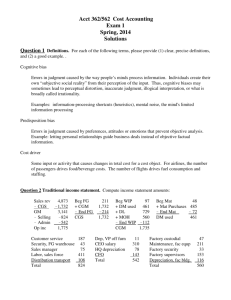

Cost Behavior & Break-Even Analysis Presentation

advertisement

Part III: Tools to Analyze Financial Operations CHAPTER 7: COST BEHAVIOR AND BREAK-EVEN ANALYSIS Fixed, Variable and Semivariable Costs Distinguishing between fixed, variable and semivariable costs is important because this knowledge is a basic working tool in financial management. Fixed, Variable and Semivariable Costs Fixed Costs are those costs that do not vary in total when activity levels (or volume) of operations change. Examine the examples in the chapter. Fixed, Variable and Semivariable Costs Variable Costs are those costs that vary in direct proportion when activity levels (or volume) of operations change. Examine the examples in the chapter. Fixed, Variable and Semivariable Costs Semivariable Costs vary when the activity levels (or volume) of operations change, but not in direct proportion The most frequent patters of semivariable costs is the step pattern. Examine the examples in the chapter. Analyze Mixed Costs The Manager needs to know how to analyze mixed costs because they occur so often. Analyze Mixed Costs by Two Simple Methods The Predominant Characteristics Method — The manager judges whether the cost is more fixed or more variable. The Step Method — The manager examines the “steps” in the step pattern of a fixed cost and decides whether the pattern appears to be more fixed or more variable. Both of these methods are judgmental. Analyze Mixed Costs Through The High-Low Method Cost is examined at its high level and its low level. Obtain the difference in cost between the high and low levels; divide the amount of change in the activity (or volume). Examine the examples in the chapter. Analyze Mixed Costs by the Scatter Graph Method The Scatter Graph finds the Mixed Cost’s average rate of variability more accurately. Use a graph to plot all points of data; cost on vertical axis, volume on horizontal axis of the graph. Fit a regression line to the plotted points. The average fixed cost is found at the point where the regression line intersects with the cost axis. Examine the examples in the chapter. Understand Computation Of the Contribution Margin The Contribution Margin equals Variable Cost deducted from net revenues. The answer is the Contribution Margin. (So called because it contributes to fixed costs and profits.) Examine the examples in the chapter. Contribution Margin: Example Examine Table 7-1 Page 53, which contains Operating Room Fixed and Variable Costs. We can see that the total costs are $,1,217,756. Of this amount, $600,822 is designated as variable cost and $616,934 is designated as fixed ($529,556 + $87,378 = $616,934). For purposes of our example, assume the Operating Room revenue amounts to $1,260,000. The contribution margin is computed as follows: Amount Revenue $1,260,000 Less Variable Cost (600,822) Contribution Margin $ 659,178 Thus $659,178 is available to contribute to fixed costs and to profit. In this example fixed costs are $616,934, so there is an amount left to contribute toward profit Contribution Margin: Practice Assumptions: Greenside Clinic has revenue totaling $3,500,000. Of this amount, 40 percent is variable cost and 60 percent is fixed cost. Step 1. Divide costs into variable and fixed. In this case $3,450,000 times 40 percent equals $1,380,000 variable cost and $3,450,000 Times 60 percent equals $2,070,000fixed cost. Step 2. Compute the contribution margin: Revenue Less Variable Costs Contribution Margin Less Fixed Costs Operating Income Amount $3,500,000 (1,380,000) $2,120,000 (2,070,000 $50,000 Contribution Margin: Assignment Assumptions: The Mental Health program for the Community Center has just completed its fiscal year end. The Program Director determines That his program has revenue for the year of $1,210,000. He believes his variable expense amounts to $205,000 and he knows his fixed expense amounts to $1,100,000. Required: Compute the contribution margin for the Community Mental Health program. Computation: Revenue Less Variable Cost Contribution Margin Less Fixed Cost Operating Profit (Loss) $1,210,000 ______________ ($205,000) ______________ $1,005,000 ______________ ($1,100,000) ______________ ($95,000) ______________ Contribution Margin: Assignment What does the result tell us about the program? 1. The contribution margin of $1,005,000 does not cover the fixed costs of $1,100,000. 2. There is an overall loss in the program of $95,000. 3. The fixed cost is very high, making it imperative that sufficient revenue levels be achieved. The Cost-Volume-Profit (CVP) Ratio or Breakeven Point The Breakeven Point is the point when the contribution margin equals the fixed costs. Loss equals a loss; More equals a profit. Thus, Breakeven Point. Examine the examples in the chapter. CVP Example C o st - V olu m e - P rofit (C V P ) C ha rt $ 5 00 Revenues (net) Less: variable cost Contribution margin Less fixed cost Operating income 4 00 $500,000 (350,000) $150,000 (120,000) $30,000 R ev enu e Li n e 100% 70% 30% Ne t O p e ra t in g In co m e B re a k ev en P o in t V a ri ab le C ost Li n e 3 00 2 00 Fi x ed C ost Li n e N et L o ss 1 00 0 0 1000 2000 3000 N um ber of V is its 4000 5000 Compute the Profit-Volume (PV) Ratio If the contribution margin is expressed as a percentage of net revenues, it is often called the Profit-Volume Ratio A PV chart needs only 2 lines to show the effect of changes in volume. See example and explanation in the chapter. CVP-PV Practice Revenues (net) Less: variable cost Contribution margin Less fixed cost Operating income +10 0 +90 +80 +70 +60 +50 +40 +30 +20 100% 70% 30% F ix e d C o st s Re covered B reakeven Poin t +10 0 -1 0 -2 0 -3 0 -4 0 -5 0 -6 0 -7 0 -8 0 -9 0 -1 -1 -1 -1 -1 -1 $500,000 (350,000) $150,000 (120,000) $30,000 N e t In c o m e P r o je c t e d Re venu es N e t L o s s ( du e to u n re c o v e r e d f ix e d c o s t s ) S a fe t y C u s h io n ( be fo r e b re a k e v e n ) 00 10 20 30 40 50 0 10 0 20 0 30 0 40 0 50 0 R e v e n u e ( i n t h o u s a n d s o f d o ll a r s ) +10 0 +90 +80 +70 +60 +50 +40 +30 +20 +10 0 -1 0 -2 0 -3 0 -4 0 -5 0 -6 0 -7 0 -8 0 -9 0 -1 -1 -1 -1 -1 -1 60 0 70 0 00 10 20 30 40 50 CPV – PV Practice Assumptions: The Mental Health program for the Community Center has just completed its fiscal year end. The Program Director determines That his program has revenue for the year of $1,210,000. He believes his variable expense amounts to $205,000 and he knows his fixed expense amounts to $1,100,000. Amount Revenue Less variable cost Contribution margin Less fixed cost Operating (loss) $1,210,000 _________ _________ (205,000) _________ $1,005,000 _________ (1,100,000) _________ $95,000 _________ Percent ________ 100.00% ________ 16.94% ________ 83.06% =PV or CM Ratio ________ 90.91% ________ 7.85% ________ Per-Visit _______ $100.00 _______ 16.94 _______ $83.06 _______ 90.91 _______ $7.85 _______ CPV – PV Assignment Assumptions: Greenside Clinic has revenue totaling $3,500,000. Of this amount, 40 percent is variable cost and 60 percent is fixed cost. The clinic had 35,000 visits. Amount Revenue $3,510,000 _________ _________ Less variable cost (1,380,000) _________ Contribution margin $2,120,000 _________ Less fixed cost (2, 070,000) _________ Operating profit (loss) _________ $50,000 Percent ________ 100.00% ________ -39.43% ________ 60.57% =PV or CM Ratio ________ -59.14% ________ 1.43% ________ Per-Visit _______ $100.00 _______ -39.43 _______ $60.57 _______ -59.14 _______ $1.43 _______ Understand Further Use of The Contribution Margin Contribution Margins are also useful in showing measures of profitability in a simple, easy-tounderstand manner. (For example, see the DRG matrix in Figure 7-8.)