Memorandum Of Law In Opposition

advertisement

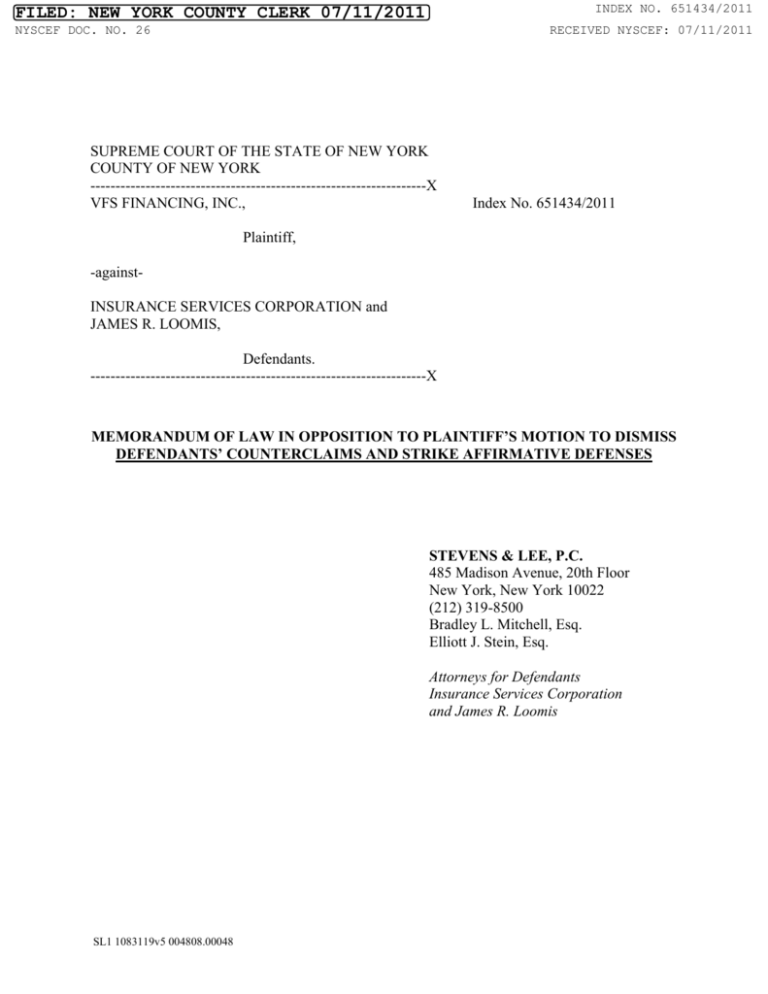

INDEX NO. 651434/2011 FILED: NEW YORK COUNTY CLERK 07/11/2011 NYSCEF DOC. NO. 26 RECEIVED NYSCEF: 07/11/2011 SUPREME COURT OF THE STATE OF NEW YORK COUNTY OF NEW YORK -------------------------------------------------------------------X VFS FINANCING, INC., Index No. 651434/2011 Plaintiff, -againstINSURANCE SERVICES CORPORATION and JAMES R. LOOMIS, Defendants. -------------------------------------------------------------------X MEMORANDUM OF LAW IN OPPOSITION TO PLAINTIFF’S MOTION TO DISMISS DEFENDANTS’ COUNTERCLAIMS AND STRIKE AFFIRMATIVE DEFENSES STEVENS & LEE, P.C. 485 Madison Avenue, 20th Floor New York, New York 10022 (212) 319-8500 Bradley L. Mitchell, Esq. Elliott J. Stein, Esq. Attorneys for Defendants Insurance Services Corporation and James R. Loomis SL1 1083119v5 004808.00048 TABLE OF CONTENTS Page STATEMENT OF THE CASE............................................................................................................. 1 ARGUMENT ........................................................................................................................................ 1 I. PLAINTIFF’S MOTION TO DISMISS THE CAUSES OF ACTION SET FORTH IN THE COUNTERCLAIMS SHOULD BE DENIED ......................................... 1 II. PLAINTIFF’S MOTION TO STRIKE THE AFFIRMATIVE DEFENSES MUST LIKEWISE BE DENIED .......................................................................................... 8 III. SHOULD PLAINTIFF’S MOTION BE GRANTED, DEFENDANTS SHOULD BE ALLOWED TO AMEND ANSWER AND COUNTERCLAIMS............................................................................................................ 10 CONCLUSION ................................................................................................................................... 11 i SL1 1083119v5 004808.00048 TABLE OF AUTHORITIES CASES Born v. Schrenkeisen, 110 N.Y. 55, 17 N.E. 339 (1888) ..............................................................................................6 Burrowes v. Combs, 25 A.D.3d 370 (1st Dep’t), lv. denied 7 N.Y.3d 704 (2006) ....................................................5 Chopp v. Welbourne & Purdy Agency, Inc., 135 A.D.2d 958 (3d Dep’t 1987) ..............................................................................................2 Cron v. Hargro Fabrics, Inc., 91 N.Y.2d 362 (1998)................................................................................................................1 Fahey v. County of Ontario, 44 N.Y.2d 934 (1978)................................................................................................................9 Foley Inc. v. Helix Group, Inc., 29 Misc.3d 1210(A), Slip Copy, 2010 WL 4054468 (N.Y.Sup. 2010) ....................................8 Glaze, Inc. v. Coach Choice Apparel, Inc., 28 Misc.3d 1225(A) (N.Y. Sup. 2010) ......................................................................................9 Guggenheimer v. Ginzburg, 43 N.Y.2d 268 (1977)................................................................................................................1 Loomis v. Civetta Corinno Const. Co., 54 N.Y.2d 18 (1981)..................................................................................................................9 Maurillo v. Park Slope U-Haul, 194 A.D.2d 142 (2d Dep’t 1993)...............................................................................................1 McCaskey, Davies and Assocs. v. New York City Health & Hosps. Corp., 59 N.Y.2d 755 (1983)................................................................................................................9 Morone v. Morone, 50 N.Y.2d 481 (1980)................................................................................................................1 Rekis v. Lake Minnewaska Mountain Houses, Inc., 170 A.D.2d 124, 573 N.Y.S.2d 331 (3d Dep’t 1991) ...............................................................6 ii SL1 1083119v5 004808.00048 Rovello v. Orofino Realty Co., 40 N.Y.2d 633 (1976)................................................................................................................1 Tokio Marine & Fire Ins. Co. v. National Union Fire Ins. Co., 18 F.Supp. 720 (S.D.N.Y.), aff’d, 91 F.2d 964 (2d Cir. 1937)..................................................6 Urstadt Biddle Properties, Inc. v. Excelsior Realty Corp., 65 A.D.3d 1135 (2d Dep’t 2009) ..............................................................................................2 Washington Ave. Associates, Inc. v. Euclid Equipment, Inc., 229 A.D.2d 486 (2d Dep’t 1996) ..............................................................................................5 West Side Federal Sav. & Loan Ass'n of New York City v. Hirschfeld, 101 A.D.2d 380, 476 N.Y.S.2d 292, (1st Dep’t 1984) .............................................................6 STATUTES, RULES & REGULATIONS CPLR 3025(b) .................................................................................................................................9 CPLR 3211(e)..................................................................................................................................8 iii SL1 1083119v5 004808.00048 By Motion to Dismiss Counterclaim and Strike Affirmative Defenses (the “Motion”), Plaintiff VFS Financing, Inc. (“Plaintiff”) moves the Court to dismiss the five causes of action set forth in the counterclaims, and to strike the eight affirmative defenses asserted by the Defendants Insurance Services Corporation (“ISC”) and James R. Loomis (“Loomis”, together with ISC, the “Defendants”). Defendants submit this memorandum of law in opposition to the Motion. STATEMENT OF THE CASE The facts upon which Defendants rely in their opposition to the Motion are set forth in the accompanying Affidavit of James R. Loomis in opposition to the Motion (the “Loomis Aff.”) and are incorporated herein as if set forth in full. All capitalized terms not otherwise defined herein shall have the meaning ascribed in the Loomis Affidavit. ARGUMENT I. PLAINTIFF’S MOTION TO DISMISS THE CAUSES OF ACTION SET FORTH IN THE COUNTERCLAIMS SHOULD BE DENIED In considering Plaintiff’s motion to dismiss the counterclaims, the Court must liberally construe the allegations set forth in the counterclaims in Defendants’ favor, accepting as true any and all factual averments. See Cron v. Hargro Fabrics, Inc., 91 N.Y.2d 362, 366 (1998); Morone v. Morone, 50 N.Y.2d 481, 484 (1980); Rovello v. Orofino Realty Co., 40 N.Y.2d 633, 635-36 (1976). The pertinent question is not whether the allegations in the counterclaim properly state a cause of action, but whether they “manifest any cause of action cognizable at law.” Guggenheimer v. Ginzburg, 43 N.Y.2d 268, 275 (1977) (emphasis added); Maurillo v. Park SL1 1083119v5 004808.00048 Slope U-Haul, 194 A.D.2d 142, 145 (2d Dep’t 1993). As shown below, Defendants have satisfied this standard. Defendants assert five (5) causes of action in their counterclaims and third-party complaint against Plaintiff and third-party defendant GE Capital Corporation: (1) fraud in the inducement, (2) breach of contract, (3) tortious interference, (4) mutual mistake, and (5) breach of the duty of good faith and fair dealing. All five causes of action survive Plaintiff’s instant Motion, because each sufficiently “manifests” the causes of action alleged therein. The underlying premise of the causes of action set forth in the counterclaims and third-party complaint is that Plaintiff and GE Capital performed a “bait and switch” on Defendants, adding new terms to the final agreement between the parties – namely the Make Whole Amount and indefinite Prepayment Premium - when the Loan Proposal agreed upon between the parties contained no such provisions. Counterclaim, ¶¶ 6, 8-10, 19-23. In addition, the claims asserted by Defendants against Plaintiff and GE Capital include the critical issue related to affirmative steps that these parties took in quashing a previously agreed to sale of the Aircraft, an act that now plainly appears to have led Defendants to have suffered significant damages. As a result of these misdeeds, Defendants now, at a minimum, seek reformation of the Loan Documents to properly reflect the terms originally agreed upon in the Loan Proposal, as well as damages incurred by Defendants as a result of the wrongful acts of Plaintiff and/or GE Capital. A. First Cause of Action: Fraud in the Inducement Plaintiff argues that Loomis’ failure to read the final loan documents vitiates Defendants’ claim that Plaintiff fraudulently induced Defendants to enter into the contract documents at issue in this case. The elements of a cause of action alleging fraud in the 2 SL1 1083119v5 004808.00048 inducement are representation of a material existing fact, falsity, scienter, reliance, and injury. See, Urstadt Biddle Properties, Inc. v. Excelsior Realty Corp., 65 A.D.3d 1135 (2d Dep’t 2009); Chopp v. Welbourne & Purdy Agency, Inc., 135 A.D.2d 958 (3d Dep’t 1987). The Counterclaim clearly alleges the requisite elements to establish a claim for fraud in the inducement. Defendants allege that (i) Plaintiff and/or GE Capital made a material representation that the Loan Documents contained the identical terms contained in the Loan proposal and Commitment Letter (Counterclaim, ¶¶ 5-10, 20, 44-53); (ii) Plaintiff and/or GE Capital knew this representation to be false and intended to induce Defendants’ reliance (Counterclaim, ¶¶ 13-15, 20-22, 31, 32, 51-57, 59); (iii) upon which Defendants relied (Counterclaim, ¶¶ 13-15, 18-20, 2431, 32, 49, 55, 56); (iv) causing Defendants damage (Counterclaims, ¶¶ 32, 39-42, 61). Thus, Plaintiff’s Motion to dismiss the First Counterclaim asserting fraud in the inducement should be denied at this early stage of the proceedings. Defendants have adequately pleaded the necessary elements, and there are many pertinent, and plead, factual issues that require fleshing out in the discovery process. Defendant should not be foreclosed from the opportunity to pursue such discovery by the granting of Plaintiff’s premature Motion. B. Second Cause of Action: Breach of Contract Plaintiff argues that there cannot be a cause of action for breach of contract because there was no contract in place to breach. Plaintiff’s premature request to dismiss this claim fails for several reasons. First, Plaintiff erroneously claims Defendants assert the breach of contract claim against it. As is plainly shown in the caption of the Second Cause of Action, however, this cause of action is plead against GE Capital only, not Plaintiff, and GE Capital has 3 SL1 1083119v5 004808.00048 not answered or otherwise moved with regard to Defendants’ Third-Party Complaint. Thus, the Second Cause of Action should not be dismissed, as it is a claim made solely against GE Capital. Second, to the extent Plaintiff and GE Capital are related entities, affiliates and/or agents of one another and to the extent the Second Cause of Action can be construed to be against Plaintiff as well, Plaintiff’s motion to dismiss should be denied on substantive grounds as well. Defendants have alleged that GE Capital delivered the Loan Proposal to ISC, that a twoyear “Prepayment Premium” was included, that the interest rate on the loan was negotiated at 6.41% per annum, and that ISC paid GE Capital significant consideration ($72,900) to lock in the terms of the Loan Proposal. Counterclaim, ¶¶ 5-7, 63-68. GE Capital subsequently delivered the Commitment Letter to Defendants, containing the same financial terms as the Loan Proposal, which Loomis agreed to and signed indicating such acceptance. Counterclaim, ¶¶ 8-10. By all accounts, these documents can be considered contracts, especially for purposes of a motion to dismiss. Defendants more than adequately allege a breach of the Loan Proposal and Commitment Letter by GE Capital’s inclusion of never-before-negotiated terms in the Loan Documents. Counterclaim, ¶¶ 21-23, 31-32, 70. These breaches damaged Defendants in that they did not get the benefit of their bargain in the Loan Documents, as well as the fact that they have suffered consequential damages caused by Plaintiff/Third-Party Defendant’s insistence that amounts not bargained for be paid, which caused, among other things, Defendants being refused permission to sell the Aircraft (which apparently has caused them to lose significant value since the time of that proposed sale), as well as actual damages incurred in the form of monies that Defendants have been forced to spend to maintain the Aircraft since that time. 4 SL1 1083119v5 004808.00048 Thus, Plaintiff’s Motion to dismiss the Second Cause of Action asserting breach of contract should be denied. C. Third Cause of Action: Tortious Interference With Contract As to Defendants’ Third Cause of Action for tortious interference with contract, there are undoubtedly issues of fact raised in this count that must survive a motion to dismiss. The elements of a tortious interference with contract claim are: (1) the existence of a valid contract; (2) knowledge of that contract; (3) the intentional procurement of a breach of that contract; and (4) damages. See Burrowes v. Combs, 25 A.D.3d 370 (1st Dep’t), lv. denied 7 N.Y.3d 704 (2006). To sustain this cause of action, Defendants “must allege that the contract would not have been breached but for” Plaintiff’s conduct. Washington Ave. Associates, Inc. v. Euclid Equipment, Inc., 229 A.D.2d 486, 487 (2d Dep’t 1996). Plaintiff’s Complaint in the case at bar seeks, inter alia, sale of the Aircraft owned by ISC to satisfy the loan by GE Capital. It is undisputed, however, that when Defendants themselves obtained a valid contract to sell the Aircraft just one year ago for $4,700,000, Plaintiff scuttled the deal. Counterclaim, ¶¶ 34-40, 77-80. Plaintiff now seeks dismissal of the Third Cause of Action on the ground that Defendants fail to sufficiently plead the existence of a valid contract for the sale of the Aircraft. A simple reading of the counterclaim refutes this specious argument. Paragraphs 34 and 77 both clearly allege that in July 2010, Loomis negotiated a sale of the Aircraft to a third party for $4,700,000. This is a clear allegation of a contract for sale of the Aircraft. Defendants also allege Plaintiff and GE Capital knew of the contract to sell the Aircraft (Counterclaim, ¶¶ 28-30, 36-38, 77-78) and intentionally procured a breach of that contract (Counterclaim, ¶¶ 39-40, 79-80). As a result, the resale value of the Aircraft has 5 SL1 1083119v5 004808.00048 apparently deteriorated, and Defendants have been forced to expend significant assets to maintain the Aircraft’s upkeep. (Counterclaim, ¶¶ 41-42, 81-82, 84). Critically, the Court ought not lose sight of the fact that in the action at bar Plaintiff is now trying to force Defendants to sell the Aircraft, the exact same relief Defendants offered Plaintiff a year ago when Defendants found a buyer for the Aircraft. Due to Plaintiff’s refusal to allow a sale at that time, however, the Aircraft’s value has, per Plaintiff’s own allegations, depreciated as a consequence of time. It is thus clear that by Plaintiff’s own action, Plaintiff caused Defendants to suffer damages, and Plaintiff failed to mitigate its own damages concerning the Aircraft. Consequently, Defendants are entitled to discovery concerning Plaintiff’s decision-making process in refusing to consent to the sale of the Aircraft a year ago, juxtaposed with Plaintiff’s present claim in its Complaint where it now seeks to obtain the exact same relief, a forced sale of the Aircraft. In light of Plaintiff’s reversal of its position in the regard, and the damage such reversal appears to have caused Defendants, it is plain that dismissal of the Third Cause of Action at the initial pleading stage is improper. D. Fourth Cause of Action: Mutual Mistake The Fourth Counterclaim for mutual mistake also undoubtedly raises a cognizable action at law, such that dismissal must be denied and discovery on this issue be allowed to proceed. A mutual mistake occurs where the parties enter into a contract under a mutual mistake of fact which is substantial and exists at the time the contract is entered into. Rekis v. Lake Minnewaska Mountain Houses, Inc., 170 A.D.2d 124, 130, 573 N.Y.S.2d 331, 335 (3d 6 SL1 1083119v5 004808.00048 Dep’t 1991). Mutual mistake does not require scienter. West Side Federal Sav. & Loan Ass'n of New York City v. Hirschfeld, 101 A.D.2d 380, 385, 476 N.Y.S.2d 292, 295 (1st Dep’t 1984). A scrivener’s error will ordinarily provide a basis for reformation of a contract, and the negligent failure to read the agreement before signing it does not generally bar such relief. See Tokio Marine & Fire Ins. Co. v. National Union Fire Ins. Co., 18 F.Supp. 720, 723 (S.D.N.Y.) (“Questions of negligence play almost no part in suits for reformation”), aff’d, 91 F.2d 964 (2d Cir. 1937); Born v. Schrenkeisen, 110 N.Y. 55, 17 N.E. 339, 341 (1888) (“such mistake of the scrivener, or of either party, no matter how it occurred, may be corrected”) (emphasis added). Here, Defendants allege facts that, on their face, can show that a mistake was committed by GE Capital in preparing the Loan Documents, and by Defendants in agreeing to the terms of the Loan Documents. It is clear from the facts asserted throughout the counterclaims/third-party complaint that Defendants and GE Capital negotiated specific financial terms for the loan in question via the Loan Proposal and Commitment Letter. Counterclaim, ¶¶ 5-10, 87-92. It also clear that GE Capital prepared the Loan Documents. Counterclaim, ¶¶ 1115, 18-20, 93. Yet, somewhere between the Loan Proposal and the signing of the Loan Documents, a mistake was made in the drafting of the documents whereby Plaintiff and/or GE Capital added terms not previously agreed upon by Defendants – the Prepayment Fee and Make Whole Amount. Counterclaim, ¶¶ 31-32, 95-97. The Fourth Counterclaim now seeks reformation of the Loan Documents to reflect this mutual mistake, and to have the Loan Documents show the true agreement among the parties. To do this, Defendants are entitled to discovery concerning Plaintiff’s and/or GE Capital’s intent at the time the Loan Proposal was made, at the time the Commitment Letter was 7 SL1 1083119v5 004808.00048 issued, whether Plaintiff and/or GE Capital viewed the Loan Proposal and/or Commitment Letter as the governing terms with Defendants, the manner in which these terms were communicated within GE Capital to be included in the Loan Documents that were to be prepared, and what circumstances caused Plaintiff to change those terms in the final Loan Documents. Plaintiff’s simple reliance on the Loan Documents signed by Defendants does not answer any of these questions. Only discovery can do so. Thus, the Fourth Counterclaim cannot be dismissed. E. Fifth Cause of Action: Breach of the Duty of Good Faith and Fair Dealing The Fifth Counterclaim incorporates the previous four counterclaims under a blanket cause of action for breach of the duty of good faith and fair dealing. As such, all of the reasons set forth thus far concerning the First Counterclaim through Fourth Counterclaim are incorporated herein as if set full at length. In sum, Defendants have plead more than enough facts to overcome a motion to dismiss any of the five counterclaims asserted by Defendants. Therefore, Plaintiff’s Motion to dismiss the counterclaims must be denied in its entirety, and the litigation should proceed on its normal course. II. PLAINTIFF’S MOTION TO STRIKE THE AFFIRMATIVE DEFENSES MUST LIKEWISE BE DENIED Much like its motion to dismiss the counterclaims, Plaintiff’s motion to strike the affirmative defenses seeks relief that is wholly inappropriate at this early juncture of the case. By moving to strike now, Plaintiff is asking Defendants to prove their affirmative defenses without the aid of any discovery whatsoever, a 180-degree reversal on how litigation normally proceeds. The purpose of affirmative defenses is that they will either be proven or disproven during discovery, and dispensed with on summary judgment or at trial. Asking Defendants to 8 SL1 1083119v5 004808.00048 specify every detail to support their affirmative defenses at this early stage is both unreasonable and burdensome, and flies in the face of normal procedure. All of Defendants’ affirmative defenses, except the seventh affirmative defense of lack of capacity to sue, should not be subject to a motion to strike or provide a basis to test the sufficiency of the complaint, since such defenses may be asserted at any time (CPLR 3211[e] ), even if not plead. Foley Inc. v. Helix Group, Inc., 29 Misc.3d 1210(A), Slip Copy, 2010 WL 4054468, at *3 (N.Y.Sup. 2010). As for Defendants’ seventh affirmative defense that this action has been prosecuted by GE Capital without evidence of authority to do so by the Plaintiff, this too cannot be stricken. CPLR 3211(e) provides “At any time before service of the responsive pleading is required, a party may move on one or more grounds set forth in [CPLR 3211(a)] …. Any objection or defense based upon [lack of legal capacity to sue] is waived unless raised either by such motion or in the responsive pleading.” Thus, Defendants had to raise the affirmative defense of standing in their Answer or waive such defense. As a result, this affirmative defense should also not be stricken prior to discovery. GE Capital’s and/or Plaintiff’s lack of capacity must be pursued in discovery, and should not be cut off at the initial pleading stage. In addition, and as already stated in Point I above, there are issues of fact concerning Plaintiff’s conduct that can only be brought to light in the normal course of discovery. Plaintiff, obviously fearful of this, brings the instant Motion in the hopes the Court short-circuits the normal course of litigation and prevents these facts from ever seeing the light of day. Only discovery, via document production and deposition testimony, will allow the issues raised in the Complaint and counterclaims to be fully vetted. Thus, the striking of Defendants’ affirmative defenses at this premature stage is unwarranted and improper, and must be denied. 9 SL1 1083119v5 004808.00048 III. SHOULD PLAINTIFF’S MOTION BE GRANTED, DEFENDANTS SHOULD BE ALLOWED TO AMEND ANSWER AND COUNTERCLAIMS It is well settled that leave to amend shall be freely granted provided the amendment is not plainly lacking in merit and does not cause prejudice or surprise to the nonmoving parties. See, CPLR 3025(b); McCaskey, Davies and Assocs. v. New York City Health & Hosps. Corp., 59 N.Y.2d 755 (1983); Fahey v. County of Ontario, 44 N.Y.2d 934 (1978). Prejudice in this context is shown where the nonmoving party is “hindered in the preparation of his case or has been prevented from taking some measure in support of his position.” Loomis v. Civetta Corinno Const. Co., 54 N.Y.2d 18, 23 (1981). Here, there is no evidence in the record that Plaintiff (a) would be prejudiced by Defendants’ amendment of their answer and/or counterclaim, or (b) would be hindered in the preparation of its defense of the counterclaims or case in chief. Glaze, Inc. v. Coach Choice Apparel, Inc., 28 Misc.3d 1225(A), Slip Copy, 2010 WL 3294300 at *3 (N.Y.Sup. 2010) (Sherwood, J.). This lawsuit is in its incipient stages and no discovery whatsoever has yet been undertaken. Thus, amending the answer and/or counterclaim will not cause Plaintiff to incur additional cost, and will not cause any delay in the case. Should the Court grant either or both of Plaintiff’s motion to dismiss the counterclaims or motion to strike Defendants’ affirmative defenses, Defendants ask that they be given an opportunity to amend the answer and/or counterclaim as appropriate. 10 SL1 1083119v5 004808.00048 CONCLUSION For the foregoing reasons, defendants Insurance Services Corporation and James R. Loomis respectfully request that the Court deny the Plaintiff’s Motion in its entirety, and that Defendants be granted such other and further relief as is just. Dated: New York, New York July 11, 2011 Respectfully submitted, STEVENS & LEE, P.C. By: Bradley L. Mitchell Elliott J. Stein 485 Madison Avenue, 20th Floor New York, NY 10022 (212) 319-8500 blm@stevenslee.com ejs@stevenslee.com Attorneys for Defendants Insurance Services Corporation and James R. Loomis 11 SL1 1083119v5 004808.00048

![[2012] NZEmpC 75 Fuqiang Yu v Xin Li and Symbol Spreading Ltd](http://s3.studylib.net/store/data/008200032_1-14a831fd0b1654b1f76517c466dafbe5-300x300.png)