Chapter 9

Budgeting

Solutions to Questions

9-1

A budget is a detailed quantitative plan

for the acquisition and use of financial and other

resources over a given time period. Budgetary

control involves the use of budgets to control

the actual activities of a firm.

9-2

1. Budgets communicate management’s

plans throughout the organization.

2. Budgets force managers to think about

and plan for the future.

3. The budgeting process provides a means

of allocating resources to those parts of the organization where they can be used most effectively.

4. The budgeting process can uncover potential bottlenecks before they occur.

5. Budgets coordinate the activities of the

entire organization by integrating the plans of its

various parts. Budgeting helps to ensure that

everyone in the organization is pulling in the

same direction.

6. Budgets define goals and objectives that

can serve as benchmarks for evaluating subsequent performance.

9-3

Responsibility accounting is a system in

which a manager is held responsible for those

items of revenues and costs—and only those

items—that the manager can control to a significant extent. Each line item in the budget is

made the responsibility of a manager who is

then held responsible for differences between

budgeted and actual results.

9-4

A master budget represents a summary

of management’s plans and goals for the future,

and outlines the way in which these plans are to

be accomplished. The master budget is composed of a number of smaller, specific budgets

encompassing sales, production, raw materials,

direct labour, manufacturing overhead, selling

and administrative expenses, and inventories.

The master budget generally also contains a

budgeted income statement, budgeted balance

sheet, and cash budget.

9-5

The level of sales impacts virtually every

other aspect of the firm’s activities. It determines the production budget, cash collections,

cash disbursements, and selling and administrative budget that in turn determine the cash

budget and budgeted income statement and

balance sheet.

9-6

A budget committee is a group of key

personnel responsible for policy matters related

to the budget program, coordination of the

budget preparation, handling budget-related

disputes and approval of the final budget. Companies use a budget committee to make the entire process more efficient and effective.

9-7

A perpetual budget is a 12-month

budget that rolls forward one month as the current month is completed. The purpose of perpetual or continuous budgets is to always keep

managers focused one year ahead.

9-8

A participative budget is one in which

persons with responsibility over cost control

prepare their own budgets. This is in contrast to

a budget that is imposed from above. The major

advantages of a participative budget are: (1)

Individuals at all levels of the organization are

recognized as members of the team whose

views and judgments are valued. (2) Budget

estimates prepared by front-line managers are

often more accurate and reliable than estimates

prepared by top managers who have less intimate knowledge of markets and day-to-day operations. (3) Motivation is generally higher when

individuals participate in setting their own goals

than when the goals are imposed from above.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

1

Participative budgets create commitment. (4) A

manager who is not able to meet a budget that

has been imposed from above can always say

that the budget was unrealistic and impossible

to meet. With a self-imposed budget, this excuse is not available.

Participative budgets do carry with them

the risk of budgetary slack. The budgets prepared by lower-level managers should be carefully reviewed to prevent too much slack.

9-9

Budget slack is the difference between

the revenues and expenses a manager believes

can be achieved and the amounts included in

the budget. Managers create slack in an attempt

to increase the likelihood of receiving bonuses

contingent upon meeting or beating budget.

They may also create slack so that they do not

have to work as hard to attain their budget.

9-10 Zero-base budgeting requires that managers start their expense budgets at zero levels

and justify all costs as if all programs were being

proposed for the first time. In traditional budgeting, by contrast, budget data are usually generated on an incremental basis, with last year’s

budget being the starting point.

profit. With not-for-profit and government agencies this is generally not the case. Often, no relationship exists between those who provide

funds and the uses to which these funds are put.

9-16 A static budget is prepared only for the

planned or budgeted level of activity. A flexible

budget provides estimates for revenues and expenses for any level of activity within a specified

range. A flexible budget can be prepared after a

reporting period is over to show managers what

revenues and expenses should have been, given

the actual level of activity for that period.

9-17 A flexible budget variance is the difference between actual and budgeted amounts for

revenues and expenses. For revenues, the flexible budget variance is caused by a difference

between the budgeted and actual selling price

per unit. For expenses, the variance is caused

either by differences between the budgeted and

actual unit cost of the item, or by differences

between the budgeted and actual quantity of

the item used.

9-11 No, although this is clearly one of the

purposes of the cash budget. The principal purpose is to provide information on probable cash

needs during the budget period, so that bank

loans and other sources of financing can be anticipated and arranged well in advance.

9-12 For a merchandising company (such as

Zellers or Sport Chek) the merchandise purchases budget replaces the production budget.

9-13 Activity-based budgeting can help identify the need for additional production capacity

and it can lead to more accurate budgets.

9-14 Some of the unique budgeting problems

faced by multinational companies include foreign

exchange fluctuations, hyperinflation, and governmental restrictions affecting a variety of factors including labour practices, advertising, and

so on.

9-15 With profit-oriented entities, there is an

intricate relationship between expenses and

revenues. Expenditures are made for the purpose of generating sufficient revenue to earn a

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

2

Managerial Accounting, 9th Canadian Edition

Exercise 9-1 (20 minutes)

1.

August sales:

$70,000 × 5%

September sales:

$180,000 × 70%, 5%

October sales:

$400,000 × 25%, 70%,

5%

November sales:

$800,000 × 25%, 70%

December sales:

$700,000 × 25%

Total cash collections

October November December

$ 3,500

$

126,000 $ 9,000

100,000

Total

3,500

135,000

280,000

$ 20,000

400,000

200,000

560,000

760,000

$229,500 $489,000

175,000

175,000

$755,000 $1,473,500

Notice that even though sales peak in November, cash collections peak

in December. This occurs because the bulk of the company’s customers

pay in the month following sale. The lag in collections that this creates is

even more pronounced in some companies. Indeed, it is not unusual for

a company to have the least cash available in the months when sales

are greatest.

2. Accounts receivable at December 31:

From November sales: $800,000 × 5%................. $ 40,000

From December sales:

$700,000 × (70% + 5%) .................................. 525,000

Total accounts receivable ..................................... $565,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

3

Exercise 9-2 (10 minutes)

July

Budgeted sales in units ............ 30,000

Add desired ending inven4,500

tory* ....................................

Total needs.............................. 34,500

Less beginning inventory .......... 3,000

Required production ................. 31,500

August

45,000

6,000

51,000

4,500

46,500

September

Quarter

60,000

5,000

135,000

5,000

65,000

6,000

59,000

140,000

3,000

137,000

*10% of the following month’s sales

For September the desired E.I. = October sales of 50,000 x 10%.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

4

Managerial Accounting, 9th Canadian Edition

Exercise 9-3 (15 minutes)

First

Quarter—Year 2

Second

Third

Fourth

Required production of calculators ........... 120,000 190,000 300,000 200,000

Number of chips per calculator ................

× 3

× 3

× 3

× 3

Total production needs—chips ................. 360,000 570,000 900,000 600,000

Production needs—chips..........................

Add desired ending inventory—chips ........

Total needs—chips ..................................

Less beginning inventory—chips ..............

Required purchases—chips ......................

Cost of purchases at $2 per chip ..............

First

Second

Year 2

Third

Year 3

First

160,000

× 3

480,000

Fourth

360,000

570,000

900,000

600,000

114,000

180,000

120,000

96,000

474,000

750,000 1,020,000

696,000

72,000

114,000

180,000

120,000

402,000

636,000

840,000

576,000

$804,000 $1,272,000 $1,680,000 $1,152,000

Year

2,430,000

96,000

2,526,000

72,000

2,454,000

$4,908,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

5

Exercise 9-4 (20 minutes)

1. Assuming that the direct labour workforce is adjusted each quarter, the direct labour budget would be:

Units to be produced ...................

Direct labour time per unit (hours)

Total direct labour hours needed ..

Direct labour cost per hour ..........

Total direct labour cost ................

1st

Quarter

5,000

×0.40

2,000

×$11.00

$22,000

2nd

Quarter

4,400

×0.40

1,760

×$11.00

$19,360

3rd

Quarter

4,500

×0.40

1,800

×$11.00

$19,800

4th

Quarter

4,900

×0.40

1,960

×$11.00

$21,560

Year

18,800

×0.40

7,520

×$11.00

$82,720

2. Assuming that the direct labour workforce is not adjusted each quarter and that overtime wages are

paid, the direct labour budget would be:

Units to be produced ...................

Direct labour time per unit (hours)

Total direct labour hours needed ..

Regular hours paid ......................

Overtime hours paid ....................

Wages for regular hours

(@ $11.00 per hour) .................

Overtime wages (@ $11.00 per

hour × 1.5 hours) .....................

Total direct labour cost ................

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

Year

$19,800

$19,800

$19,800

$19,800

$79,200

3,300

$23,100

0

$19,800

0

$19,800

2,640

$22,440

5,940

$85,140

5,000

×0.40

2,000

1,800

200

4,400

×0.40

1,760

1,800

0

4,500

×0.40

1,800

1,800

0

4,900

×0.40

1,960

1,800

160

18,800

×0.40

7,520

7,200

360

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

6

Managerial Accounting, 9th Canadian Edition

Exercise 9-5 (15 minutes)

1.

Small Corporation

Manufacturing Overhead Budget

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

5,400

× $1.75

$ 9,450

35,000

44,450

15,000

20,400

× $1.75

$ 35,700

140,000

175,700

60,000

$28,750

$28,400

$29,100

$29,450

$115,700

2. Total budgeted manufacturing overhead for the year (a) ......................................

Total budgeted direct labour-hours for the year (b) ..............................................

Predetermined overhead rate for the year (a) ÷ (b) .............................................

$175,700

20,400

$8.61

Budgeted direct labour-hours .......

Variable overhead rate ................

Variable manufacturing overhead .

Fixed manufacturing overhead .....

Total manufacturing overhead .....

Less depreciation ........................

Cash disbursements for manufacturing overhead ........................

5,000

× $1.75

$ 8,750

35,000

43,750

15,000

4,800

× $1.75

$ 8,400

35,000

43,400

15,000

5,200

× $1.75

$ 9,100

35,000

44,100

15,000

Year

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

7

Exercise 9-6 (15 minutes)

Hirst Company

Selling and Administrative Expense Budget

Budgeted unit sales ..................................

Variable selling and administrative expense

per unit .................................................

Variable expense ......................................

Fixed selling and administrative expenses:

Advertising.............................................

Executive salaries ...................................

Insurance ..............................................

Property taxes........................................

Depreciation ..........................................

Total fixed selling and administrative expenses...................................................

Total selling and administrative expenses ...

Less depreciation ......................................

Cash disbursements for selling and administrative expenses...................................

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

Year

x $2.75

$ 33,000

x $2.75

$ 38,500

x $2.75

$ 30,250

x $2.75

$ 27,500

x $2.75

$129,250

12,000

40,000

12,000

40,000

6,000

12,000

40,000

12,000

40,000

6,000

16,000

48,000

160,000

12,000

6,000

64,000

12,000

14,000

11,000

10,000

47,000

16,000

16,000

6,000

16,000

68,000

101,000

16,000

74,000

112,500

16,000

74,000

104,250

16,000

74,000

101,500

16,000

290,000

419,250

64,000

$ 85,000

$ 96,500

$ 88,250

$ 85,500

$355,250

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

8

Managerial Accounting, 9th Canadian Edition

Exercise 9-7 (20 minutes)

Cash balance, beginning ..........

Add collections from customers

Total cash available ..................

Less disbursements:

Purchase of inventory ............

Operating expenses ...............

Equipment purchases ............

Dividends .............................

Total disbursements .................

Excess (deficiency) of cash

available over disbursements .

Financing:

Borrowings ...........................

Repayments (including interest)....................................

Total financing .........................

Cash balance, ending ...............

Quarter (000 omitted)

3

4

2

1

$ 6 * $ 5

65

70

71 *

75

35 *

28

8 *

2 *

73

45

30

8

2

85

(2) *

(10)

7

0

7

$5

$ 5 $ 5

96 * 92

101

97

*

*

*

*

*

15 *

0

15

$ 5

Year

$ 6

323 *

329

48

30 *

10 *

2 *

90

35 *

25

10

2 *

72

11 *

25

9

0

0

22

(17) *

(17)

$ 8

(23)

(1)

$ 8

(6)

(6)

$ 5

163

113 *

36 *

8

320

*Given.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

9

Exercise 9-8 (15 minutes)

AutoLav Inc.

Flexible Budget

Overhead Costs

Sales

Variable expenses:

Cleaning supplies .........................

Utilities .......................................

Maintenance ................................

Total variable expenses ...................

Contribution margin………………….

Fixed expenses:

Operator wages ...........................

Depreciation ................................

Rent...................... ......................

Insurance....................…………

Selling and administrative..........

Total fixed expenses .......................

Operating income ...........................

Cost Formula

(per car)

Activity (cars)

7,000 8,000 9,000

$10.00

$70,000 $80,000 $90,000

0.75

0.60

0.15

1.50

$8.50

5,250 6,000 6,750

4,200 4,800 5,400

1,050 1,200 1,350

10,500 12,000 13,500

59,500 68,000 76,500

10,000

20,000

8,000

1,000

4,000

43,000

$16,500

10,000

20,000

8,000

1,000

4,000

43,000

$25,000

10,000

20,000

8,000

1,000

4,000

43,000

$33,500

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

10

Managerial Accounting, 9th Canadian Edition

Exercise 9-9 (30 minutes)

1.

AutoLav Inc.

Flexible Budget Performance Report

For the Month Ended August 31

Actual number of cars .................. 7,800

Overhead Costs

Cost

Formula

(per

car)

Sales

$10.00

Variable expenses:

Cleaning supplies .........................

0.75

Utilities ........................................

0.60

Maintenance ................................

0.15

Total variable expenses ...................

1.50

Actual

$78,000

Flexible

Budget

$78,000

5,725

4,795

1,400

11,920

5,850

4,680

1,170

11,700

Contribution margin ........................

8.50

66,080

66,300

Fixed expenses:

Operator wages ...........................

Depreciation ................................

Rent ............................................

Insurance ....................................

Selling and administrative .............

Total fixed expenses .......................

Operating income ...........................

10,270

20,100

8,000

1,090

3,750

43,210

$22,870

10,000

20,000

8,000

1,000

4,000

43,000

$23,300

Flexible

Budget

Variance

$0

(125)

115

230

220

220 U

270

100

0

90

(250)

210

$430

Students may question the variances for fixed costs. Operator wages can

differ from what was budgeted for a variety of reasons including an unanticipated increase in the wage rate; changes in the mix of workers between

those earning lower and higher wages; changes in the number of operators

on duty; and overtime. Depreciation may have increased because of the

acquisition of new equipment or because of a loss on equipment that must

be scrapped—perhaps due to poor maintenance. (This assumes that the

loss flows through the depreciation account on the performance report.)

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

F

U

U

U

11

U

U

U

F

U

U

Exercise 9-9 Part 2.

Overhead Costs

Sales

Variable expenses:

Cleaning supplies

Utilities

Maintenance

Total variable expenses

Contribution margin……

Fixed expenses:

Operator wages

Depreciation

Rent

Insurance

Selling and administrative

Total fixed expenses

Operating income

Actual

(7,800

cars)

Flexible

Budget

Variance

Flexible

Budget

(7,800 cars)

Sales

Volume

Variance

Static

Budget

(8,000 cars)

$78,000

$0

$78,000

$2,000 U

$80,000

5,725

4,795

1,400

11,920

66,080

(125) F

115 U

230 U

220 U

220 U

5,850

4,680

1,170

11,700

66,300

150 F

120 F

30 F

300 F

1,700 U

6,000

4,800

1,200

12,000

68,000

10,270

20,100

8,000

1,090

3,750

43,210

$22,870

270 U

100 U

0

90 U

(250) F

210 U

$430 U

10,000

20,000

8,000

1,000

4,000

43,000

$23,300

0

0

0

0

0

0

1,700 U

10,000

20,000

8,000

1,000

4,000

43,000

$25,000

Total static-budget variance: $2,130 U

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

12

Managerial Accounting, 9th Canadian Edition

Exercise 9-10 (30 minutes)

1.

(a)

(b)

Budgeted Activity

Activity Cost Pool

Rate

Direct labour support $3 per DLH

Batch setups

$500 per setup

Materials handling

$200 per setup

Purchasing

$150 per order

Quality inspections

$50 per inspection

Customer orders

$25 per order

Product design

$2,000 per modification

Total

a

(6,000 x 2.5) + (15,000 x 2)

b

(6,000 ÷ 500) + (15,000 ÷ 1,500)

c

16 + 20

d

(6,000 x .1) + (15,000 x .1)

e

1,000 + 750

f

5+3

2. Total overhead budget:

Budgeted activity costs per part 1.

Organization sustaining costs

Total overhead costs

(c)

Activity

45,000 hoursa

22 setupsb

22 setupsb

36 ordersc

2,100 inspectionsd

1,750 orderse

8 modificationsf

(b x c)

Budgeted

Activity Cost

$135,000

11,000

4,400

5,400

105,000

43,750

16,000

$320,550

$320,550

250,000

$570,550

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

13

Exercise 9-10 (continued)

3. Total budgeted production costs (including direct costs):

Item

Direct material costs:

R-192: $45 x 6,000

T-295: $30 x 15,000

Direct labour costs:

R-192: $20 x 15,000

T-295: $20 x 30,000

Activity costs (part 1)

Organization sustaining costs

Total production costs

Budgeted

Amount

$ 270,000

450,000

300,000

600,000

320,550

250,000

$2,190,550

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

14

Managerial Accounting, 9th Canadian Edition

Problem 9-11 (30 minutes)

1. Davis and Smith used a top-down approach to prepare the budget. That

is, they prepared the budget with little or no input from the individuals

who would have to implement the budget. In contrast, the recommended approach is a participative budget in which the individuals who

have cost control responsibility initiate and fully participate in the budgeting process. Participatory budgets have a number of advantages including: 1) those who are closest to the action are likely to have better

information; 2) managers are likely to be more committed to and understand a budget they participated in preparing than a budget that is imposed from above; and 3) participative budgets help to foster a sense

that everyone’s input is valued.

2. While Davis and Smith are undoubtedly pleased with their work, the dissatisfaction expressed by some employees with the budget process is a

sign that there may be storm clouds ahead. If employees feel that the

budget is unrealistic, the fact that it was imposed can lead to resentment, anger, and a sense of helplessness. Employees may, as a consequence, spend their time and energy complaining about the budget

rather than creatively solving problems. And if the budget is indeed unrealistic and managers are held responsible for meeting the budget, unproductive finger-pointing is likely to result as reality fails to live up to

expectations.

CMA Solution, adapted

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

15

Problem 9-12 (30 minutes)

1. September cash sales ..............................................

September collections on account:

July sales: $20,000 × 18% ....................................

August sales: $30,000 × 70% ...............................

September sales: $40,000 × 10% .........................

Total cash collections ...............................................

3,600

21,000

4,000

$36,000

2. Payments to suppliers:

August purchases (accounts payable) ....................

September purchases: $25,000 × 20% ..................

Total cash payments ................................................

$16,000

5,000

$21,000

3.

$ 7,400

Calgon Products

Cash Budget

For the Month of September

Cash balance, September 1..................................

$ 9,000

Add cash receipts:

Collections from customers................................

36,000

Total cash available before current financing .........

45,000

Less disbursements:

Payments to suppliers for inventory ................... $21,000

Selling and administrative expenses ...................

9,000 *

Equipment purchases ........................................ 18,000

Dividends paid ..................................................

3,000

Total disbursements ............................................

51,000

Excess (deficiency) of cash available over disbursements ......................................................

(6,000)

Financing:

Borrowings .......................................................

11,000

Repayments .....................................................

0

Interest ............................................................

0

Total financing ....................................................

11,000

Cash balance, September 30 ................................

$ 5,000

*$13,000 – $4,000 = $9,000.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

16

Managerial Accounting, 9th Canadian Edition

Problem 9-13 (45 minutes)

1. Black is using the budget as a club to pressure employees and as a way

to find someone to blame rather than as a legitimate planning and control tool. His planning seems to consist of telling everyone to increase

sales volume by 40%. This kind of “planning” requires no analysis, no

intelligence, no business insight, and is very likely viewed with contempt

by the employees of the company.

2. The way in which the budget is being used is likely to breed hostility,

tension, mistrust, lack of respect, and actions designed to meet targets

using any means available. Unreasonable targets imposed from the top,

coupled with a “no excuses” policy and the threat of being fired, create

an ideal breeding ground for questionable business practices. Managers

who would not, under ordinary circumstances, cheat or cut corners may

do so if put under this kind of pressure.

3. As the old saying goes, Kelly Cantano is “between a rock and a hard

place.” The Code of Ethical Conduct for Management Accountants states

that management accountants have a responsibility to “disclose fully all

relevant information that could reasonably be expected to influence an

intended user’s understanding of the reports, comments, and recommendations presented.” Assuming that Kelly helps prepare the Production Department’s reports to top management, collaborating with her

boss in hiding losses due to defective disk drives would clearly violate

this standard. Apart from the misrepresentation on the accounting reports, the policy of shipping defective returned units to customers is

bound to have a negative effect on the company’s reputation. If this

policy were to become widely known, it would very likely have a devastating effect on the company’s future sales. Moreover, this practice may

be illegal under statutes designed to protect consumers.

Having confronted her boss with no satisfactory resolution of the problem, Kelly must now decide what to do. The Code of Ethical Conduct for

Management Accountants suggests that Kelly go to the next higher level

in management to present her case. Unfortunately, in the prevailing

moral climate at CompuDrive, she is unlikely to win any blue ribbons for

blowing the whistle on her boss. All of the managers below Black are

likely to be in fear of losing their own jobs and many of them may have

taken actions to meet Black’s targets that they are not proud

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

17

Problem 9-13 (continued)

of either. It would take tremendous courage for Kelly to take the problem all the way up to Black himself—particularly in view of his less-thanhumane treatment of subordinates. And going to the Board of Directors

is unlikely to work either since Black and his venture capital firm apparently controls the Board. Resigning, with a letter of memorandum to the

individual who is most likely to be concerned and to be able to take action, may be the only ethical course of action that is left open to Kelly in

this situation. Of course, she must pay her rent, so hopefully she has

good alternative employment opportunities.

Note: This problem is very loosely based on the MiniScribe scandal reported in the December, 1992 issue of Management Accounting as well

as in other business publications. After going bankrupt, it was discovered that managers at MiniScribe had perpetrated massive fraud as a

result of the unrelenting pressure to meet unrealistic targets. Q. T.

Wiles, the real chairman of MiniScribe, was reported to have behaved

much as described in this problem. Kelly Cantano is, alas, a fabrication.

Hopefully, there were people like Kelly at MiniScribe who tried to do

something to stop the fraud.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

18

Managerial Accounting, 9th Canadian Edition

Problem 9-14 (45 minutes)

1.

Production budget:

July

August

September October

Budgeted sales (units) ........... 60,000 75,000 105,000

Add desired ending inventory . 23,000 29,000

18,600

Total needs ........................... 83,000 104,000 123,600

Less beginning inventory ....... 22,000 23,000

29,000

Required production .............. 61,000 81,000

94,600

Note: July E.I. = 8,000 units + 75,000 (next months sales) x 20%

October E.I. = 8,000 units + 30,000 (Nov. Sales) x 20%

53,000

14,000

67,000

18,600

48,400

2. During July and August the company is building inventories in anticipation of peak sales in September. Therefore, production exceeds sales

during these months. In September and October inventories are being

reduced in anticipation of a decrease in sales during the last months of

the year. Therefore, production is less than sales during these months

to cut back on inventory levels.

3. Direct materials budget:

Required production (units) ..

Material D236 needed per

unit ..................................

Production needs (kgs.) .......

Add desired ending inventory (kgs.) ........................

Total Material D236 needs ....

Less beginning inventory

(kgs.) ...............................

Material D236 purchases

(kgs.) ...............................

July

61,000

August September

81,000

94,600

x 4 kgs. x 4 kgs.

244,000 324,000

x 4 kgs.

378,400

129,600 151,360

373,600 475,360

Third

Quarter

236,600

x 4 kgs.

946,400

77,440 *

77,440

455840

1,023,840

129,000 129,600

151,360

129,000

244,600 345,760

304,480

894,840

* 48,400 units (October production) × 4 kgs. per unit = 193,600

kgs.; 193,600 kgs. × 0.4 = 77,440 kgs.

As shown in part (1), production is greatest in September. However, as

shown in the raw material purchases budget, the purchases of materials

is greatest a month earlier because materials must be on hand to support the heavy production scheduled for September.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

19

Problem 9-15 (30 minutes)

1.

Taylor Company

Direct Materials Purchases Budget

Required production .............................

Raw materials per unit ..........................

Production needs .................................

Add desired ending inventory ................

Total needs ..........................................

Less beginning inventory ......................

Raw materials to be purchased .............

Cost of raw materials to be purchased at

$2.50 per kilogram ............................

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

$46,500

$54,000

$55,500

$39,250 $195,250

6,000

x3

18,000

4,200

22,200

3,600

18,600

7,000

x3

21,000

4,800

25,800

4,200

21,600

8,000

x3

24,000

3,000

27,000

4,800

22,200

5,000

x3

15,000

3,700

18,700

3,000

15,700

Year

26,000

x3

78,000

3,700

81,700

3,600

78,100

Schedule of Expected Cash Disbursements for Materials

Accounts payable, beginning balance ....

1st Quarter purchases ..........................

2nd Quarter purchases .........................

3rd Quarter purchases ..........................

4th Quarter purchases ..........................

Total cash disbursements for materials ..

$11,775

32,550

$44,325

$13,950

37,800

$51,750

$16,200

38,850

$55,050

$ 11,775

46,500

54,000

$16,650

55,500

27,475

27,475

$44,125 $195,250

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

20

Managerial Accounting, 9th Canadian Edition

Problem 9-15 (continued)

2.

Taylor Company

Direct Labour Budget

Units to be produced ..........................

Direct labour time per unit (hours) ......

Total direct labour-hours needed .........

Direct labour cost per hour .................

Total direct labour cost .......................

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

6,000

7,000

8,000

5,000

x 0.50

x 0.50

x 0.50

x 0.50

3,000

3,500

4,000

2,500

x $12.00 x $12.00 x $12.00 x $12.00

$ 36,000 $ 42,000 $ 48,000 $ 30,000

Year

26,000

x 0.50

13,000

x $12.00

$156,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

21

Problem 9-16 (30 minutes)

1.

1.1.

Culbert Dessert Corporation

Direct Labour Budget

Units to be produced ...................

Direct labour time per unit (hours)

Total direct labour-hours needed ..

Direct labour cost per hour ..........

Total direct labour cost ................

2.

1.1.

1st

Quarter

8,000

0.30

2,400

$10.50

$25,200

2nd

Quarter

11,000

0.30

3,300

$10.50

$34,650

3rd

Quarter

9,000

0.30

2,700

$10.50

$28,350

4th

Quarter

Year

13,000

0.30

3,900

$10.50

$40,950

41,000

0.30

12,300

$10.50

$129,150

Year

Culbert Dessert Corporation

Manufacturing Overhead Budget

Budgeted direct labour-hours .......

Variable overhead rate ................

Variable manufacturing overhead .

Fixed manufacturing overhead .....

Total manufacturing overhead .....

Less depreciation ........................

Cash disbursements for manufacturing overhead ........................

1st

Quarter

2nd

Quarter

3rd

Quarter

4th

Quarter

3,900

$1.50

$ 5,850

23,000

28,850

7,000

12,300

$1.50

$18,450

92,000

110,450

28,000

$19,600

$20,950

$20,050

$21,850

$82,450

2,400

$1.50

$ 3,600

23,000

26,600

7,000

3,300

$1.50

$ 4,950

23,000

27,950

7,000

2,700

$1.50

$ 4,050

23,000

27,050

7,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

22

Managerial Accounting, 9th Canadian Edition

Problem 9-17 (45 minutes)

1. Schedule of expected cash collections:

From accounts receivable.

From April sales:

20% × 200,000 ............

75% × 200,000 ............

4% × 200,000 ..............

From May sales:

20% × 300,000 ............

75% × 300,000 ............

From June sales:

20% × 250,000 ............

Total cash collections .......

April

Month

May

$141,000 $ 7,200

40,000

June

Quarter

$148,200

$ 8,000

40,000

150,000

8,000

225,000

60,000

225,000

50,000

$181,000 $217,200 $283,000

50,000

$681,200

150,000

60,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

23

Problem 9-17 (continued)

2. Cash budget:

Cash balance, beginning ..........................

Add receipts:

Collections from customers....................

Total available ..............

Less disbursements:

Merchandise purchases ....................

Payroll.......................

Lease payments.........

Advertising ................

Equipment purchases .

Total disbursements .....

Excess (deficiency) of

receipts over disbursements ...............

Financing:

Borrowings ................

Repayments ..............

Interest .....................

Total financing .............

Cash balance, ending ...

April

Month

May

June

Quarter

$ 26,000

$ 27,000

$ 20,200

$ 26,000

181,000

207,000

217,200

244,200

283,000

303,200

681,200

707,200

108,000

9,000

15,000

70,000

8,000

210,000

120,000

9,000

15,000

80,000

—

224,000

180,000

8,000

15,000

60,000

—

263,000

408,000

26,000

45,000

210,000

8,000

697,000

(3,000)

20,200

40,200

10,200

30,000

—

—

30,000

$ 27,000 $

—

—

—

—

20,200

—

(30,000)

(1,200)

(31,200)

$ 9,000

30,000

(30,000)

(1,200)

(1,200)

$ 9,000

3. If the company needs a minimum cash balance of $20,000 to start each

month, the loan cannot be repaid in full by June 30. If the loan is repaid

in full, the cash balance will drop to only $9,000 on June 30, as shown

above. Some portion of the loan balance will have to be carried over to

July, at which time the cash inflow should be sufficient to complete repayment.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

24

Managerial Accounting, 9th Canadian Edition

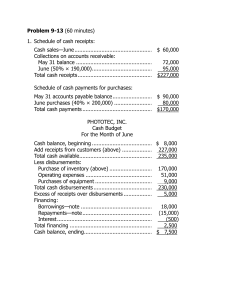

Problem 9-18 (60 minutes)

1. Schedule of cash receipts:

Cash sales—June ...............................................

Collections on accounts receivable:

May 31 balance ..............................................

June (50% × 190,000) ....................................

Total cash receipts .............................................

$ 60,000

72,000

95,000

$227,000

Schedule of cash payments for purchases:

May 31 accounts payable balance .......................

June purchases (40% × 200,000) ......................

Total cash payments ..........................................

$ 90,000

80,000

$170,000

Pixelize, Inc.

Cash Budget

For the Month of June

Cash balance, beginning ....................................

Add receipts from customers (above) .................

Total cash available............................................

Less disbursements:

Purchase of inventory (above) .........................

Selling and administrative expenses .................

Purchases of equipment ..................................

Total cash disbursements ...................................

Excess of receipts over disbursements ................

Financing:

Borrowings—note ...........................................

Repayments—note ..........................................

Interest ..........................................................

Total financing ..................................................

Cash balance, ending .........................................

$ 8,000

227,000

235,000

170,000

51,000

9,000

230,000

5,000

18,000

(15,000)

(500)

2,500

$ 7,500

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

25

Problem 9-18 (continued)

2.

Pixelize, Inc.

Budgeted Income Statement

For the Month of June

Sales .....................................................

Cost of goods sold:

Beginning inventory .............................

Add purchases .....................................

Goods available for sale .......................

Ending inventory..................................

Cost of goods sold ...............................

Gross margin .........................................

Selling and administrative expenses

($51,000 + $2,000) .............................

Operating income ...................................

Interest expense ....................................

Net income ............................................

3.

$250,000

$ 30,000

200,000

230,000

40,000

190,000

60,000

53,000

7,000

500

$ 6,500

Pixelize, Inc.

Budgeted Balance Sheet

June 30

Assets

Cash .......................................................................

Accounts receivable (50% × 190,000) ......................

Inventory ................................................................

Buildings and equipment, net of depreciation

($500,000 + $9,000 – $2,000) ..............................

Total assets .............................................................

Liabilities and Shareholders’ Equity

Accounts payable (60% × 200,000) .........................

Note payable...........................................................

Common stock ........................................................

Retained earnings ($85,000 + $6,500) .....................

Total liabilities and equity .........................................

$ 7,500

95,000

40,000

507,000

$649,500

$120,000

18,000

420,000

91,500

$649,500

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

26

Managerial Accounting, 9th Canadian Edition

Problem 9-19 (60 minutes)

1. The sales budget for the third quarter:

July

Aug.

Sept.

Quarter

Budgeted sales (units) .....

6,500

5,000

4,000

15,500

Selling price per unit ........

x $60

x $60

x $60

x $60

Total budgeted sales ........ $390,000 $300,000 $240,000 $930,000

The schedule of expected cash collections from sales:

July

Aug.

Sept.

Quarter

Accounts receivable, beginning balance ............ $160,000

$160,000

July sales:

$390,000 × 50%, 45% . 195,000 $175,500

370,500

August sales:

$300,000 × 50%, 45% .

150,000 $135,000 285,000

September sales:

$240,000 × 50% ..........

120,000 120,000

Total cash collections ....... $355,000 $325,500 $255,000 $935,500

2. The production budget for July through October:

Budgeted sales (units) ......................

Add desired ending inventory ............

Total needs ......................................

Less beginning inventory...................

Required production (units)...............

July

6,500

1,000

7,500

1,300

6,200

Aug.

5,000

800

5,800

1,000

4,800

Sept.

4,000

600

4,600

800

3,800

Oct.

3,000

500

3,500

600

2,900

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

27

Problem 9-19 (continued)

3. The direct materials purchases budget for the third quarter:

July

Required production—units

(above) ............................

6,200

Raw materials needs per

unit .................................. x 3 kgs.

Production needs (kgs.) ....... 18,600

Add desired ending inventory ..................................

2,880

Total needs ......................... 21,480

Less beginning inventory

3,720

Raw materials to be purchased ............................. 17,760

Cost of raw materials to be

purchased at $3.50 per

kg. ................................... $62,160

Aug.

Sept.

Quarter

4,800

3,800

14,800

x 3 kgs.

14,400

x 3 kgs.

11,400

x 3 kgs.

44,400

2,280

16,680

2,880

1,740 *

13,140

2,280

1,740

46,140

3,720

13,800

10,860

42,420

$48,300

$38,010

$148,470

*2,900 units (October) × 3 kgs. per unit = 8,700 kgs.;

8,700 kgs. × 20% = 1,740 kgs.

The schedule of expected cash disbursements:

Accounts payable, beginning

balance ................................

July purchases:

$62,160 × 70%, 30% ...........

August purchases:

$48,300 × 70%, 30% ...........

September purchases:

$38,010 × 70% ....................

Total cash disbursements .........

July

Aug.

Sept.

$11,400

Quarter

$11,400

43,512 $18,648

33,810 $14,490

62,160

48,300

26,607

26,607

$54,912 $52,458 $41,097 $148,467

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

28

Managerial Accounting, 9th Canadian Edition

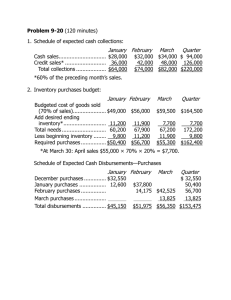

Problem 9-20 (120 minutes)

It may be helpful to see the Sales Budget Summary first.

Sales Budget

March (actual) April

May

June

Total Sales

$60,000

$70,000

$85,000

$90,000

Cash (20%)

$12,000

$14,000

$17,000

$18,000

Credit (80%)

48,000

56,000

68,000

72,000

All credit sales are collected in the month following the sale.

July

$50,000

$10,000

40,000

1. Schedule of expected cash collections:

Cash sales.............................

Credit sales ...........................

Total collections .....................

April

May

June

Total

April

May

June

Total

$14,000 $17,000 $18,000 $ 49,000

48,000 56,000 68,000 172,000

$62,000 $73,000 $86,000 $221,000

2. a. Merchandise purchases budget:

Budgeted cost of goods sold .... $42,000 $51,000 $54,000 $147,000

Add desired ending inventory* . 15,300 16,200

9,000

9,000

Total needs ............................. 57,300 67,200 63,000 156,000

Less beginning inventory ......... 12,600 15,300 16,200

12,600

Required purchases ................. $44,700 $51,900 $46,800 $143,400

*

At April 30: $51,000 × 30% = $15,300.

At June 30: $50,000 July sales × 60% × 30% = $9,000.

b. Schedule of cash disbursements for purchases:

For March purchases .............

For April purchases ................

For May purchases ................

For June purchases ...............

Total cash disbursements .......

April

May

June

Total

$18,300

$18,300

22,350 $22,350

44,700

25,950 $25,950

51,900

23,400

23,400

$40,650 $48,300 $49,350 $138,300

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

29

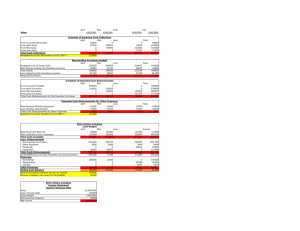

Problem 9-20 (continued)

3. Schedule of cash disbursements for selling and administrative expenses:

Salaries and wages ....................

Shipping ...................................

Advertising................................

Other expenses .........................

Total cash disbursements for

operating expenses .................

April

May

June

Total

$ 7,500 $ 7,500 $ 7,500 $22,500

4,200

5,100

5,400 14,700

6,000

6,000

6,000 18,000

2,800

3,400

3,600

9,800

$20,500 $22,000 $22,500 $65,000

4. Cash budget:

Cash balance, beginning ............

Add cash collections ..................

Total cash available .................

Less disbursements:

For inventory purchases ..........

For selling and administrative

expenses .............................

For equipment purchases ........

For dividends ..........................

Total disbursements...................

Excess (deficiency) of cash ........

Financing:

Borrowings .............................

Repayments ...........................

Interest ($10,000 × 1% × 3) ..

Total financing ..........................

Cash balance, ending.................

April

May

June

Total

48,300

49,350

138,300

20,500 22,000

11,500

3,000

0

0

72,650 73,300

(1,650) 8,050

22,500

0

3,500

75,350

18,700

65,000

14,500

3,500

221,300

8,700

$ 9,000 $ 8,350 $ 8,050 $ 9,000

62,000 73,000 86,000 221,000

71,000 81,350 94,050 230,000

40,650

10,000

0

0

10,000

0

0 (10,000) (10,000)

0

0

(300)

(300)

10,000

0 (10,300)

(300)

$ 8,350 $ 8,050 $ 8,400 $ 8,400

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

30

Managerial Accounting, 9th Canadian Edition

Problem 9-20 (continued)

5. Income Statement:

Neotec Company

Income Statement

For the Quarter Ended June 30

Sales .......................................................

Cost of goods sold:

Beginning inventory (given) ....................

Add purchases (Part 2) ...........................

Goods available for sale ..........................

Ending inventory (Part 2) .......................

Gross margin............................................

Selling and administrative expenses:

Salaries and wages (Part 3) ....................

Shipping (Part 3)....................................

Advertising (Part 3) ................................

Depreciation ..........................................

Other expenses (Part 3) .........................

Operating income .....................................

Less interest expense (Part 4) ...................

Net income ..............................................

$245,000

$ 12,600

143,400

156,000

9,000

22,500

14,700

18,000

6,000

9,800

147,000

98,000

71,000

27,000

300

$ 26,700

Note: CGS can also be computed as follows:

Sales of $245,000 x 60% = $147,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

31

Problem 9-20 (continued)

6. Balance sheet:

Neotec Company

Balance Sheet

June 30

Assets

Current assets:

Cash (Part 4) .................................................................

Accounts receivable (80% × $90,000).............................

Inventory (Part 2) ..........................................................

Total current assets ..........................................................

Buildings and equipment, net

($214,100 + $14,500 – $6,000) ......................................

Total assets ......................................................................

$ 8,400

72,000

9,000

89,400

222,600

$312,000

Liabilities and Shareholders’ Equity

Current liabilities:

Accounts payable (Part 2: 50% × $46,800) ..

Shareholders’ equity:

Common stock ............................................

Retained earnings* .....................................

Total liabilities and equity ...............................

* Retained earnings, beginning ...................

Add net income.......................................

Total.......................................................

Less dividends ........................................

Retained earnings, ending .......................

$ 23,400

$190,000

98,600

288,600

$312,000

$ 75,400

26,700

102,100

3,500

$ 98,600

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

32

Managerial Accounting, 9th Canadian Edition

Problem 9-21 (60 minutes)

1. a. Schedule of expected cash collections:

Year 1—Fourth quarter sales:

$300,000 × 65% .......................

Year 2—First quarter sales:

$400,000 × 33% .......................

$400,000 × 65% .......................

Year 2—Second quarter sales:

$500,000 × 33% .......................

$500,000 × 65% .......................

Year 2—Third quarter sales:

$600,000 × 33% .......................

$600,000 × 65% .......................

Year 2—Fourth quarter sales:

$480,000 × 33% .......................

Total cash collections ....................

First

Year 2 Quarter

Second

Third

Fourth

Total

$195,000

$ 195,000

132,000

132,000

260,000

$260,000

165,000

165,000

325,000

$325,000

198,000

$390,000

198,000

390,000

158,400

$327,000 $425,000 $523,000 $548,400

158,400

$1,823,400

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

33

Problem 9-21 (continued)

b. Schedule of budgeted cash disbursements for merchandise purchases:

Year 1—Fourth quarter purchases:

$180,000 × 80% .......................

Year 2—First quarter purchases:

$260,000 × 20% .......................

$260,000 × 80% .......................

Year 2—Second quarter purchases:

$310,000 × 20% .......................

$310,000 × 80% .......................

Year 2—Third quarter purchases:

$370,000 × 20% .......................

$370,000 × 80% .......................

Year 2—Fourth quarter purchases:

$240,000 × 20% .......................

Total cash disbursements ..............

First

Year 2 Quarter

Second

Third

Fourth

Total

$144,000

$ 144,000

52,000

52,000

208,000

$208,000

62,000

62,000

248,000

$248,000

74,000

$296,000

74,000

296,000

48,000

$196,000 $270,000 $322,000 $344,000

48,000

$1,132,000

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

34

Managerial Accounting, 9th Canadian Edition

Problem 9-21 (continued)

2.

Budgeted sales..................

Variable expense rate ........

Variable expenses..............

Fixed expenses .................

Total expenses ..................

Less depreciation ..............

Cash disbursements ..........

First

Year 2 Quarter

Second

Third

Fourth

$400,000 $500,000 $600,000 $480,000

x 12%

x 12%

x 12%

x 12%

48,000

60,000

72,000

57,600

90,000

90,000

90,000

90,000

138,000 150,000 162,000 147,600

20,000

20,000

20,000

20,000

$118,000 $130,000 $142,000 $127,600

Year

$1,980,000

x 12%

237,600

360,000

597,600

80,000

$ 517,600

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

35

Problem 9-21 (continued)

3. Cash budget for Year 2:

First

Cash balance, beginning .................... $ 20,000

Add collections from sales .................. 327,000

Total cash available ............................ 347,000

Less disbursements:

Merchandise purchases ................... 196,000

Operating expenses ........................ 118,000

Dividends .......................................

10,000

Land...............................................

0

Total disbursements ........................... 324,000

Excess (deficiency) of receipts over

disbursements ...............................

23,000

Financing:

Borrowings .....................................

0

Repayments....................................

0

Interest ($60,000 × 1% × 9) ..........

0

Total financing ...................................

0

Cash balance, ending ......................... $ 23,000

Year 2 Quarter

Second

Third

$ 23,000 $ 18,000

425,000 523,000

448,000 541,000

Fourth

Year

$ 18,500 $ 20,000

548,400 1,823,400

566,900 1,843,400

270,000

130,000

10,000

80,000

490,000

322,000

142,000

10,000

48,500

522,500

344,000

127,600

10,000

0

481,600

1,132,000

517,600

40,000

128,500

1,818,100

(42,000)

18,500

85,300

25,300

60,000

0

0

0

0

0

60,000

0

$ 18,000 $ 18,500

0

60,000

(60,000)

(60,000)

(5,400)

(5,400)

(65,400)

(5,400)

$ 19,900 $ 19,900

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

36

Managerial Accounting, 9th Canadian Edition

Problem 9-22 (60 minutes)

1. Collections on sales:

July

August Sept.

Quarter

Cash sales ..............................

$ 8,000 $14,000 $10,000 $ 32,000

Credit sales:

May: $30,000 × 80% × 20% ..

4,800

4,800

June: $36,000 × 80% × 70%,

20% ..................................

20,160

5,760

25,920

July: $40,000 × 80% × 10%,

70%, 20% .........................

3,200 22,400

6,400

32,000

Aug.: $70,000 × 80% × 10%,

70% ..................................

5,600 39,200

44,800

Sept.: $50,000 × 80% × 10%

4,000

4,000

Total cash collections ...............

$36,160 $47,760 $59,600 $143,520

2. a. Merchandise purchases budget:

Budgeted cost of goods sold* ..

Add desired ending inventory**

Total needs .............................

Less beginning inventory .........

Required inventory purchases ..

July

August

Sept.

Oct.

$24,000 $42,000 $30,000 $27,000

31,500 22,500 20,250

55,500 64,500 50,250

18,000 31,500 22,500

$37,500 $33,000 $27,750

*Cost of goods sold is 60% of sales, based on income statements provided

in the problem.

*75% of the next month’s budgeted cost of goods sold.

b. Schedule of expected cash disbursements for merchandise purchases:

Accounts payable, June 30 .......

July purchases ........................

August purchases ....................

September purchases ..............

Total cash disbursements .........

July

August

Sept.

Quarter

$11,700

$11,700

18,750 $18,750

37,500

16,500 $16,500 33,000

13,875 13,875

$30,450 $35,250 $30,375 $96,075

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

37

Problem 9-22 (continued)

3.

Scott Products, Inc.

Cash Budget

For the Quarter Ended September 30

Cash balance, beginning ........

Add collections from sales

Total cash available .............

Less disbursements:

For inventory purchases ......

For selling expenses ............

For administrative expenses

For land .............................

For dividends ......................

Total disbursements ..............

Excess (deficiency) of cash

available over disbursements ................................

Financing:

Borrowings .........................

Repayment .........................

Interest* ............................

Total financing ......................

Cash balance, ending ............

* $10,000 × 1% × 3 =

$4,000 × 1% × 2 =

July

August

Sept.

Quarter

$ 8,000 $ 8,410 $ 8,020 $ 8,000

36,160

47,760 59,600 143,520

44,160 56,170

67,620 151,520

30,450

7,200

3,600

4,500

0

45,750

35,250

11,700

5,200

0

0

52,150

30,375

8,500

4,100

0

1,000

43,975

96,075

27,400

12,900

4,500

1,000

141,875

(1,590)

4,020

23,645

9,645

10,000

4,000

14,000

0

0 (14,000) (14,000)

0

0

(380)

(380)

10,000

4,000 (14,380)

(380)

$ 8,410 $ 8,020 $ 9,265 $ 9,265

$300

80

$380

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

38

Managerial Accounting, 9th Canadian Edition

Problem 9-23 (90 minutes)

1.

Budgeted sales....................

Add desired ending inventory* ................................

Total needs .........................

Less beginning inventory .....

Required production ............

April

May

10,600

40,600

6,000

34,600

15,000

68,000

10,600

57,400

June

Quarter

30,000 53,000 75,000 158,000

13,600 13,600

88,600 171,600

15,000

6,000

73,600 165,600

*20% of the next month’s sales.

2. Material #226:

Required production—

units ............................

Material #226 per unit .....

Production needs—

kilograms .....................

Add desired ending inventory* ......................

Total needs—kilograms ....

Less beginning inventory .

Required purchases—

kilograms .....................

Required purchases at

$4.00 per kilogram........

April

May

June

Quarter

34,600

× 2 kgs.

57,400

× 2 kgs.

73,600

× 2 kgs.

165,600

× 2 kgs.

69,200

114,800

147,200

331,200

68,880

138,080

23,000

88,320

203,120

68,880

76,080

223,280

88,320

76,080

407,280

23,000

115,080

134,240

134,960

384,280

$460,320

$536,960

$539,840 $1,537,120

* 60% of the following month’s production needs. For June: July

production 68,000 + 9,000 – 13,600 = 63,400 units; 63,400

units × 2 kgs. per unit = 126,800 kgs.; 126,800 kgs. × 60% =

76,080 kgs.

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

39

Problem 9-23 (continued)

Material #301:

April

May

Required production—

units ............................

34,600

57,400

Material #301 per unit .....

× 5 mt. × 5 mt.

Production needs—

173,000 287,000

metres .........................

Add desired ending inventory* ............................

86,100 110,400

Total needs—metres ........ 259,100 397,400

Less beginning inventory..

35,000

86,100

Required purchases—

metres .........................

224,100 311,300

Required purchases at

$1.50 per metre ............ $336,150 $466,950

June

Quarter

73,600

× 5 mt.

368,000

165,600

× 5 mt.

828,000

95,100

463,100

110,400

95,100

923,100

35,000

352,700

888,100

$529,050

$1,332,150

* 30% of the following month’s production needs. For June:

July production 68,000 + 9,000 – 13,600 = 63,400 units;

63,400 units × 5 mt. per unit = 317,000 mt.;

317,000 mt. × 30% = 95,100 mt.

3. Direct labour budget:

Cutting .......

Assembly ....

Finishing .....

Units

Produced

165,600

165,600

165,600

Direct Labour

Hours

Per

Unit

Total

0.15

0.60

0.10

24,840

99,360

16,560

140,760

Cost per

DLH

$16.00

$14.00

$18.00

Total Cost

$ 397,440

1,391,040

298,080

$2,086,560

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

40

Managerial Accounting, 9th Canadian Edition

Problem 9-23 (continued)

4. Manufacturing overhead budget:

Expected production for the year ..............................

Actual production through March 31 .........................

Expected production, April through December ...........

Variable manufacturing overhead rate per unit

($124,800 ÷ 48,000 units) ....................................

Variable manufacturing overhead .............................

Fixed manufacturing overhead ($4,166,000 × 9/12) ..

Total manufacturing overhead ..................................

Less depreciation ($2,619,000 × 9/12) .....................

Cash disbursement for manufacturing overhead ........

380,000

48,000

332,000

× $2.60

$ 863,200

3,124,500

3,987,700

1,964,250

$2,023,450

CMA Solution, adapted

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

41

Problem 9-24 (120 minutes)

1. Schedule of expected cash collections:

January February

Cash sales (40% of this

month’s sales) ..................

Credit sales* .......................

Total collections ...................

$28,000

36,000

$64,000

March

Quarter

$32,000 $34,000 $ 94,000

42,000 48,000 126,000

$74,000 $82,000 $220,000

*60% of the preceding month’s sales.

2. Merchandise purchases budget:

Budgeted cost of goods sold

(70% of sales)..................

Add desired ending inventory*................................

Total needs .........................

Less beginning inventory .....

Required purchases .............

January February

March

Quarter

$49,000 $56,000

$59,500 $164,500

11,200

11,900

60,200

67,900

9,800

11,200

$50,400 $56,700

7,700

7,700

67,200

172,200

11,900

9,800

$55,300 $162,400

*At March 30: April sales $55,000 × 70% × 20% = $7,700.

Schedule of expected cash disbursements—merchandise purchases

December purchases ...........

January purchases ..............

February purchases .............

March purchases .................

Total disbursements ............

January February

$32,550

12,600

$45,150

March

Quarter

$ 32,550

$37,800

50,400

14,175 $42,525

56,700

13,825

13,825

$51,975 $56,350 $153,475

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

42

Managerial Accounting, 9th Canadian Edition

Problem 9-24 (continued)

3. Schedule of expected cash disbursements—selling and administrative

expenses

Commissions .......................

Rent ...................................

Other expenses ...................

Total disbursements ............

January February

$12,000

1,800

5,600

$19,400

March

$12,000 $12,000

1,800

1,800

6,400

6,800

$20,200 $20,600

Quarter

$36,000

5,400

18,800

$60,200

4. Cash budget:

January February

Cash balance, beginning ....

Add cash collections ..........

Total cash available .........

Less cash disbursements:

For inventory ..................

For operating expenses ...

For equipment ................

Total disbursements ..........

Excess (deficiency) of cash

Financing:

Borrowings .....................

Repayments ...................

Interest* ........................

Total financing ..................

Cash balance, ending ........

$ 6,000

64,000

70,000

* $3,000 × 1% × 3 =

$6,000 × 1% × 2 =

Total interest

$ 90

120

$210

45,150

19,400

3,000

67,550

2,450

3,000

0

0

3,000

$ 5,450

$ 5,450

74,000

79,450

51,975

20,200

8,000

80,175

(725)

6,000

0

0

6,000

$ 5,275

March

Quarter

$ 5,275 $ 6,000

82,000 220,000

87,275 226,000

56,350

20,600

0

76,950

10,325

153,475

60,200

11,000

224,675

1,325

0

(5,000)

(210)

(5,210)

$ 5,115 $

9,000

(5,000)

(210)

3,790

5,115

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

43

Problem 9-24 (continued)

5.

Lim Corporation

Income Statement

For the Quarter Ended March 31

Sales ($70,000 + $80,000 + $85,000) .......

Cost of goods sold:

Beginning inventory (Given) ...................

Add purchases (Part 2) ...........................

Goods available for sale ..........................

Less ending inventory (Part 2) ................

Gross margin............................................

Selling and administrative expenses:

Commissions (Part 3) .............................

Rent (Part 3) .........................................

Depreciation (Given) ..............................

Other expenses (Part 3) .........................

Operating income .....................................

Less interest expense ...............................

Net income ..............................................

$235,000

$ 9,800

162,400

172,200

7,700

36,000

5,400

2,400

18,800

164,500

70,500

62,600

7,900

210

$ 7,690

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

44

Managerial Accounting, 9th Canadian Edition

Problem 9-24 (continued)

6.

Lim Corporation

Balance Sheet

March 31

Assets

Current assets:

Cash (Part 4) .............................................................

Accounts receivable ($85,000 × 60%).........................

Inventory (Part 2) ......................................................

Total current assets ......................................................

Fixed assets—net

($110,885 + $3,000 + $8,000 – $2,400) .....................

Total assets ..................................................................

$ 5,115

51,000

7,700

63,815

119,485

$183,300

Liabilities and Shareholders’ Equity

Accounts payable (Part 2: $55,300 × 75%) .....

Bank loan payable .........................................

Shareholders’ equity:

Common stock (Given) ................................

Retained earnings* .....................................

Total liabilities and equity ...............................

* Retained earnings, beginning .................

Add net income.....................................

Retained earnings, ending .....................

$ 41,475

4,000

$100,000

37,825

137,825

$183,300

$30,135

7,690

$37,825

© McGraw-Hill Ryerson Ltd. 2012. All rights reserved.

Solutions Manual, Chapter 9

45

Problem 9-25 (30 minutes)

1. The cost formulas in the flexible budget performance report below were

obtained by dividing the costs from the static budget in the problem

statement by the budgeted level of activity (700 samples). The fixed

costs are carried over from the static budget.

Centrico Medical Laboratory

Flexible Budget Performance Report

For the Month Ended September 30

Budgeted activity (in samples) ........... 700

Actual activity (in samples) ................ 920

Costs

Variable costs:

Medical supplies ............

Lab tests .......................

Refreshments for staff

and volunteers ............

Administrative supplies ..

Total variable cost ............