to the essential need for business leaders to understand technology, or more specifically how technology is affecting their business, requiring them to identify company strengths even as the business environment rapidly changes. A clear signal for optimism is that 61% of the CEOs surveyed see more opportunities than they did three years ago, and 39% are very confident of growth. This is balanced According to the Survey, CEOs are also looking to develop new partnerships and alliances. ”Fifty-one percent plan to enter into new strategic alliances or joint ventures over the next year – the highest percentage since we began asking the question in 2010.” Interestingly, 54% of those questions cite access to new technologies as a reason for partnering. A thorough read of the PWC Survey and one can easily understand the drive of Thailand’s government to put in place the framework for a digital economy. Page 9 February 2015 Bangkok, A Visitors Choice Destination MasterCard’s 2014 Global Destination Cities Index, now in its fourth year, notes that the expansion of air travel in 2013 was dramatic, with some three billion passengers flying commercial flights around the globe. To illustrate the importance of this, the survey notes that “the growth rates of international visitor arrivals and their cross-border spending in the 132 destination cities covered by the MasterCard Global Destination Cities Index exceeded world real GDP growth over the 2009 to 2014 period (2014 based on forecast estimates).” This year Bangkok has been ranked number 2, London comes in first. The survey notes the two cities have been in a tight race for the number one slot and this appears to continue to be the case. Paris, Singapore and Dubai complete the top five destinations. Bangkok is also ranked fifth in terms of international tourist spending, with spending at US$13.04 billion in 2014. “Bangkok, ranked second in the world, is in the top rank in the region with 16.43 million international visitors.” And, it is second in the region in terms of tourist spending. The survey also notes that Bangkok “has a very diversified network of feeder cities and origin countries, which explains Bangkok’s well known resilience as a tourism hotspot.” The survey underlines the link between opening or upgrading an airport and an increase in the volume of air travel. It should be noted here that Thailand has completed its upgrade of Phuket Airport, which was done ahead of schedule, and next year will begin construction on an additional runway at Suvarnabhumi airport, as part of the overall airport expansion program in Thailand. Page 10 The survey also provides an “air hub index”, measuring a destination city’s air connectivity with the rest of world, and the strength of each of the connections. Bangkok ranks number 11 in this index, and the 7th fastest growing destination city by “airhub index.” Given the restoration of stability in Bangkok and the return to economic growth, as well as a government effort to increase tourist arrivals this year, Thailand has not only remained competitive, but has even brighter days on the horizon. February 2015 BOI’S MISSIONS AND EVENTS Mrs. Hirunya Suchinai, Acting Secretary General of BOI, delivered welcoming remarks at Thailand’s Investment Opportunities on Alternative Energy. The event was organized by the ASEANKorea Center (AKC) and Thailand Board of Investment (BOI) on 22 January 2015 at Centara Grand, Central World. Mr.Pornchai Patiparnprechavut, Deputy Secretary General of the Energy Regulatory Commission (ERC), H.E. Hae Moon Chung, Secretary General of the AKC, and H.E. Jeon Jae Man, Ambassador of the Republic of Korea to Thailand, also joined in this event. (from the left). Mr. Boonyuen Khamhong, Vice Governor of Nakhon Ratchasima, together with Ms. Ajarin Pattanapanchai, BOI Senior Executive Investment Advisor, presided over the seminar “New Investment Promotion Strategies: Towards Sustainable Growth” on 21 January 2015 at the Dusit Princess Hotel, Nakhon Ratchasima, to announce the new BOI investment promotion strategies to investors in the Northeastern Region. Ms. Ajarin Pattanapanchai, BOI Senior Executive Investment Advisor, accompanied by BOI executives, presided over the seminar “New Investment Promotion Strategies: Towards Sustainable Growth” on 23 January 2015 at BITEC Bangna to announce the new BOI investment promotion strategies to Chinese and Taiwanese investors. Ms. Ajarin Pattanapanchai, BOI Senior Executive Investment Advisor, together with representatives from the National Science and Technology Development Agency (NSTDA), presented Thailand innovation in nanotechnology and attended The 14th International Nanotechnology Exhibition & ConferenceNANOTECH 2015 at Tokyo Big Sight, Tokyo, on 30 January 2015. Mr. Chanin Khaochan, Acting Executive Director of Investment Promotion Bureau 2, accompanied by Mrs. Orapin Swadpanich, BOI Taipei Director, led an investment mission to Taiwan from 26 – 29 January 2015 where they met with potential investors in the machinery industry. Mrs. Supisara Chomparn, Senior Professional Investment Promotion Officer, together with Mr. Apipong Khunakornbodintr, BOI Beijing Director, led an investment mission to Tianjin, China, from 25 – 30 January 2015. The mission included an investment promotion seminar and company visits. Page 11 February 2015 THAILAND ECONOMY-AT-A-GLANCE Exchange Rate Trends Facts about Thailand Population (2010) ASEAN Population Literacy Rate Minimum Wage 66 million 625 million 96% 300 Baht/day GDP (2013) GDP per Capita (2013) GDP Growth (2013) GDP Growth (2014, projected) Export Growth (2013) Export Growth (2014, projected) Trade Balance (2013) Current Account Balance (2013) International Reserves (2013) Capacity Utilization (2013) Manufacturing Production Index (2013) Core Inflation (2014, projected) Headline Inflation (2014, projected) Consumer Price Index (Nov 2014) (2011=100) US$ 387 billion US$5,673 2.9% 0.7% -0.2% 0.0% Source: Bank of Thailand US$ 6.7 billion US$ -2.5 billion US$ 167.23 billion 64.36% 175.80 1.9-2.9 1.9-2.9 107.19 Corporate Income Tax Withholding Tax Value Added Tax SET Monthly Closing Values 10-20% 0-15% 7% Nov Average Exchange Rates US$1 = 32.78 baht €1 = 40.89 baht £1 = 51.47 baht 100 ¥ = 28.25 baht CNY1 = 5.36 baht Source: Stock Exchange of Thailand Industrial Capacity Utilization (%) Top 10 Exports 2014 (Jan-Oct) Product Share Value (US$ bn) 1 Motor cars, parts and accessories 10.81 20.61 2 Automatic data processing machines and parts thereof 7.93 15.12 3 Refine fuels 5.01 9.55 4 Precious stones and jewellery 4.45 8.48 5 Polymers of ethylene, propylene, etc in primary forms 4.29 8.17 6 Chemical products 3.84 7.33 7 Rubber products 3.55 6.77 8 Electronic integrated circuits 3.25 6.19 9 Machinery and parts thereof 3.16 6.02 10 Rubber 2.67 5.10 Total Source: Bank of Thailand International Reserves / Short-term Debt (%) 190.62 Source: Ministry of Commerce Source: Bank of Thailand BOI Head Office, Office of the Board of Investment 555 Vibhavadi-Rangsit Road, Chatuchak, Bangkok 10900, Thailand Tel: +66 (0) 2553 8111 Fax: +66 (0) 2553 8316 Website: www.boi.go.th E-mail: head@boi.go.th BEIJING Thailand Board of Investment, Beijing Office Royal Thai Embassy No.40 Guang Hua Road, Beijing, 100600, P.R.China Tel: (86-10) 6532-4510 Fax:(86-10) 6532-1620 E-mail: beijing@boi.go.th FRANKFURT Thailand Board of Investment, Frankfurt Office Bethmannstr. 58, 5.OG 60311 Frankfurt am Main Federal Republic of Germany Tel: (49 69) 92 91 230 Fax:(49 69) 92 91 2320 E-mail: fra@boi.go.th GUANGZHOU Thailand Board of Investment, Guangzhou Office Royal Thai Consulate-General Guangzhou No.36 Youhe Road, Haizhu District, Guangzhou, P.R.C 510310 Tel: +8620 8385 8988 Ext. 220-225 +8620 8387 7770 (Direct Line) Fax:+8620 8387 2700 E-mail: guangzhou@boi.go.th LOS ANGELES Thailand Board of Investment, Los Angeles Office Royal Thai Consulate-General 611 North Larchmont Boulevard, 3rd Floor, Los Angeles, CA 90004 USA Tel: (1-323) 960 1199 Fax:(1-323) 960 1190 E-mail: boila@boi.go.th MUMBAI Thailand Board of Investment, Mumbai Office Royal Thai Consulate-General, 1st Floor, Dalalmal House, Jamnalal Bajaj Marg, Nariman Point, Mumbai 400 021 Republic of India Tel: (9122) 2204 1589-90 Fax: (9122) 2282 1071 E-mail: mumbai@boi.go.th NEW YORK Thailand Board of Investment, New York Office 7 World Trade Center, 34th Floor, Suite F, 250 Greenwich Street, New York, NY 10007 Tel: (1-212) 422 9009 Fax: (1-212) 422 9119 E-mail: nyc@boi.go.th OSAKA Thailand Board of Investment, Osaka Office Royal Thai Consulate-General, Osaka, Bangkok Bank Bldg. 7th Floor , 1-9-16 KyutaroMachi, Chuo-Ku, Osaka 541-0056 Japan Tel: (81-6) 6271-1395 Fax:(81-6) 6271-1394 E-mail: osaka@boi.go.th PARIS Thailand Board of Investment, Paris Office Ambassade Royale de Thailande, 8, Rue Greuze 75116 Paris, France Tel: (33 1) 5690 2600 (33 1) 5690 2601 Fax:(33 1) 5690 2602 E-mail: par@boi.go.th SEOUL Thailand Board of Investment, Seoul Office #1804, 18th Floor, Koryo Daeyeongak Center, 97 Toegye-ro, Jung-gu, Seoul, 100-706, Korea Tel: (822) 319-9998 Fax:(822) 319-9997 E-mail: seoul@boi.go.th SHANGHAI Thailand Board of Investment, Shanghai Office Royal Thai Consulate-General 15 F., Crystal Century Tower, 567 Weihai Road, Shanghai, 200041, P.R.China Tel: (86-21) 6288-9728, (86-21) 6288-9729 Fax:(86-21) 6288-9730 E-mail: shanghai@boi.go.th STOCKHOLM Thailand Board of Investment, Stockholm Office Stureplan 4C 4th Floor 114 35 Stockholm, Sweden Tel: +46 (0)8 463 1158 +46 (0)8 463 1172 +46 (0)8 463 1174 to 75 Fax: +46 (0)8 463 1160 E-mail: stockholm@boi.go.th SYDNEY Thailand Board of Investment, Sydney Office 234 George Street, Sydney, Suite 101, Level 1, New South Wales 2000, Australia Tel:+61-2-9252-4884 Fax:+61-2-9252-4882 E-mail: sydney@boi.go.th TAIPEI Thailand Board of Investment, Taipei Office Taipei World Trade Center 3rd Floor, Room 3E39-40, No.5, Xin-Yi Road, Sec.5 Taipei 110, Taiwan, R.O.C. Tel: (886) 2-23456663 Fax:(886) 2-23459223 E-mail: taipei@boi.go.th TOKYO Thailand Board of Investment, Tokyo Office Royal Thai Embassy 8th Fl., Fukuda Building West, 2-11-3 Akasaka, Minato-ku, Tokyo 107-0052 Japan Tel: (81 3) 3582 1806 Fax: (81 3) 3589 5176 E-mail: tyo@boi.go.th Page 12