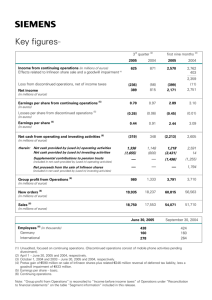

consolidated financial statements of suez environnement company

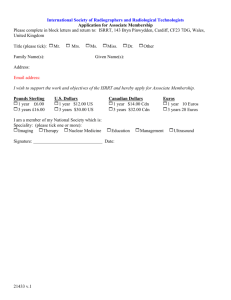

advertisement