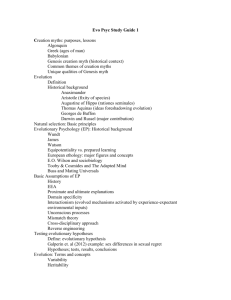

Developing Evolutionary Theory for Economics and Management

advertisement